TOP FREQUENTLY ASKED QUESTIONS REGARDING ABSD AFTER 16 DEC 2021

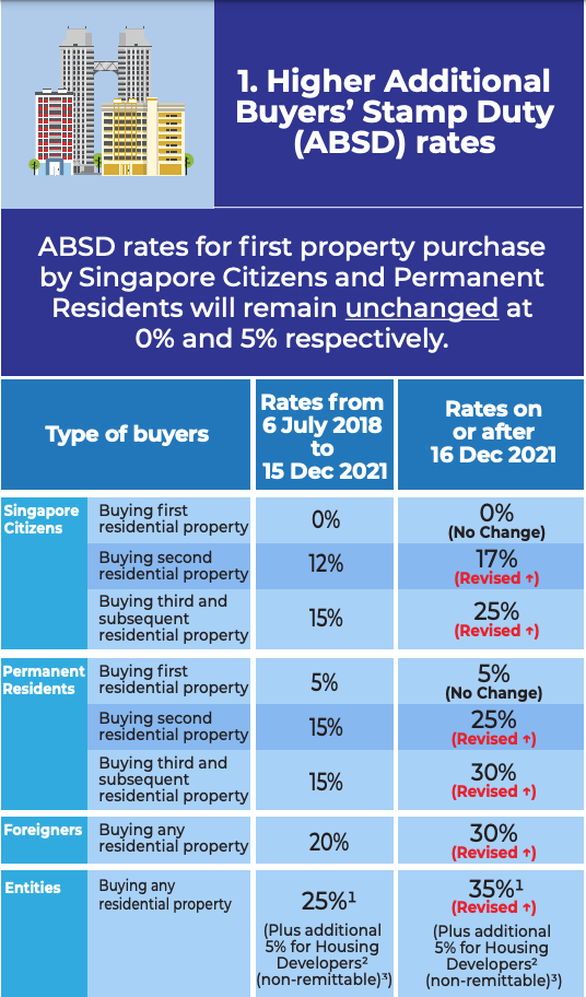

ADDITIONAL BUYER’S STAMP DUTY (ABSD)

1. Residency status – If the buyer is in the process of obtaining his Singapore Citizenship (SC) or Singapore Permanent Residency (PR) at the time of purchase, can he later apply for a remission to enjoy lower ABSD rates based on his new residency status? The applicable ABSD rate is based on the residency of the buyer on the date of purchase. The buyer must have been granted the residency status by the Immigration and Checkpoint Authority (ICA) as at the date of purchase in order to enjoy lower ABSD liability. The date of issue reflected in the IC collection slip would be taken as when the residency status was granted.

2. Property count – If the individual has sold his existing property (i.e. a buyer has executed the Acceptance to Option to Purchase) but the sale has not been legally completed, will the existing property still be in his property count? No, the existing property is considered sold once there is an executed sale contract. It will not be included in the individual’s property count.

3. ABSD Rates – Can the date of offer of the Option by the Seller be backdated to avoid paying the new and higher ABSD rates? No, it is an offence under Section 62 of Stamp Duties Act. IRAS takes a very serious view of any individual who evades stamp duty by executing documents containing false information. One may also be guilty of a criminal offence for assisting or being involved in the preparation of any such document containing false information that is used to evade stamp duty. Any person found guilty of such an offence under the law shall be liable on conviction to a fine not exceeding $10,000 or imprisonment for a term not exceeding 3 years, or with both.

IRAS conducts regular audits, and where fraudulent activities are detected, hefty penalties will be imposed and IRAS will not hesitate to prosecute any offenders.

1. Residency status – If the buyer is in the process of obtaining his Singapore Citizenship (SC) or Singapore Permanent Residency (PR) at the time of purchase, can he later apply for a remission to enjoy lower ABSD rates based on his new residency status? The applicable ABSD rate is based on the residency of the buyer on the date of purchase. The buyer must have been granted the residency status by the Immigration and Checkpoint Authority (ICA) as at the date of purchase in order to enjoy lower ABSD liability. The date of issue reflected in the IC collection slip would be taken as when the residency status was granted.

2. Property count – If the individual has sold his existing property (i.e. a buyer has executed the Acceptance to Option to Purchase) but the sale has not been legally completed, will the existing property still be in his property count? No, the existing property is considered sold once there is an executed sale contract. It will not be included in the individual’s property count.

