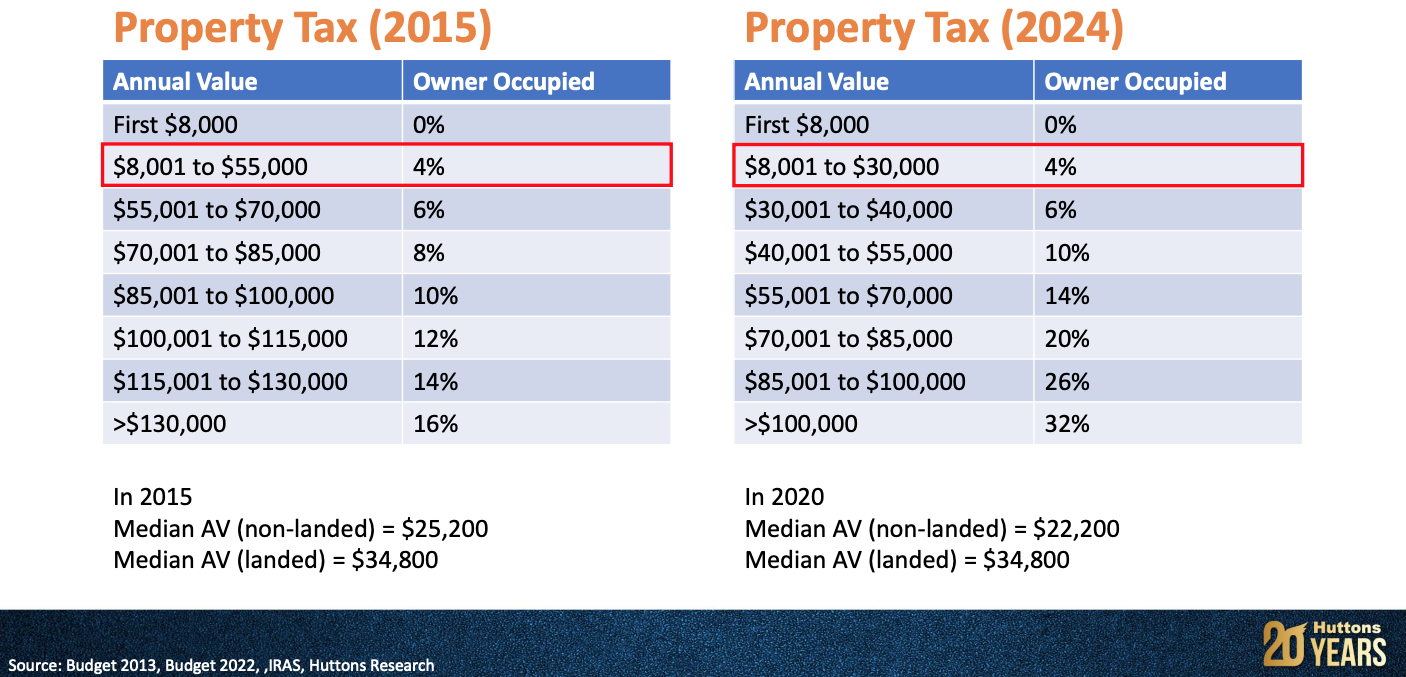

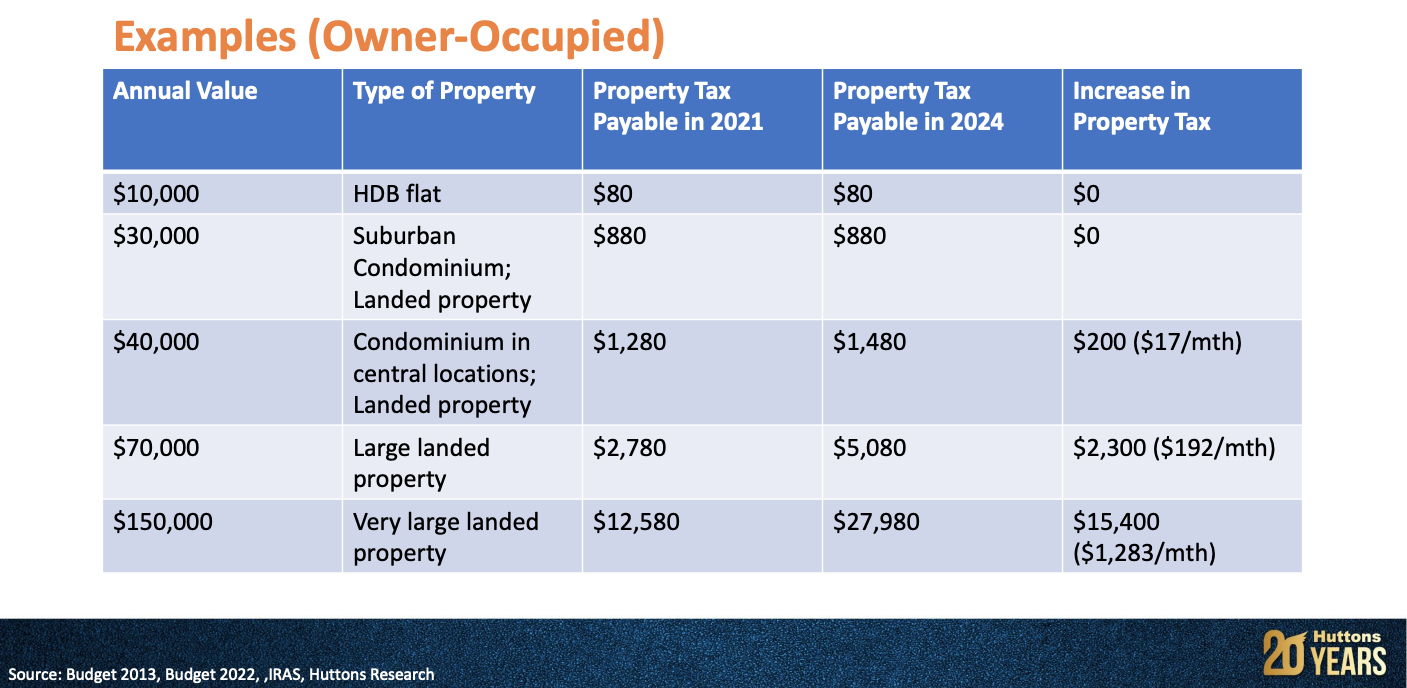

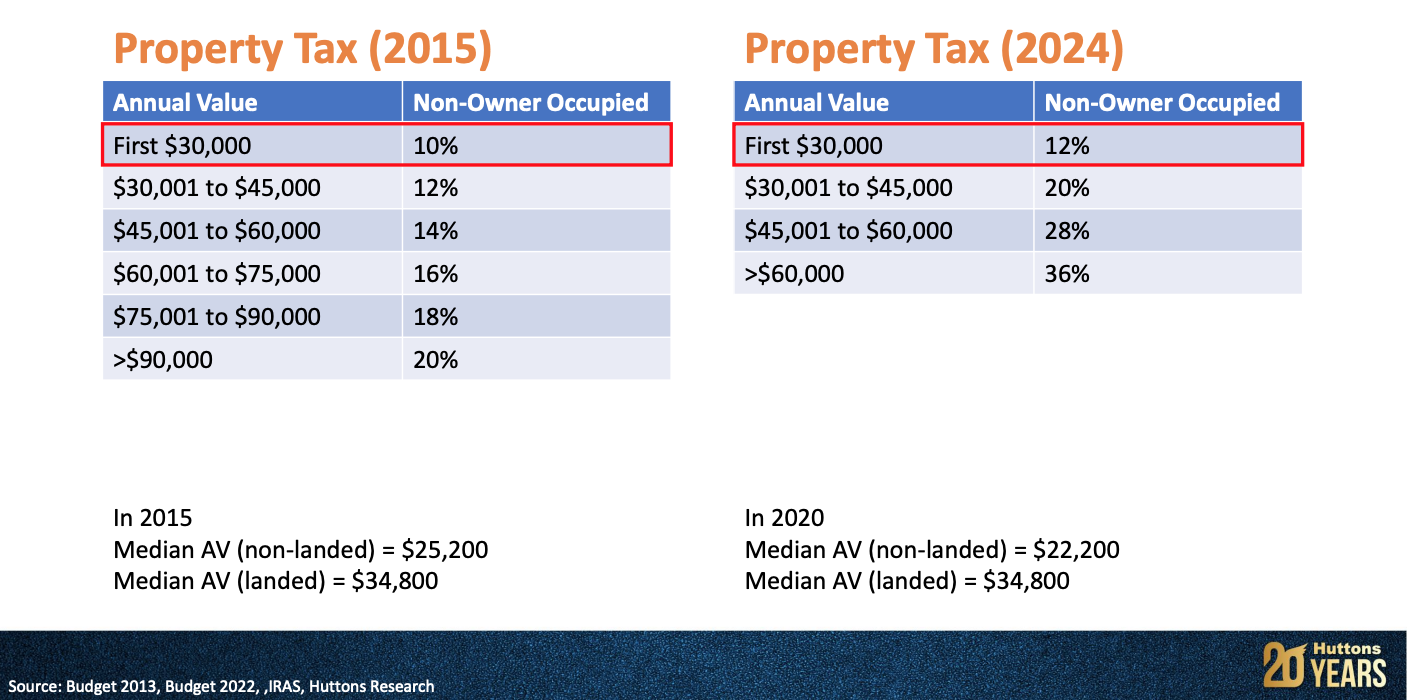

Increasing property taxes is probably the easiest and cost effective way of levying a wealth tax. As described by some, it is the low lying fruit. While there is an increase across the board for both owner-occupied and non-owner occupied residential properties, properties with a higher annual value will be taxed more.

