5 shophouses on Club Street sold for S$25.9 million

A row of 5 shophouses commanding a prominent 50-metre wide triple road frontage on 1, 3 and 5 Club Street, which are 3 storeys high with an attic, and numbers 7 and 9 Club Street, which are 2 storeys high - sitting on a combined land of approximately 3,557 square feet (sq ft), with an estimated total built-up area of 7,225 sq ft has been sold for nearly $26 million translating to S$3,582 per sq ft on the blended floor area to mainboard-listed food services and property development company ABR Holdings.

It was reported that response to the EOI for the shophouses were “overwhelming”, with enquiries from many new-to-market buyers from China, Hong Kong and Indonesia as the shophouses were on a rare island site coupled with excellent locational attributes in the Central Business District.

The past two months also saw several transactions for shophouses, e.g. 93 Tanjong Pagar Rd sold for S$13.25m, Hotel Soloha in Teck Lim Road changed hands for S$53.38 million, 3 shophouses at corner of Kreta Ayer and Keong Saik roads sell for slightly above S$44 million, etc.

The flow of hot money has brought about an increase in prices of conservation shophouses amid strong demand and limited supply which tempted shophouse owners to flip these heritage properties for quick gains resulting in 217 transactions worth S$1.53b last year.

Coffeeshops

An adjacent coffeeshop at Blk 201D Tampines Street 21 has recently been sold for S$16,800,000. The same buyer also bought a coffeeshop located at Block 201 Tampines Street 21 sold for a record S$41,682,168 with the buyer spending a total of close to S$60 million on both coffeeshops in Tampines.

Singapore's commercial property market is also not to be outdone as transactions continue breathing life and vibrancy in this sector. The latest deal is at Bugis Junction Towers, where Sun Venture Group is said to be doing exclusive due diligence with a view to buy the 15-storey office block for between S$675 million and S$680 million. This translates to close to S$2,720 per square foot on the net lettable area (NLA) of 248,853 sq ft estimating the net rental yield to be at around 3 per cent. Located above Bugis MRT station, Bugis Junction Towers has about 94 per cent occupancy, and monthly average rents on existing leases are at the S$8-plus psf level. The anchor tenant in the building is Enterprise Singapore.

In Peck Seah Street, Tokyo-based Kajima Corporation is paying S$111.1 million for Nehsons Building, an almost 50-year-old office building, which when redeveloped, will add to the area’s gentrification. Nehsons Building’s existing gross floor area (GFA) of around 69,240 sq ft offers a potential for Kajima to optimise Nehsons Building by redeveloping it into a mixed-used asset that includes commercial and residential components. Earlier this year, Kajima bought 55 Market Street, a 16-storey 999-year leasehold office building, from AEW for S$286.9 million (or S$3,450 psf on NLA). Research by JLL as at 28 Jun 2022 show that S$4.7 billion of Singapore office assets have been transacted in the 1st half of this year, including the Westgate Tower deal.

Over at the industrial property segment, an entity linked to LaSalle Investment Management is understood to be acquiring Victory Centre, a 7-storey ramp-up facility near the Aljunied MRT station, for S$90 million with about 50 years left on the lease. Located at the corner of Sims Drive and Aljunied Road, the light industrial building's gross floor area is close to 170,000 sq ft, reflecting the 2.5 plot ratio (or ratio of maximum GFA to land area) designated for the Business 1-zoned site under the URA Master Plan. The building’s space has been carved into more than 80 units, averaging about 1,600 sq ft each. It is almost fully occupied, with the passing rent said to average about S$2.50 psf a month.

As we face a current shortage in supply of new private residential properties, there is also a limited supply of good-quality prime CBD offices, conservation shophouses and industrial properties on sites with more than 30 years’ balance lease term.

