WHY DO PEOPLE CHOOSE TO LIVE IN THE CITY

|

GREATER VARIETY OF ETHNIC FOOD, RESTAURANTS, CAFES & EATERIES |

EXCITING EVENTS & NIGHTLIFE TO CHILL AFTER WORK |

MORE EMPLOYMENT OPPORTUNITIES & CULTURAL VENUES

EXCELLENT PUBLIC TRANSPORTATION - CAR LITE CITY

SURROUNDED BY AMENITIES: SHOPPING CENTRES, SUPERMARKETS

PROXIMITY TO COMPREHENSIVE HEALTHCARE HUB

SURROUNDED BY GREEN SPACES: PARKS & GARDENS

AFFORDABLE HEARTLAND PRICES & FOOD EVEN IN PRIME CBD DISTRICT

wHich Other NEIGHBOURHOOD Can You Find ALL THE ABOVE?

UPSIDE POTENTIAL 1:

URA Masterplan For Pearl's Hill / Outram Park:

6,000 homes to be built in Pearl's Hill over 10 years, with more planned for other central locations

6,000 homes to be built in Pearl's Hill over 10 years, with more planned for other central locations

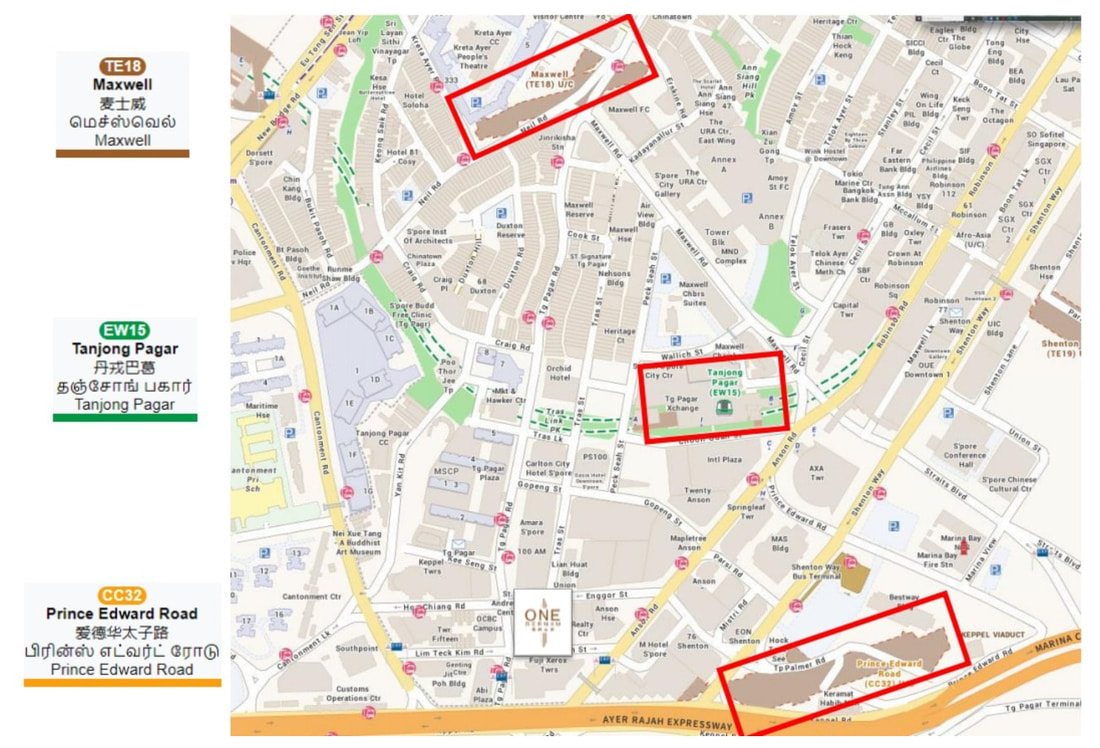

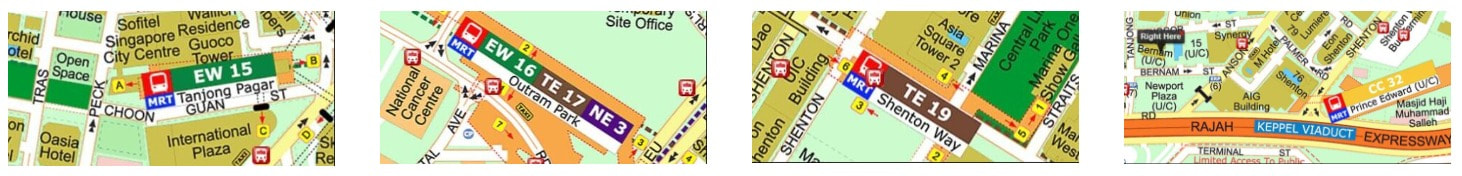

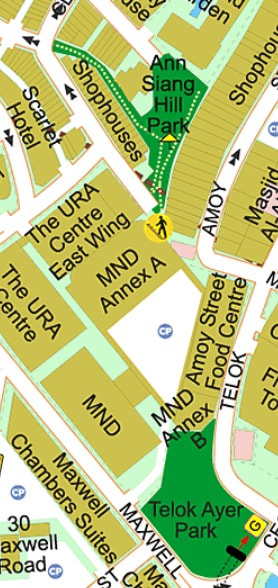

As one of the two remaining hills in the city, URA said that Pearl’s Hill will undergo development as an inclusive and community-centric neighbourhood. Future residents can look forward to a variety of amenities within a proposed mixed-use development to be integrated with Outram Park MRT Station and around the neighbourhood to meet their daily needs. Given Pearl’s Hill's convenient location near the Central Business District, Chinatown Historic District and Tiong Bahru neighbourhood, as well as access to four MRT lines, the area has been gazetted as a car-lite district - a network of street-level and elevated connections for residents of Pearl’s Hill to promote "a delightful pedestrian and cycling experience". These connections will also have convenient access to Pearl’s Hill City Park, key transport and amenity nodes, as well as a seamless walking experience towards surrounding urban precincts such as Robertson Quay and Fort Canning Park.

Additionally, the National Parks Board will be enhancing Pearl’s Hill City Park with new park facilities and "contemplative landscapes" that support the physical and mental well-being of park users.

Additionally, the National Parks Board will be enhancing Pearl’s Hill City Park with new park facilities and "contemplative landscapes" that support the physical and mental well-being of park users.

UPSIDE POTENTIAL 2:

NPARKS MASTERPLAN:

6KM GREEN CONNECTOR FROM ORCHARD TO SINGAPORE RIVER

6KM GREEN CONNECTOR FROM ORCHARD TO SINGAPORE RIVER

As part of ongoing plans to enhance Orchard Road as a lifestyle destination and to ‘Bring Back the Orchard’, Singapore’s signature street is envisioned to be transformed into a lush green corridor by introducing new green spaces and lush planting. It will form part of a 6km-long green connection linking key historic green and blue spaces in our city centre – Singapore Botanic Gardens, Istana, Fort Canning Park and Singapore River.

