Real estate professional Kiwi Lim believe Singapore's property market outlook for 2023 may see a return of foreign buyers, strong upgrading demand from Singaporeans, higher residential private condo prices even with higher home loan interest rates in Singapore.

From Apr 2022 after Singapore announced the easing of border measures for fully vaccinated travellers, the number of tourists coming to Singapore and correspondingly the number of foreigners buying new and resale residential properties in Singapore has risen from a low of 2.8% foreign buying in the first 3 months of 2022 to almost 5% in the next eight months.

The top 5 nationalities buying residential properties in 2022 are from China, Malaysia, India, USA and Indonesia. The number of homes in the CCR sold from April also shot up. Developers sold 361 units per month in the CCR in 1Q 2022. This jumped by almost 60% to a quarterly average of 577 units in 2Q and 3Q 2022. The resale market also saw an increase in sales of homes in the CCR, albeit at a lower 36%.

Foreign talent is steadily returning to Singapore, as Singapore's non-resident population nears pre-pandemic levels of an estimated number of 1.7 million. Moreover, China's wealthy Chinese are increasingly seeking safe havens to park their assets and funds beyond the reach of Beijing’s common prosperity drive. In the first eight months of 2022, Chinese residential property buyers accounted for about one-fifth of the 425 luxury condos sold in Singapore.

"The supply of new homes will pick up in 2023 to an estimated 10,000 to 12,000 units spread over 40 launches. Based on the estimated units, 20% are in the Core Central Region, 50% in the Rest of Central Region and 30% in the Outside Central Region. Several of the major project launches in 1Q 2023 should be well-received by the market. They include 8 Shenton Way, Blossoms by the Park, Jalan Tembusu, Lentor Hill Residences, Marina View, Newport Residences, Sceneca Residences, Terra Hill, The Botany at Dairy Farm, The Continuum, The Hill@OneNorth and The Reserve Residences." said real estate professional Kiwi Lim from Huttons Asia,

From Apr 2022 after Singapore announced the easing of border measures for fully vaccinated travellers, the number of tourists coming to Singapore and correspondingly the number of foreigners buying new and resale residential properties in Singapore has risen from a low of 2.8% foreign buying in the first 3 months of 2022 to almost 5% in the next eight months.

The top 5 nationalities buying residential properties in 2022 are from China, Malaysia, India, USA and Indonesia. The number of homes in the CCR sold from April also shot up. Developers sold 361 units per month in the CCR in 1Q 2022. This jumped by almost 60% to a quarterly average of 577 units in 2Q and 3Q 2022. The resale market also saw an increase in sales of homes in the CCR, albeit at a lower 36%.

Foreign talent is steadily returning to Singapore, as Singapore's non-resident population nears pre-pandemic levels of an estimated number of 1.7 million. Moreover, China's wealthy Chinese are increasingly seeking safe havens to park their assets and funds beyond the reach of Beijing’s common prosperity drive. In the first eight months of 2022, Chinese residential property buyers accounted for about one-fifth of the 425 luxury condos sold in Singapore.

"The supply of new homes will pick up in 2023 to an estimated 10,000 to 12,000 units spread over 40 launches. Based on the estimated units, 20% are in the Core Central Region, 50% in the Rest of Central Region and 30% in the Outside Central Region. Several of the major project launches in 1Q 2023 should be well-received by the market. They include 8 Shenton Way, Blossoms by the Park, Jalan Tembusu, Lentor Hill Residences, Marina View, Newport Residences, Sceneca Residences, Terra Hill, The Botany at Dairy Farm, The Continuum, The Hill@OneNorth and The Reserve Residences." said real estate professional Kiwi Lim from Huttons Asia,

