Urban Redevelopment Authority (URA) on Friday (July 24) released final data reports that private home prices in Singapore edged up 0.3 per cent in the second quarter from the previous three months bucking the initial prediction from URA's flash estimate released on July 1 of a possible 1.1 per cent drop during 2nd quarter.

But analysts warned that a market recovery is far from certain as business closures, salary cuts and job losses will eventually take their toll in the months ahead. "This surprising turnaround was mainly due to pent-up demand in the later half of June as showflats were opened – with safe distancing precautions – as well as viewings being allowed under stringent conditions," said Mr Leonard Tay, head of research, Knight Frank Singapore.

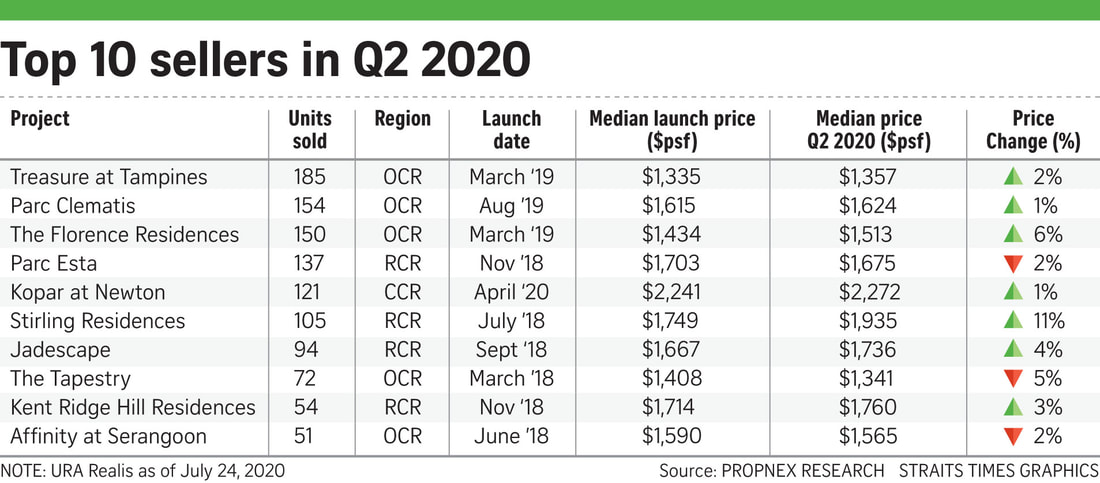

For the first half of 2020, overall prices of private home dipped 0.7 per cent, a very mild decline considering the unprecedented pandemic and economic disruption," he noted. Developers launched 1,852 uncompleted private residential units excluding executive condominiums (ECs) for sale in Q2 2020, compared with 2,093 units in the previous quarter and sold 1,713 units (excluding ECs) in Q2, 20.3 per cent less than the 2,149 units taken up in the previous quarter.

To know why residential properties in Singapore remain resilient despite Covid, you may read the news analysis article here.

For the second quarter, prices of non-landed properties rose 0.4 per cent from the previous three months, compared with the 1 per cent drop in the previous quarter.

Giving a breakdown by region, the URA said that prices of non-landed properties in the core central region jumped 2.7 per cent in Q2, compared with the 2.2 per cent drop in the previous quarter. Prices of non-landed properties in the city fringe or rest of central region fell 1.7 per cent, compared with the 0.5 per cent fall in the previous quarter.

Prices in the suburbs or outside central region edged up 0.1 per cent, compared with the 0.4 per cent fall in the previous quarter while prices of landed properties remained unchanged in the second quarter of this year, after dipping 0.9 per cent in the first quarter.

To find out how COVID affects home buyer's decision making process when choosing their dream home, you may read the news analysis article here.

Developers did not launch any EC units for sale in the second quarter, and sold 71 EC units in the quarter. In comparison, they launched 1,044 EC units and sold 590 EC units in the previous quarter.

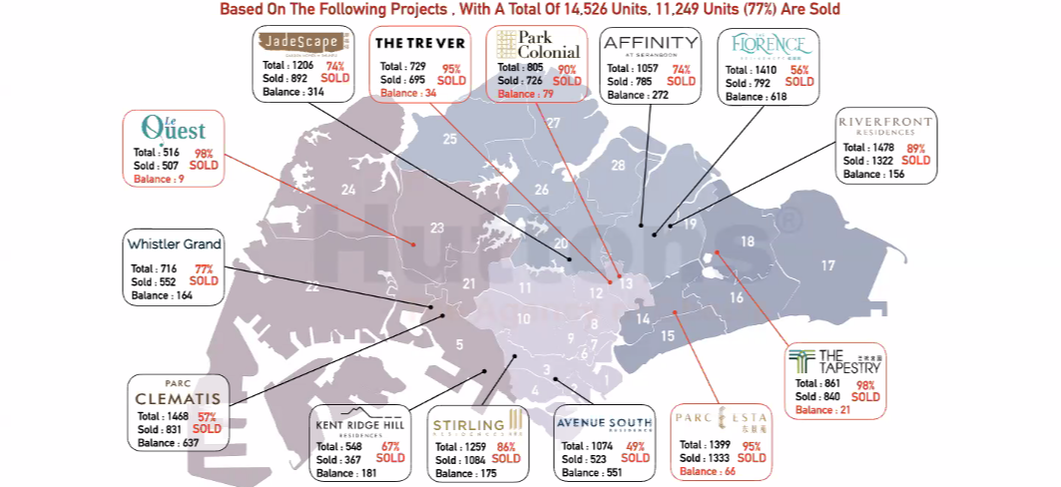

As at the end of Q2, there was a total supply of 49,090 uncompleted private residential units (excluding ECs) in the pipeline with planning approvals, compared with 48,868 units in the previous quarter. Of this number, 27,977 units or more than half remained unsold as at the end of Q2, compared with the 29,149 units in the previous quarter.

After adding the supply of 3,613 EC units in the pipeline, there were 52,703 units in the pipeline with planning approvals. Of the EC units in the pipeline, 1,899 remain unsold. In total, 29,876 units with planning approvals (including ECs) remain unsold, down from 31,099 units in the previous quarter.

"The crisis won't last forever; it will pass. So what home buyers are doing now is to prepare for the future, so that when the pandemic is finally over, they can continue their asset progression plans." said real estate professional Kiwi Lim from Huttons Asia.

RSS Feed

RSS Feed