Interest centred mainly on Outside Central Region (OCR) (Figure 1) while the proportion of Singaporeans buying private residential properties increased to above 80 per cent in April and May, reflecting underlying confidence in the market.

To find out how COVID affects home buyer's decision making process when choosing their dream home, you may read the news analysis article here.

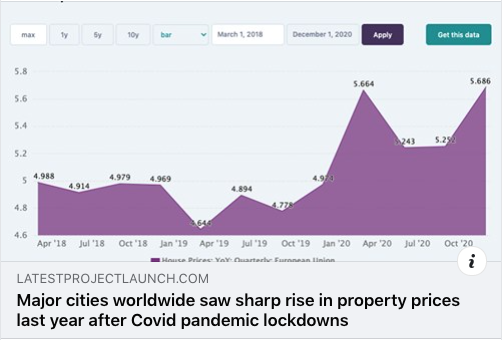

- Memories of past cycles. Looking back at past crises, including the Sars public health crisis, residential prices in land-scarce Singapore have rebounded after each cycle, on one occasion by as much as 62 per cent after the 2008 global financial crisis (Figure 2). From an economic perspective, the scarcity of land appears to be a supply fundamental that can weather the erosive effect of shocks.

- High liquidity with limited investment options. For many, there are currently limited options with a wall of money trying to find an investment, gravitating them to residential properties.

- Low cost of borrowing. The cost of borrowing is at an all-time low and interest rates are expected to remain low in the near future with the current fixed rate mortgage rate of about 1.5 per cent.

- Stable asset class. Real estate is a relatively stable asset class. For instance, in Q1 2020, the URA private residential property price index fell by one per cent. This contrasts with the STI which fell by 23 per cent and property stocks by more than 20 per cent, notwithstanding that the stock market has recovered some ground since then.

- Emotional attachment. Owners often have strong emotional ties to their residential properties as it is an asset where one can physically enjoy and have the pride of ownership, a legacy which can be passed on to the next generation.

- Serious investors with longer term perspective. Macro-prudential policies introduced over the years have also weeded out speculators, leaving genuine investors who take a longer-term perspective.

- Established developers. Similarly, the many crises we have weathered have ensured that developers who survived are generally in a much better position with stronger balance sheets than before, lending stability to the market.

Real estate professional Kiwi Lim from Huttons Asia is seeing an increase in real estate interest from overseas foreign buyers especially from Hong Kong and China eyeing Singapore properties. Just last month in June 2020, right after the circuit breaker in Singapore eases into phase 2, Singapore saw 169 purchases by foreigners, made up of 120 permanent residents (PRs) and 49 non-PRs. The previous high was in August 2019 with 188 foreign buyers.

Private property prices increased 0.3% in 2nd Quarter of 2020 in spite of COVID pandemic. Read the news article here.

RSS Feed

RSS Feed