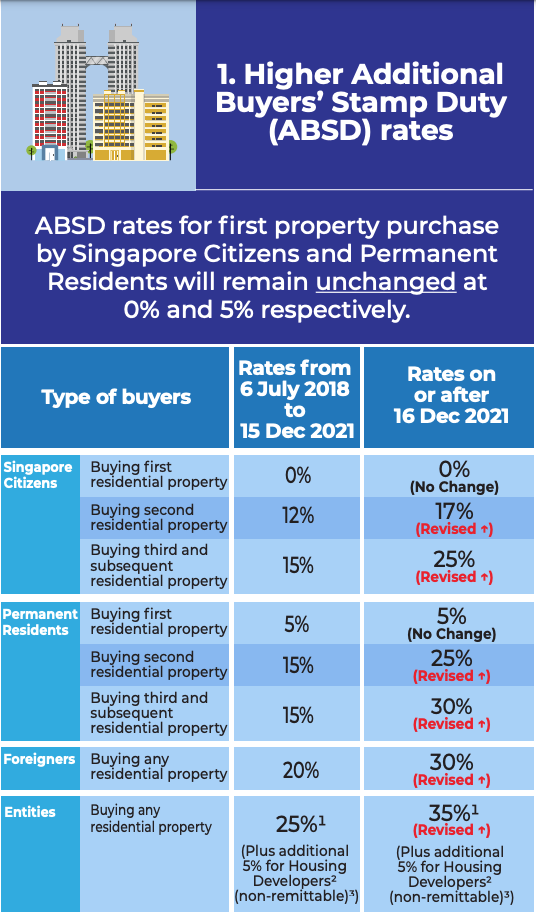

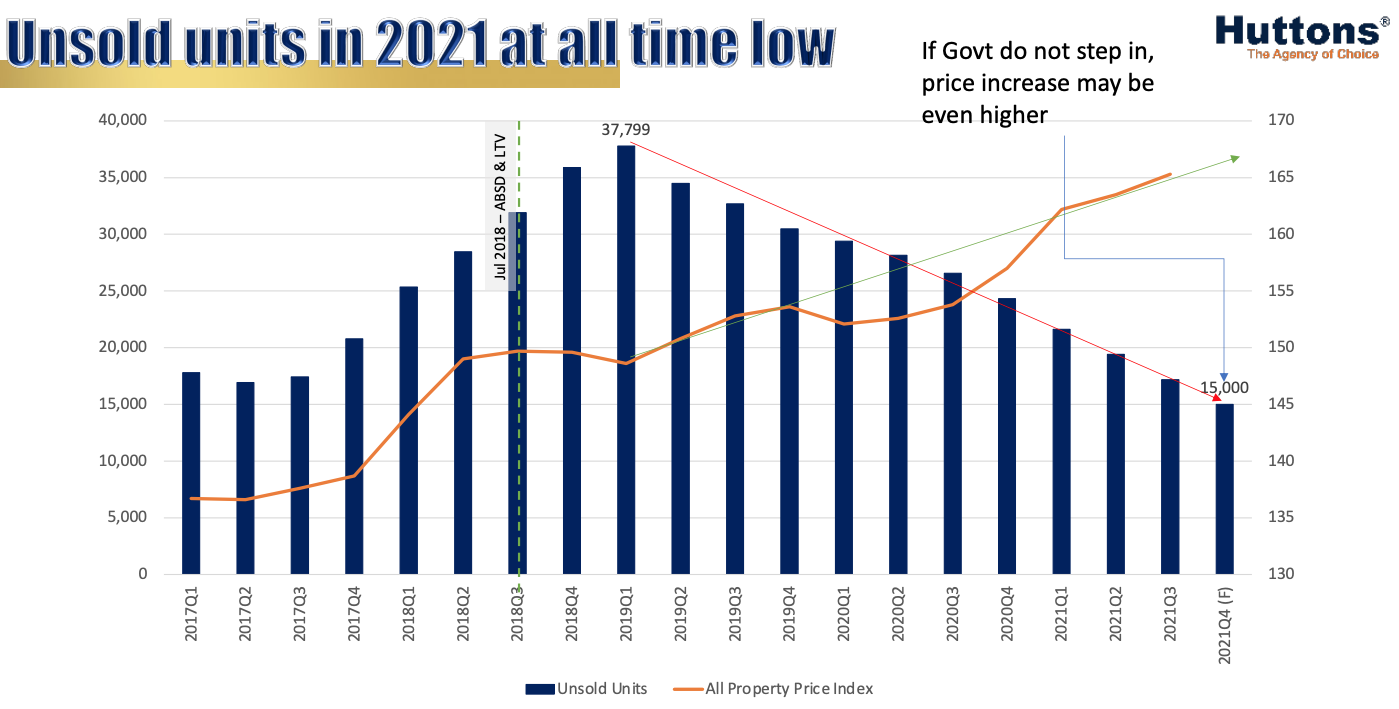

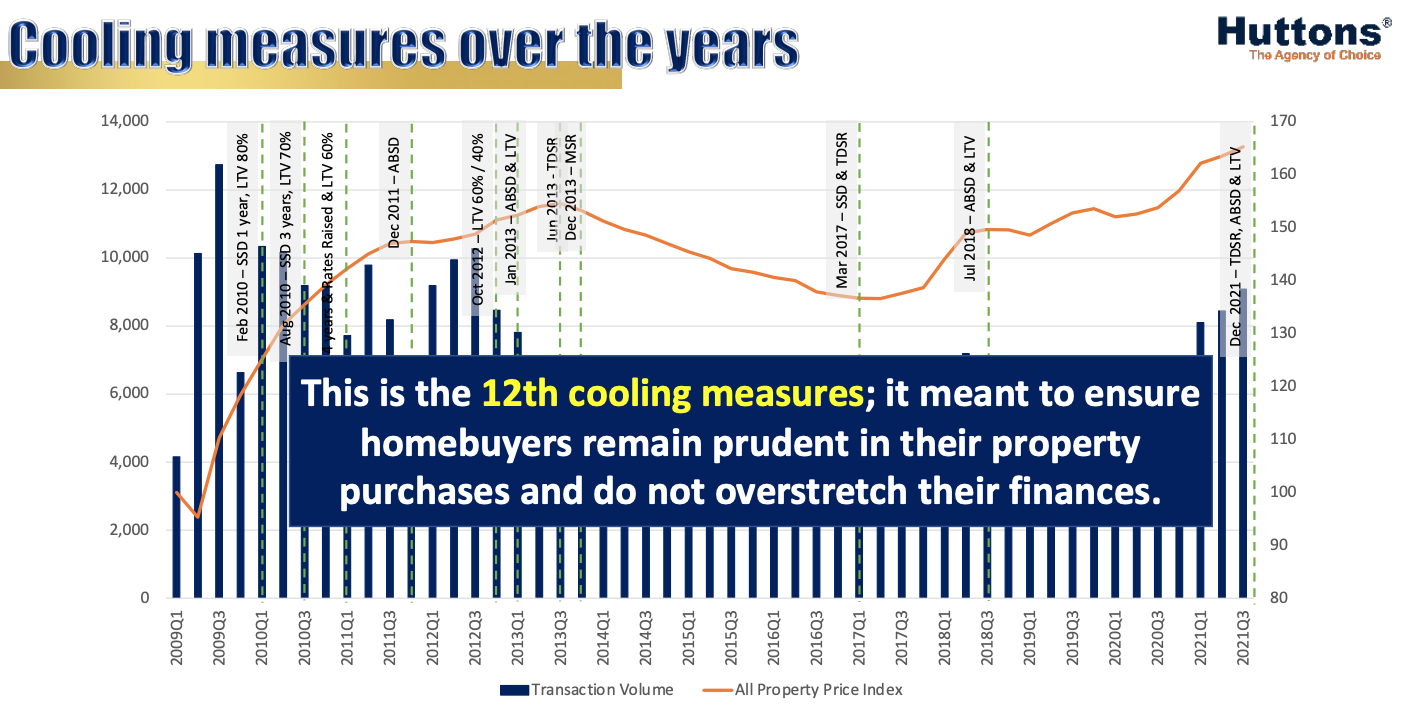

The government has removed property speculators from the real estate market in Singapore after it announced new measures to cool the property market on 16 Dec 2021 to promote a stable and sustainable property market.