The majority of the property market will not be affected as they will not see a big increase in the annual value and hence the property tax payable. Singaporeans made up more than 80% of the buyers in recent years and thus should not be affected much. Will this make investing in properties less attractive? It may not.

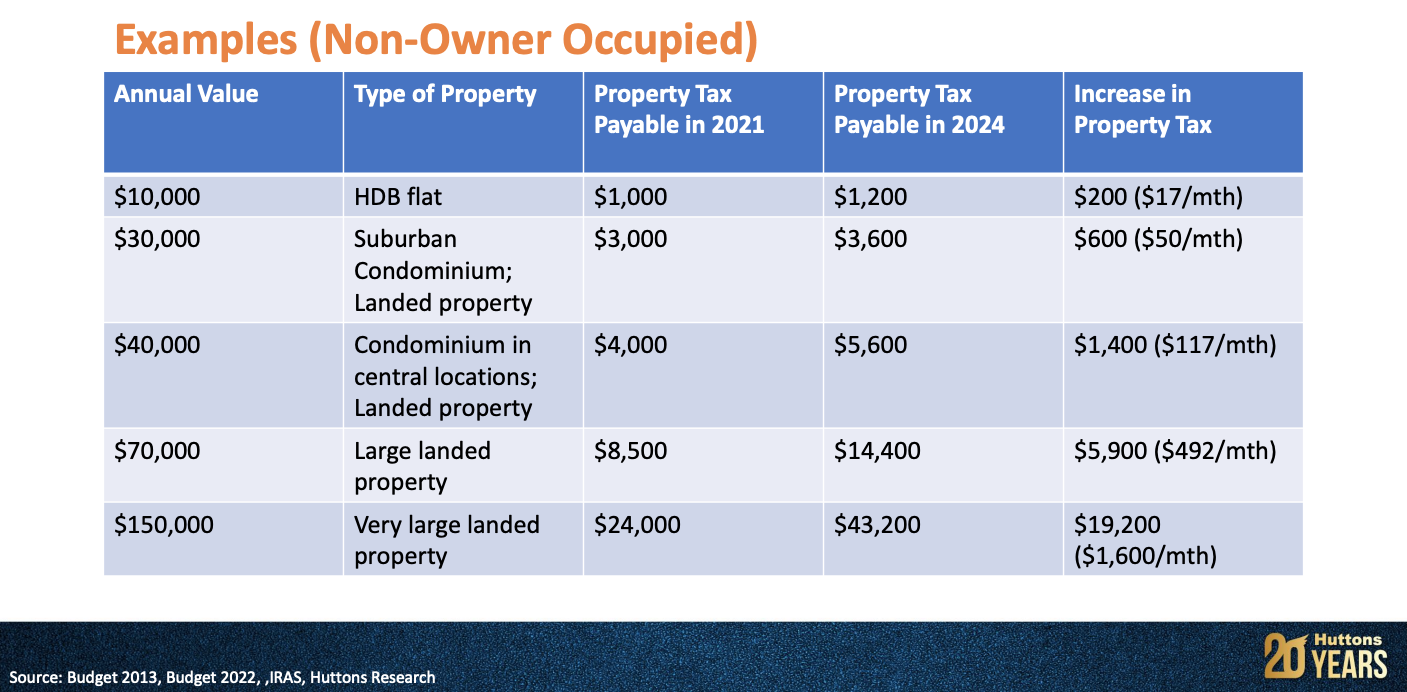

Most investors buy properties for several reasons - wealth preservation, rental and capital appreciation. Properties are a good hedge against inflation and hold its value over time. Furthermore investors look towards capital appreciation more than rental income. Capital appreciation is more significant than rental. In the current positive rental market conditions, owners will try to pass some of the increase in property taxes to the tenants. This will result in higher rents and costs to foreigners.

They may ask for a higher pay package which raises the business costs for companies. For those in the top 1% of the population who use the residential home occasionally, the increase may not be significant to them.

The majority of the property market will not be affected as they will not see a big increase in the annual value and hence the property tax payable. Singaporeans made up more than 80% of the buyers in recent years and thus should not be affected much. Will this make investing in properties less attractive? It may not.

Most investors buy properties for several reasons - wealth preservation, rental and capital appreciation. Properties are a good hedge against inflation and hold its value over time. Furthermore investors look towards capital appreciation more than rental income. Capital appreciation is more significant than rental. In the current positive rental market conditions, owners will try to pass some of the increase in property taxes to the tenants. This will result in higher rents and costs to foreigners.

They may ask for a higher pay package which raises the business costs for companies. For those in the top 1% of the population who use the residential home occasionally, the increase may not be significant to them.