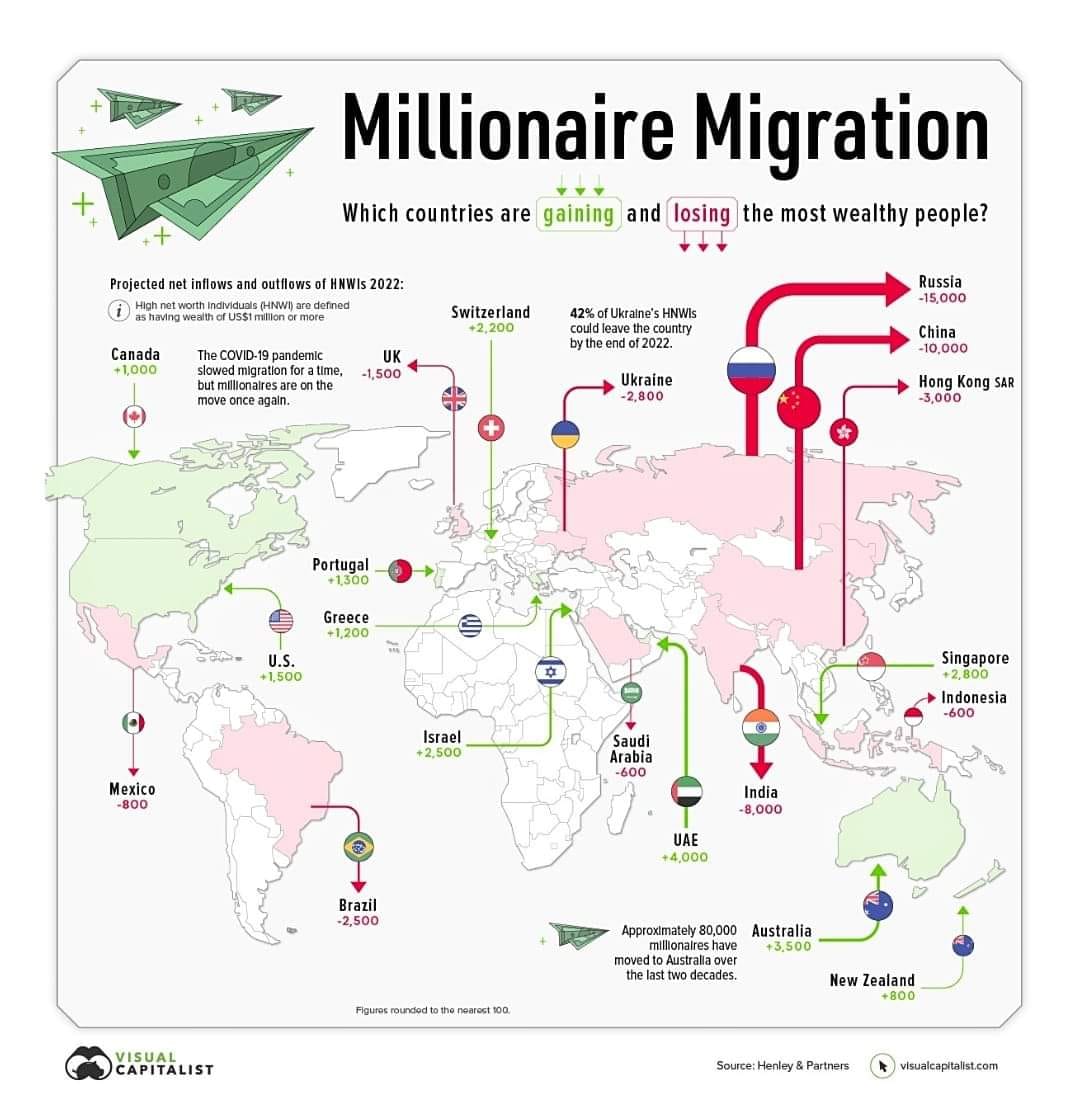

Real estate professional Kiwi Lim from Huttons Asia expect to see more non residential transactions in the 2nd half of 2022 as more overseas funds are transferred into Singapore which is favored by HNWI as a country with good governance, stable financial center with availability of good international schools and a generally bilingual population in both English & Mandarin. The absence of inheritance tax attracts wealthy businessmen to stay in Singapore to build their businesses empire for their future generations providing more employment which also benefit Singaporeans.

The UK is seen to be steadily losing its attraction as a world financial center due to Brexit and rising taxes with net outflows of 1,500 HNWI predicted for 2022. America is also losing its appeal among migrating millionaires with the threat of higher taxes and a shift in priority towards a protectionist economy.

China’s deteriorating relationships with Australia, the US and the rest of the western nations are a major long-term concern for HNWI residing in China and Hong Kong (SAR China) as HNWI families are leaving to resettle in Singapore, Canada, Portugal and a few other countries. The war in Russia and Ukraine is making these two countries less popular with HNWI. Brazil and India are also expected to see more HNWI leaving within these few years.

RSS Feed

RSS Feed