Recovery or Recession?

Singapore's Ministry of Trade and Industry (MTI) forecasted that Singapore's GDP will see a slower economic expansion of about 1% to 3% in 2024, noting that major global economies like the U.S. will likely slow in the first half of the year before picking up gradually in the second half of the year. The beginning of this year started well where we saw a surge in US consumer sentiment in January 2024 compared to the previous month by the most since 2005 as retreating inflation helped bolster views about the economy and household finances.

China is also showing signs of recovery from the shocks of the pandemic and slack foreign demand which caused exports to decline in 2023. Progress has been achieved in technology development and important advancements have been made in building a modern industrial system. However, challenges to China's recovery for 2024 remains with the lack of effective demand, the excess capacity in certain industries, weak social expectations plus many hidden risks including the unresolved real estate crisis as well as the local government debt problem.

Cost of living and expenses has gone up worldwide due to higher transportation costs, war and protectionism that has reduced the quantity of raw materials circulating around the world. Climate change has also caused a drop in food production with food prices soaring across the world over the past 3 years.

The past few months saw some developers bidding somewhat cautiously for GLS land parcels in the recent Government Land Sales (GLS) program. The GLS program is an initiative by the Singapore government to release land for sale to private developers through a competitive bidding process. The goal is to ensure a steady supply of land for various types of developments, such as residential, commercial, and mixed-use projects.

Developers' response and cautious bid prices seem to factor in the impact of the 60% additional buyer’s stamp duty (ABSD) on foreigner buyers and higher ABSD rates for investors as well as taking into account current market challenges and uncertainties. Developers also has to take into account potentially higher construction costs amid the current regional instability around the world and inflationary pressures.

Will fewer GLS Land Sites Be Released in 2024?

If the Urban Redevelopment Authority (URA) in Singapore perceive the recent lower bids for GLS land parcel sites as a sign that there are enough supply of new condos in the market, they may decide to reduce the number of available Government Land Sales (GLS) land sites to be released for sale in 2024.

With lesser land parcels being put out for sale by the govt, developers who need to replenish their land banks may need to look towards the older private condo developments for enbloc opportunities or bid higher for the available Government Land Sales (GLS) land sites.

