Decoupling (Fractional Transaction)

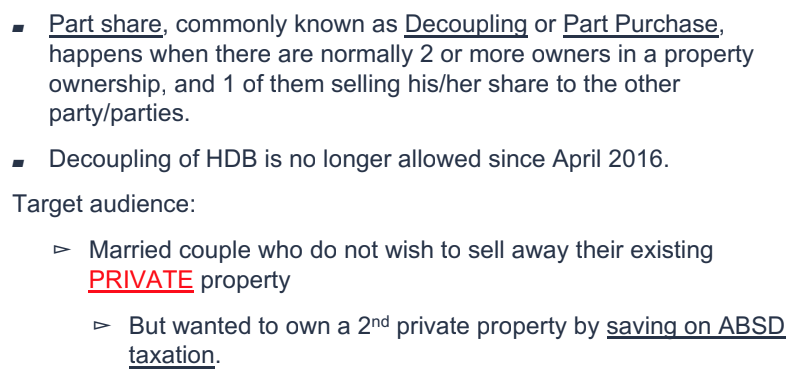

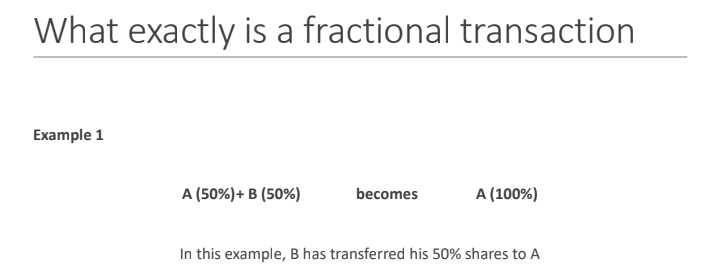

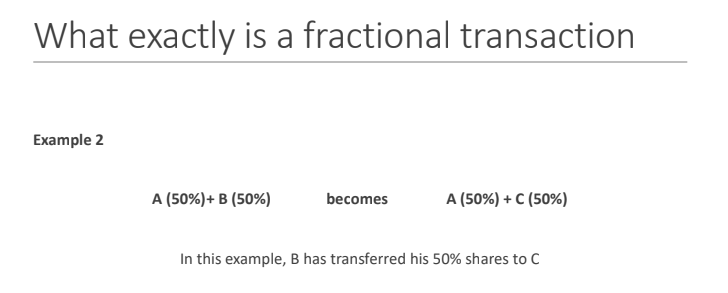

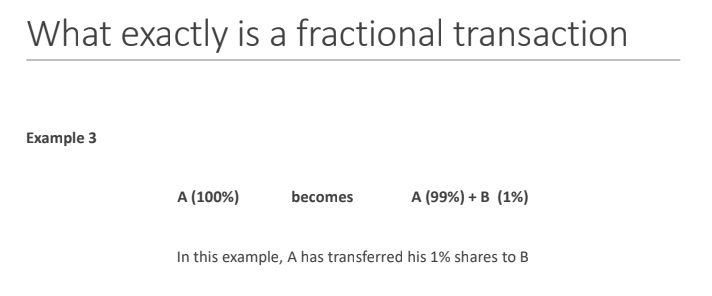

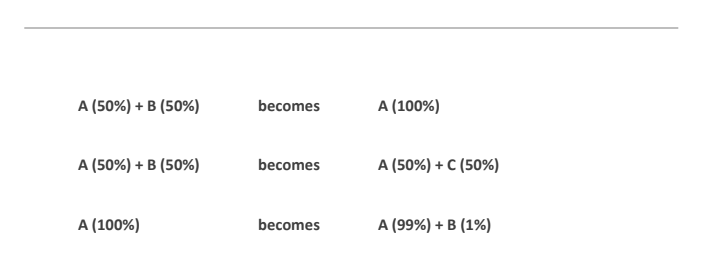

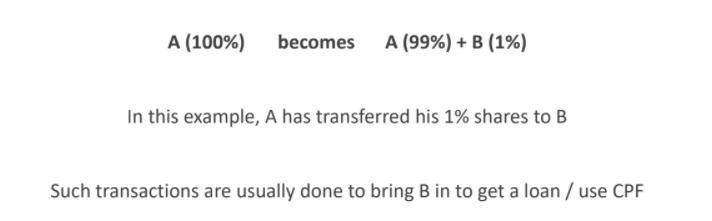

A fractional transaction is a transfer of shares in a property or maybe called "decoupling".

