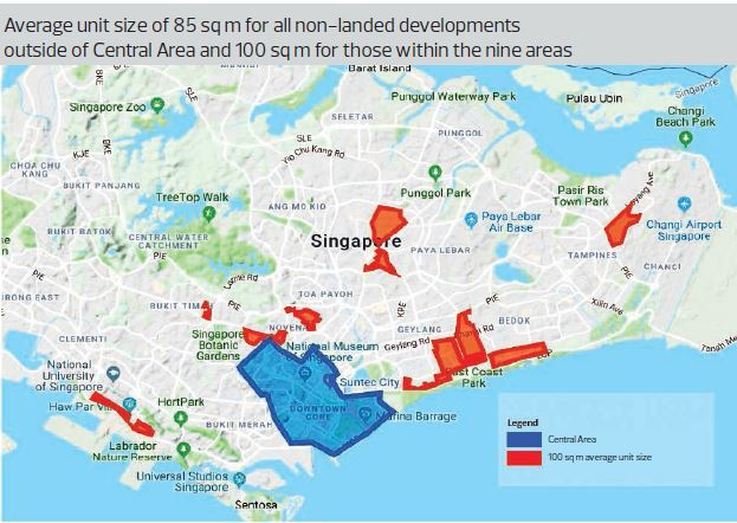

The upsizing of units was announced on Oct 17 by URA through three circulars on building guidelines for non-landed residential developments. Nine areas in Singapore — up from four currently — will be subject to a more stringent requirement of an average unit size of 100 sq m. These nine areas are Marine Parade, Joo Chiat-Mountbatten, Telok Kurau-Jalan Eunos, Balestier, Stevens Road-Chancery, Pasir Panjang, Kovan-How Sun area, Shelford and Loyang.

With effect from Jan 17, 2019, the bonus gross floor area (GFA) cap for outdoor spaces — such as balconies, private enclosed spaces and private roof terraces —in private non-landed projects will be reduced from 10% to 7%. The total balcony area for each unit will be capped at 15% of the net internal area. A new scheme that will take effect immediately will offer a bonus of up to 1% GFA to encourage developers to provide residents with more indoor recreational spaces such as gyms or function rooms.

This latest URA circular addresses the problem of rising psf prices and shrinking apartment sizes and is generally expected to benefit consumers as it means developers will have to build more family-friendly units outside the Central Area. With up to 50,000 residential units in the pipeline, the authorities do not want too many shoebox apartments because it could lead to problems down the road.

The likely effect of increasing the floor area of units will mean the average psf selling price of residential projects will be lowered as developers try to maintain affordability in terms of the absolute price of the unit therefore may result in a moderation in overall prices. The increase in floor area of units will mean more comfortable and livable homes. Fewer units per project will translate into lower density in housing estates, and thus, an improvement in the living environment.

In the near term, the revised guidelines should not affect developers that have bought land and obtained both the pre-application traffic feasibility study (PAFS) from the Land Transport Authority and planning approvals from URA, e.g. the four recently acquired sites by CDL at Amber Park, West Coast Vale, Handy Road and Sumang Walk Executive Condominium sites.

Generally, the supply that is scheduled through 2023 — assuming five years of construction — should be unaffected by the new circulars. From 2023, there is likely to be a readjustment of unit sizes in line with changing economics and demographics. Together, a greater choice of unit sizes, an optimal balcony size, more indoor recreational spaces and less traffic congestion within an estate should lead to a more sustainable property market.

The revised average unit sizes translate into a 20% reduction in the number of units, and together with the restrictions on the spread of units and usage of balconies, is likely to discourage developers from participating in government land sale or collective sale tenders.

While we may see a decline in land prices in the near term, a lack of supply in the future might be an unintended consequence. Given that the revised development guidelines will only be implemented three months from now, developers with existing land parcels are likely to bring forward their planning process. Developers that have purchased land through en bloc deals this year could face some challenges in obtaining planning permits.

Home owners looking for property in the city usually don’t mind living in an apartment the size of a hotel room for the convenience of being close to the MRT station, Orchard Road or the CBD. Thus, in the prime districts of Orchard Road and the financial district, there is still a market for compact one- and two-bedroom apartments.

RSS Feed

RSS Feed