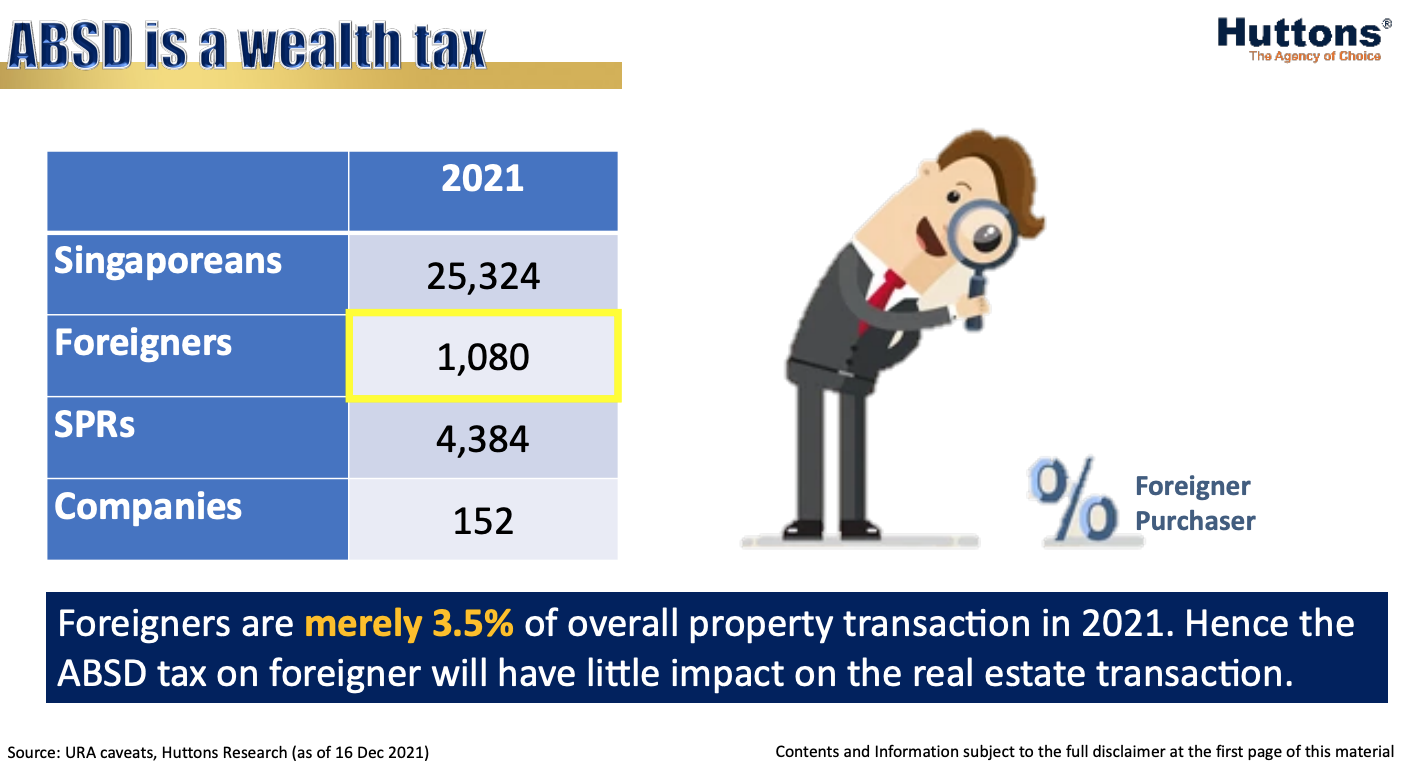

Higher ABSD Does Not Seem To Dampen Pent Up Foreigner Demand For Singapore property

Prohibitive stamp duty fees of 30% for foreigners buying property in Singapore doesn't really keep expats / overseas property investors out because many other countries that they would like to move to has banned foreigner buyers, e.g. Bali, Canada, Thailand, Australia (foreigners can only buy new launches) and New Zealand all blocked international buyers.

