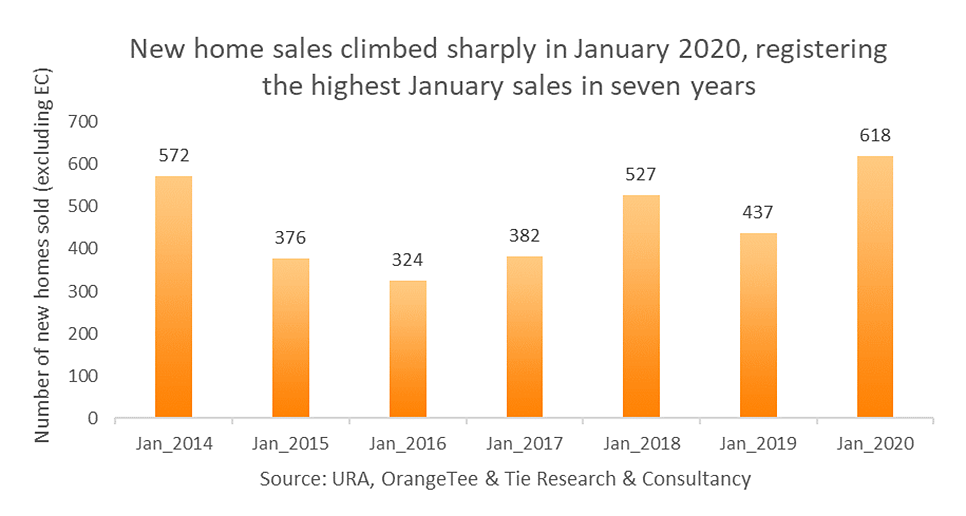

This was also 41.4 per cent more than the 437 units sold over the same period last year. Last month registered the highest January new private home sales in seven years.

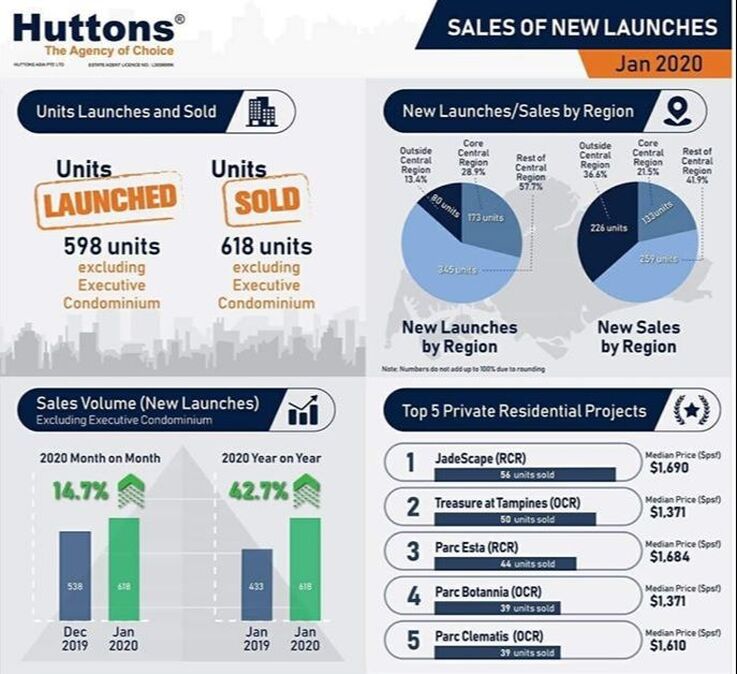

January 2020's sales take-up was led by projects in the city fringes or rest of central region (RCR), which accounted for 41.9 per cent (259 units) of total sales excluding executive condominiums followed by the surburban areas or outside central region (OCR), at 36.6 per cent (226 units).

The proportion of sales in the luxury segment or core central region (CCR) rose to its highest level since January 2019 at 21.5 per cent (133 units). This could be attributed to more high-end projects launched in January, she said, including The Avenir, Leedon Green and Van Holland, which collectively sold 74 units last month.

So far there seems to have been "no major impact" on the property market from the COVID-19 outbreak. Property buyers will be "realistic, prudent and highly selective" as the disease dampens global economies, affecting job stability and "longer term mortagage servicing capabilities by Singaporeans with limited affordability".

Real estate powerhouse Huttons Asia's Kiwi Lim believes that Singapore's property market can withstand the impact of Covid-19 because the Singapore government has built further resilience since the Sars outbreak through efforts to diversify the economy.

When the storm calms, the tide of the market re-emerges with pent-up demand from buyers and investors. With the Government potentially announcing measures during the financial Budget to assist affected sectors and the resilient nature of the real estate market, we are likely expect(ing) new home sales volume to reach 9,000 to 10,000 units this year.

RSS Feed

RSS Feed