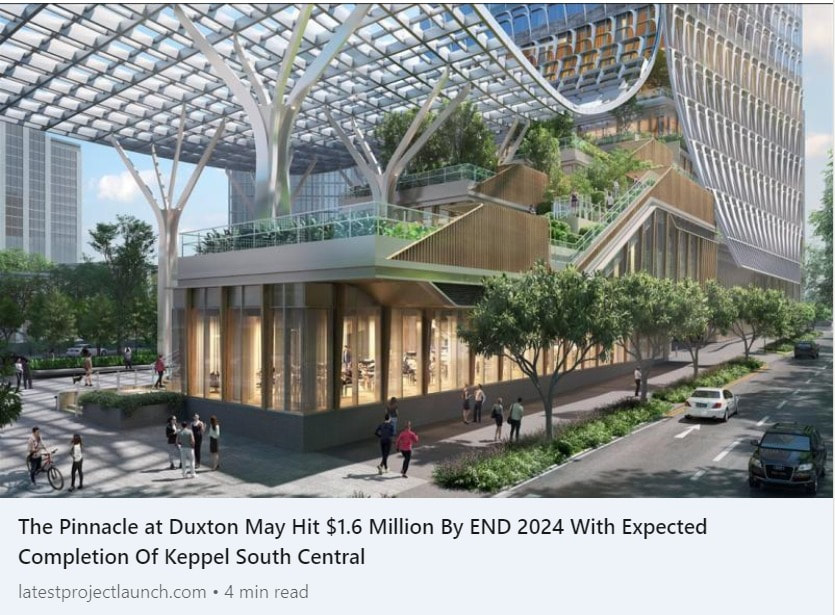

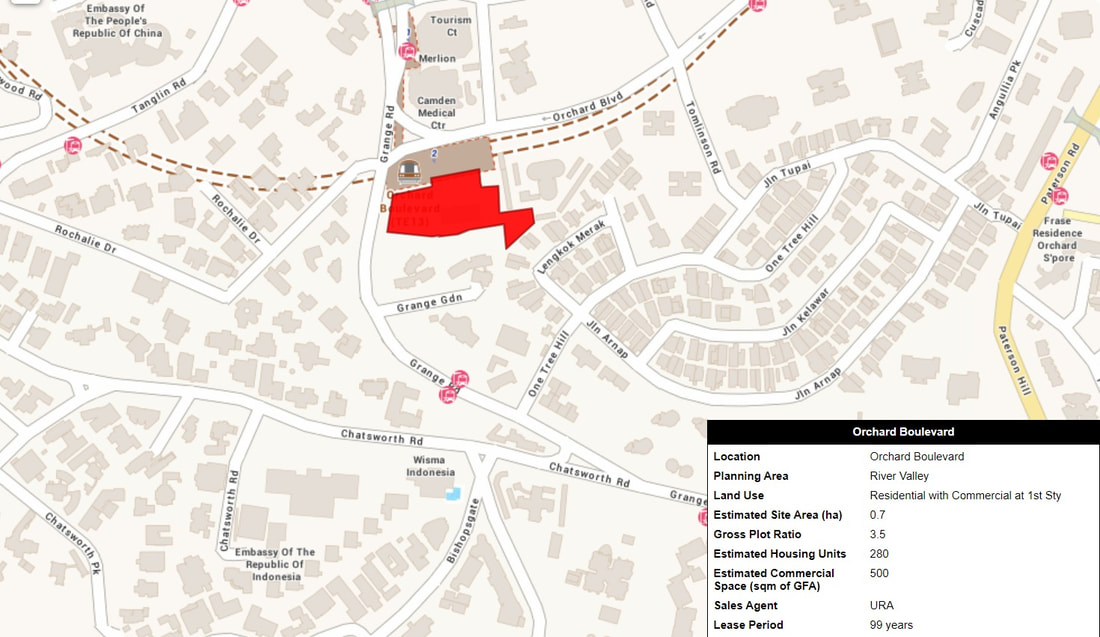

Orchard Boulevard GLS Land Parcel

Last Thursday on 1 Feb 2024, UOL Group and Singapore Land Group (SingLand) jointly submitted the top bid of $428.3 million for the Orchard Boulevard GLS land parcel site which can yield 280 units and about 500 sq m of commercial space. - equivalent to a land rate of $1,617 per square foot per plot ratio (psf ppr) which was below market expectations.

Mr Liam Wee Sin, group chief executive of UOL said the Orchard Boulevard GLS land parcel site is a timely addition to UOL's luxury collections in Nassim, Meyer and Watten. UOL is planning to develop “a high-rise luxury development of 36 storeys or more to capitalise on the panoramic views Orchard Boulevard GLS land parcel site.

This bid is around 30% below the 2018 record price of $2,377 per square foot per plot ratio (psf ppr) set by the nearby Cuscaden Road government land sales (GLS) land parcel site (now known as Cuscaden Reserve) which was the last residential land parcel to be released in the Orchard / Tanglin area since 2018.

"In my opinion, UOL secured a good deal for the Orchard Boulevard GLS land parcel site as Orchard Road is going through a major transformation" said Kiwi Lim from the largest private real estate agency in Singapore, "the land site is also surrounded by embassies, GCB estates, medical centre and shopping malls in the exclusive prime Orchard area."

Latest Update on 21 February 2024:

Mainboard listed property development group UOL Group and Singapore Land Group (SingLand) have just been awarded the government land sales (GLS) site at Orchard Boulevard on 21 February 2024.

The plum orchard land parcel was awarded to United Venture Development (No.7), an 80:20 joint venture company between UOL Venture Investments, a wholly owned subsidiary of UOL Group, and SingLand Residential Development, a wholly owned subsidiary of SingLand.

