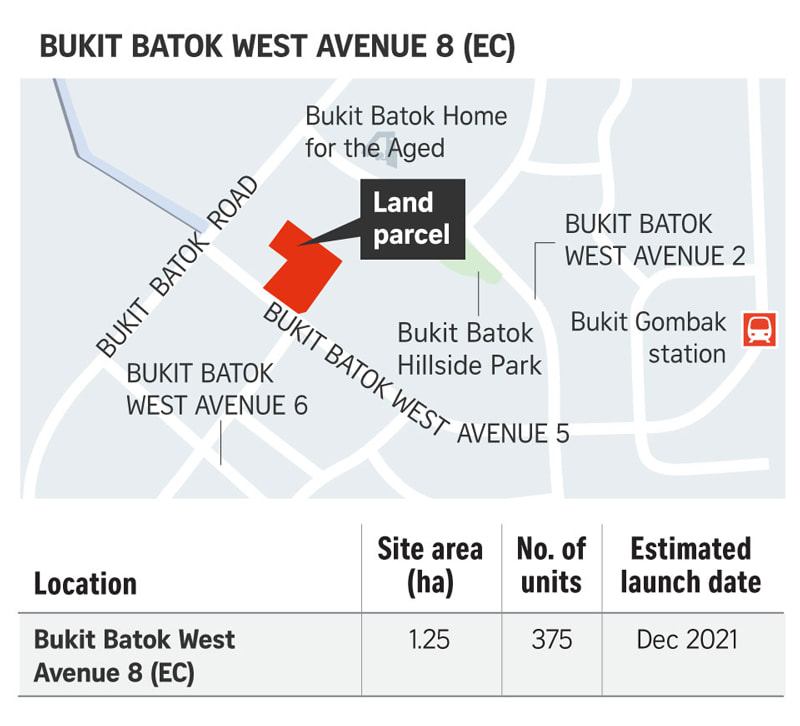

The Bukit Batok executive condo land parcel is expected to yield 375 residential units. It has a site area of 12,449.30 square metres (sq m) and maximum gross floor area of 37,348 sq m, with maximum building height of 60-70 metres. Its top bid of $662 psf ppr is 9.8% higher than that of the nearby Tengah Garden Walk EC plot, which was awarded in June 2021 to a joint venture between City Developments and MCL Land for $603 psf ppr.

ECs have always been popular among home buyers due to their more affordable prices, and tend to appeal to some first-time home owners or HDB upgraders who are least affected by the recently announced property cooling measures. This upcoming Bukit Batok executive condo is in an area where private housing supply is fairly limited, with the last private residential project there being the nearby Le Quest - a nearby mixed use development also developed by Qingjian Realty.

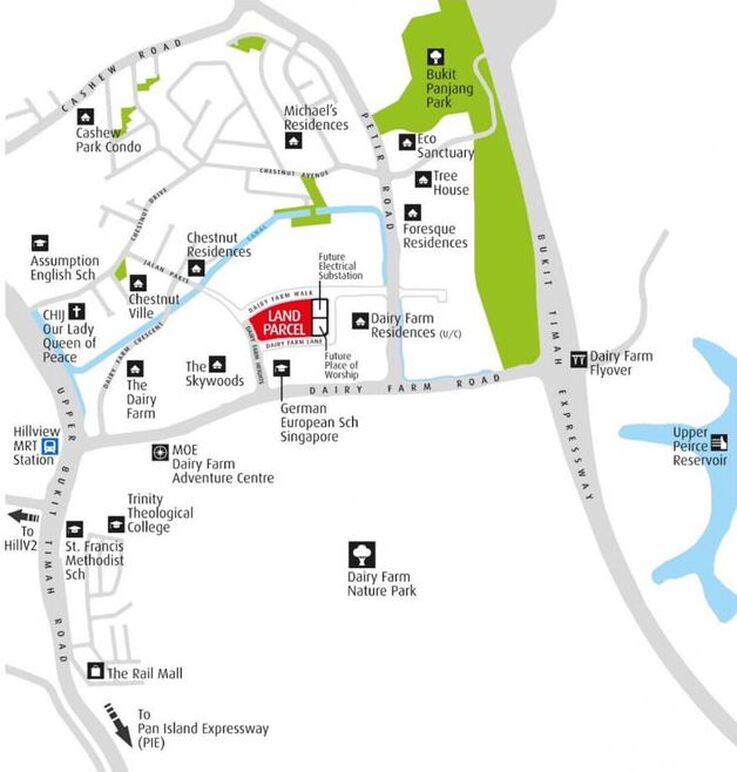

The site - spanning 15,663.2 sq m, the parcel has a maximum gross floor area of 32,893 sq m and an expected yield of about 385 units, was hotly contested with the top three bids within 3 per cent of each other. Developers remain confident in the suburban residential market which is likely to see sustained demand from first-time buyers and home upgraders.

Nearby, there's a 460-unit Dairy Farm Residences which is also 95 per cent sold, with 81 units going for an average price of 1,680 psf after the new curbs were introduced.

Unsold stock in the suburbs was at an estimated record low of 3,972 units as at the end of 2021, this balance inventory of unsold mass market homes could potentially be snapped up in less than a year, based on the annual average sales of about 4,900 new OCR units between 2017 and 2021.

Real estate consultant Kiwi Lim from Huttons Asia estimates that at the land rate of $662 psf ppr, next year's EC buyers may expect record prices from $1,350 psf onwards starting with this upcoming Bukit Batok West executive condominium.

Developers are still trying to replenish their land banks amid the latest round of property curbs in December 2021 through government land sales (GLS) land parcels as the momentum for en bloc market slowed after the recent cooling measure raised developer's ABSD from 25% to 35% when purchasing residential properties if they could not sell all their units within five years. Developers also face an additional 5% non-remittable ABSD. Kiwi Lim believe developers will still consider en bloc if a development's location and pricing are attractive and if Government Land Sale (GLS) sites are not suitable. The current available inventory of unsold private residential units in the property market have fallen to a record low never seen since 2006.

RSS Feed

RSS Feed