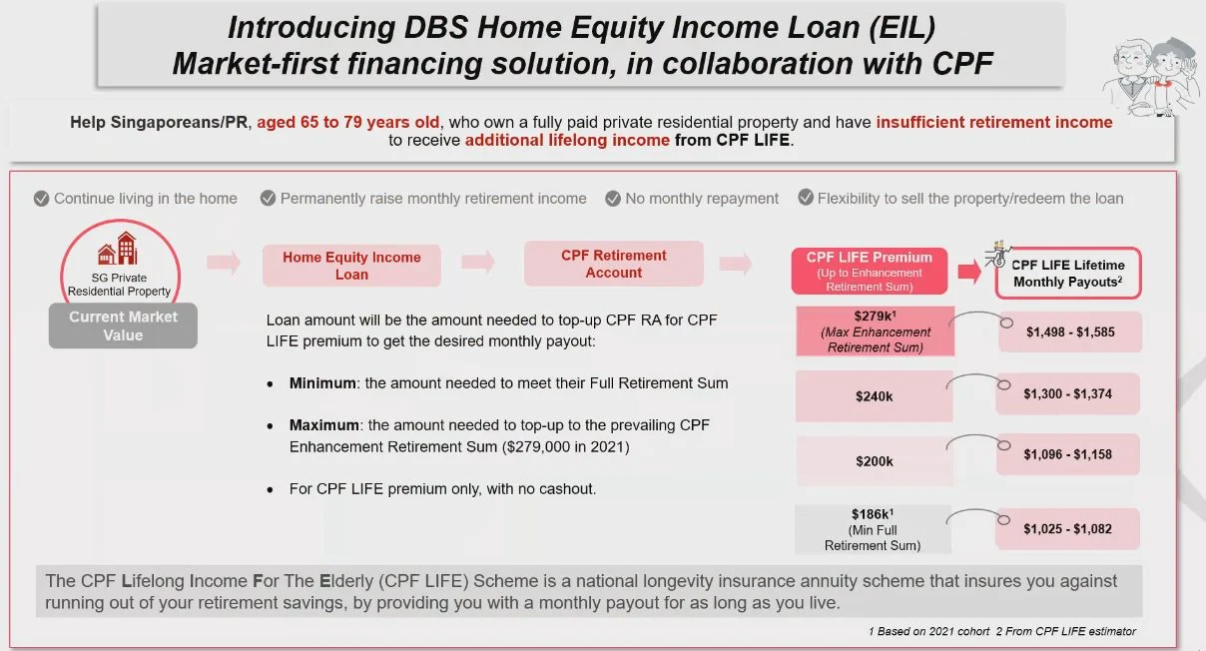

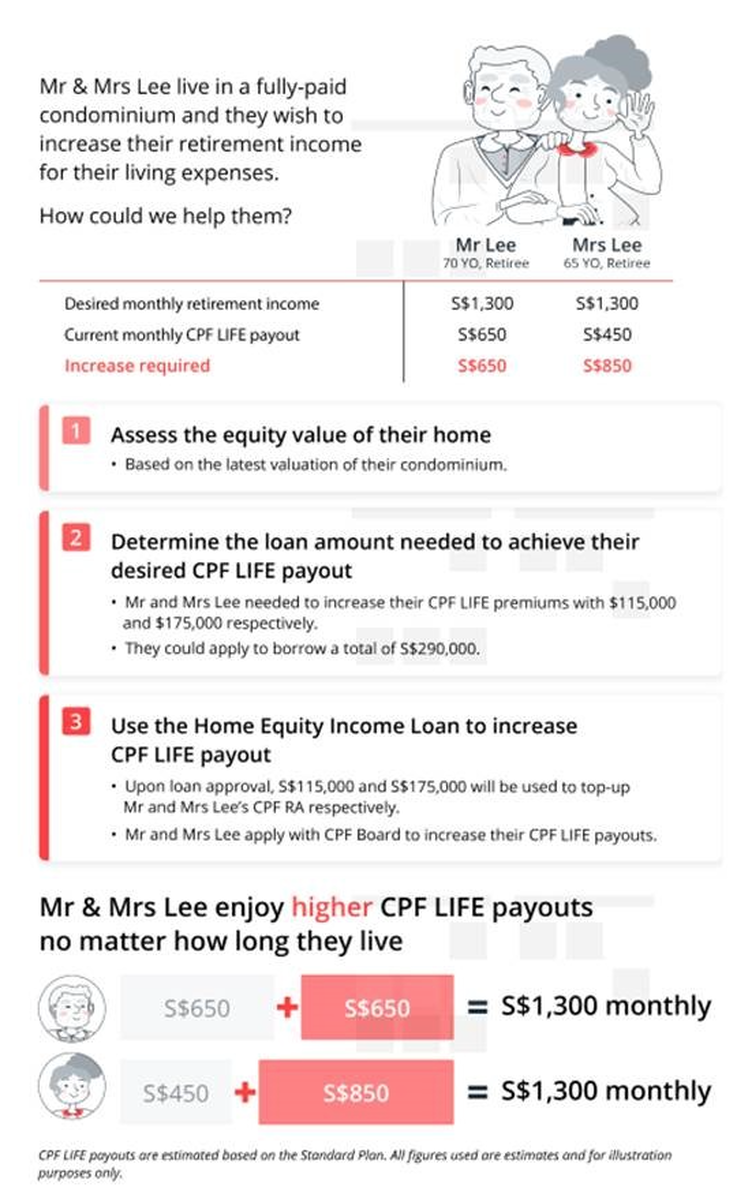

By doing this, seniors are able to receive higher monthly payouts under the CPF Life (Lifelong income for the elderly) scheme — a national longevity insurance annuity scheme that allows CPF account holders to receive higher monthly payouts to supplement their retirement funds for as long as they live.

Seniors who take up this loan scheme, called a home equity income loan, are not required to make monthly repayments and are still able to live in their property. Borrowers may choose to sell their property any time. If the property’s value declines during the loan period, they will not be required to make payment to reduce the loan amount.

The loan will last for up to 30 years or until the youngest borrower reaches 95, and the interest rate is fixed at 2.88 per cent a year throughout the loan period.

In summary:

- Singapore residents aged 65 to 79 living in fully paid private properties may borrow against their home to top up their Central Provident Fund accounts.

- The money can be used to top up CPF Life, an annuity scheme giving them monthly payments for life.

- They may continue living in the property or choose to sell it anytime, and are not required to make monthly loan repayments.

- Sales proceeds from selling the property in future will be used to repay the loan.

- The loan will last for up to 30 years, with its interest rate fixed throughout the loan period. Currently, the loan will be extended at 2.88 per cent per annum, but this rate could be adjusted for subsequent borrowers based on changing market conditions.

- Top-ups are not required if the property's value falls during the loan period.

- Rather than making monthly repayments, the loan amount and accrued interest under this scheme will be repaid as one lump sum at loan maturity. The bank will reach out to the customers and their family members a year before maturity to remind them.

- In cases where customers are bankrupted during the loan tenure or outlive loan maturity, the bank "will not take immediate action against the property", DBS said

You may click HERE for more information on the newly launched DBS Home Equity Income Loan.

RSS Feed

RSS Feed