2nd Plantation Close Executive Condo (EC) Land Parcel in Tengah

A 2nd executive condominium (EC) land parcel at Plantation Close in Tengah that was put out for tender by The Housing and Development Board garnered fewer-than-expected bids from developers on Thursday 1 Feb 2024, with the top bid of S$423.4 million or S$701 per square foot per plot ratio (psf ppr) coming from Hoi Hup Realty and Sunway Developments.

The Housing and Development Board tender that closed attracted only four bids, when market watchers had anticipated up to eight offers to come in at around S$710 psf.

Developers may be concerned about the oversupply of executive condos (EC) in the west area with the oncoming executive condos (EC) supply at the adjacent plot, which could potentially yield 495 new units and competition from two nearby Bukit Batok West Avenue executive condo (EC) projects, Altura EC and Lumina Grand EC.

The top bid on Thursday was slightly lower than the amount for the neighboring site also in Plantation Close at another tender last year 2023 in June. Last year's adjacent Plantation Close executive condo (EC) site saw nine bidders fighting for it and was also won by the same developer Hoi Hup Realty and Sunway Developments for S$703 per square foot per plot ratio (psf ppr), or S$348.5 million.

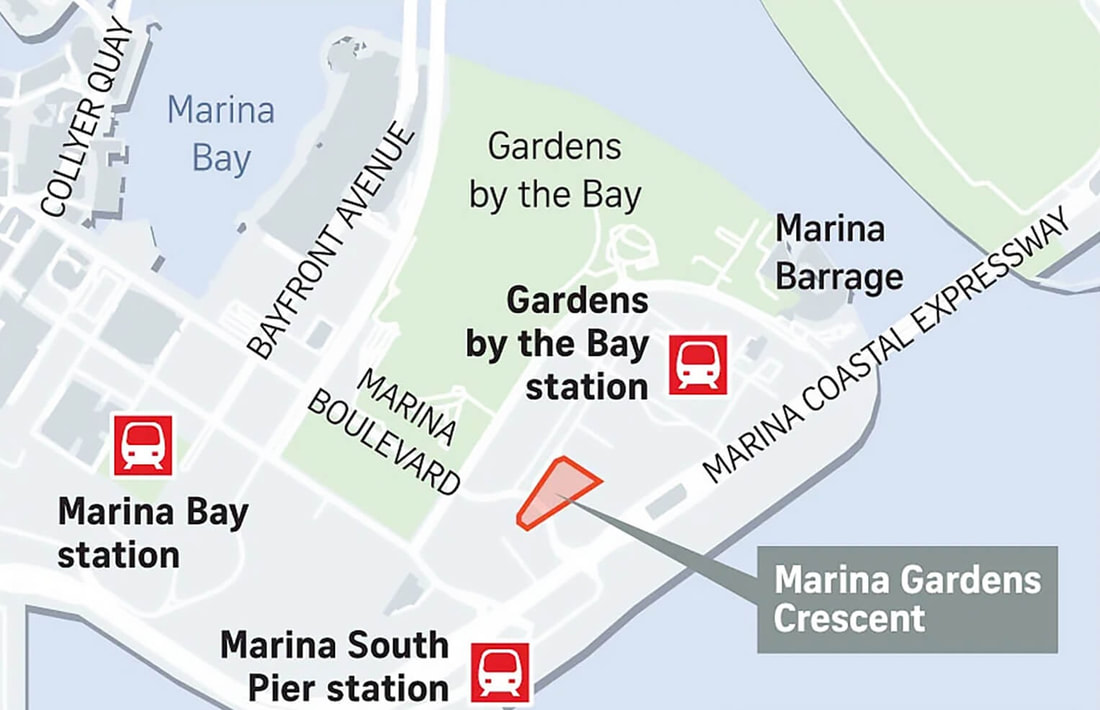

White Site at Marina Gardens Crescent

Last month in Jan 2024, the government land sales (GLS) tender for the white site at Marina Gardens Crescent drew just one bid at $770.46 million, submitted by a consortium comprising GuocoLand, Hong Leong Holdings and TID (a joint venture between Hong Leong Holdings and Japanese developer Mitsui Fudosan). The bid price works out to $984 per square foot per plot ratio (psf ppr) for the 99-year leasehold, 1.73ha white site. Analysts believe this lower bid may be due to the higher costs and challenges that will be faced by the developer for building close to an MRT line as well as the high costs of building an underground pedestrian link to the MRT station.