UPSIDE POTENTIAL 3:

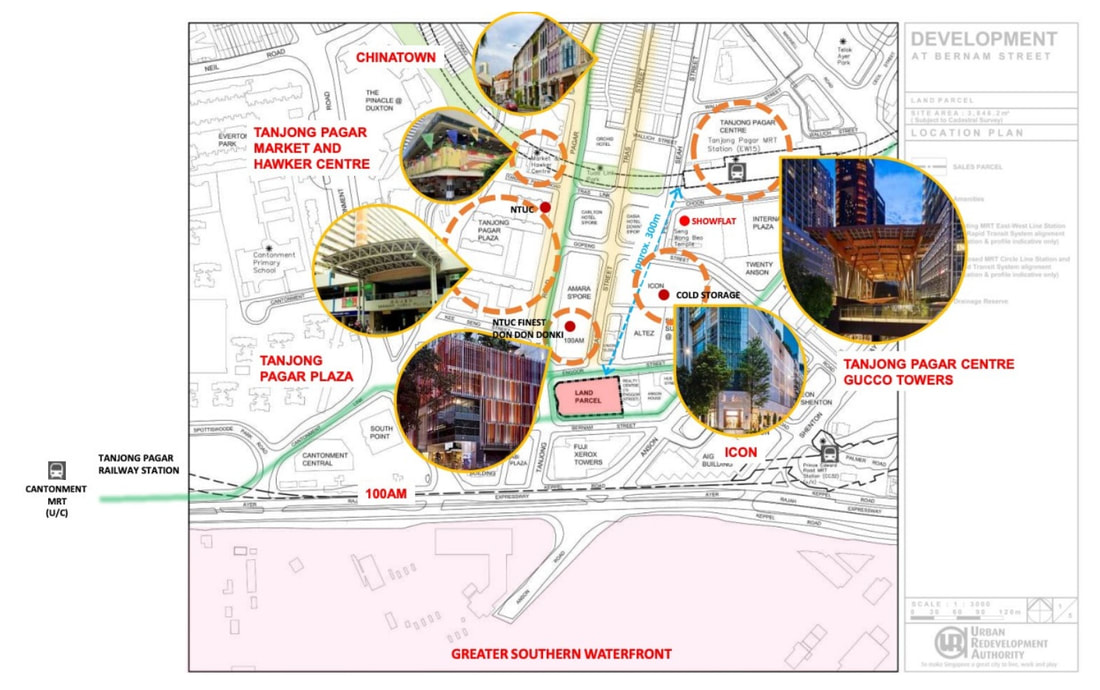

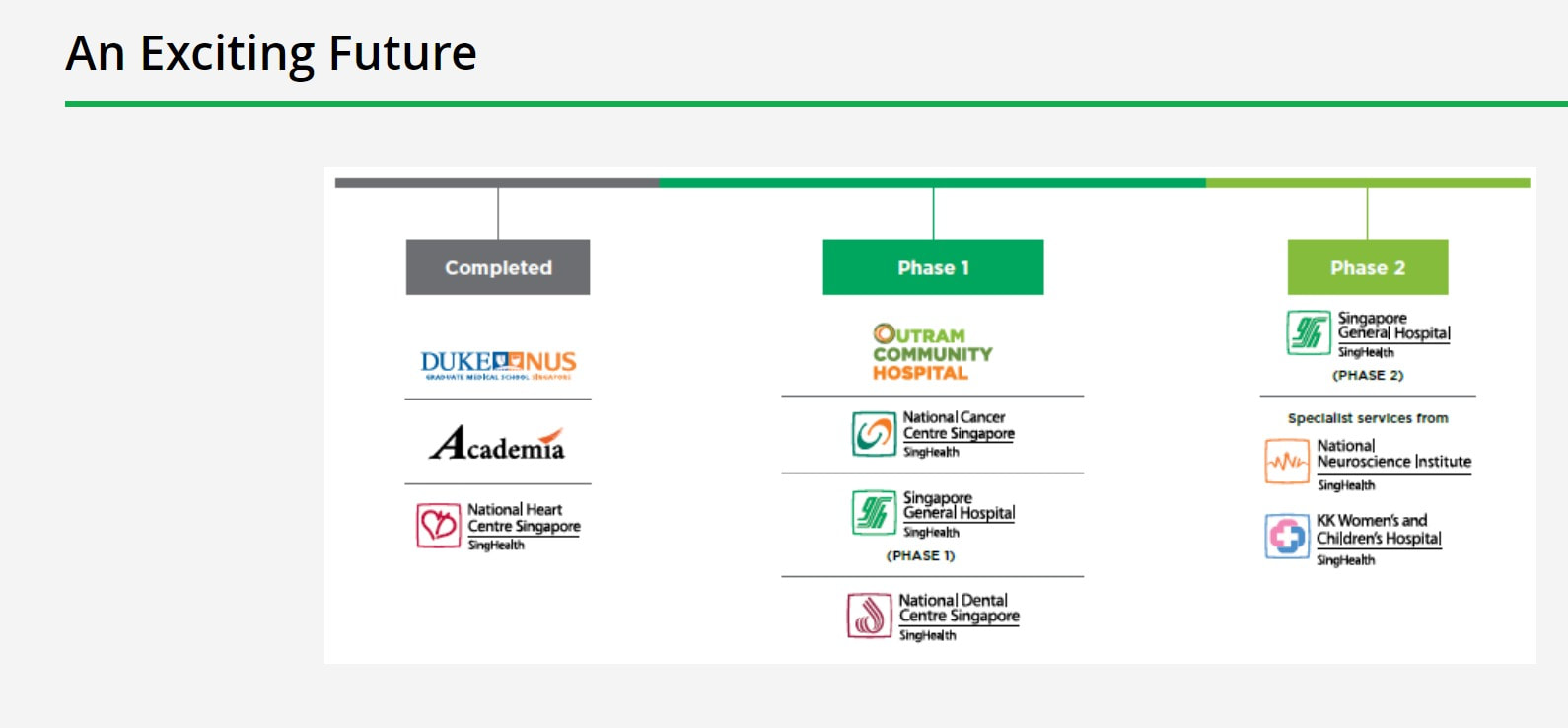

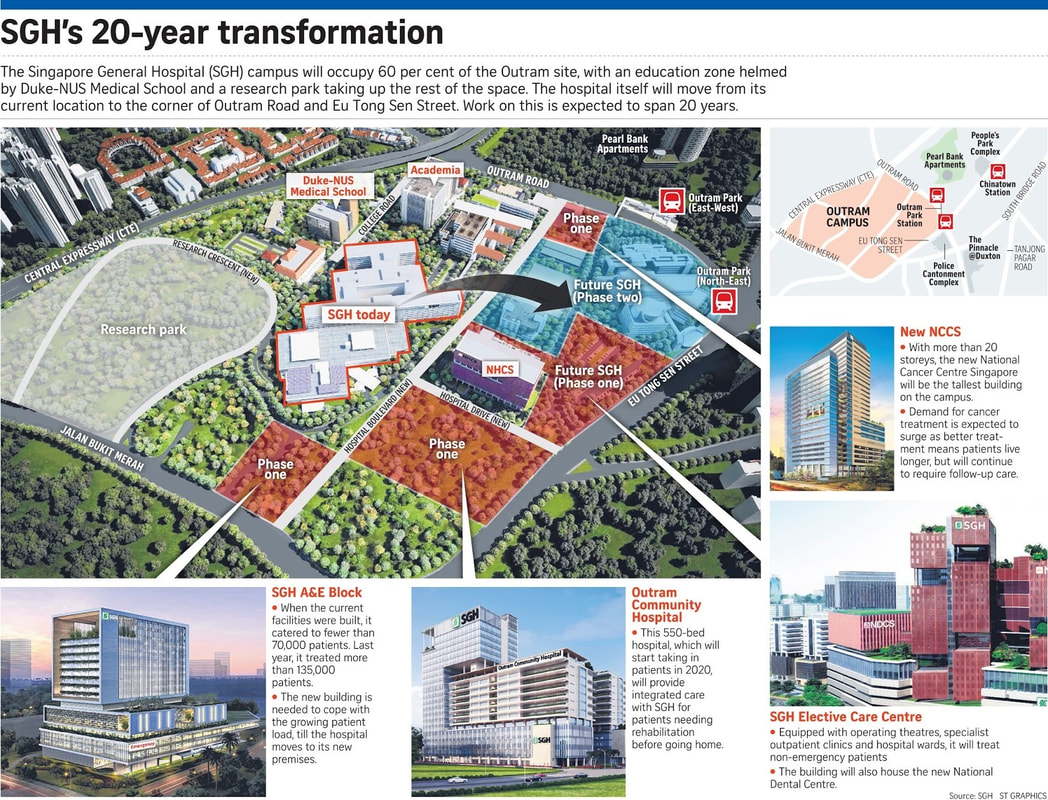

URA SGH CAMPUS MASTERPLAN: SGH MEDICAL HUB & SGH MEDICAL CAMPUS

Home to the SingHealth Duke-NUS Academic Medical Centre, SGH Campus offers a full spectrum of healthcare services helmed by flagship hospital SGH, five national specialty centres – cancer, dental, eye, heart and neuroscience – and SingHealth Polyclinic (Outram). The new development will be expected to employ around 10,000 medical professional & educators.