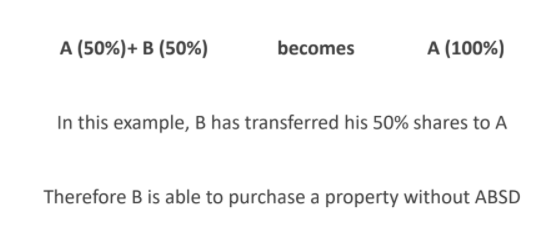

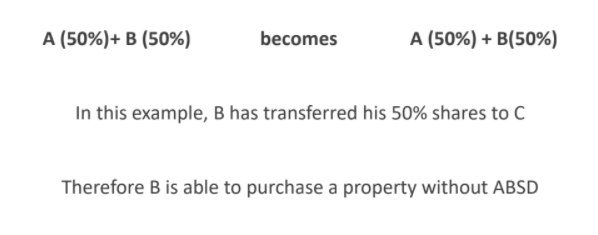

Many home owners enter into “decoupling” transactions to enable one party to exit from the existing property, and thereafter purchase the next property with no ABSD, or lower ABSD.

This is possible as IRAS assesses BSD & ABSD payable based on the number of properties owned in the following manner.

Many home owners enter into “decoupling” transactions to enable one party to exit from the existing property, and thereafter purchase the next property with no ABSD, or lower ABSD.

This is possible as IRAS assesses BSD & ABSD payable based on the number of properties owned in the following manner.

“Decoupling” is a widely used term when registered proprietors wish to remove one of their names from the title and free themselves of a property count for the purposes of calculating Buyer’s Stamp Duty (“BSD”) and/ or Additional Buyer’s Stamp Duty (“ABSD”). In legal language, this is more accurately termed as a part sale and purchase of shares in the property.

“Decoupling” essentially allows the outgoing owner to purchase another residential property without paying ABSD or paying a lower rate of ABSD. Whilst we have been noticing an increasing trend for proprietors to “de-couple”, there are a number of issues that such proprietors need to take note on before undertaking such an exercise.

“Decoupling” essentially allows the outgoing owner to purchase another residential property without paying ABSD or paying a lower rate of ABSD. Whilst we have been noticing an increasing trend for proprietors to “de-couple”, there are a number of issues that such proprietors need to take note on before undertaking such an exercise.

