Restrictions in buying a Landed Property

The Residential Property Act (the “Act”) prohibits any foreign person to purchase any Residential Property (as defined in the Act), which shall include any vacant land or landed property, unless approval is obtained for such purchase.

A foreign person would be one who is not an approved purchaser

as defined under the Act, being one of the following:-

A Singapore company

A Singapore limited liability partnership

A Singapore society

A foreign person to whom approval has been granted under section 25, 30 or 31 of the Act

Any person, company, limited liability partnership, society, association or other organisation or body who or which has been exempted by the Minister under section 32 of the Act

Any body, corporate or otherwise, declared by the Minister by notification in the Gazette to be a public authority or an instrumentality or agency of the Government

For the avoidance of doubt and for clarity sake of this article, it is important to note that a Singapore company is defined under the Act to be a company incorporated in Singapore and its directors and members are all citizens of Singapore.

Applications for Approval to Purchase Restricted Property

There are two forms of application that are available for foreign persons for the purposes of purchasing or acquiring such restricted properties. One may apply for:-

a) A LDAU Approval under Section 25 of the Act, where the subject property will only be for your own occupation and that of your family as a dwelling-house and not for any other purpose; or

b) A Qualifying Certificate under Section 31 of the Act, where you intend to apply as a housing developer for the purposes of re-developing the subject property.

For the purposes of this article, we will explore more on acquiring a landed property for your own occupation as a dwelling house.

A foreign person would be one who is not an approved purchaser

as defined under the Act, being one of the following:-

A Singapore company

A Singapore limited liability partnership

A Singapore society

A foreign person to whom approval has been granted under section 25, 30 or 31 of the Act

Any person, company, limited liability partnership, society, association or other organisation or body who or which has been exempted by the Minister under section 32 of the Act

Any body, corporate or otherwise, declared by the Minister by notification in the Gazette to be a public authority or an instrumentality or agency of the Government

For the avoidance of doubt and for clarity sake of this article, it is important to note that a Singapore company is defined under the Act to be a company incorporated in Singapore and its directors and members are all citizens of Singapore.

Applications for Approval to Purchase Restricted Property

There are two forms of application that are available for foreign persons for the purposes of purchasing or acquiring such restricted properties. One may apply for:-

a) A LDAU Approval under Section 25 of the Act, where the subject property will only be for your own occupation and that of your family as a dwelling-house and not for any other purpose; or

b) A Qualifying Certificate under Section 31 of the Act, where you intend to apply as a housing developer for the purposes of re-developing the subject property.

For the purposes of this article, we will explore more on acquiring a landed property for your own occupation as a dwelling house.

LDAU Approval-in-Principal

To apply for a LDAU Approval, it is important to note the following:-

1) Each application is considered on its own merits and the main requirements are that you are a Singapore PR and make an adequate contribution to Singapore.

2) You should be a permanent resident of Singapore for at least five (5) years.

3) The application process takes approximately four (4) to six (6) weeks from the submission.

4) For the application of in-principle approval, you will need to submit particulars of the specific property you wish to purchase within six (6) months after the issuance of the letter of approval, failing which your approval will lapse.

Should you decide to proceed to make an application, you should be prepared to furnish the following details (where applicable):-

i) Copy of your Identity Card;

ii) Copy of your Spouse’s Identity Card;

iii) Copy of your Passport and valid entry / re-entry permit;

iv) Copy of your Marriage Certificate;

v) Copies of your tertiary/

professional and/or technical

qualifications;

vi) Copies of your spouse’s

tertiary/professional and/or

technical qualifications;

vii) Copies of your notice of assessment of income tax for the last three (3) years;

viii) Copies of your spouse’s notice of assessment of income tax for the last three

(3) years;

ix) Your child/children’s birth certificates/NRICs;

x) Copy of your latest pay advice or letter from employer stating last drawn pay;

xi) Copy of your spouse’s latest pay advice or letter from employer stating last drawn pay;

xii) Details of yours and your spouse’s employment history (Name of employer, start and end date, designation and country of work); and

xiii) If you or your spouse have an interest in any company, please furnish copies of latest audited accounts and instant information print out of the company.

To apply for a LDAU Approval, it is important to note the following:-

1) Each application is considered on its own merits and the main requirements are that you are a Singapore PR and make an adequate contribution to Singapore.

2) You should be a permanent resident of Singapore for at least five (5) years.

3) The application process takes approximately four (4) to six (6) weeks from the submission.

4) For the application of in-principle approval, you will need to submit particulars of the specific property you wish to purchase within six (6) months after the issuance of the letter of approval, failing which your approval will lapse.

Should you decide to proceed to make an application, you should be prepared to furnish the following details (where applicable):-

i) Copy of your Identity Card;

ii) Copy of your Spouse’s Identity Card;

iii) Copy of your Passport and valid entry / re-entry permit;

iv) Copy of your Marriage Certificate;

v) Copies of your tertiary/

professional and/or technical

qualifications;

vi) Copies of your spouse’s

tertiary/professional and/or

technical qualifications;

vii) Copies of your notice of assessment of income tax for the last three (3) years;

viii) Copies of your spouse’s notice of assessment of income tax for the last three

(3) years;

ix) Your child/children’s birth certificates/NRICs;

x) Copy of your latest pay advice or letter from employer stating last drawn pay;

xi) Copy of your spouse’s latest pay advice or letter from employer stating last drawn pay;

xii) Details of yours and your spouse’s employment history (Name of employer, start and end date, designation and country of work); and

xiii) If you or your spouse have an interest in any company, please furnish copies of latest audited accounts and instant information print out of the company.