The SGH Campus Master Plan anticipates the healthcare needs of Singaporeans and will provide an environment that supports the latest models of care that are holistic, multidisciplinary and teambased with integration across the whole spectrum of care.

The SGH Campus of the future will be Singapore’s largest medical campus when completed linking all patient care, education and research facilities as an interconnected healthcare ecosystem. It will provide patients with healthcare that is easily accessible, integrated and seamlessly connected to cutting-edge research and education, translating to better health outcomes for patients.

The SGH Campus is designed to deliver a seamless continuum of care, the resulting vibrant healthcare ecosystem will also drive a world-class Academic Medical Centre that will define healthcare for Singapore.

The SGH Campus of the future will be Singapore’s largest medical campus when completed linking all patient care, education and research facilities as an interconnected healthcare ecosystem. It will provide patients with healthcare that is easily accessible, integrated and seamlessly connected to cutting-edge research and education, translating to better health outcomes for patients.

The SGH Campus is designed to deliver a seamless continuum of care, the resulting vibrant healthcare ecosystem will also drive a world-class Academic Medical Centre that will define healthcare for Singapore.

UPSIDE POTENTIAL 4:

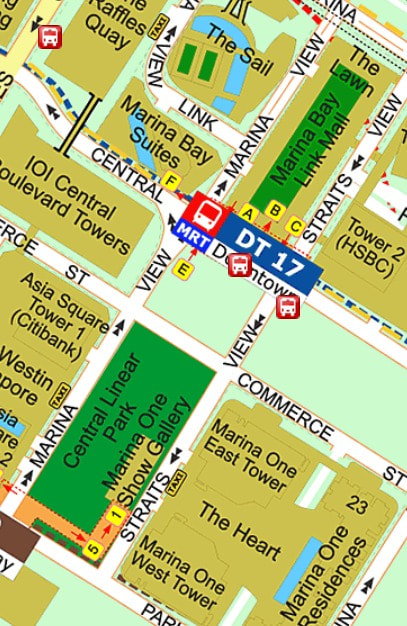

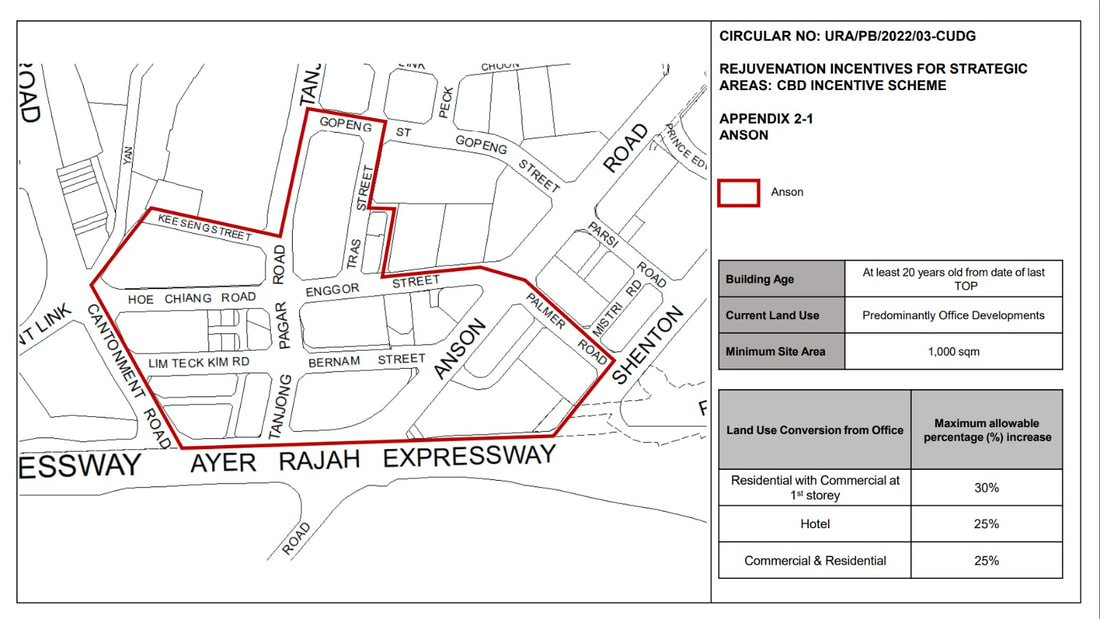

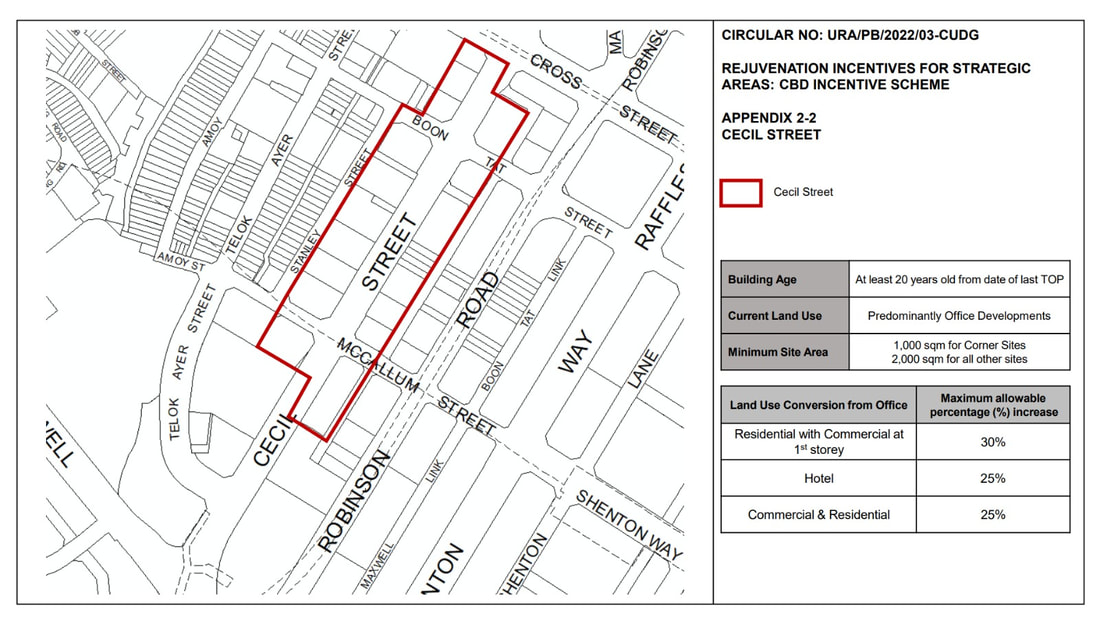

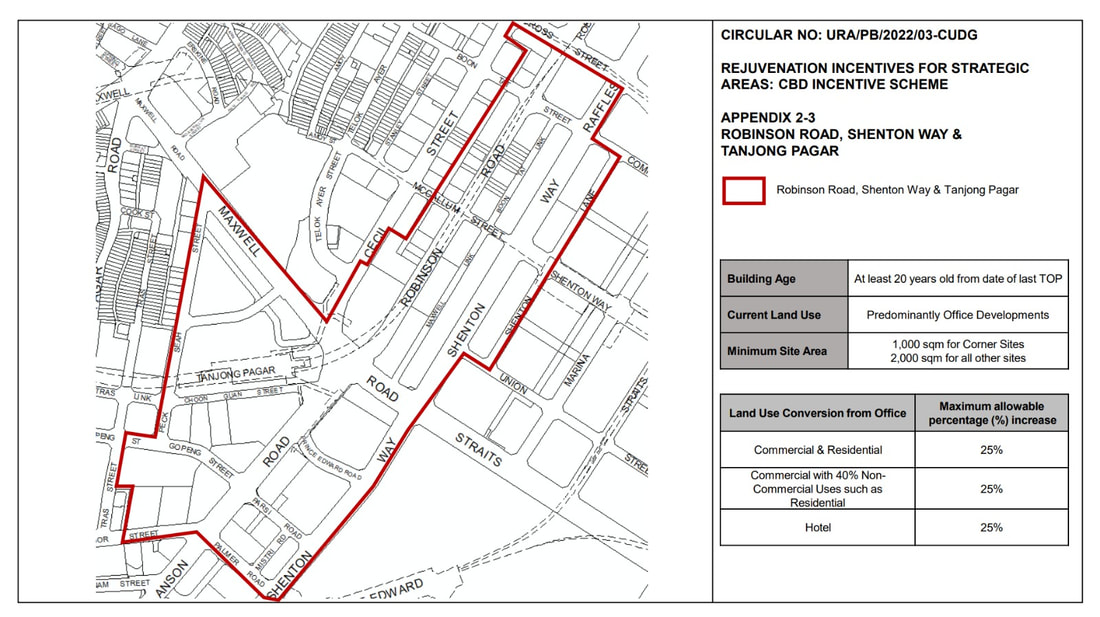

URA CBD MASTERPLAN: Central Business District (CBD) Incentive Scheme

The CBD Incentive Scheme and the Strategic Development Incentive (SDI) Scheme aim to encourage the rejuvenation of the CBD and other strategic areas in Singapore. Sites that fall within the designated areas for the CBD Incentive Scheme shall be guided by the CBD Incentive Scheme and shall not be considered under the SDI Scheme.

Part of URA's plan to Revitalise the CBD with more facilities for work, live and play

UPSIDE POTENTIAL 5:

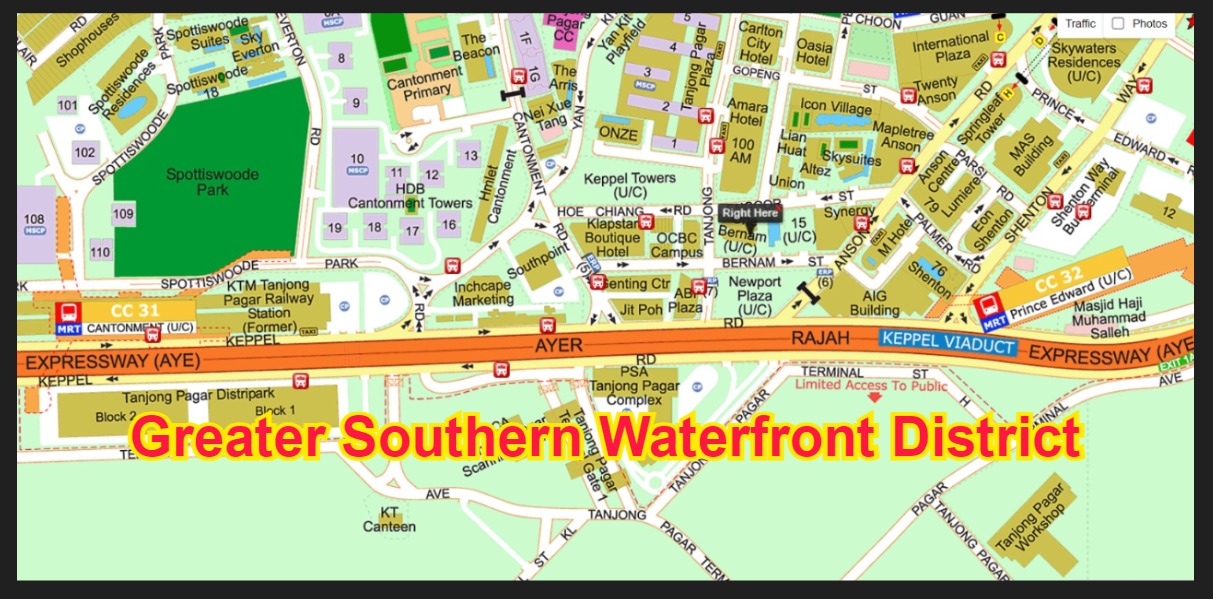

URA MASTERPLAN: GREATER SOUTHERN WATERFRONT DISTRICT

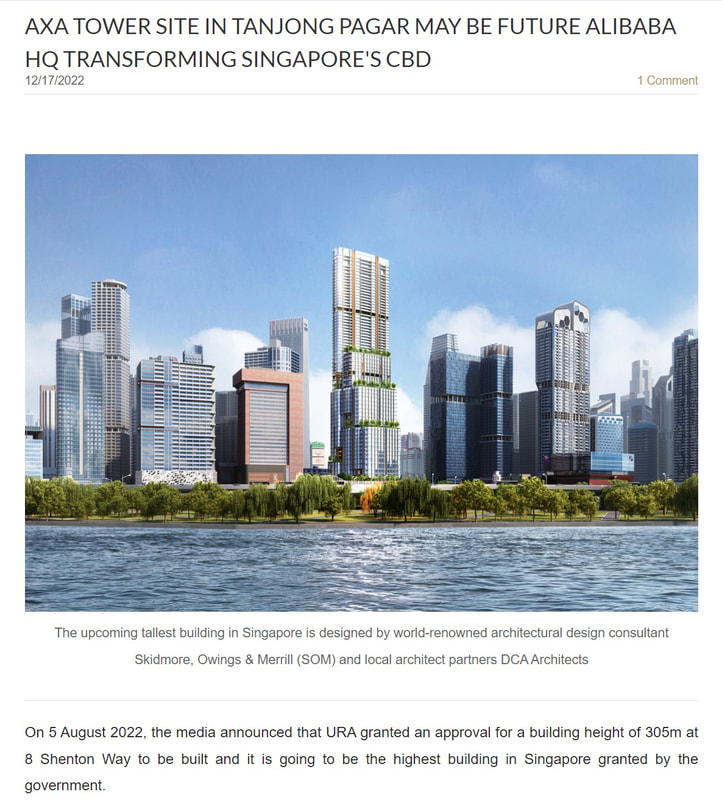

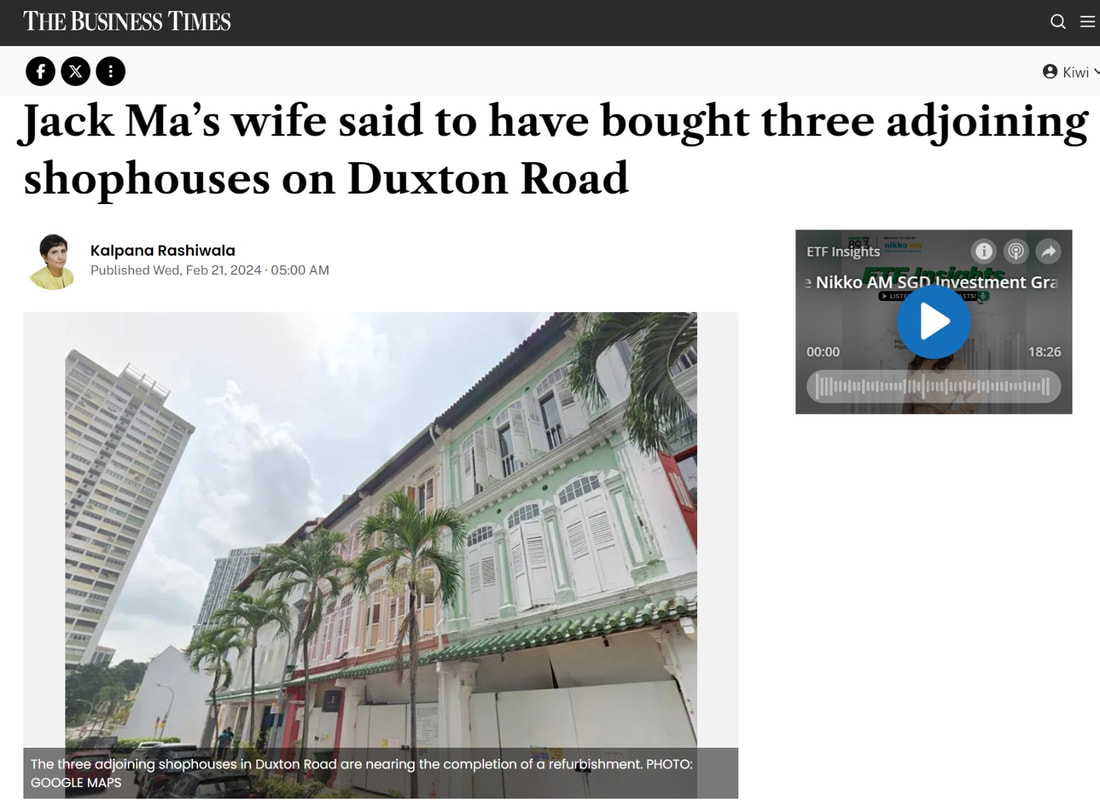

UPSIDE POTENTIAL 6: (WILDCARD)

ALIBABA & JACK MA'S REVITALISATION OF TANJONG PAGAR CBD

UPSIDE POTENTIAL 7:

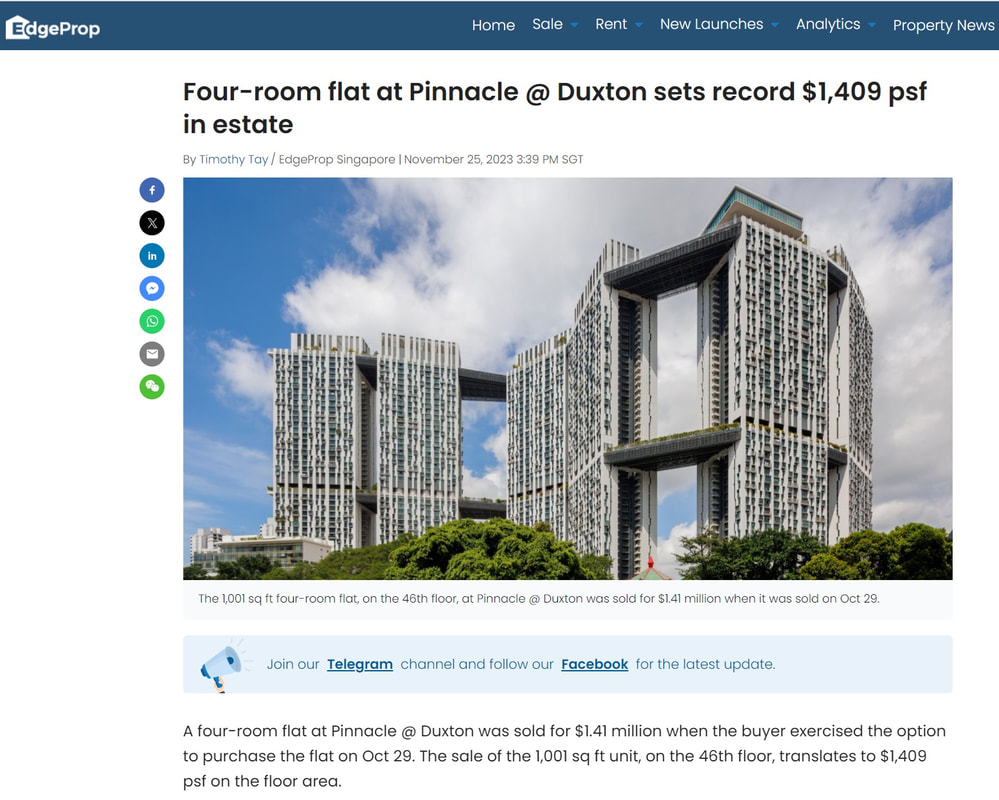

NEAREST RESALE HDB SOLD ABOVE $1,400 PSF (14 YEAR OLD HDB)

UPSIDE POTENTIAL 8:

SINGAPORE POSITIONS ITSELF AS MEDIATION CENTRE OF THE WORLD

As the United States and China seek out a new equilibrium in their relationship, Singapore will be the mediation centre of the world to help reduce unpredictability and hopefully help steer global events towards peace rather than war. Singapore will work towards being constructive, providing value and finding partners to sign on to such agreements – “that is how we can play a part in strengthening multilateralism in the world”, said DPM Wong.

UPSIDE POTENTIAL 9:

GREAT TENANT POOL

UPSIDE POTENTIAL 10:

IF US FED RESERVE CUT INTEREST RATES, WILL BUYERS ENTER THE MARKET?

UPSIDE POTENTIAL 11:

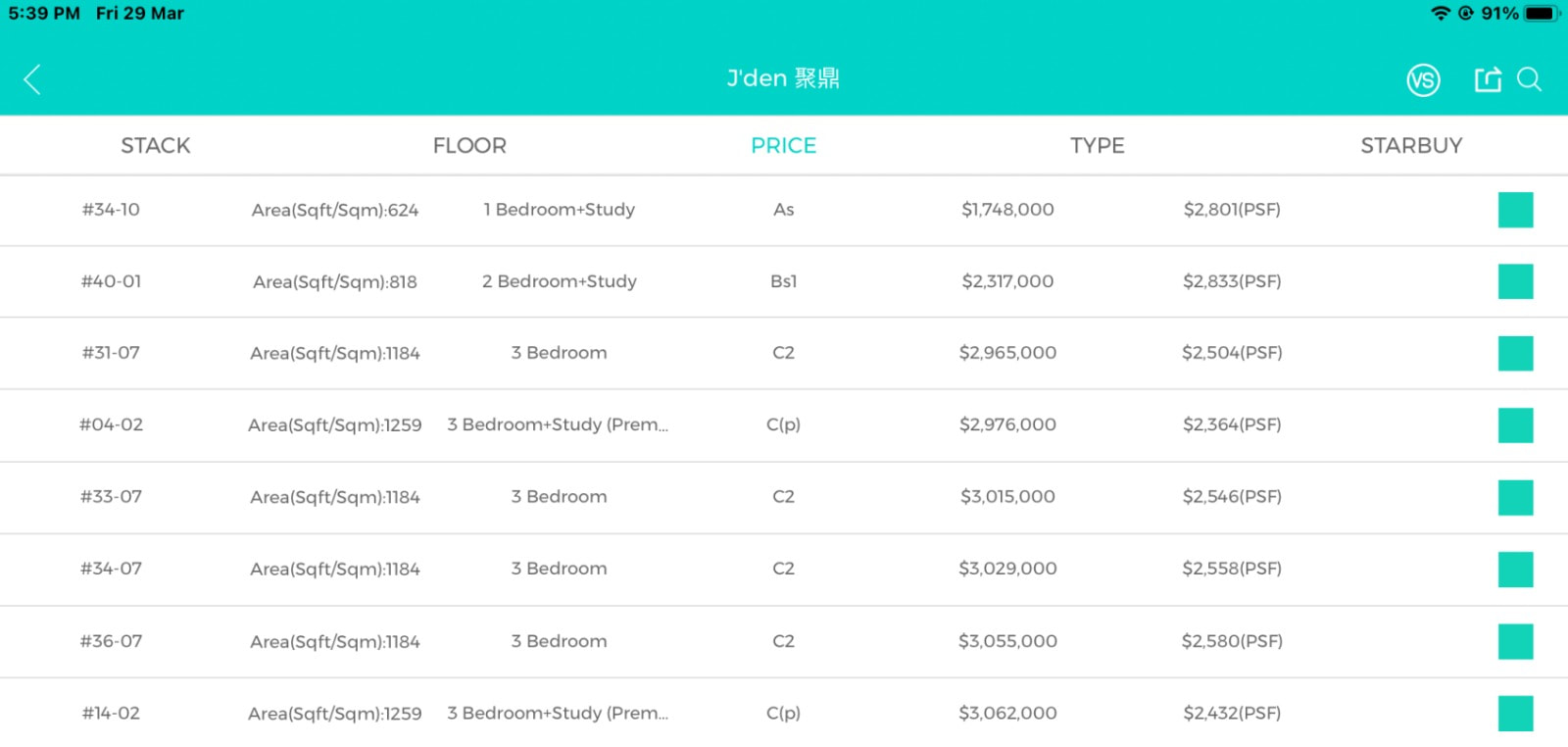

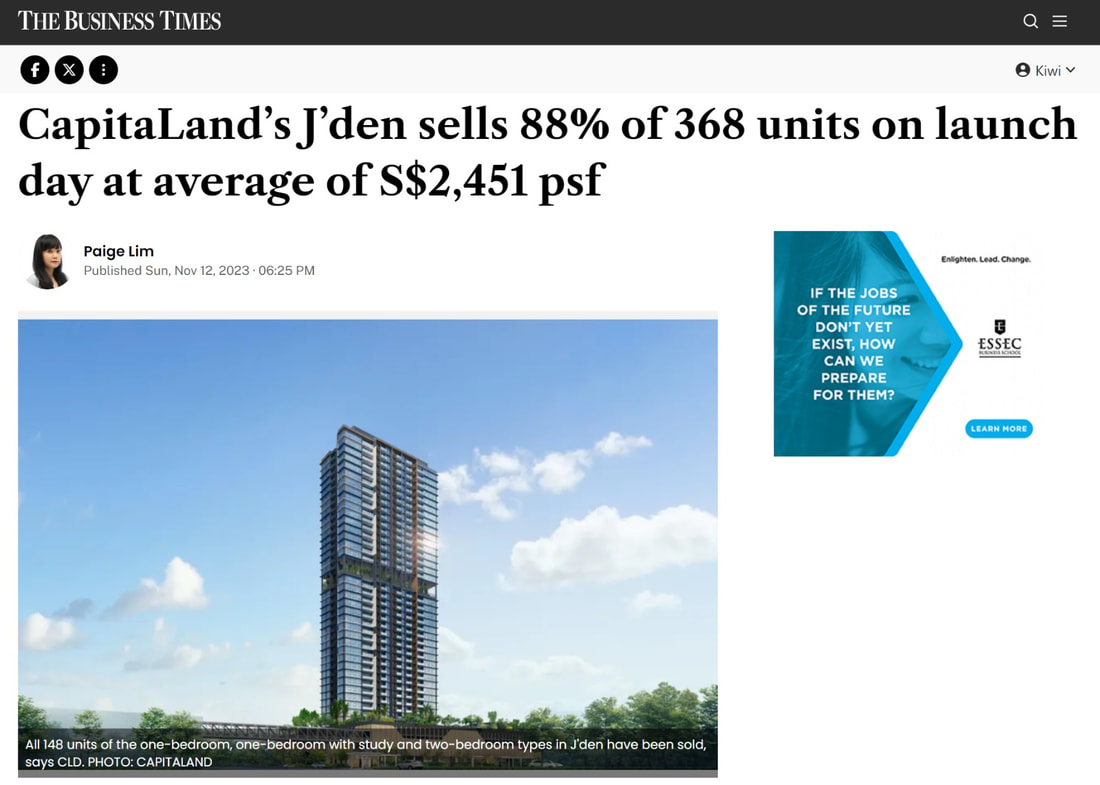

WALLICH RESIDENCES & TMW SELLING ABOVE $3,100 PSF

|

Developer: Guocoland

Total Units: 181 residential units + shopping mall + office + mrt TOP: 2018 Tenure: 99 year from Feb 2011 Address: 3 Wallich Street Site Area: 161,708 sqft USP: Large floorplate units with integrated lifestyle |

Developer: Chip Eng Seng

Total Units: 324 residential units + 11 commercial units TOP: 2028 Tenure: 99 year from 28 April 2023 Address: 31 Tras Street Site Area: 42,000 sqft USP: All 1 & 2 bedrooms with 2 bedroom dual-key units |

NEWPORT RESDIENCES EXPECTED TO SELL ABOVE $3,700 PSF

UPSIDE POTENTIAL 12:

OCR NEW CONDOS - JURONG EAST ABOVE $2,800 PSF (2ND CBD)

If HDB bESIDE oNE bERNAM sOLD aT $1,4XX PSF & top IN 2010, dO yOU aGREE

oNE bERNAM cONDO eXPECTED tO top iN 2025 aT $2,8XX psf iS uNDERVALUED?

UPSIDE POTENTIAL 13:

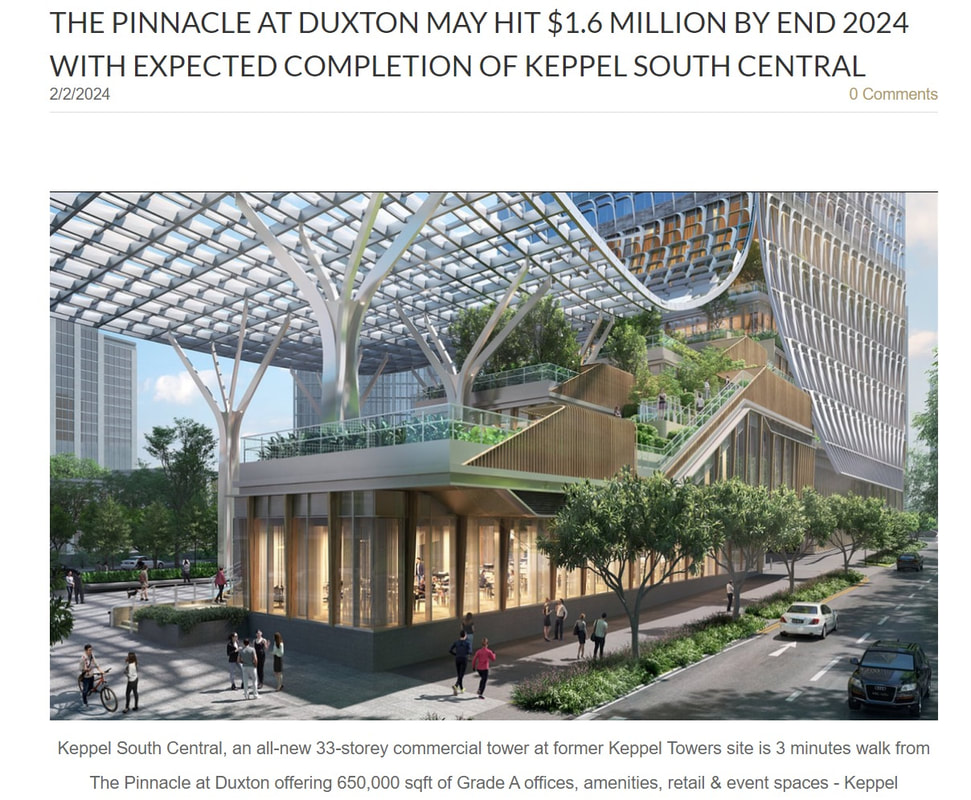

KEPPEL SOUTH CENTRAL (RIGHT BETWEEN P@D & ONE BERNAM)

With Nearby HDB Flats Selling At $1,4xx PSF,

Do You Agree Its Easy For HDB Owners To Upgrade Within The Vicinity?