3. ABSD Rates – Can the date of offer of the Option by the Seller be backdated to avoid paying the new and higher ABSD rates? No, it is an offence under Section 62 of Stamp Duties Act. IRAS takes a very serious view of any individual who evades stamp duty by executing documents containing false information. One may also be guilty of a criminal offence for assisting or being involved in the preparation of any such document containing false information that is used to evade stamp duty. Any person found guilty of such an offence under the law shall be liable on conviction to a fine not exceeding $10,000 or imprisonment for a term not exceeding 3 years, or with both.

IRAS conducts regular audits, and where fraudulent activities are detected, hefty penalties will be imposed and IRAS will not hesitate to prosecute any offenders.

ABSD SPOUSES REMISSION

4. Refund conditions – What are the conditions for a married couple to qualify for ABSD refund on the purchase of their second residential property?

The ABSD refund is only extended to married couples with at least one SC spouse who purchase a second property in both spouses’ names only, provided the first property is sold within 6 months after 1) date of purchase1 of second property or 2) issue date of Temporary Occupation Permit (TOP) / Certificate of Statutory Completion (CSC), whichever is earlier (if the second property was uncompleted at the time of purchase) (referred to as “6-month sale timeline”). The married couple must not acquire a third or subsequent residential property before the sale of their first property. They must remain married at the time of sale of their first property. ABSD must be paid on the second property and the refund application must be made within 6 months after the sale of the first property. 1The date of purchase refers to the date of the instrument that effects the purchase (e.g. Acceptance to Option to Purchase/ Sale and Purchase Agreement), not the date of legal completion for the purchase.

5. Extension of 6-month sale timeline – Can the married couple still request for ABSD refund if they were unable to sell their first residential property within the 6-month sale timeline due to poor market conditions (e.g. Government cooling measures, Seventh Month, festivals and public holidays), condition of property, or personal circumstances (e.g. children’s exams, need time to move into second residential property)?

No. The ABSD refund is a special concession given only to Singaporean married couples, to facilitate their changing of homes. Given the intent, such couples should sell off their first property expeditiously and not hold on to two properties for an undue period. This is why one of the conditions for ABSD refund is that the first property must be sold within 6 months of the purchase of the second property. This condition is strictly applied to all who wish to avail themselves to the ABSD refund. To be fair and transparent to all Singaporean married couples, the refund conditions are consistently applied, and there will be no extension of the six-month timeline to sell the first property. If Singaporean married couples wish to apply for an ABSD refund, they should take into account their personal circumstances, the conditions of the market and of their first property, and ensure that the 6-month criterion can be met. In this regard, they are strongly encouraged to start the process to sell their first residential property as early as possible. They could also sell their first property before buying the replacement property.

6. Buyers who are not married couples – Can a single purchaser also qualify for the ABSD remission on the purchase of a second residential property if the conditions are met?

No. The ABSD refund on the second property is only granted to Singapore married couples to facilitate their changing of homes. The remission is not extended to other groups of buyers such as parent and child or siblings making a joint purchase, or singles buying a property on their own, as this will inadvertently undermine the underlying policy intent for moderating demand among Singaporeans for second residential properties. Singapore citizen (SC) and permanent resident (PR) buyers who do not wish to incur the higher ABSD on second residential properties should sell their first property before purchasing their replacement property.

7. Third residential property purchase – If the married couple jointly purchased a third residential property, and was able to sell their existing 2 properties within the 6-month sale timeline, can they qualify for ABSD refund?

No. The current ABSD refund for Singaporean married couple buying their second property is strictly not extended to the purchase of third or subsequent property, even if the married couple ultimately only owns 1 property.

SELLER’S STAMP DUTY (SSD)

8. SSD holding period – Does the SSD holding period start from the date of issue of the Option to Purchase (OTP), the date of Acceptance to OTP or the date of legal completion/key collection?

The SSD holding period starts from the date of the instrument that gave effect to the original acquisition (e.g. Acceptance to OTP, Sale and Purchase Agreement signed by the buyers and sellers, transfer instrument). 9. SSD holding period – Is the SSD holding period similar to HDB’s minimum occupation period (MOP)? No, the SSD holding period commences from the date of instrument that gave effect to the purchase, whereas the MOP generally commences from the date of key collection for new/resale flats. Even if HDB approves a sale within MOP, SSD is payable if the flat is sold within the SSD holding period.

LEASE DUTY

10. Renewal of lease – Do tenants need to pay lease duty for the renewal of lease?

If there is a document executed for the lease renewal, lease duty is payable as if it were a new lease.