Additional Buyer’s Stamp Duty In the event approval has been granted by the relevant authorities for the purchase of such restricted properties, you will also need to consider the stamp duties that may be applicable to you in such an acquisition.

On top of the Buyer’s Stamp Duty which is calculated based on the following calculation:

1% on first $180,000

2% on next $180,000

3% on next $640,000

4% for the remainder you will also need to consider the relevant Additional Buyer’s Stamp Duty that may be applicable to

the purchase based on your profile as shown below:

a) Foreigners – at the rate of 20%

b) Companies, partnerships and societies (including all corporate entitles and developers-companies) – at the rate of 25% (plus additional 5% for housing developer which is non-remittable)

c) Singapore Permanent Residents (PR) – at the rate of 5% for their purchase of the first residential property and PR who already own 1 residential properties – at the rate of 15%

d) Singapore Citizens (SC) who already own 1 residential property would have to pay at the rate 12% and SC who already own 2 or more residential properties would have to pay at the rate of 15% on the purchase of another residential property.

Please also note that if a buyer is liable to pay ABSD but fails to do so, the document is considered not duly stamped. Non-stamping without lawful excuse is an offence and would attract penalties.

It may also be note-worthy that Nationals of United States of America, Switzerland, Liechtenstein, Norway and Iceland will be treated like a-category (d) above and will be entitled to apply for remission of ABSD and you will not have to pay ABSD if it is remitted by the relevant authority.

RESIDENTIAL PROPERTY NOTIFICATION N.7 OF THE ACT

However, in purchasing any vacant land or landed property, it may also not be a requirement that you will have to apply for an LDAU Approval because the Residential Property Notification N.7 had also expressly declared some lands to be non-residential property for the purposes of the Act.

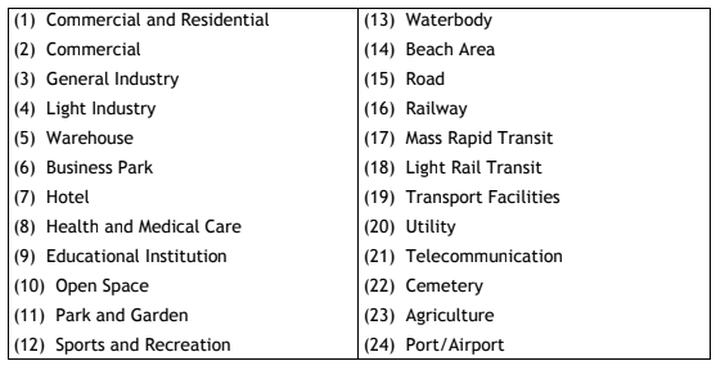

This will primarily relate to the zoning of the land pursuant to the Master Plan and such exclusions include land which are zoned the following as stipulated in the schedule of the said notification:-

On top of the Buyer’s Stamp Duty which is calculated based on the following calculation:

1% on first $180,000

2% on next $180,000

3% on next $640,000

4% for the remainder you will also need to consider the relevant Additional Buyer’s Stamp Duty that may be applicable to

the purchase based on your profile as shown below:

a) Foreigners – at the rate of 20%

b) Companies, partnerships and societies (including all corporate entitles and developers-companies) – at the rate of 25% (plus additional 5% for housing developer which is non-remittable)

c) Singapore Permanent Residents (PR) – at the rate of 5% for their purchase of the first residential property and PR who already own 1 residential properties – at the rate of 15%

d) Singapore Citizens (SC) who already own 1 residential property would have to pay at the rate 12% and SC who already own 2 or more residential properties would have to pay at the rate of 15% on the purchase of another residential property.

Please also note that if a buyer is liable to pay ABSD but fails to do so, the document is considered not duly stamped. Non-stamping without lawful excuse is an offence and would attract penalties.

It may also be note-worthy that Nationals of United States of America, Switzerland, Liechtenstein, Norway and Iceland will be treated like a-category (d) above and will be entitled to apply for remission of ABSD and you will not have to pay ABSD if it is remitted by the relevant authority.

RESIDENTIAL PROPERTY NOTIFICATION N.7 OF THE ACT

However, in purchasing any vacant land or landed property, it may also not be a requirement that you will have to apply for an LDAU Approval because the Residential Property Notification N.7 had also expressly declared some lands to be non-residential property for the purposes of the Act.

This will primarily relate to the zoning of the land pursuant to the Master Plan and such exclusions include land which are zoned the following as stipulated in the schedule of the said notification:-

CONCLUSION:

In light of the above information, it is therefore imperative that you speak to one of us before considering any acquisition of property or properties in Singapore to enable us to advice you of the adequate requirements for foreign ownership and stamp duty implication.

In light of the above information, it is therefore imperative that you speak to one of us before considering any acquisition of property or properties in Singapore to enable us to advice you of the adequate requirements for foreign ownership and stamp duty implication.