The Marina Gardens Crescent white site can be developed into a mixed-use project potentially yielding about 775 residential units, with commercial, hotel, residential, sports and recreational and other compatible components or a combination of two or more of these uses with a maximum gross floor area of 782,978 sq ft based on URA’s estimation.

Last year in June, there was another GLS site 'zoned residential with commercial at 1st storey' at the adjacent plot of land along Marina Gardens Lane that was awarded to a Kingsford Group-led consortium of developers for $1.034 billion or approximately $1,402 per square foot per plot ratio (psf ppr.

Latest Update on 8 Feb 2024:

The Urban Redevelopment Authority has rejected a $770.46 million bid submitted on Jan 18 by a consortium comprising GuocoLand, Hong Leong Holdings, and TID (a joint venture between Hong Leong Holdings and Japanese developer Mitsui Fudosan) for a government land sale (GLS) site at Marina Gardens Crescent.

Will Developers Sell Low If They Buy Low?

The pricing of condo property developments by property developers is influenced by various factors, and the purchase price of the land or property is one of them. However, it's important to note that property development involves a complex set of considerations, and the selling price is determined by more than just the acquisition cost. Below are some key factors to consider:

- Development Costs:

- Property developers incur various costs beyond the purchase of land, including construction costs, financing costs, planning and approval fees, marketing expenses, and more. These costs contribute significantly to the overall pricing strategy.

- Market Conditions:

- Property developers assess current market conditions, demand, and supply dynamics before setting selling prices. Economic factors, interest rates, and trends in the real estate market also play a crucial role.

- Profit Margin:

- Developers aim to achieve a reasonable profit margin to ensure the financial viability of the project. The selling price is often set to cover all costs and provide a return on investment.

- Location and Amenities:

- The location of the property, as well as the amenities and features offered, can impact the perceived value and consequently the selling price. Properties in prime locations or with desirable amenities may command higher prices.

- Target Market:

- Developers consider their target market and the affordability of potential buyers. The pricing strategy is influenced by the segment of the market they aim to attract.

- Government Policies:

- Government policies, such as regulations on development charges, stamp duties, and zoning restrictions, can affect the overall cost structure and pricing strategy of residential property developments.

- Competition:

- The level of competition in the real estate market, including the presence of other developers and available inventory, can influence developer's pricing decisions too.

"Buyers may think that developers may tend to price their new launches at a lower price if their bid is lower for the GLS land parcels. While developers may seek to acquire land at favorable prices to enhance their profit potential, the final selling price is determined by a combination of factors as mentioned above. Condo projects like Pasir Ris 8, The Arden, Normanton Park, Canninghill Piers, etc are just some recent examples." said Kiwi Lim real estate professional who have been analysing the market for more than ten years.

"Two attention grabbing transactions early this year on 9 Jan 2024 at $5,397 psf totaling $33 million for two units at the ultra luxurious The Ritz-Carlton Residences may be indicative of a new wave of Singapore PRs who rushed to apply for Singapore PR status after the foreigner Additional Buyer Stamp Duties (ABSD) was increased to 60%. I believe we may see more such Singaporean PR buyers after the Chinese New Year celebrations this year especially in the CCR districts where there is short supply of new condo projects." said Kiwi Lim.

If you like to read more, you may follow me on Linkedin or scroll below to subscribe to my newsletter to receive a list of estimated breakeven prices of current new launch projects and property news analysis to help you with your property decisions.

RSS Feed

RSS Feed