11. Refund of lease duty – If a lease has ended early, can a refund be obtained for the remaining period of the lease?

As the lease agreement has been made use of (i.e. lease has commenced), there will be no refund for the remaining period. However, if the lease was aborted without being made used of, you may be eligible for a refund.

4. Refund conditions – What are the conditions for a married couple to qualify for ABSD refund on the purchase of their second residential property?

The ABSD refund is only extended to married couples with at least one SC spouse who purchase a second property in both spouses’ names only, provided the first property is sold within 6 months after 1) date of purchase1 of second property or 2) issue date of Temporary Occupation Permit (TOP) / Certificate of Statutory Completion (CSC), whichever is earlier (if the second property was uncompleted at the time of purchase) (referred to as “6-month sale timeline”). The married couple must not acquire a third or subsequent residential property before the sale of their first property. They must remain married at the time of sale of their first property. ABSD must be paid on the second property and the refund application must be made within 6 months after the sale of the first property. 1The date of purchase refers to the date of the instrument that effects the purchase (e.g. Acceptance to Option to Purchase/ Sale and Purchase Agreement), not the date of legal completion for the purchase.

5. Extension of 6-month sale timeline – Can the married couple still request for ABSD refund if they were unable to sell their first residential property within the 6-month sale timeline due to poor market conditions (e.g. Government cooling measures, Seventh Month, festivals and public holidays), condition of property, or personal circumstances (e.g. children’s exams, need time to move into second residential property)?

No. The ABSD refund is a special concession given only to Singaporean married couples, to facilitate their changing of homes. Given the intent, such couples should sell off their first property expeditiously and not hold on to two properties for an undue period. This is why one of the conditions for ABSD refund is that the first property must be sold within 6 months of the purchase of the second property. This condition is strictly applied to all who wish to avail themselves to the ABSD refund. To be fair and transparent to all Singaporean married couples, the refund conditions are consistently applied, and there will be no extension of the six-month timeline to sell the first property. If Singaporean married couples wish to apply for an ABSD refund, they should take into account their personal circumstances, the conditions of the market and of their first property, and ensure that the 6-month criterion can be met. In this regard, they are strongly encouraged to start the process to sell their first residential property as early as possible. They could also sell their first property before buying the replacement property.

6. Buyers who are not married couples – Can a single purchaser also qualify for the ABSD remission on the purchase of a second residential property if the conditions are met?

No. The ABSD refund on the second property is only granted to Singapore married couples to facilitate their changing of homes. The remission is not extended to other groups of buyers such as parent and child or siblings making a joint purchase, or singles buying a property on their own, as this will inadvertently undermine the underlying policy intent for moderating demand among Singaporeans for second residential properties. Singapore citizen (SC) and permanent resident (PR) buyers who do not wish to incur the higher ABSD on second residential properties should sell their first property before purchasing their replacement property.

7. Third residential property purchase – If the married couple jointly purchased a third residential property, and was able to sell their existing 2 properties within the 6-month sale timeline, can they qualify for ABSD refund?

No. The current ABSD refund for Singaporean married couple buying their second property is strictly not extended to the purchase of third or subsequent property, even if the married couple ultimately only owns 1 property.

SELLER’S STAMP DUTY (SSD)

8. SSD holding period – Does the SSD holding period start from the date of issue of the Option to Purchase (OTP), the date of Acceptance to OTP or the date of legal completion/key collection?

The SSD holding period starts from the date of the instrument that gave effect to the original acquisition (e.g. Acceptance to OTP, Sale and Purchase Agreement signed by the buyers and sellers, transfer instrument). 9. SSD holding period – Is the SSD holding period similar to HDB’s minimum occupation period (MOP)? No, the SSD holding period commences from the date of instrument that gave effect to the purchase, whereas the MOP generally commences from the date of key collection for new/resale flats. Even if HDB approves a sale within MOP, SSD is payable if the flat is sold within the SSD holding period.

LEASE DUTY

10. Renewal of lease – Do tenants need to pay lease duty for the renewal of lease?

If there is a document executed for the lease renewal, lease duty is payable as if it were a new lease.

11. Refund of lease duty – If a lease has ended early, can a refund be obtained for the remaining period of the lease?

As the lease agreement has been made use of (i.e. lease has commenced), there will be no refund for the remaining period. However, if the lease was aborted without being made used of, you may be eligible for a refund.