Whether foreign investors will be affected by the stamp duty to look elsewhere also depends on many other factors, e.g. less restrictive jurisdictions for doing business, stable and dynamic financial market, ease of travel, stable political government, good economic fundamentals. Therefore, other than stamp duties for buying a property in a country, foreigners also based their decisions on their own objectives, country demographics and market conditions.

Most importantly, compared to the rest of the world... Singapore is a rare country that is safe with low crime rate (ladies can even walk alone on the street at 3am in the morning), has good racial harmony, has a vast array of international food selections and has a population that is mostly bilingual in both English language and Mandarin.

Whether foreign investors will be affected by the stamp duty to look elsewhere also depends on many other factors, e.g. less restrictive jurisdictions for doing business, stable and dynamic financial market, ease of travel, stable political government, good economic fundamentals. Therefore, other than stamp duties for buying a property in a country, foreigners also based their decisions on their own objectives, country demographics and market conditions.

Most importantly, compared to the rest of the world... Singapore is a rare country that is safe with low crime rate (ladies can even walk alone on the street at 3am in the morning), has good racial harmony, has a vast array of international food selections and has a population that is mostly bilingual in both English language and Mandarin.

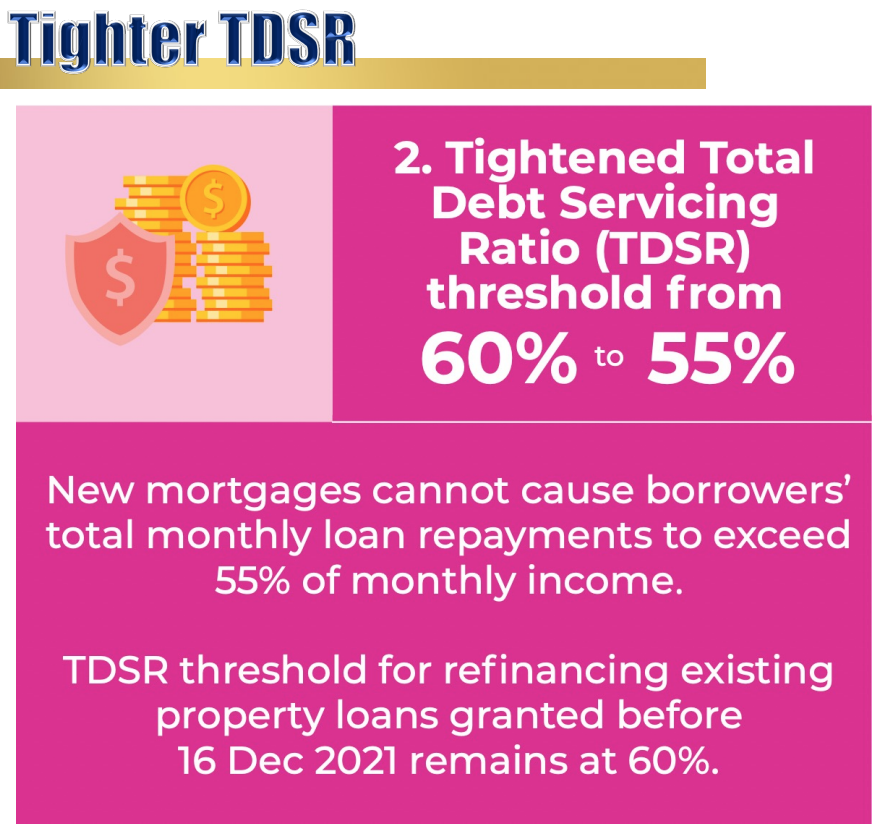

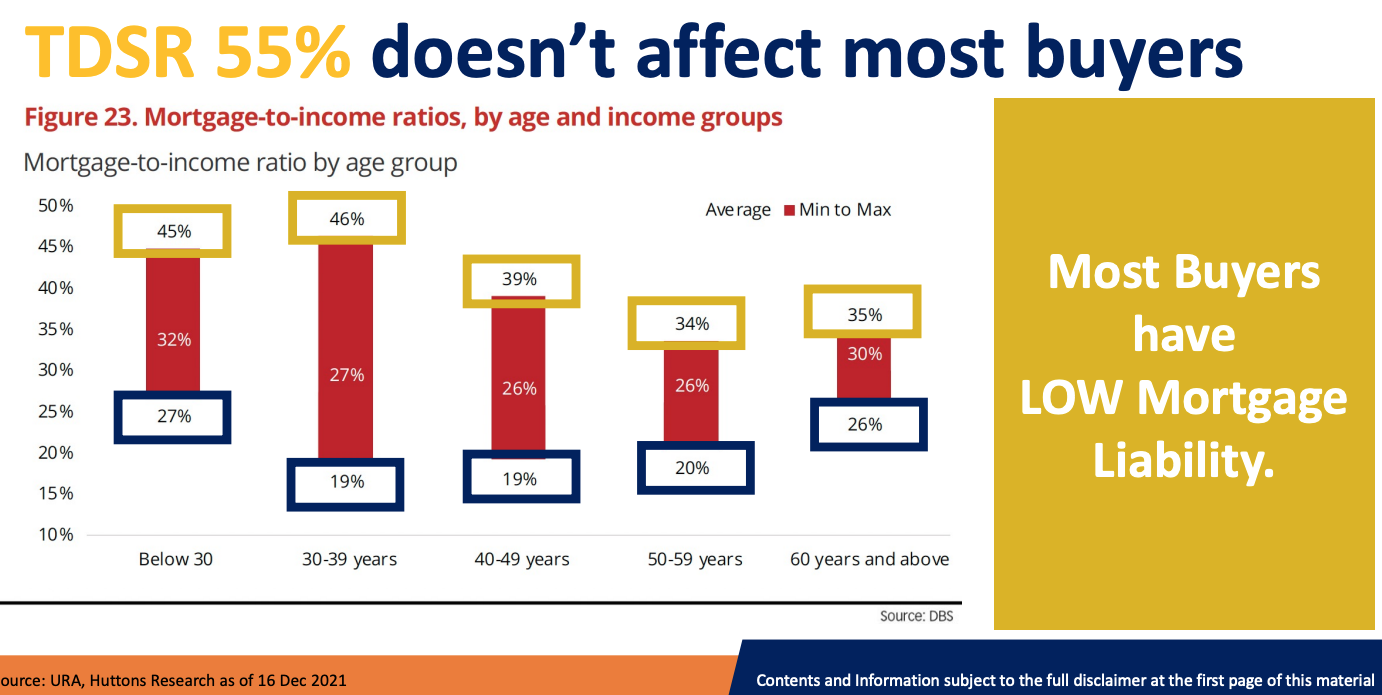

HOW DOES A LOWER TDSR AFFECT 2023 MARKET OUTLOOK?

