After the government's April 2023 property cooling measure announcement which increased the Additional Buyers’ Stamp Duty (“ABSD”) for ownership of second and subsequent residential properties, we see more joint property owners, especially spouses enquiring about “decoupling” as a solution to reduce their stamp duty taxes arising from the purchase of a second and subsequent residential property.

In the context of Singapore real estate, "decoupling" refers to a strategy where registered owners / proprietors of a property, e.g. a married couple decide to restructure the ownership of their property by removing one of their names from the title to reduce the burden of Additional Buyer’s Stamp Duty (ABSD) when purchasing a second property.

In legal language, this is more accurately termed as a part sale and purchase of shares in the property. Below is a more detailed explanation:

In the case of a married couple, “Decoupling” essentially makes one owner the sole owner of the property allowing the outgoing owner (e.g. the spouse) to purchase another residential property without paying ABSD or saving the higher ABSD rates payable to IRAS applied to second and subsequent property purchases.

Through the years, we have noticed an increasing trend for proprietors to “decouple”, there are a number of issues that such proprietors need to take note on before undertaking such an exercise.

For private properties, decoupling would be subject to MAS’ and banks’ financing rules and requirements (e.g. ability of remaining owner to refund the outgoing owner’s CPF monies and finance the mortgage solely.) This would mean that in the event there is a CPF charge on the property and / or an outstanding mortgage loan, the purchaser of the part share may then have to consider taking up a fresh loan or to restructure the loan to finance the part purchase and also to re-finance his or her existing share in the event full cash payment is not an option.

For HDB flats, on top of MAS’ and banks’ financing rules, HDB only allows transfer of ownership of HDB flats under the following six scenarios: -

Divorce

Marriage

Medial Reasons

Death of an Owner

Financial Hardship

Renunciation of Singapore Citizenship

Loan Issue When Decoupling

In the event the purchasing proprietor would be taking up a fresh loan or restructuring the existing loan, the lending bank would usually be arranging for a valuation report to determine the market value of the property. In this instance, it would then be possible to peg the purchase price of the part share to the market value at the time of the contract.

In the absence of a valuation report however, proprietors must understand that they run the risk of a transaction which was entered into at an undervalue or that the contract may be insufficiently stamped. In relation to the latter and for the purposes of this article, it is imperative to note that stamp duty is computed based on the purchase price or market value of the property, whichever is higher. An undervalue transaction undermines the principle on which the stamp duty is based – To be concise, this means that the contract for a sale and purchase of a property may have been insufficiently stamped and the resulting ramification is that the purchaser of the property may be liable to pay a penalty of up to four (4) times the amount imposed by IRAS.

By Way Of Gift - Out of Love and Affection

Apart from the method of part sale and purchase of share in the property, another method could be when the share in the property is transferred out of love and affection (i.e. by way of gift). However, Section 16 of the Stamp Duties Act provides that “any conveyance or transfer operating as a voluntary disposition inter vivos shall be chargeable with the like stamp duty as if it were a conveyance or transfer on sale”. As such, stamp duties shall also be payable and be charged based on the market value of the share in property transferred. Should stamp duty be insufficiently paid, this would result in the same ramification as discussed in the preceding paragraph.

Stamp Duty

In relation to the purchase or transferring of the part share, Buyer Stamp Duty (BSD) and possibly Additional Buyer Stamp Duty (ABSD) will be applicable, depending on the profile of the purchaser.

Seller’s Stamp Duty (SSD)

On the other hand, consideration must also be placed on the vendor or transferor of the part share as Seller’s Stamp Duty (SSD) may also be applicable, depending on the date of acquisition of the property. If the Property was purchased by on or after 11 March 2017 and sold within 3 years from the date of acquisition, SSD on the sale price will also be payable and computed as shown below:-

