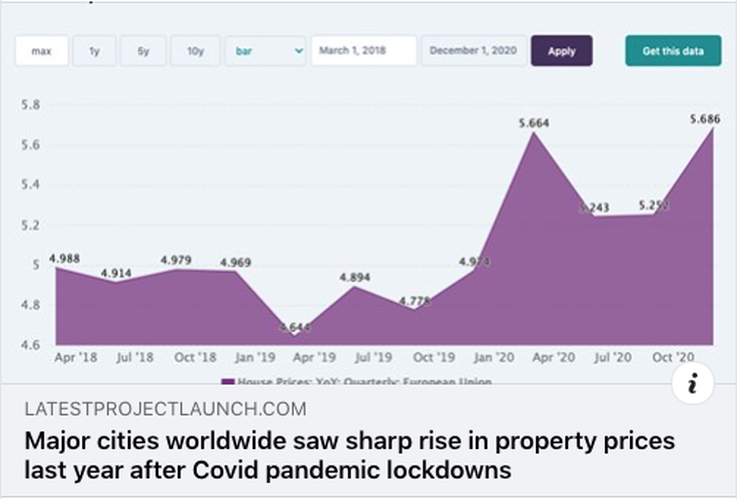

Property prices soared in over 60 countries according to IMF’s Global House Price Index, most developed cities across the world saw increases in property prices during 2020, and this trend has largely continued in countries into 2021 this year.

Global financial centres saw property prices shooting past 20% from Jan 2020 till now, whereas Singapore - an established financial centre wth good infrastructure and a safe convenient environment with a bilingual nation is one of the choice destination in the world saw a proportionately smaller property price increase of an estimated 8% from 1 Jan 2020 till today,

The surge in stamp duties and property taxes collected in the first half of Singapore's current financial year hit more than $5 billion (stamp duties contributed S$3.22 billion and property tax collection quadrupled to nearly S$2 billion, compared with the S$508 million collected during the same period last year).

Thanks to a “healthy” contribution from corporate income tax and property-related taxes this year, the Government's coffers were shored up, enabling recent COVID-19 support measures to be rolled out without tapping on past reserves, economists said.

Corporate income tax collection for FY21 stands at S$12.76 billion, versus S$5.69 billion in FY20 and S$12.5 billion in FY19; personal income tax collection for FY21 works out to some S$8.03 billion. This is up from S$6.93 billion in FY20 and S$7.03 billion in FY19.

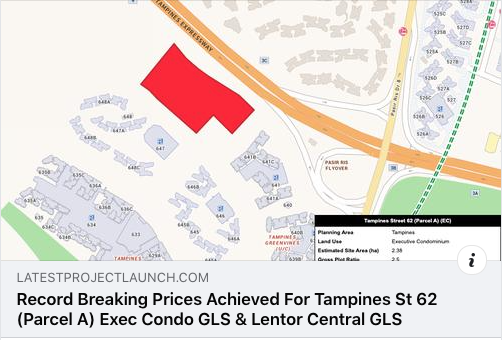

The soaring demand and constrained supply of available HDB flats, condos and private properties have been great news for homeowners who have seen their home values increase as well as for those who have been able to take advantage of historically low mortgage rates.

"People who were on the edge about buying a home have jumped into the market; some of these people are first-time homebuyers or buying second homes, both of whom add considerable pressure to the market - a trend that is expected to continue into the near future." said real estate analyst Kiwi Lim from Huttons Asia.

Sectors such as finance and insurance seem to have performed well. Some say that this pandemic has hit low-wage workers disproportionately amid an uneven recovery, whereas high-wage or high-skilled workers have not been hit as hard.

Analysts also suggested that with this increase in tax collections, the government could afford to delay the Goods and Services Tax (GST) hike, which is due between 2022 and 2025. GST collections for FY21 clocked some S$6.04 billion, up from S$4.66 billion in FY20 and S$5.56 billion in FY19.

Taxes collected by IRAS are used to support Singapore's economic and social programmes to achieve quality growth and an inclusive society.

RSS Feed

RSS Feed