The Government has therefore decided to implement a set of measures to cool the private and public housing markets, to promote continued housing affordability. The private residential measures are calibrated to dampen broad-based demand, especially from those purchasing property for investment rather than owner-occupation. Measures to tighten financing conditions for both public and private housing will encourage greater financial prudence. The Government will also be ramping up the supply for both private and public housing.

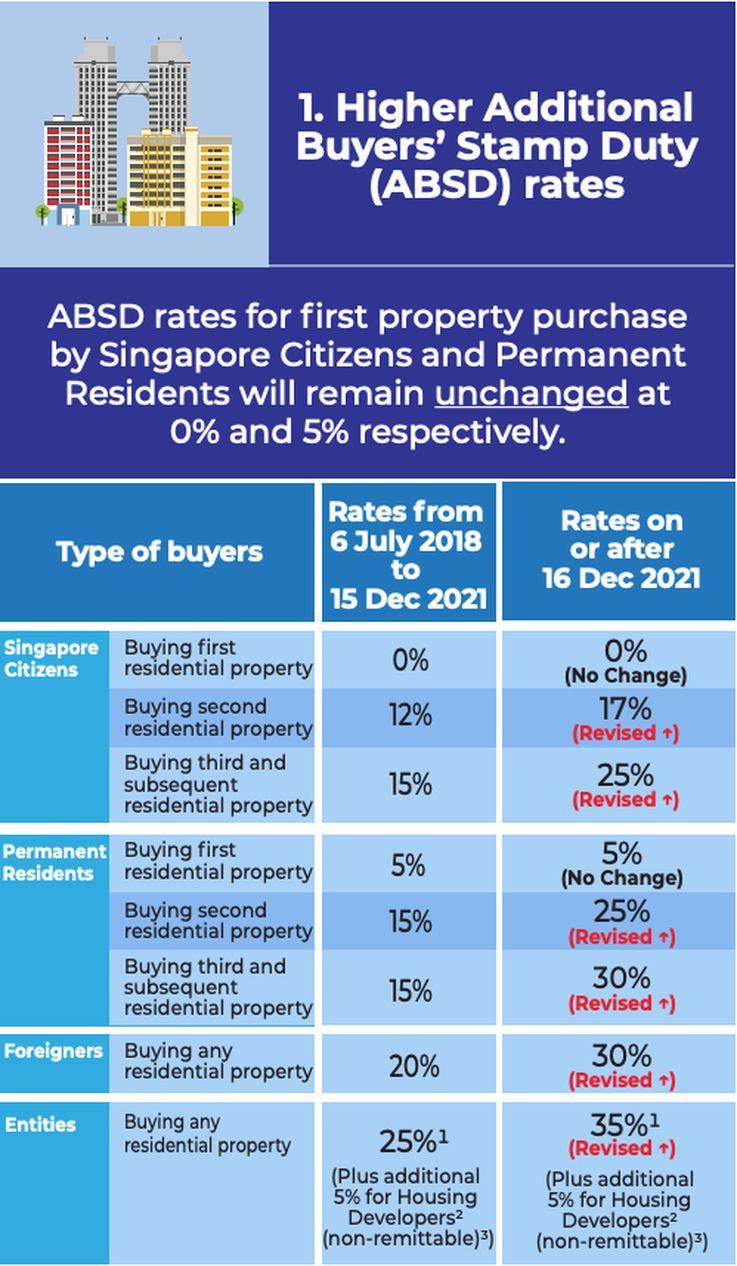

Raising Additional Buyer’s Stamp Duty (ABSD) Rates

The current ABSD rates for Singapore Citizens (SCs) and Singapore Permanent Residents (SPRs) purchasing their first residential property will remain at 0% and 5% respectively.

The Government will raise the ABSD rates as follows:

a. Raise ABSD rate to 17% for SCs purchasing their 2nd residential property;

b. Raise ABSD rate to 25% for SCs purchasing their 3rd and subsequent residential property, and SPRs purchasing their 2nd residential property

c. Raise ABSD rate to 30% for SPRs purchasing their 3rd and subsequent residential property and foreigners purchasing any residential property,

d. Raise ABSD rate to 35% for entities purchasing any residential property; and

e. Raise ABSD rate to 35% for developers purchasing any residential property. This 35% may be remitted under the Stamp Duties (Non-licensed Housing Developers) (Remission for ABSD) Rules and the Stamp Duties (Housing Developers) (Remission of ABSD) Rules, subject to conditions. In addition to this 35% ABSD rate, the non-remittable component remains unchanged at 5%.