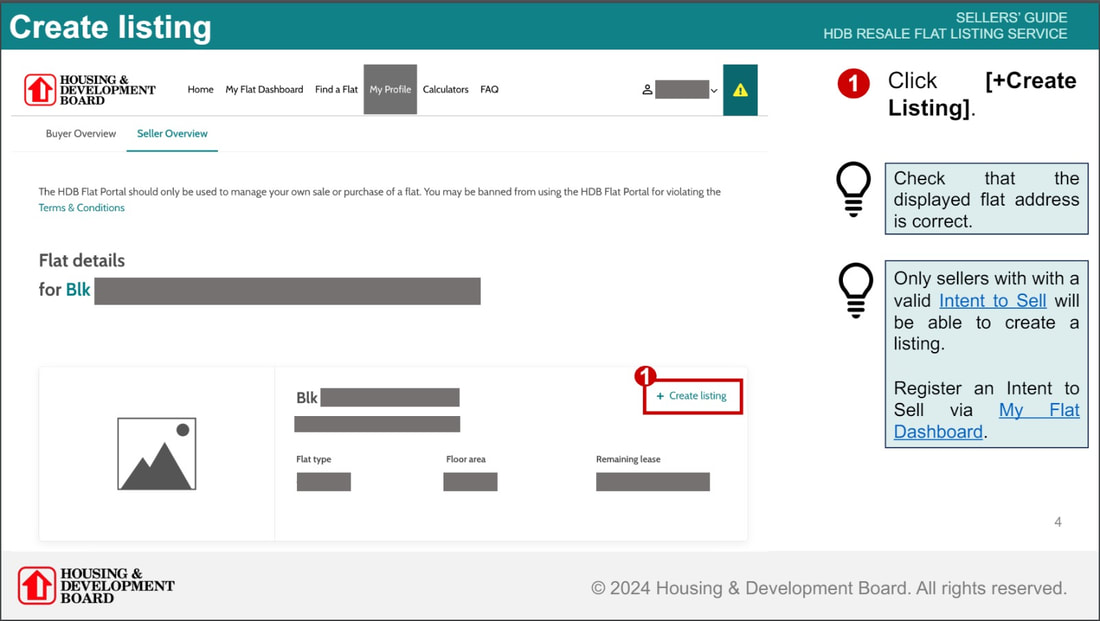

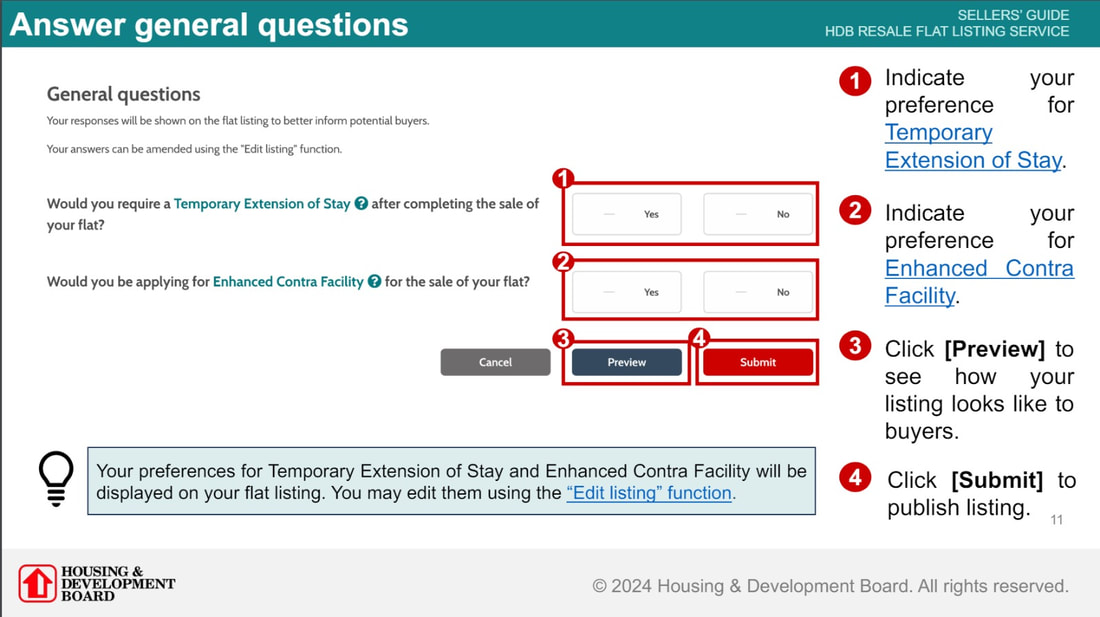

Steps Involved in Decoupling:

- Valuation of Property: Obtain a current market valuation of the property to determine the value of the share being transferred.

- Legal Process: Engage a lawyer to handle the transfer of ownership. This includes preparing the necessary legal documents and ensuring compliance with regulations.

- Stamp Duty: Pay the stamp duty on the transfer. While the transferring spouse may avoid ABSD, the receiving spouse will still need to pay Buyer’s Stamp Duty (BSD) based on the market value of the transferred share.

- Mortgage Considerations: If there is an outstanding mortgage, get approval from the bank for the transfer and refinance if necessary.

- Registration: Register the transfer with the Singapore Land Authority (SLA).

Decoupling can be an effective strategy for married couples in Singapore looking to expand their property portfolio while minimizing ABSD. While decoupling is a convenient solution to save on ABSD taxes, property owners should bear in mind some implications which may arise from decoupling. These issues should be discussed carefully so that all parties concerns are addressed in respect of the legal and beneficial ownership of their properties.

RSS Feed

RSS Feed