FINANCING, PRIVATE PROPERTIES VS HDB FLATS

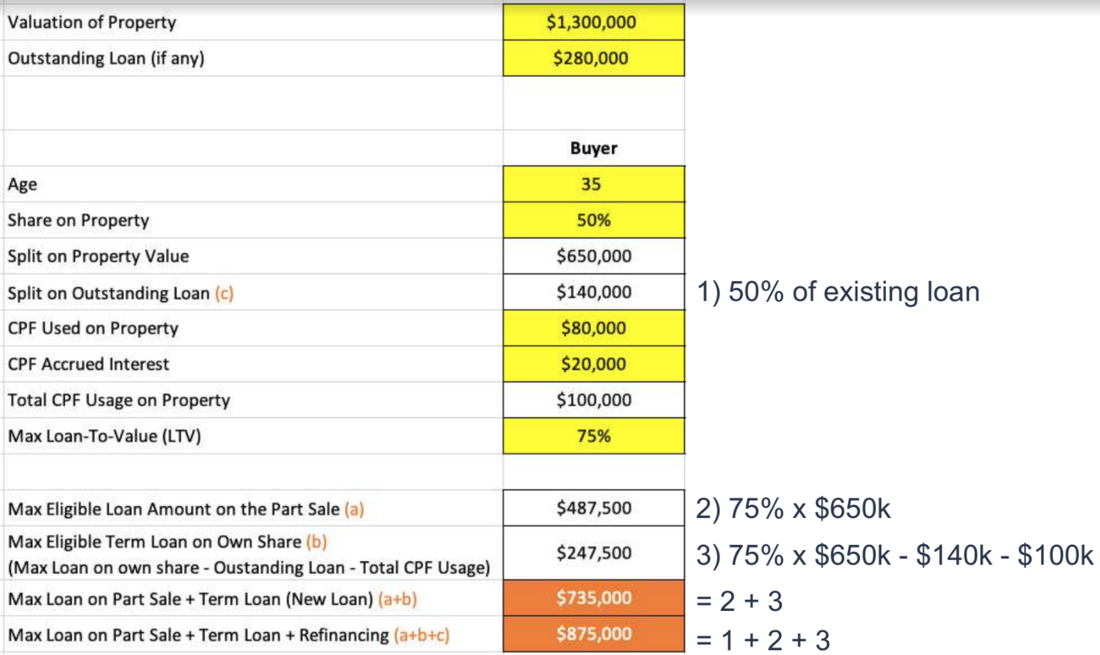

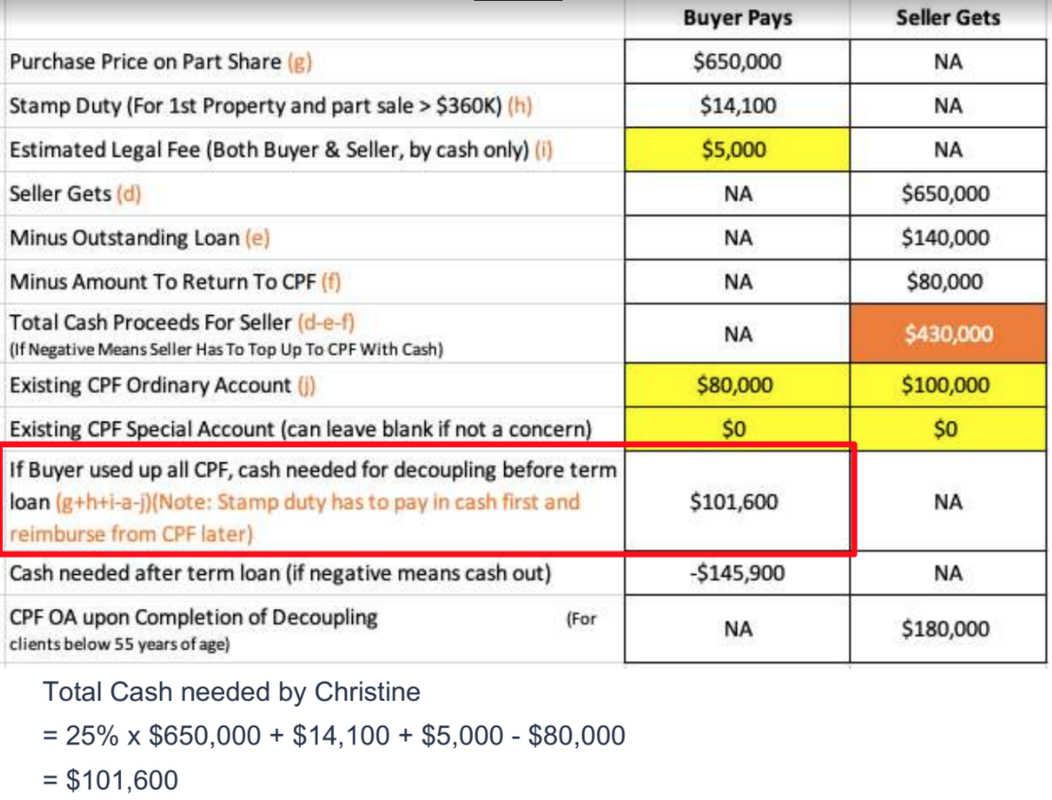

For private properties, decoupling would be subject to MAS’ and banks’ financing rules and requirements (e.g. ability of remaining owner to refund the outgoing owner’s CPF monies and finance the mortgage solely.)

