Why and What is Sell One Buy Two?

This 'Sell One Buy Two' concept is usually suited for husband and wife who are the owners of the HDB flat.

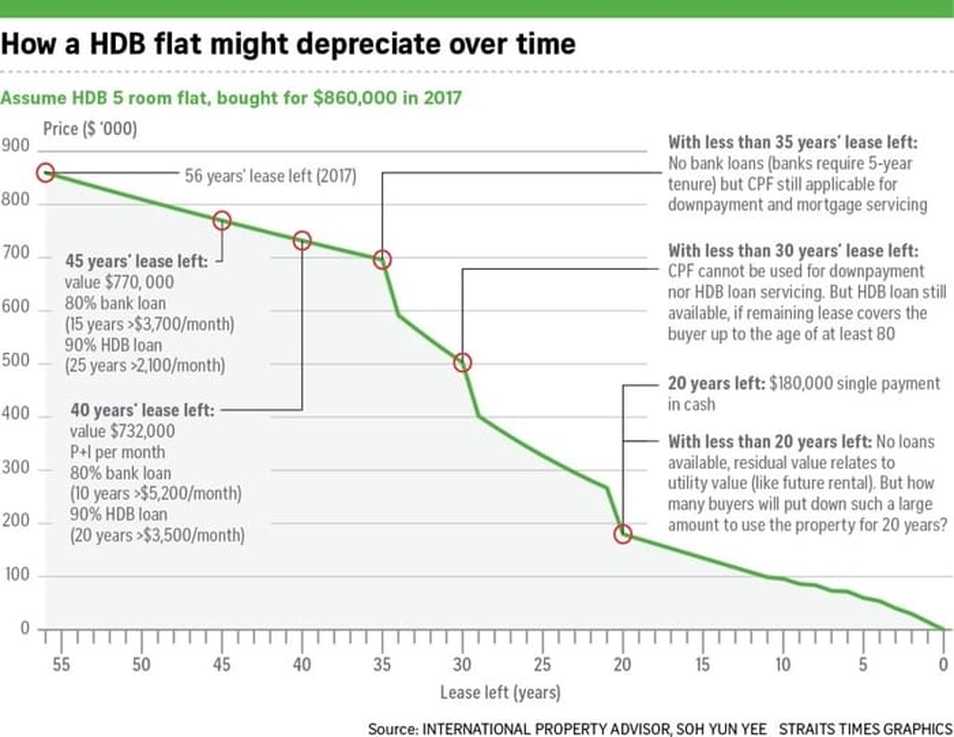

From the Straits Times analysis table above, we know that HDB flats depreciate over time as they get older, many HDB home owners are worried that they may not be able to retire with their HDB flat.

HDB disallowed transfer of ownership or “de-coupling” since April 2016 therefore couples who co-owned the HDB flat together can no longer apply to remove one person from the ownership of the flat to become an occupier (instead of an owner) in order to allow the occupier to buy a private property (effectively the couple's 2nd property) without paying Additional Buyer's Stamp Duty on the new property.

However, if you choose to hold and own only your HDB flat, it is primarily merely for own stay and is unable to effectively hedge against inflation rates of between 1% to 2% annually in Singapore. Moreover, with the recent increase in Additional Buyer Stamp Duty (ABSD) from 7% to 12% of the purchase price since 6 July 2018 , most Singaporeans couldn’t afford to buy a second property leaving them with these 3 common options below:

(1) Pay for ABSD for your second property

You can keep your HDB flat but you are sacrificing 12% of the condo price, which is a lot of money. For example, if you’re buying a $1million property, that is a WHOPPING $120k of ABSD. It’s going to take years to recover this amount!!

(2) Retire with only one HDB flat

You can have a simple and less stressful life. Accepting the fact that your HDB flat will depreciate as the years go by and miss out the chance to gain profit or move forward.

(3) Sell your HDB flat now so that each person can own a private property under individual names

As every couple hope for early or comfortable retirement, most HDB flat owners chose the 3rd option as they agree it’s the most ideal one in their plan for retirement.

From the Straits Times analysis table above, we know that HDB flats depreciate over time as they get older, many HDB home owners are worried that they may not be able to retire with their HDB flat.

HDB disallowed transfer of ownership or “de-coupling” since April 2016 therefore couples who co-owned the HDB flat together can no longer apply to remove one person from the ownership of the flat to become an occupier (instead of an owner) in order to allow the occupier to buy a private property (effectively the couple's 2nd property) without paying Additional Buyer's Stamp Duty on the new property.

However, if you choose to hold and own only your HDB flat, it is primarily merely for own stay and is unable to effectively hedge against inflation rates of between 1% to 2% annually in Singapore. Moreover, with the recent increase in Additional Buyer Stamp Duty (ABSD) from 7% to 12% of the purchase price since 6 July 2018 , most Singaporeans couldn’t afford to buy a second property leaving them with these 3 common options below:

(1) Pay for ABSD for your second property

You can keep your HDB flat but you are sacrificing 12% of the condo price, which is a lot of money. For example, if you’re buying a $1million property, that is a WHOPPING $120k of ABSD. It’s going to take years to recover this amount!!

(2) Retire with only one HDB flat

You can have a simple and less stressful life. Accepting the fact that your HDB flat will depreciate as the years go by and miss out the chance to gain profit or move forward.

(3) Sell your HDB flat now so that each person can own a private property under individual names

As every couple hope for early or comfortable retirement, most HDB flat owners chose the 3rd option as they agree it’s the most ideal one in their plan for retirement.