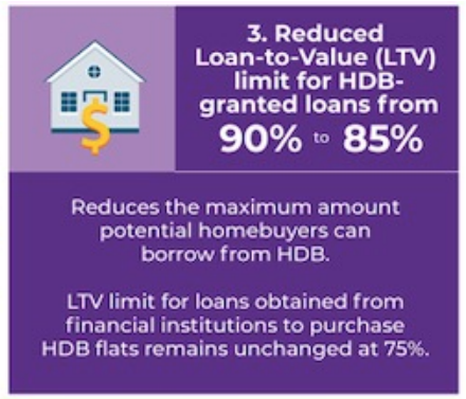

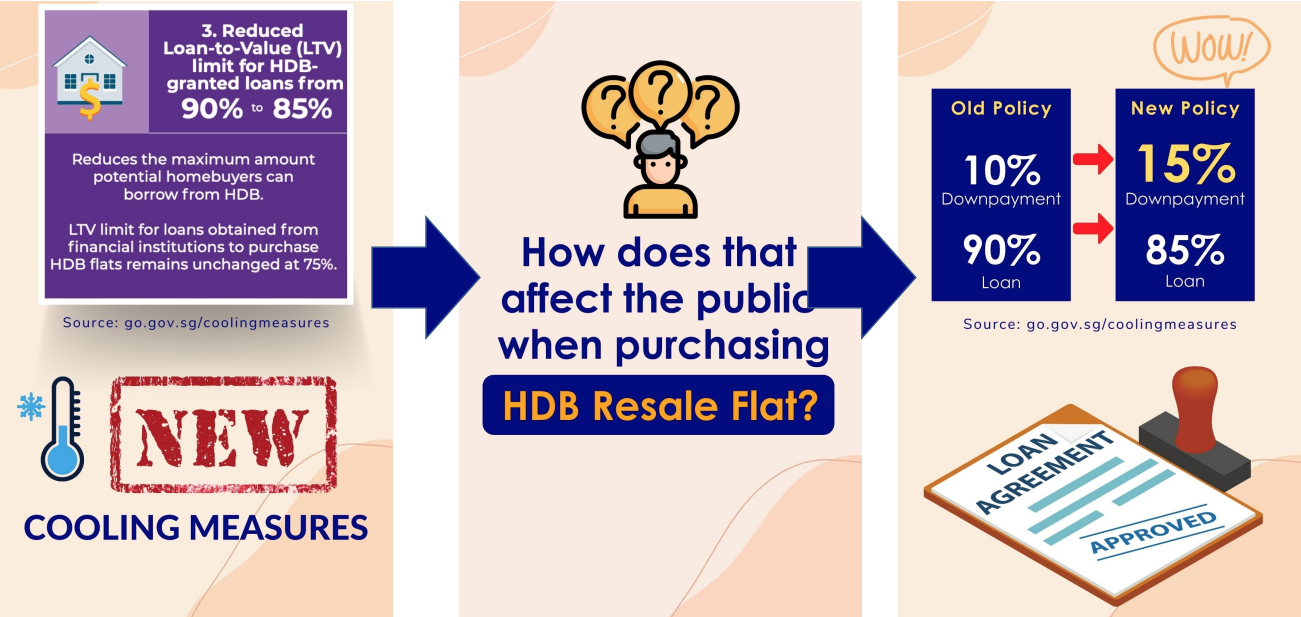

HOW DOES LOWER LTV For HDB LOANS AFFECT HDB BUYERS?

Will The Government Lower GLS Land Prices In 2023?