This would mean that in the event there is a CPF charge on the property and/or an outstanding mortgage loan, the purchaser of the part share may then have to consider taking up a fresh loan or to restructure the loan to finance the part purchase and also to re-finance his or her existing share in the event full cash payment is not an option.

In relation to HDB flats, on top of MAS’ and banks’ financing rules, HDB only allows transfer of ownership of HDB flats under the following six scenarios: -

Divorce

Marriage

Medial Reasons

Death of an Owner

Financial Hardship

Renunciation of Singapore Citizenship

DETERMINING THE PURCHASE PRICE OF THE PART SHARE

In the event the purchasing proprietor would betaking up a fresh loan or restructuring the existing loan, the lending bank would usually be arranging for a valuation report to determine the market value of the property. In this instance, it would then be possible to peg the purchase price of the part share to the market value at the time of the contract.

In the absence of a valuation report however, proprietors must understand that they run the risk of a transaction which was entered into at an undervalue or that the contract may be insufficiently stamped. In relation to the latter and for the purposes of this article, it is imperative to note that stamp duty is computed based on the purchase price or market value of the property, whichever is higher. An undervalue transaction undermines the principle on which the stamp duty is based – To be concise, this means that the contract for a sale and purchase of a property may have been insufficiently stamped and the resulting ramification is that the purchaser of the property may be liable to pay a penalty of up to four (4) times the amount imposed by IRAS.

TRANSFER OF PART SHARE BY WAY OF GIFT OR FOR NOMINAL CONSIDERATION

Apart from the method of part sale and purchase of share in the property, another method could be when the share in the property is transferred out of love and affection (i.e. by way of gift). However, Section 16 of the Stamp Duties Act provides that “any conveyance or transfer operating as a voluntary disposition inter vivos shall be chargeable with the like stamp duty as if it were a conveyance or transfer on sale”. As such, stamp duties shall also be payable and be charged based on the market value of the share in property transferred. Should stamp duty be insufficiently paid, this would result in the same ramification as discussed in the preceding paragraph.

For private properties, decoupling would be subject to MAS’ and banks’ financing rules and requirements (e.g. ability of remaining owner to refund the outgoing owner’s CPF monies and finance the mortgage solely.)

This would mean that in the event there is a CPF charge on the property and/or an outstanding mortgage loan, the purchaser of the part share may then have to consider taking up a fresh loan or to restructure the loan to finance the part purchase and also to re-finance his or her existing share in the event full cash payment is not an option.

In relation to HDB flats, on top of MAS’ and banks’ financing rules, HDB only allows transfer of ownership of HDB flats under the following six scenarios: -

Divorce

Marriage

Medial Reasons

Death of an Owner

Financial Hardship

Renunciation of Singapore Citizenship

DETERMINING THE PURCHASE PRICE OF THE PART SHARE

In the event the purchasing proprietor would betaking up a fresh loan or restructuring the existing loan, the lending bank would usually be arranging for a valuation report to determine the market value of the property. In this instance, it would then be possible to peg the purchase price of the part share to the market value at the time of the contract.

In the absence of a valuation report however, proprietors must understand that they run the risk of a transaction which was entered into at an undervalue or that the contract may be insufficiently stamped. In relation to the latter and for the purposes of this article, it is imperative to note that stamp duty is computed based on the purchase price or market value of the property, whichever is higher. An undervalue transaction undermines the principle on which the stamp duty is based – To be concise, this means that the contract for a sale and purchase of a property may have been insufficiently stamped and the resulting ramification is that the purchaser of the property may be liable to pay a penalty of up to four (4) times the amount imposed by IRAS.

