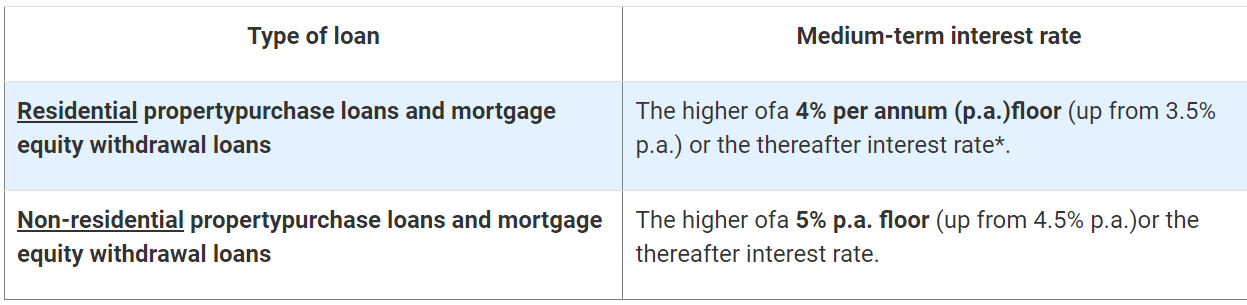

Residential Property TDSR & MSR raised from 3.5% to 4%

For property loans granted by private financial institutions, MAS will raise by 0.5%-point the medium-term interest rate floor used to compute the Total Debt Servicing Ratio (TDSR) for private residential property and Mortgage Servicing Ratio (MSR) for HDB flats.

- This will apply to loans for the purchase of properties where the Option to Purchase (OTP) is granted on or after 30 September 2022, or where there is no OTP, the date of the Sale and Purchase Agreement is on or after 30 September 2022.

- The actual interest rates charged for mortgages will continue to be determined by the private financial institutions.

Non Residential Property TDSR raised from 4.50% to 5.00%

For non-residential property loans granted by private financial institutions, MAS will raise by 0.5%-point the medium-term interest rate floor used to compute the Total Debt Servicing Ratio (TDSR) and Mortgage Servicing Ratio (MSR) for non-residential properties from 4.5% to 5%.

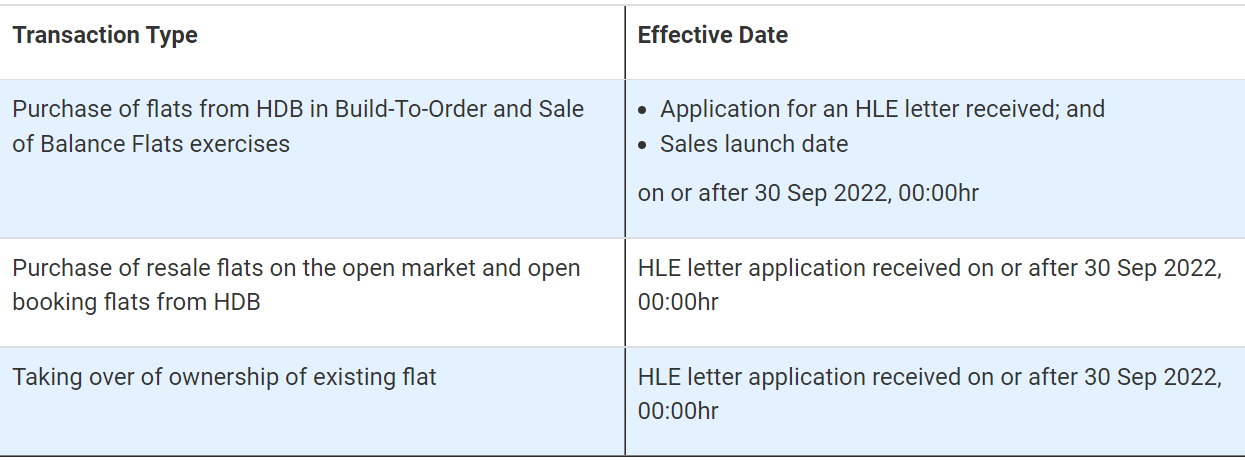

Housing Loans Granted By HDB - HLE MSR raised from 2.60% to 3.00%

For housing loans granted by HDB, HDB will introduce an interest rate floor of 3% for computing the eligible loan amount.

- The interest rate floor will apply to fresh applications for an HDB Loan Eligibility (HLE) letter received on or after 30 September 2022, 00:00 hours.

