The new cooling measures saw additional buyer's stamp duties (ABSD) taxes increased by up to 10% to a whopping 25% ABSD taxes in addition to the normal stamp duty payable by Singaporeans buying their 3rd property leading analysts to wonder if the government is dissuading citizens from buying any more property due to a lack of supply in the market.

Not only that, the new cooling measure also made the TDSR stress test tougher to pass by lowering the 60% TDSR to 55% TDSR effectively assuming that the buyer took a 45% pay cut when calculating their mortgage loans.

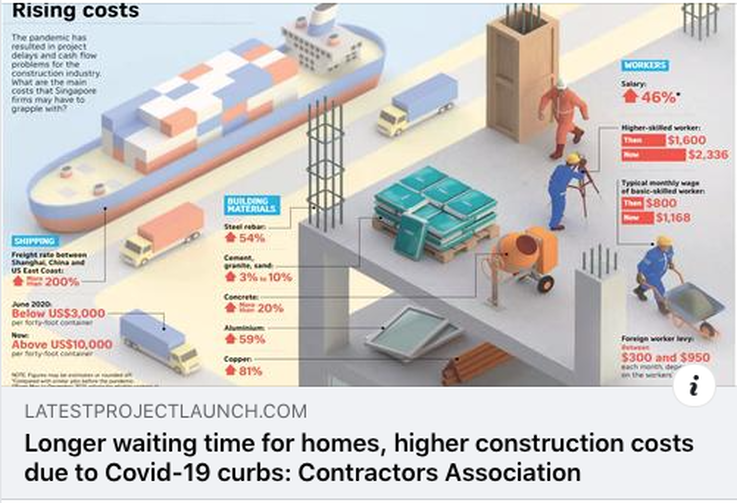

Kiwi Lim from Huttons Asia said developers braced themselves for a knee jerk reaction from the market sentiment after the cooling measure announcement by not increasing prices even as construction costs and manpower costs are mounting and hurting developers' bottom line.

Other developers are expected to follow suit to slowly increase prices of various new launch condo projects as the market faced a double whammy of record low supply of available new condo units in Singapore coupled with rising construction costs. For example, The Florence Residences in suburban Hougang sold 98% and currently see units priced at more than $1,9xx psf amidst higher building costs.

This year's upcoming mass market new condo launches are expected to sell from around $2,000 psf onwards even for those in the OCR districts (Outside Central Region) due to the higher land costs from the bidding of the Government Land Sale Parcels (GLS).

Early this year in January 2021, CDL successfully clinched a GLS land parcel in Tanjong Katong for more than $1,300 psf ppr leading analysts to estimate its possible launch next year around $2,3xx psf.

"Low interest rates, limited supply and strong demand are some factors that have led to the increase in home prices last year leading to a 10.6% increase in private home prices in 2021. However, property prices is expected to climb at a slower pace due to rising home loan interest rates and the economic uncertainties brought about by rapidly rising fuel costs due to the Russian-Ukraine war. Therefore, I believe Singapore's residential property prices are expected to rise slower between 3% to 5% this year in 2022." said Kiwi Lim

RSS Feed

RSS Feed