TRANSFER OF PART SHARE BY WAY OF GIFT OR FOR NOMINAL CONSIDERATION

Apart from the method of part sale and purchase of share in the property, another method could be when the share in the property is transferred out of love and affection (i.e. by way of gift). However, Section 16 of the Stamp Duties Act provides that “any conveyance or transfer operating as a voluntary disposition inter vivos shall be chargeable with the like stamp duty as if it were a conveyance or transfer on sale”. As such, stamp duties shall also be payable and be charged based on the market value of the share in property transferred. Should stamp duty be insufficiently paid, this would result in the same ramification as discussed in the preceding paragraph.

STAMP DUTY

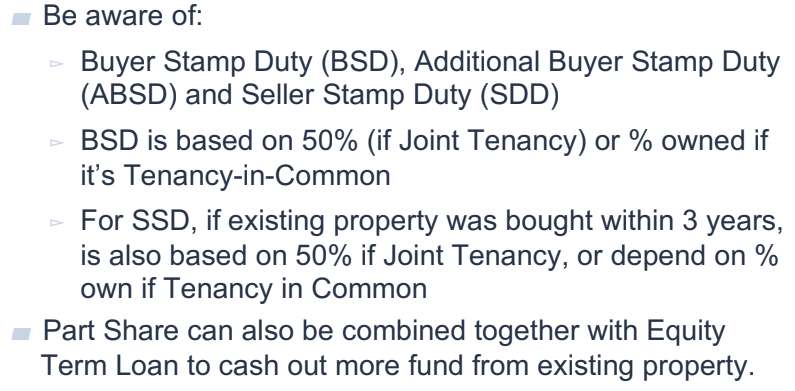

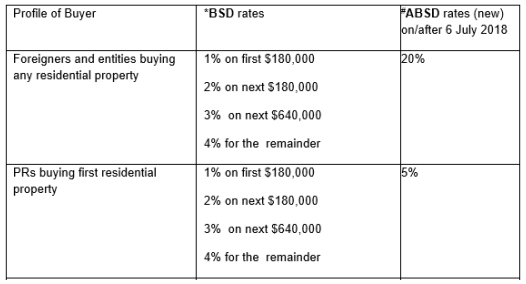

In relation to the purchase or transferring of the part share, BSD and possibly ABSD will be applicable, depending on the profile of the purchaser.

In relation to the purchase or transferring of the part share, BSD and possibly ABSD will be applicable, depending on the profile of the purchaser.

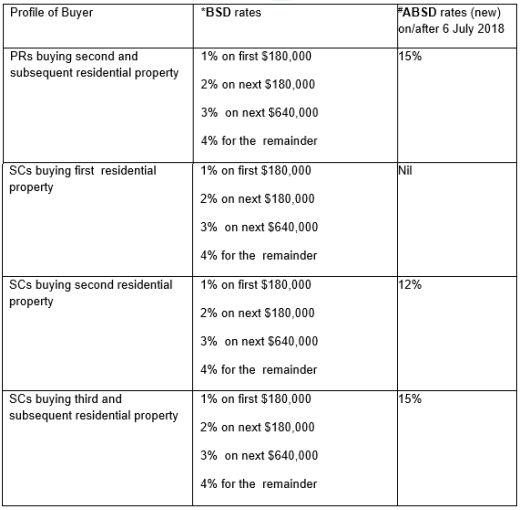

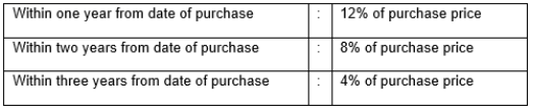

Seller’s Stamp Duty (“SSD”)

On the other hand, consideration must also be placed on the vendor or transferor of the part share as Seller’s Stamp Duty (“SSD”) may also be applicable, depending on the date of acquisition of the property. If the Property was purchased by on or after 11 March 2017 and sold within 3 years from the date of acquisition, SSD on the sale price will also be payable and computed as follows:-

On the other hand, consideration must also be placed on the vendor or transferor of the part share as Seller’s Stamp Duty (“SSD”) may also be applicable, depending on the date of acquisition of the property. If the Property was purchased by on or after 11 March 2017 and sold within 3 years from the date of acquisition, SSD on the sale price will also be payable and computed as follows:-

