Two major changes kicked in on 6 July 2018 – Additional Buyer's Stamp Duty (ABSD) went up, while loan-to-value or LTV limits went down.

Additional Buyer's Stamp Duty (ABSD)

Liable buyers are required to pay ABSD on top of the existing Buyer’s Stamp Duty (BSD). ABSD and BSD are computed on the purchase price as stated in the dutiable document or the market value of the property (whichever is the higher amount).

The ABSD rates have been adjusted on 6 Jul 2018. You may refer to the attached ABSD Fact Sheet for an overview of more details on the adjusted ABSD rates and the ABSD remission for acquisition of residential properties during the transitional period.

Liable buyers are required to pay ABSD on top of the existing Buyer’s Stamp Duty (BSD). ABSD and BSD are computed on the purchase price as stated in the dutiable document or the market value of the property (whichever is the higher amount).

The ABSD rates have been adjusted on 6 Jul 2018. You may refer to the attached ABSD Fact Sheet for an overview of more details on the adjusted ABSD rates and the ABSD remission for acquisition of residential properties during the transitional period.

Determining ABSD Liability

The ABSD liability will depend on the profile of the buyer as at the date of purchase or acquisition of the residential property:

A. Whether the buyer is an individual or an entity

B. The residency status of the buyer and

C. The count of residential properties owned by the buyer

The ABSD liability will depend on the profile of the buyer as at the date of purchase or acquisition of the residential property:

A. Whether the buyer is an individual or an entity

B. The residency status of the buyer and

C. The count of residential properties owned by the buyer

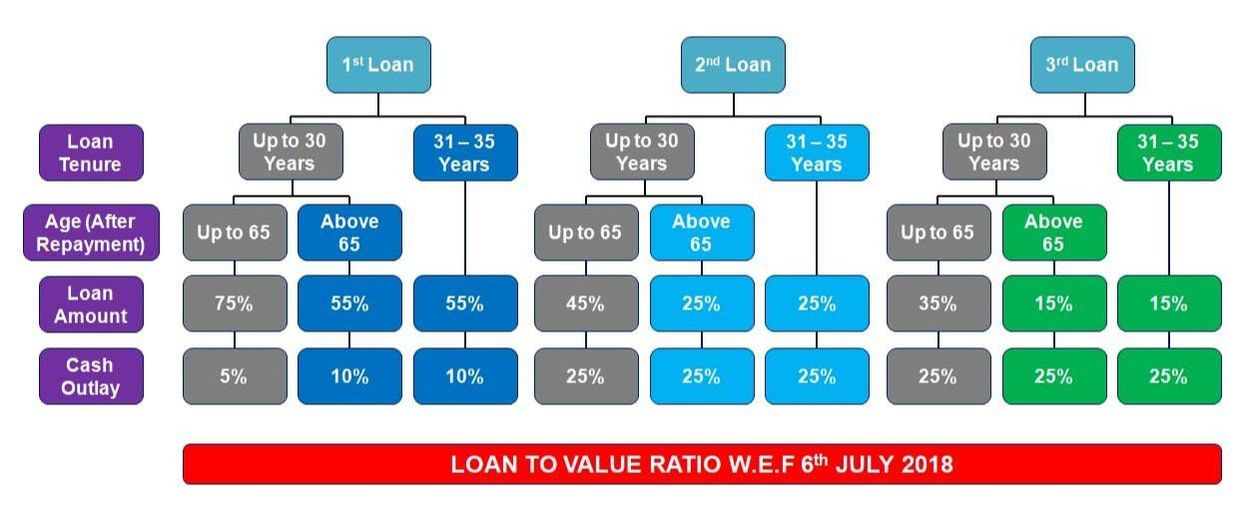

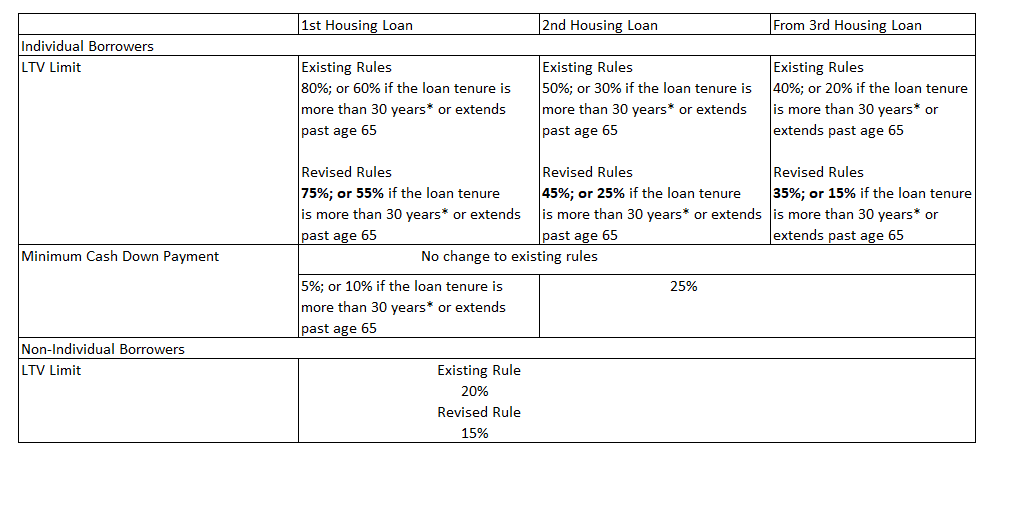

Loan-to-value (LTV) limits

Loan-to-value (LTV) limits will be tightened by 5%-points for all housing loans granted by financial institutions. These revised LTV limits do not apply to loans granted by HDB. The table below summarises the adjustments to the LTV limits: