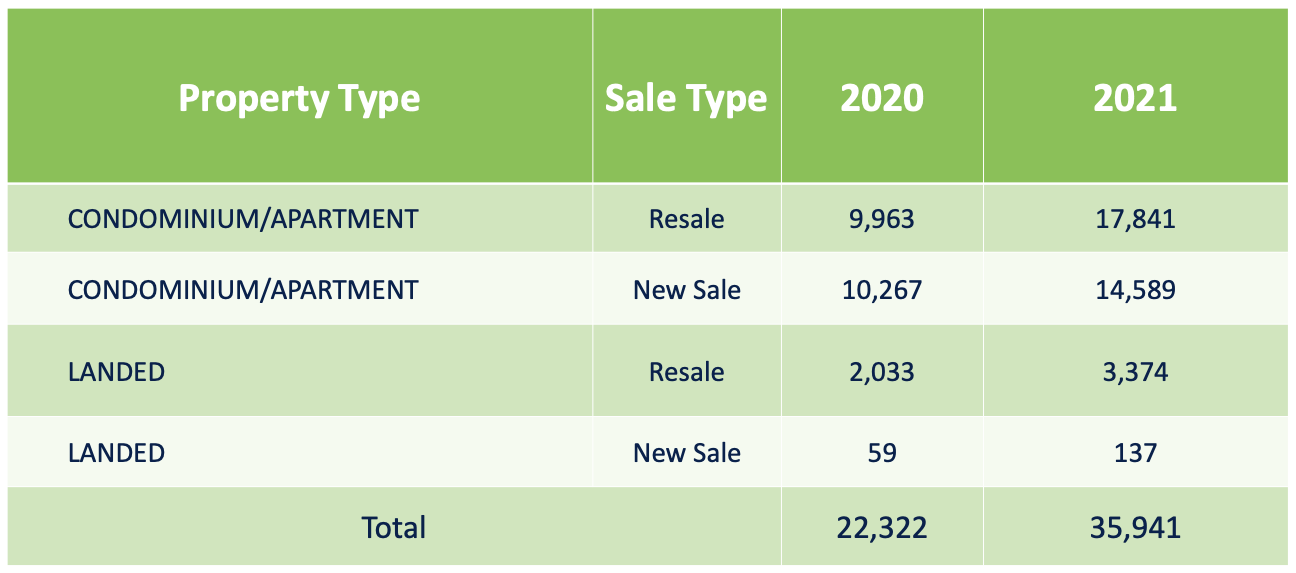

According to past records, an average of 9,000 new condo units are sold yearly in Singapore.

During the Covid pandemic, in 2020, more than 10,000 new condo units were sold and last year more than 14,500 new condo units were sold last year in 2021.

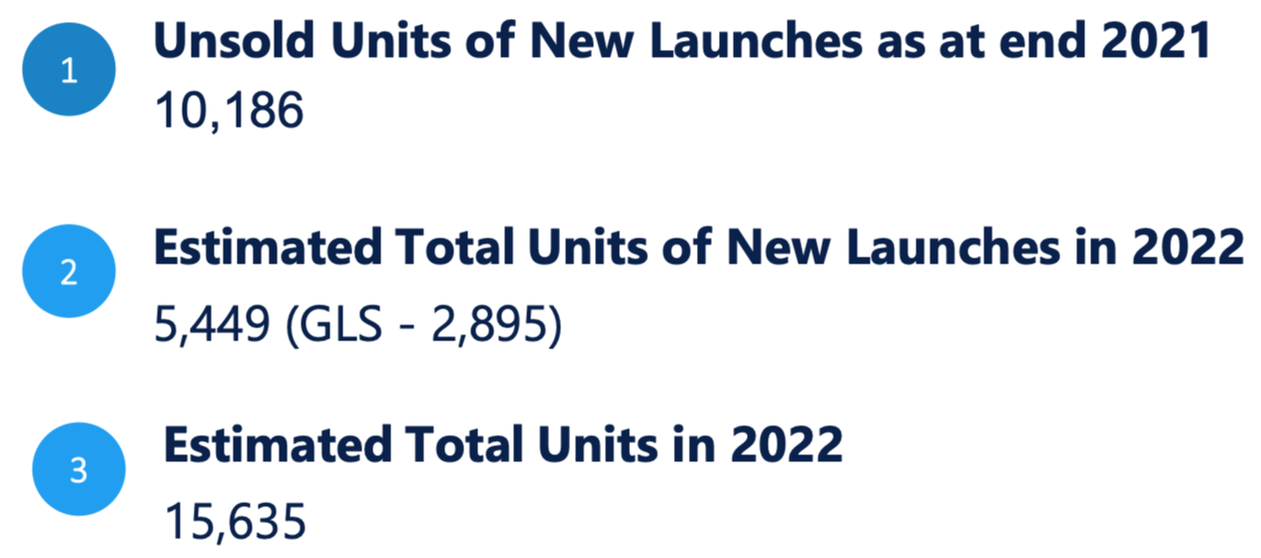

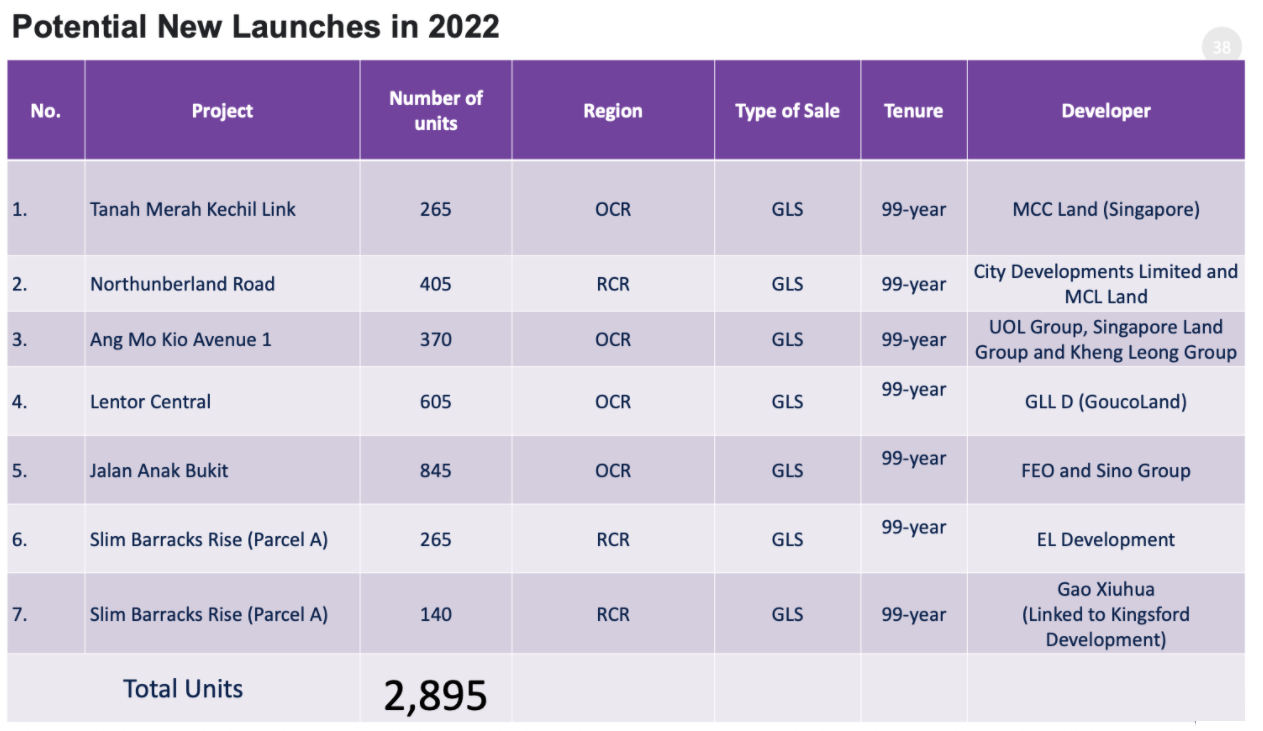

The current remaining unsold new condo units left available in the market are estimated at around 10,000 units. This year in 2022, we expect around 5,400 new condo units to be launched into the market with 7 mass market condos (see below table) and many other smaller sized apartment projects.

There are only seven upcoming mass market condo projects in the pipeline for this year 2022. These projects are as shown above.

These seven mass market condo projects are expected to be launched at $2,000 psf or more on average. Once these mass market projects are launched throughout this year, it will set a new benchmark for mass market new condo pricing.

Previously five years ago, mass market condos were launched around $1,500 psf. This year's mass market condos will test the psychological barrier of mass market condo upgraders to accept $2,000 psf as the new normal.

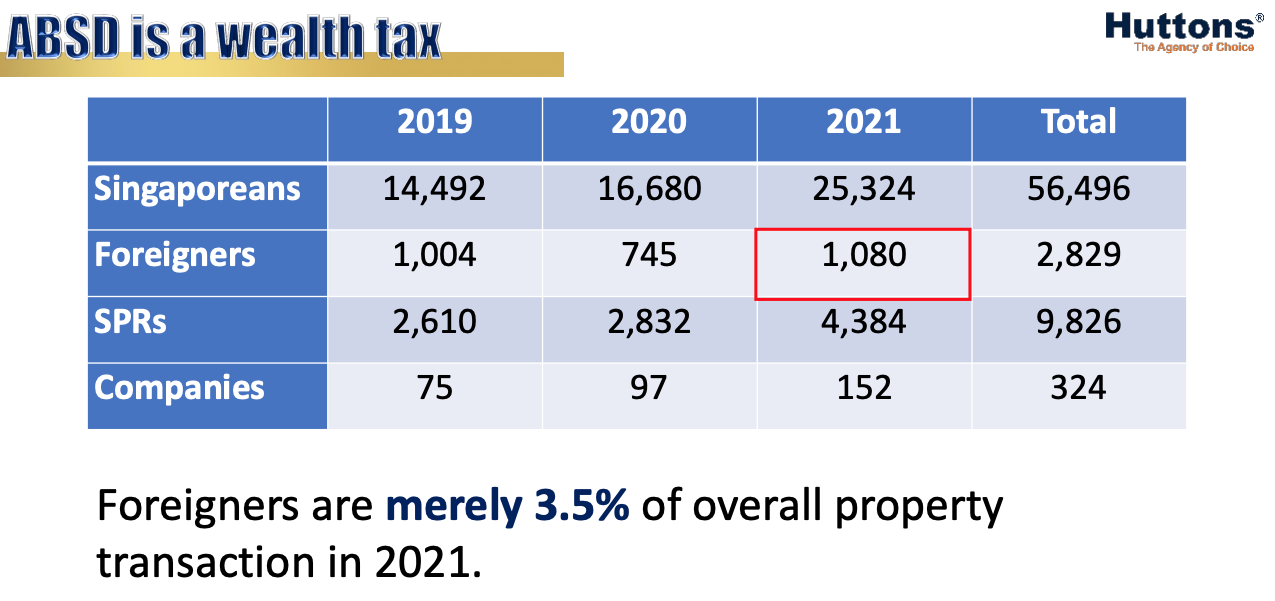

Before Covid, the percentage of foreigner buyers in Singapore's property market is around 15% on average. However during the Covid pandemic, foreigner buyers of our local property is less than 5% in 2020 and 2021 not because they are no longer interested in Singapore property but because Singapore's borders were closed to them.

Therefore, the property market demand seen in 2020 and 2021 is largely driven by domestic demand consisting of mainly Singaporeans and PRs and not influenced by foreign demand for our property in Singapore. We felt the increase in ABSD for foreigners will only serve little to reduce the demand for local property, moreover because Singapore currently has no estate tax, the 30% ABSD charged upon foreigner buyers is still lesser than the estate tax in other countries which can be as high as 45% for some making Singapore look attractive for estate planning. Once the borders open, we expect foreign buyers who are looking to home their families in a stable and safe environment in a country that is fluent in both Mandarin and English to find Singapore a very attractive place to live, work and play.

The government's latest round of cooling measures announced last month are expected to take the wind out of the sails of the residential collective sale market.

Under the new rules, entities buying residential properties must pay 35 per cent ABSD – up from 25 per cent – if they cannot sell all their units in five years. There is also an additional non-remittable 5 per cent ABSD for developers.

Developers will have to consider the additional tax impact and buyers’ concerns about the future selling prices, as well as how these will affect demand and the take-up rate as developers will have to pay the heftier 35 per cent Additional Buyers’ Stamp Duty (ABSD) should they fail to complete and sell all units within five years – which analysts said will make developers more cautious with their land bids.

This may cause developers to probably look towards developing properties in less regulated overseas markets or join in the competition to bid for local government land sale (GLS) land parcels. Kiwi Lim from Huttons Asia feel that if developers are not acquiring land from collective sales, the government may need to significantly release much more land for sale from the government's limited reserved land parcels that they are currently holding on or we may see a much smaller supply of future upcoming condos launched yearly in Singapore's property market in the next five years of around 5,000 new condo units per year, excluding Executive Condo projects. If demand for new condo units continue to hover around 9,000 units during pre-Covid period, the supply will not be sufficient to meet demand.

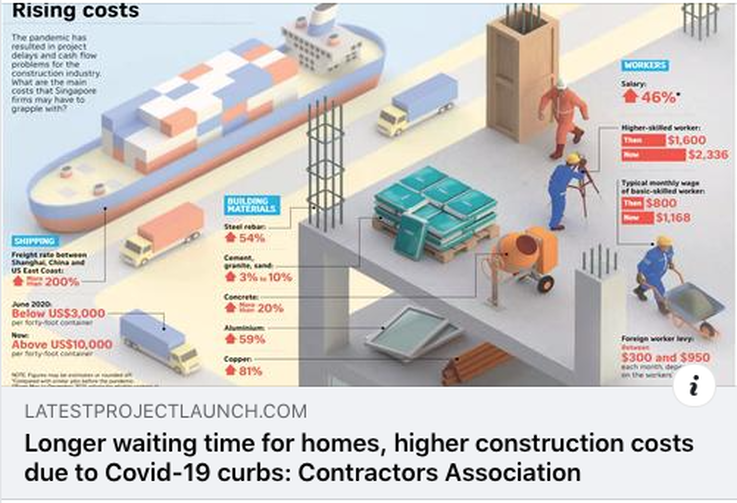

The cost of construction labour and building materials has escalated by 30 per cent to 50 per cent over the past few months. The tightening of foreign construction workers entering Singapore as well as the increase in their levy fees will also adversely affect the inflow of construction workers and will negatively impact the timeline of construction projects and may cause delays as the construction association - Singapore Contractors Association Limited (Scal) warned recently.

Singapore Contractors Association Limited (Scal) predicted that some sub-contractor and main-contractor companies may be forced to close and it will adversely impact some 100,000 residents working in the construction sector. The government has asked that all stakeholders - including developers to share the (increased) expenses instead of contractors taking the biggest hit by allowing the contractors to submit a higher quote for the construction costs to replace the previously signed agreements which were at a lower quote as they were prepared using the costs before Covid pandemic raised the costs. Developers therefore are unwilling to lower prices and may even have to raise prices for their unsold supply of new condo projects currently available and launched in the market.

RSS Feed

RSS Feed