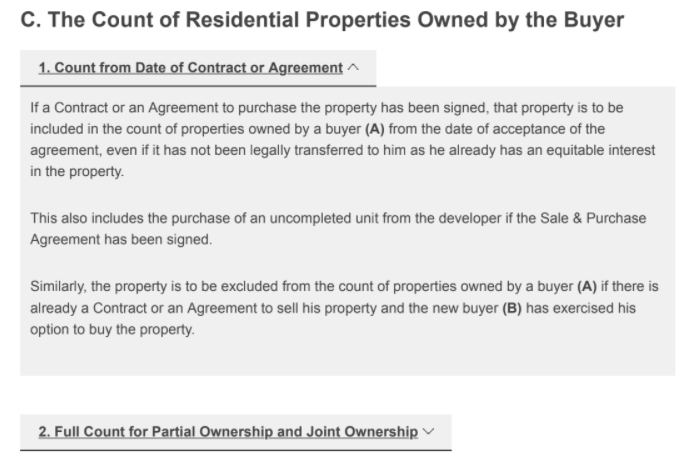

STAMP DUTY REMISSION – TRANSFER OF INTEREST IN PROPERTY REMISSION

Technically, an existing proprietor who purchases or transfers the part share from the outgoing proprietor would have been treated as acquiring a second property. As long as a person acquires any interest in a residential property, the property will be included in the count of residential properties owned by him.

However, IRAS recognises that the sale or transfer of the partial interest in the property is to the transferee to which he or she already owns an interest in the same property.

Therefore, partial ABSD may be remitted on the transferee if:-

1) the instrument is for the sale or transfer of partial interest in a single residential property to the transferee(s),

2) as at the date of the instrument, the transferee(s) is a relevant individual i.e. a Singapore Citizen who owns interests in 2 residential properties or Singapore Permanent Resident who owns interests in 1 residential property, and

3) one of the 2 residential properties or the 1 residential property referred to in (2) above (whichever applicable) is the same property referred to in (1).

Technically, an existing proprietor who purchases or transfers the part share from the outgoing proprietor would have been treated as acquiring a second property. As long as a person acquires any interest in a residential property, the property will be included in the count of residential properties owned by him.

However, IRAS recognises that the sale or transfer of the partial interest in the property is to the transferee to which he or she already owns an interest in the same property.

Therefore, partial ABSD may be remitted on the transferee if:-

1) the instrument is for the sale or transfer of partial interest in a single residential property to the transferee(s),

2) as at the date of the instrument, the transferee(s) is a relevant individual i.e. a Singapore Citizen who owns interests in 2 residential properties or Singapore Permanent Resident who owns interests in 1 residential property, and

3) one of the 2 residential properties or the 1 residential property referred to in (2) above (whichever applicable) is the same property referred to in (1).