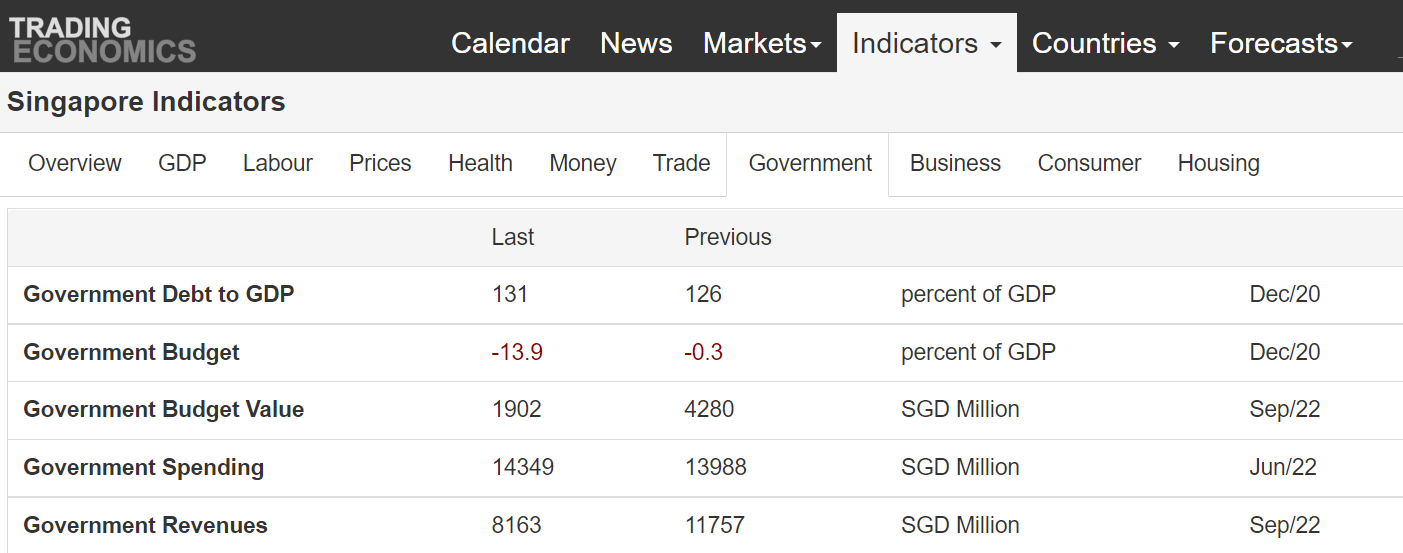

If you look at the above chart showing Singapore's budget statistics this year in 2022, the government spent an estimated $6 billion more than its received revenues. This means that the Singapore government had to tap into our national reserves for the additional $6 billion in expenditures, to handle Covid and other unforeseen expenses.

All in all, due to the unforeseen Covid pandemic which terrorised the world from 2020 - 2022, the govenrment drew from our past accumulated national reserves more than $43 billion for the three financial years of 2020 to 2022, you may click the Straits Times image below to read more about it.

All residential properties in Singapore are either build on private collective enbloc sales or government land sales (GLS) which developers will bid for in order to secure land for their apt / condo building projects.

All government land sales (GLS) revenue goes to our national reserve. The government has reiterated countless times during the past two years about how we need to top-up our national reserves in order to prevent another pandemic or an unforeseen crisis that might hit Singapore in future. This is the reason why Singapore government decided to push ahead with its plan to raise GST by 1% in 2023 and by another 1% more in 2024 even though Singapore is facing rising living costs and high inflation rates at the possible expense of losing votes.

With the above scenario, real estate consultant Kiwi Lim from Huttons Asia believe that it is very challenging for the government to lower prices of upcoming government land sales (GLS) in 2023 and 2024 as the need to shore up our heavily depleted national reserves remain a top priority for our nation.

All in all, due to the unforeseen Covid pandemic which terrorised the world from 2020 - 2022, the govenrment drew from our past accumulated national reserves more than $43 billion for the three financial years of 2020 to 2022, you may click the Straits Times image below to read more about it.

All residential properties in Singapore are either build on private collective enbloc sales or government land sales (GLS) which developers will bid for in order to secure land for their apt / condo building projects.

All government land sales (GLS) revenue goes to our national reserve. The government has reiterated countless times during the past two years about how we need to top-up our national reserves in order to prevent another pandemic or an unforeseen crisis that might hit Singapore in future. This is the reason why Singapore government decided to push ahead with its plan to raise GST by 1% in 2023 and by another 1% more in 2024 even though Singapore is facing rising living costs and high inflation rates at the possible expense of losing votes.

With the above scenario, real estate consultant Kiwi Lim from Huttons Asia believe that it is very challenging for the government to lower prices of upcoming government land sales (GLS) in 2023 and 2024 as the need to shore up our heavily depleted national reserves remain a top priority for our nation.

Will Singapore Enter Into Recession In 2023?

Real estate professional Kiwi Lim from Huttons Asia believe Singapore's economy will be suitably cushioned to prevent a hard landing as the island nation is well diversified in its economic umbrella and has cut down on its over reliance on America & Europe for its trade. The aggregate economic growth in Singapore’s major trading partners in Asia, China and India is expected to ease somewhat but the savings and wealth accumulated in recent years especially in Asian giants like China and India which Singapore has extensive trade and economic relations with will help cushion the deeper recessionary impact that may be seen widely in America and European countries towards the 2nd half of 2023.

Against this backdrop, Singapore's trade-related and modern services sector in 2023 may see a slower expansion or stagnation as compared to 2022, although the recovery in the domestic-oriented and travel-related sectors should "gather pace" with the relaxation of Covid-19 measures.

Against this backdrop, Singapore's trade-related and modern services sector in 2023 may see a slower expansion or stagnation as compared to 2022, although the recovery in the domestic-oriented and travel-related sectors should "gather pace" with the relaxation of Covid-19 measures.