- There will be no impact to existing HLE applications received by HDB before this time.

- This will not affect the actual HDB concessionary interest rate, which will remain unchanged at 2.6% p.a..

- flat buyers who are taking an HDB housing loan at the concessionary interest rate; and

- whereby commercial interest rate is charged, e.g. flat buyers who are taking a second HDB housing loan and buying an HDB flat before disposing of their existing one. The interest rate will be converted to the concessionary rate after the flat buyer has disposed of the existing flat and used the CPF refund and 50% of the cash proceeds received to reduce the second HDB housing loan amount.

LTV For HDB Housing Loans cut from 85% to 80%

HDB will lower the Loan-to-Value (LTV) limit for HDB housing loans from 85% to 80%. The lower LTV limit will apply to new flat applications for sales exercises launched and complete resale applications which are received by HDB on or after 30 September 2022.

The revised LTV limit does not apply to loans granted by private financial institutions, for which the LTV limit remains at 75%.

HDB does not expect this to affect first-timer and lower-income flat buyers significantly, as they may receive significant housing grants of up to $80,000 when buying a subsidised flat directly from HDB, or up to $160,000 when buying a resale flat. They can also tap on their CPF savings to pay for the flat purchase, thereby reducing the loan amount they may need to take.

HDB Loan will continue to be priced at 0.10% + OA rate

There is no change to the actual interest rate charged for housing loans provided by HDB. The HDB concessionary interest rate is reviewed quarterly, and will continue to be pegged at 0.1%-point above the prevailing CPF OA interest rate. It will remain at 2.6% p.a. from 1 October to 31 December 2022.

To moderate demand in the HDB resale market, HDB will impose a wait-out period of 15 months for private residential property owners (PPOs) and ex-PPOs to buy a non-subsidised HDB resale flat. The wait-out period will not apply to seniors aged 55 and above who are moving from their private property to a 4-room or smaller resale flat. This new measure will take effect from 30 September 2022. It is a temporary measure which will be reviewed in future depending on overall market conditions and housing demand.

Ex-PPOs refer to those who had disposed of a private property prior to submitting an application to buy a resale flat.

Seniors aged 55 years and above (and their spouses) not affected by Wait Out Period

The 15-month wait-out period will not apply to seniors aged 55 and above (and their spouses) who are moving from their private property to a 4-room or smaller resale flat. Senior private residential property owners PPOs / ex-PPOs can continue to buy a 2-room Flexi flat on short lease (if they are aged 55 and above) and Community Care Apartment (if they are aged 65 and above) from HDB. In addition, private residential property owners PPOs / ex-PPOs, regardless of age, with extenuating circumstances, e.g. financial difficulties, may approach HDB for assistance, and we will assess their situation on a case-by-case basis.

Ex-PPOs refer to those who had disposed of a private property prior to submitting an application to buy a resale flat.

The Singapore government assures Singaporeans that they are committed to keep public housing inclusive, affordable and accessible to Singaporeans. The government will continue to monitor the property market and adjust policies to ensure that they remain relevant.

Real estate professional Kiwi Lim felt this recent measure seem to be more targeted towards resale HDB buyers in order to manage the rising prices of HDB resale flats which has seen more and more million dollar resale flats being transacted in the market. There are more HDB resale flats changing hands for at least $1 million in the first nine months of 2022 than in the whole of 2021, as overall property prices continue to edge up. To date, there have been 274 million-dollar HDB resale flat transactions, exceeding the 259 units recorded in 2021, according to HDB data.

"There are a growing number of elderly above 55 who cashed out from the sales of their private properties to live their retirement years in a large 5 room HDB flat, EA or EM and these buyers are very willing to pay larger amounts of COV for their retirement homes. I believe the government is trying very hard to prevent the number of million dollar flats from hitting 300 units this year" said Kiwi Lim.

1. Do both spouses have to be 55 to be exempted from 15 months wait out?

Yes. Both spouses need to be 55. The 15-month wait-out period will not apply to seniors and their spouses, both of whom must be aged 55 and above, who move from their private property to a four-room or smaller resale flat.

2. Can I buy resale HDB now as I have sold off my private property before the cooling measures?

No. The resale application must be before 30 Sep. You will have to wait out for 15 months from the official completion date.

3. When does the 15 months date start?

It starts from the official completion of the sale of your private property.

If unsure, you may check directly with HDB as there may be conditions subject to changes without notice.

RSS Feed

RSS Feed