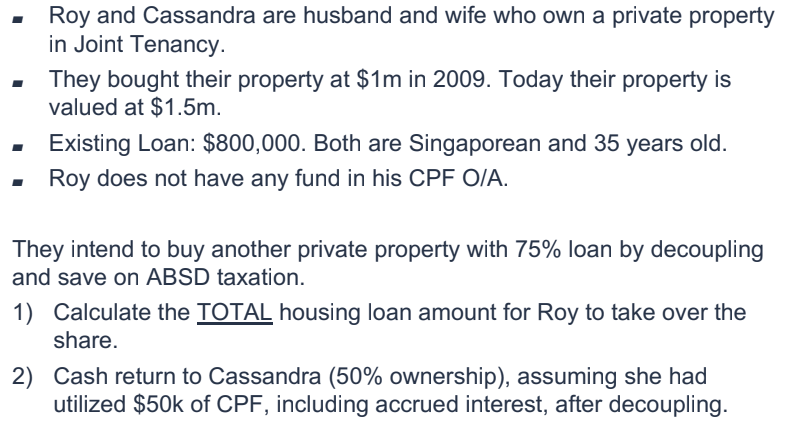

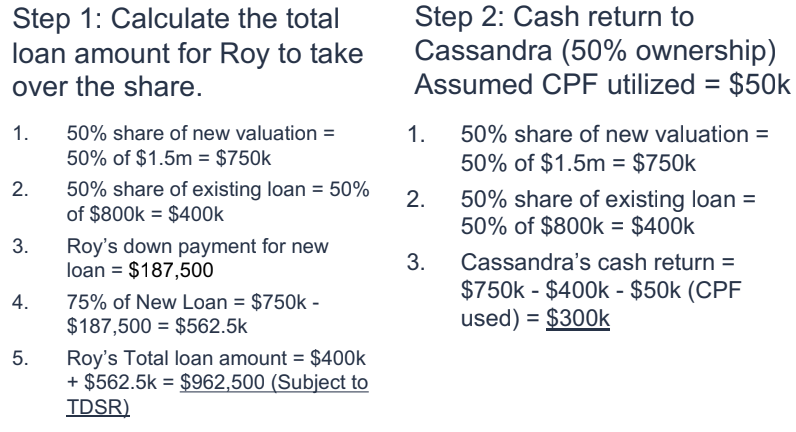

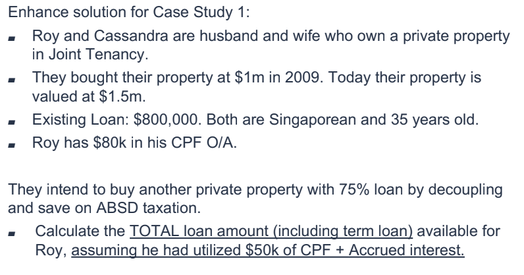

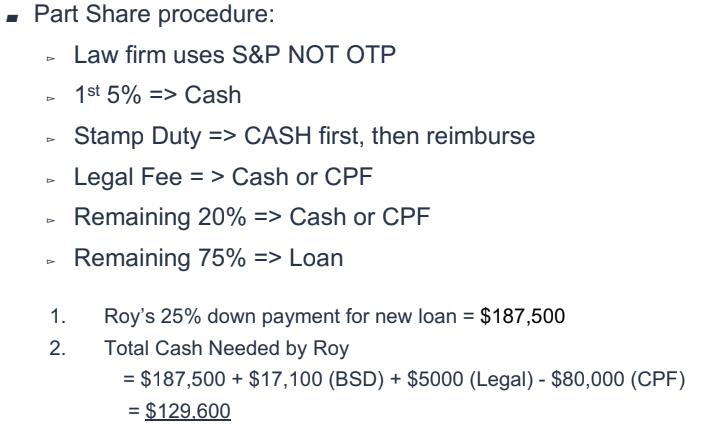

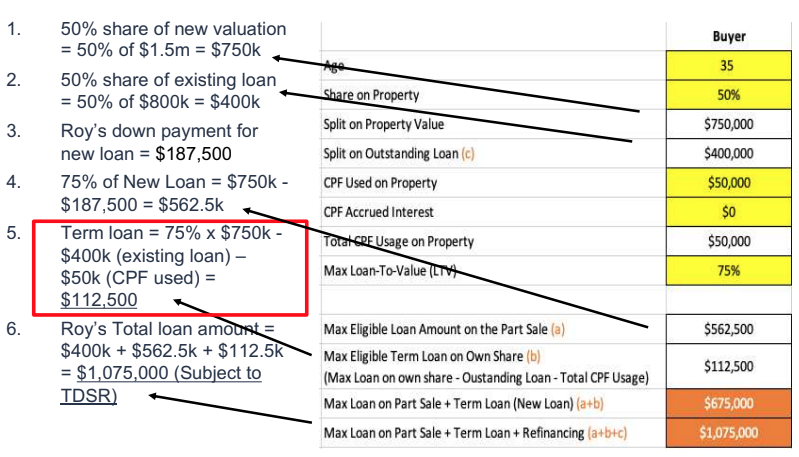

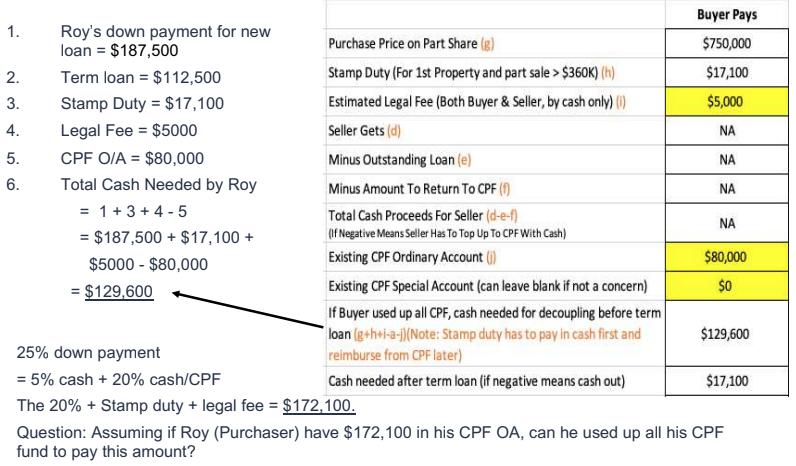

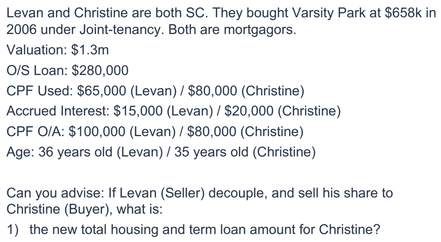

