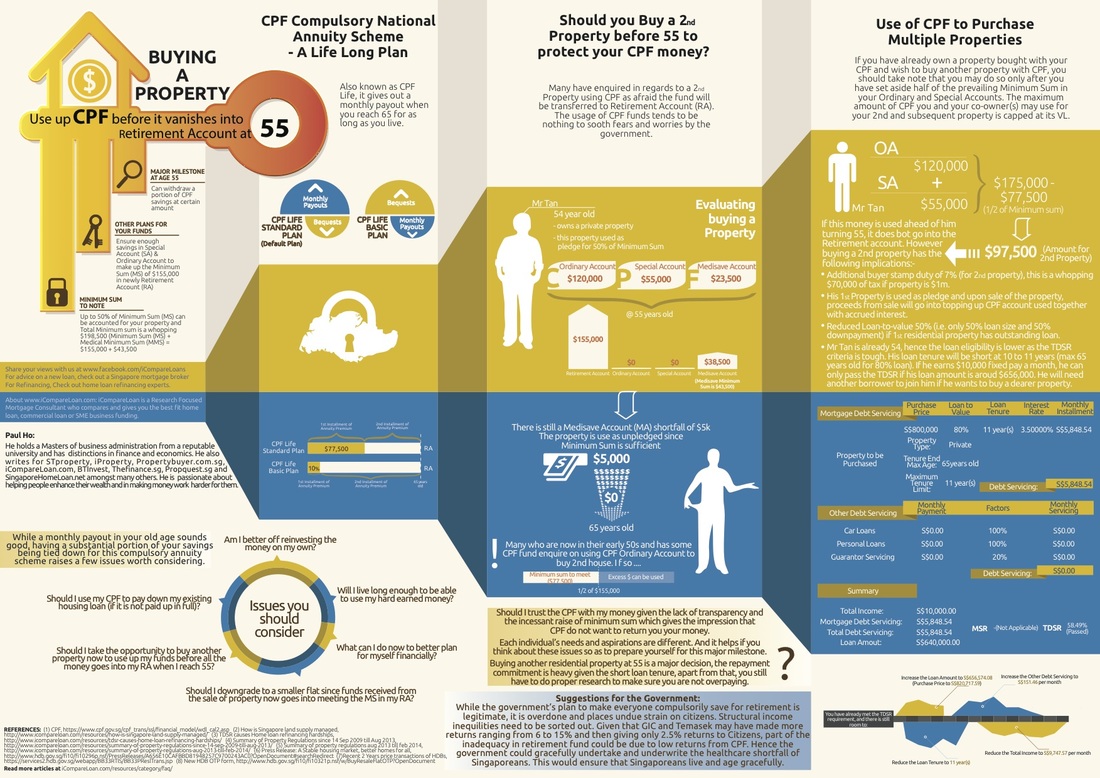

For Singaporeans, reaching 55 years old marks a major milestone from the perspective of personal financial planning. The CPF, Singapore’s pension scheme, has other plans for your funds.

First, you need to make sure that you have enough savings in your Special Account (SA) and Ordinary Account (OA) to make up the Minimum Sum (MS) of $155,000 in your newly set up Retirement Account (RA).

Up to 50% of the Minimum Sum (MS) can be accounted for with your property if you had used CPF savings to pay for your property. However, if you sell your property after 55, any amount drawn down from the CPF previously to purchase the property plus accrued interest will now have to go back to your CPF.

On top of that, there is still the Medisave Account which has a mandated Minimum sum of $43,500 which will have to be topped up before any funds are withdrawn.

This means that the Total Minimum sum is a whopping $198,500. (Minimum Sum (MS) + Medical Minimum Sum (MMS) = $155,000 + $43,500)

Should you Buy a 2nd Property before 55 to protect your CPF money?

Many people have called us to enquire about buying a 2nd property using CPF as they are afraid that the money gets taken away into Retirement account. Also the flip-flops denials and admissions by the government regarding how they have used our CPF funds does nothing to sooth fears and worries about the CPF.

Scenario of Mr. Tan who is currently 54 years old – Evaluating buying a property

Owns a private property. This property can be used as pledge for up to 50% of Minimum Sum if required. However the property pledge is not automatic if you meet the Retirement Account (RA) minimum sum.

Has the following savings in CPF: -

At 55 years old, a retirement account would be created. All the monies will be transferred from the Special Account (SA) into the Retirement account (RA) and top up of Medisave Account (MA). After this transfer his account situation will look like this: -

This scenario is where Property is used as a pledge (of up to 50% of the Minimum sum of $155,000).