Do You Agree Its Easy For HDB Owners To Upgrade Within The Vicinity?

UPSIDE POTENTIAL 14:

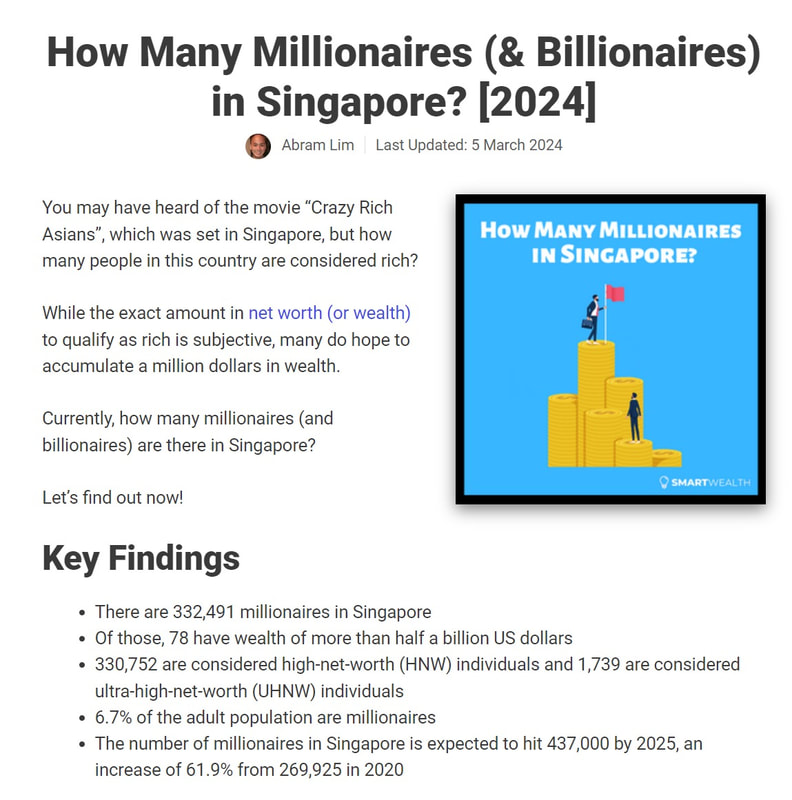

MILLIONAIRES LOVE PRIME DISTRICT / CBD PROPERTIES

- STATUS SYMBOL & LOW SUPPLY

- STATUS SYMBOL & LOW SUPPLY

In 2024, Singapore has an adult population of 4,977,000, and there are 332,491 millionaires (with US$1 million or more in assets excluding the property they stay in). Despite the rising cost of living and being called one of the most expensive cities in the world (in the eyes of expatriates), Singapore is still home to many wealthy people.

UPSIDE POTENTIAL 15:

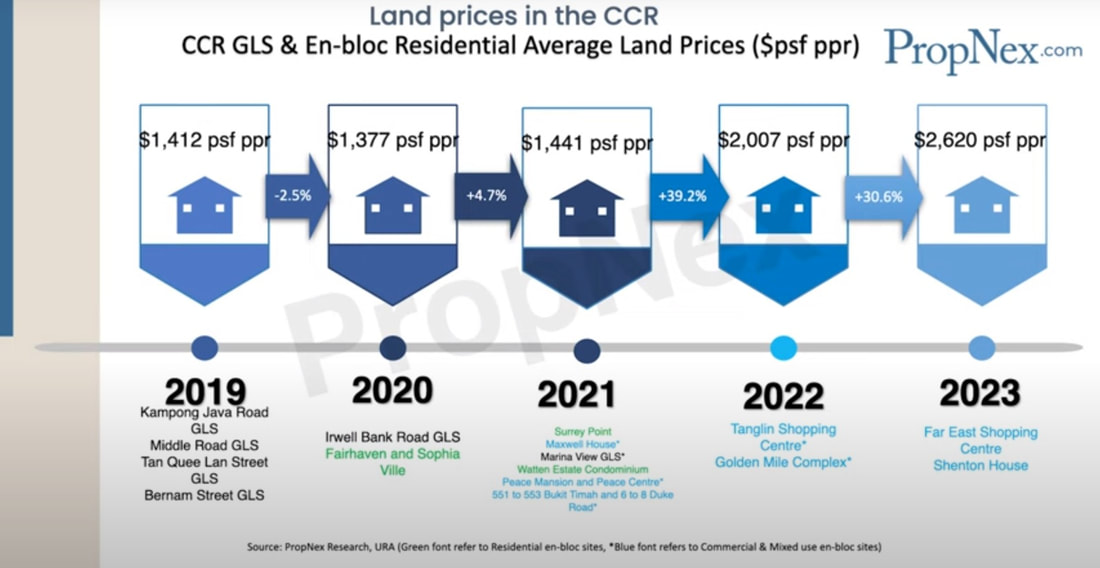

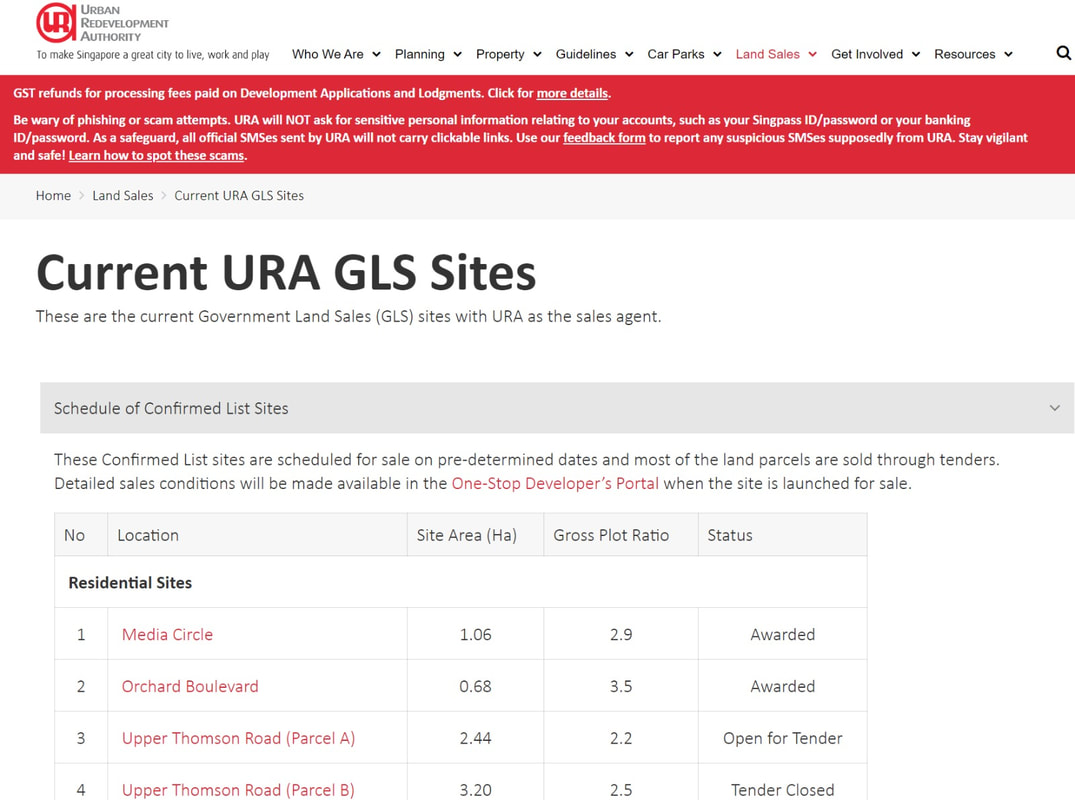

CCR / RCR LAND PRICE TREND IN SINGAPORE

UPSIDE POTENTIAL 16:

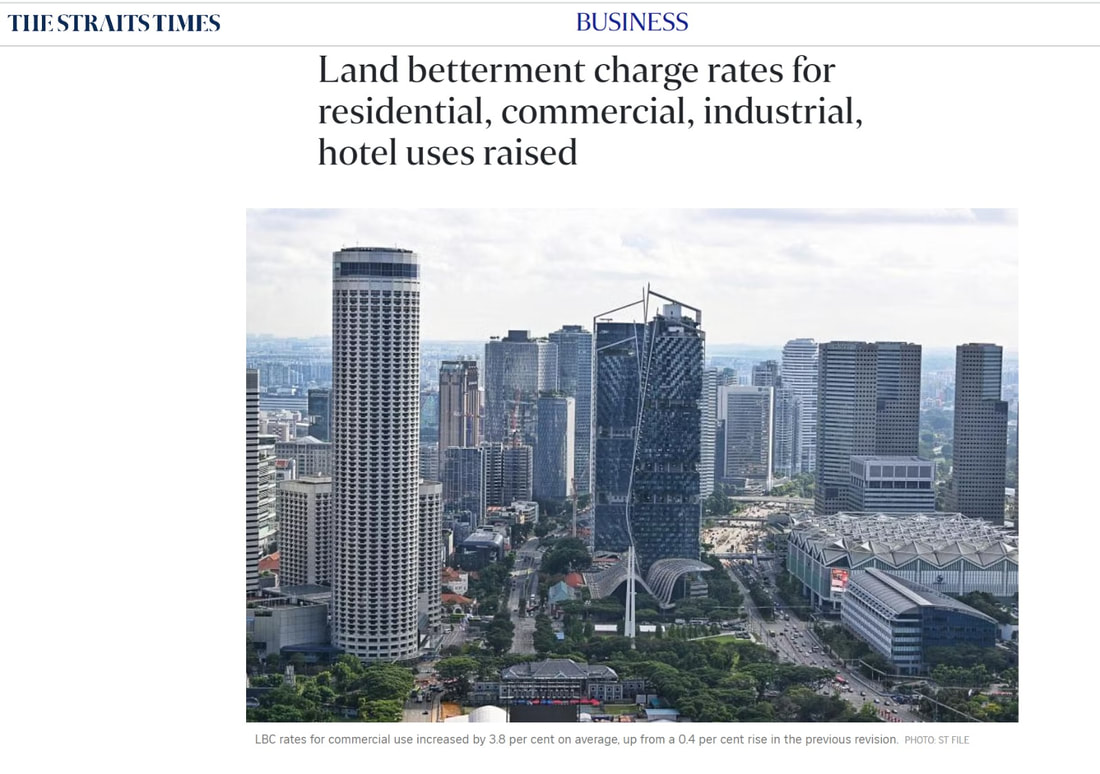

WILL HIGHER LAND BETTERMENT CHARGE (LBC) & HARMONISATION RAISE NEW CONDO PSF PRICES?

With effect from 1 August 2022, a new Land Betterment Charge (LBC) will replace Differential Premium (DP), Development Charge (DC) and Temporary Development Levy (TDL), and be administered by the Singapore Land Authority (SLA).

Will the LBC Revision Affect Property Prices? The hike in LBC means that the total cost of developing land is going to rise since developers are going to have to pay a higher tax on the increase in the value of the land as the land betterment charge (LBC) rates for key use groups – residential, commercial, industrial and hotels – for the next half year have all been raised for the first time since a September 2011 review.

The latest LBC rates for the 1 March to 31 Aug 2024 period were announced on 29 Feb 2024, following a review by the Singapore Land Authority in consultation with the taxman’s chief valuer.

Developers pay an LBC for the right to enhance the use of some sites or to build bigger projects on them and this is expected to raise land costs payable by developers when developing the land to build private residential properties.

Will the LBC Revision Affect Property Prices? The hike in LBC means that the total cost of developing land is going to rise since developers are going to have to pay a higher tax on the increase in the value of the land as the land betterment charge (LBC) rates for key use groups – residential, commercial, industrial and hotels – for the next half year have all been raised for the first time since a September 2011 review.

The latest LBC rates for the 1 March to 31 Aug 2024 period were announced on 29 Feb 2024, following a review by the Singapore Land Authority in consultation with the taxman’s chief valuer.

Developers pay an LBC for the right to enhance the use of some sites or to build bigger projects on them and this is expected to raise land costs payable by developers when developing the land to build private residential properties.

Understanding The Big Picture In Singapore

Who Owns The Most Land In Singapore?

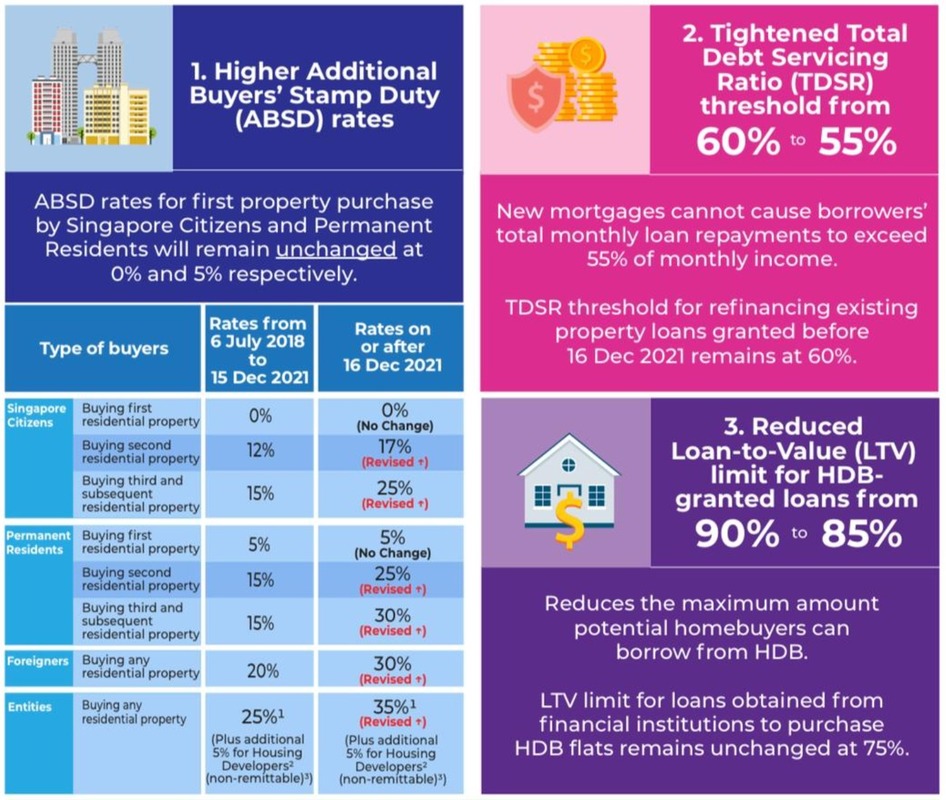

TDSR, ABSD and SSD Keeps Property Prices Realistic