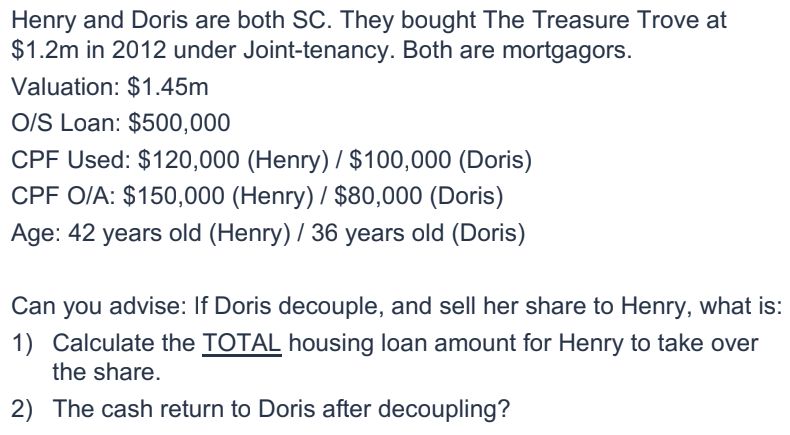

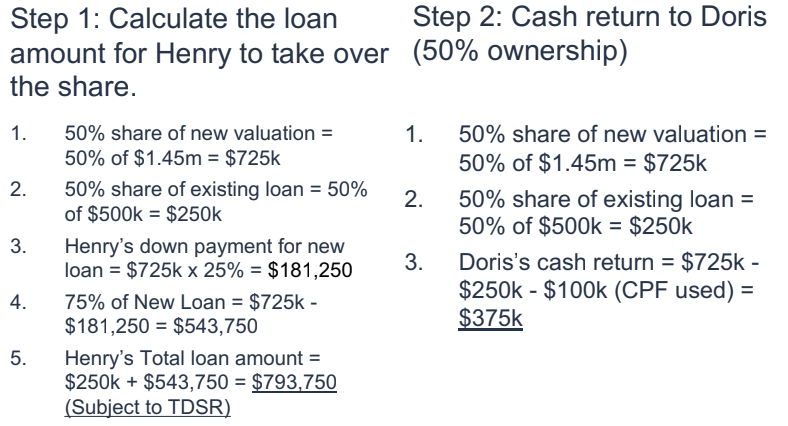

Case Studies:

*The information above shall not be construed and be relied upon as legal or financial advice and all readers are advised to seek separate legal advice for all matters related or arising from the issues raised in the above.