However if you forgot to pledge your property upon reaching 55 years old, you can do so later. Without property as pledge: -

With property unpledged, apart from the $5,000 that can be withdrawn at 55 years old. That means that between 55 and 65 years old, there is practically NO MONEY until you pledge your property. If you do pledge your property years later, the minimum sum may yet again rise leading to a decreased withdrawal.

For Mr. Tan who have pledged 1st property and are looking to buy 2nd Property

Many people who are now in their early 50s (before 55) and who has some CPF monies and who have already pledge their 1st property are approaching us to discuss using their CPF Ordinary account to buy another House. If they buy a 2nd house, they only needs to meet 50% of the Minimum Sum, which is $155,000 * 0.5 = $77,500. Anything (the sum of SA + OA) in excess of $77,500 can be used.

Then his Account will look like this: -

USE OF CPF TO PURCHASE MULTIPLE PROPERTIES

If you already own a property bought with your CPF and wish to buy another property with CPF, you should take note that you may do so only after you have set aside half of the prevailing Minimum Sum in your Ordinary and Special Accounts. The maximum amount of CPF you and your co-owner(s) may use for your second and subsequent property is capped at its VL.

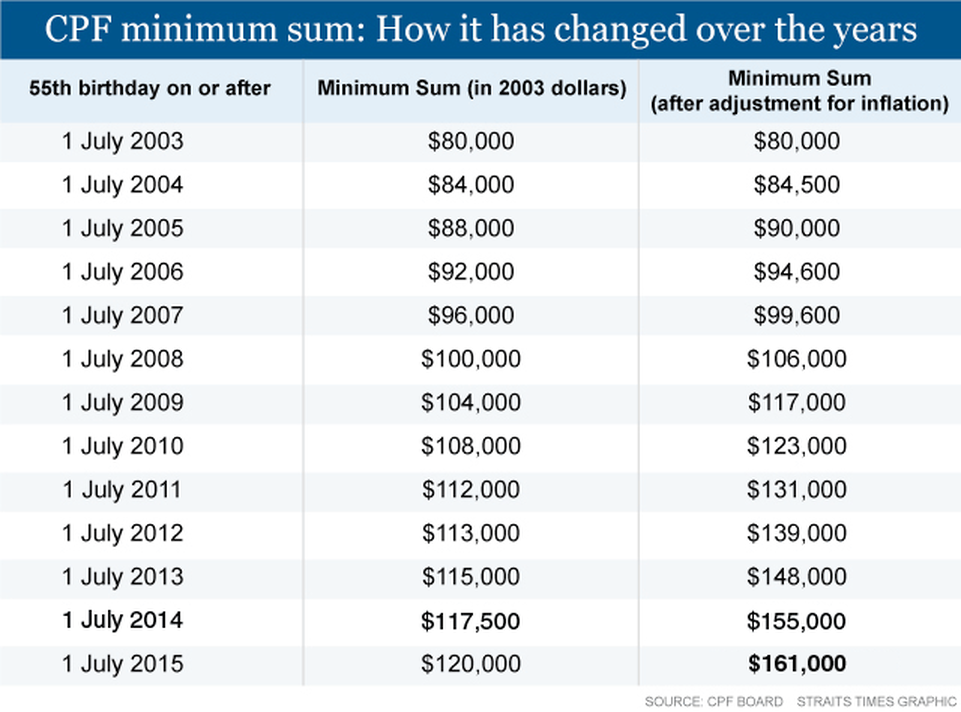

* The Minimum Sum changes every July. Please refer to the CPF website for information on the prevailing Minimum Sum.

Mr. Tan, has $120,000 in (OA) and $55,000 in (SA). In otherwords, since he already has a Private property as pledge towards the Minimum sum of $155,000. He can use any sum of money in excess of $77,500 for his 2nd property purchase, provided that they are in the Ordinary account (OA).

If this money is used ahead of him turning 55, it does not go into the Retirement account. However buying a 2nd property has the following implications: -

First, you need to make sure that you have enough savings in your Special Account (SA) and Ordinary Account (OA) to make up the Minimum Sum (MS) of $155,000 in your newly set up Retirement Account (RA).

Up to 50% of the Minimum Sum (MS) can be accounted for with your property if you had used CPF savings to pay for your property. However, if you sell your property after 55, any amount drawn down from the CPF previously to purchase the property plus accrued interest will now have to go back to your CPF.

On top of that, there is still the Medisave Account which has a mandated Minimum sum of $43,500 which will have to be topped up before any funds are withdrawn.

This means that the Total Minimum sum is a whopping $198,500. (Minimum Sum (MS) + Medical Minimum Sum (MMS) = $155,000 + $43,500)

Should you Buy a 2nd Property before 55 to protect your CPF money?