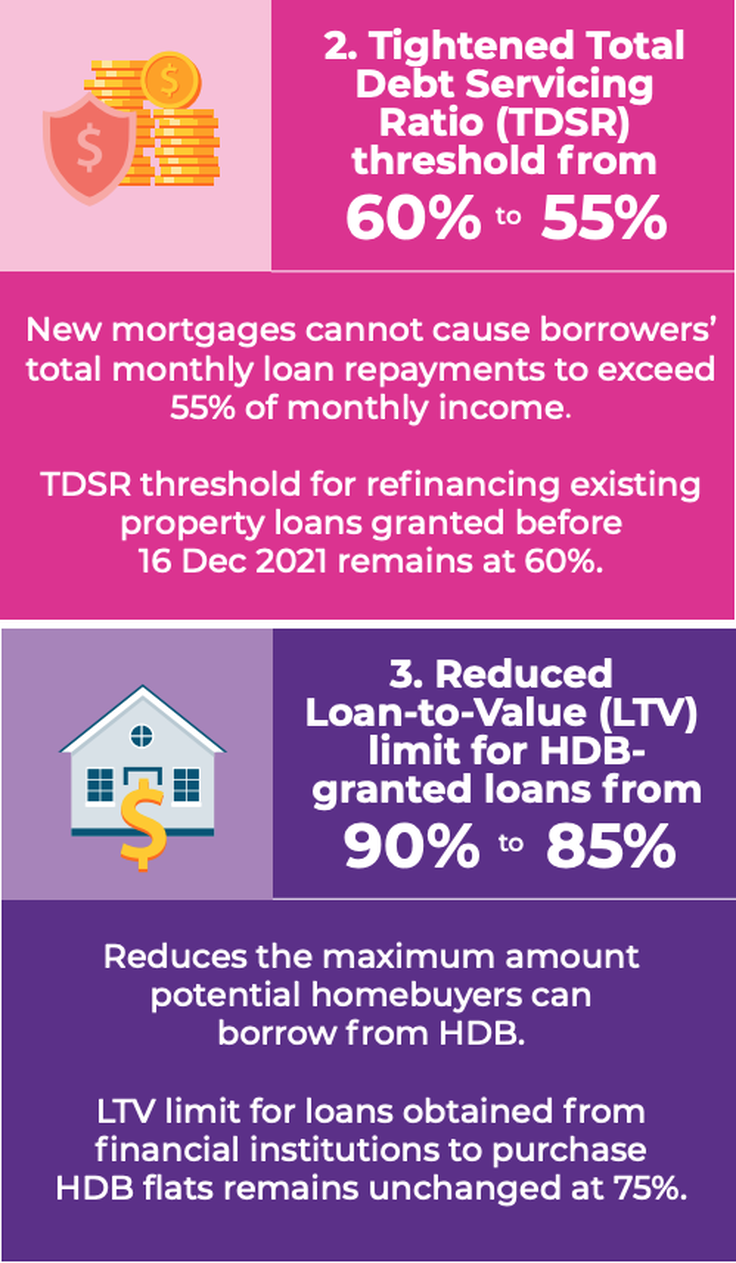

The TDSR threshold6 will be tightened by 5%-points from 60% to 55%. The revised TDSR threshold will apply to loans for the purchase of properties where the OTP is granted on or after 16 December 2021, and for mortgage equity withdrawal loan applications made on or after 16 December 2021. Borrowers with existing property loans granted before 16 December 2021 will not be affected by the revised TDSR threshold when refinancing their loans.7

6 TDSR is applicable to both residential and non-residential property loans granted by financial institutions to individuals, sole proprietors and vehicles with no substantive genuine commercial business, set up for the purchase of properties held by individuals.

7 TDSR is currently waived for borrowers who refinance their owner-occupied housing loans. For borrowers refinancing their existing investment property loans, MAS has provided for a temporary TDSR waiver for borrowers affected by COVID-19. Otherwise, the previous 60% TDSR will apply.

Measure Specific to Public Housing

Tightening of Loan-to-Value (LTV) Limit

The LTV limit for HDB housing loans will be tightened by 5%-points from 90% to 85%. The revised LTV limit does not apply to loans granted by financial institutions, for which the LTV limit remains at 75%.

The LTV limit of 85% will apply to new flat applications for sales exercises launched after 16 December 2021, and complete resale applications8 which are received by HDB from 16 December 2021 onwards.

RSS Feed

RSS Feed