This marks Hong Kong-listed Logan Property's maiden participation in the Government Land Sales (GLS) programme and foray into the Singapore residential market. "Bullish bidding is now the norm for GLS residential sites, driven by expected market recovery and limited number of sites on the market.

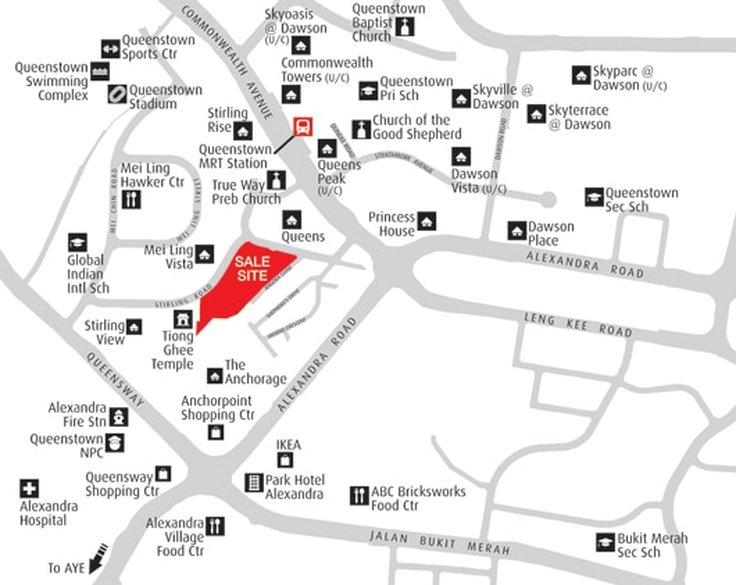

The site, which can yield 1,110 units on a huge 2.11-ha size requiring heavy financial commitment from developers - saw a healthy demand of 13 developers bidding for the prime land parcel.

The substantial number of bidders for this relatively large plot reflects both the hunger of developers for limited sites and their upbeat sentiments indicating that the property market in Singapore may be recovering.

Developers have confidence in the Singapore residential market, believing that prices could return to growth soon & the ability to price higher than the existing launches in the vicinity. Logan Property investor relations director Derek Lee told The Business Times that the group has been studying the Singapore market for a while & believes "its the right time to enter Singapore. No one knows where the (market) bottom is but our bidding price is reasonable given the quality land site & location".

RSS Feed

RSS Feed