Many people have called us to enquire about buying a 2nd property using CPF as they are afraid that the money gets taken away into Retirement account. Also the flip-flops denials and admissions by the government regarding how they have used our CPF funds does nothing to sooth fears and worries about the CPF.

Scenario of Mr. Tan who is currently 54 years old – Evaluating buying a property

Owns a private property. This property can be used as pledge for up to 50% of Minimum Sum if required. However the property pledge is not automatic if you meet the Retirement Account (RA) minimum sum.

Has the following savings in CPF: -

- Ordinary Account = $120,000

- Special Account = $55,000

- Medisave Account = $23,500

At 55 years old, a retirement account would be created. All the monies will be transferred from the Special Account (SA) into the Retirement account (RA) and top up of Medisave Account (MA). After this transfer his account situation will look like this: -

This scenario is where Property is used as a pledge (of up to 50% of the Minimum sum of $155,000).

- Retirement Account = $155,000

- ($77,500 from property pledge + 55,000 from SA + 22,500 from OA)

- Ordinary Account = $0

- ($120,000 – 22,500 (transferred to OA) - $20,000 to MA) - $77,500 Pay out to CPF member)

- Special Account = $0

- ($55,000 - $55,000 (transferred to RA) )

- Medisave Account = $43,500 (No Shortfall)

- $23,500 + $20,000 (From OA)

- CPF withdrawal amount = $77,500

However if you forgot to pledge your property upon reaching 55 years old, you can do so later. Without property as pledge: -

- Retirement Account = $155,000

- Ordinary Account = $0

- Special Account = $0

- Medisave Account = $38,500 (Medisave Minimum Sum is $43,500)

- Only $5000 withdrawal is possible. (Note 9, Appendix 1)

- Property unpledged.

With property unpledged, apart from the $5,000 that can be withdrawn at 55 years old. That means that between 55 and 65 years old, there is practically NO MONEY until you pledge your property. If you do pledge your property years later, the minimum sum may yet again rise leading to a decreased withdrawal.

For Mr. Tan who have pledged 1st property and are looking to buy 2nd Property

Many people who are now in their early 50s (before 55) and who has some CPF monies and who have already pledge their 1st property are approaching us to discuss using their CPF Ordinary account to buy another House. If they buy a 2nd house, they only needs to meet 50% of the Minimum Sum, which is $155,000 * 0.5 = $77,500. Anything (the sum of SA + OA) in excess of $77,500 can be used.

Then his Account will look like this: -

- CPF used for 2nd Property = $97,500

- $120,000 + $55,000 - $77,500 (1st property pledge)

- Ordinary Account = $22,500

- ($120,000 – $97,500 for 2nd property)

- Special Account = $55,000

- Medisave Account = $23,500 (Medisave Minimum Sum is $43,500)

USE OF CPF TO PURCHASE MULTIPLE PROPERTIES

If you already own a property bought with your CPF and wish to buy another property with CPF, you should take note that you may do so only after you have set aside half of the prevailing Minimum Sum in your Ordinary and Special Accounts. The maximum amount of CPF you and your co-owner(s) may use for your second and subsequent property is capped at its VL.

* The Minimum Sum changes every July. Please refer to the CPF website for information on the prevailing Minimum Sum.

Mr. Tan, has $120,000 in (OA) and $55,000 in (SA). In otherwords, since he already has a Private property as pledge towards the Minimum sum of $155,000. He can use any sum of money in excess of $77,500 for his 2nd property purchase, provided that they are in the Ordinary account (OA).

- $120,000 (OA) + $55,000 (SA) - $77,500 (1st Property pledge) = $97,500.

- Mr. Tan can use $97,500 for 2nd Property purchase.

If this money is used ahead of him turning 55, it does not go into the Retirement account. However buying a 2nd property has the following implications: -

- Additional buyer stamp duty of 7% (for 2nd Property), this is a whopping $70,000 of tax if property is $1m. (i.e. Freeing up $97,500 from CPF but $70,000 of it ends up as tax)

- His 1st Property is used as pledge and upon sale of the property, proceeds from sale will go into topping up CPF account used together with accrued interest.

- Reduced Loan-to-value of 50% (i.e. only 50% loan size and 50% downpayment) if 1st residential property has outstanding loan.

- Mr. Tan is already 54, hence the loan eligibility is lower as the TDSR criteria is tough. His loan tenure will be short at 10 to 11 years (max 65 years old for 80% loan). If he earns $10,000 fixed pay a month, he can only pass the TDSR if his loan amount is around $656,000. He will need another borrower to join him if he wants to buy a dearer property.