This latest round of cooling measures are seen by industry watchers as one of the most aggressive yet. Notably, Additional Buyer Stamp Duties (ABSD) for non-entities have been increased by about 5% to 15% for certain buyer types. This is higher as compared to previous rounds, where the increases ranged from only 5% to 10%. Additionally, the Total Debt Servicing Ratio (TDSR) has been tightened further from 60% to 55% as well as Loan-to- value ratios (LTV) for HDB loans have been reduced from 90% to 85%.

ABSD for foreigners was significantly increased by 10% points to reach 30%. Some consider the increase in ABSD for foreigners to have limited effect, given their small impact as foreign purchases for non-landed private residential properties made up only around 4% of demand for 2020 and 2021.

The increase in ABSD is not expected taper foreign buying demand, especially when borders’ measures are gradually relaxed, leading to the return of overseas buyers. Foreigners’ interest may be diverted to alternative asset classes such as strata retail shops, shophouses or strata offices that do not face or have limited cooling measure risk.

The impact would be more keenly felt for property investors. Singaporean property buyers now face higher ABSD of 17% and 25% for their 2nd and 3rd property purchase, respectively as compared to 12% and 15% previously. For PRs, they now have to pay 25% and 30% ABSD for their 2nd and 3rd private residential purchase from 15% previously. Coupled with TDSR tightening, investor demand is expected to cool significantly, due to potential higher upfront costs and tighter financing conditions.

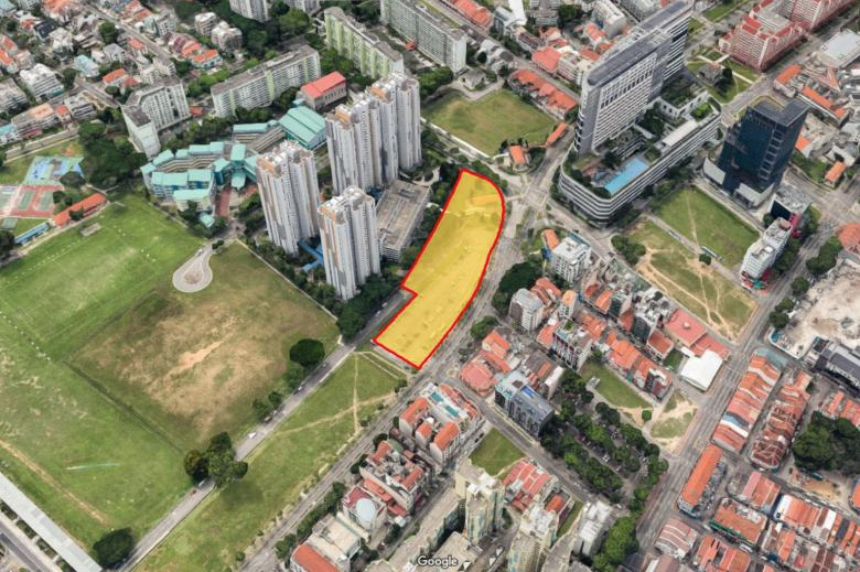

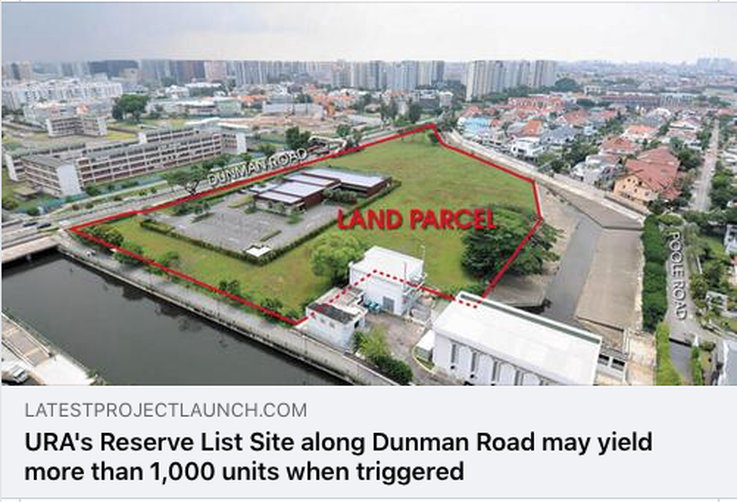

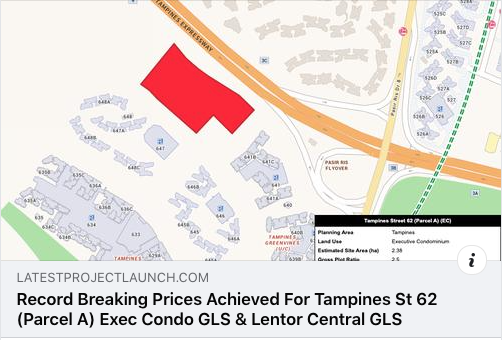

We could still see en-bloc demand for well-located smaller sites at prime districts, where buyers’ profiles tend to be very high net worth and hence may not be too impacted by higher ABSD. As developers need to ensure feasible profit margins, land bid prices are expected to moderate after factoring in higher costs and risks associated. As developers turn towards Government Land Sales (GLS) Programme to fill their empty lan banks, the government is under pressure to release more land to fill the void from en-bloc market to satisfy developer's demand for land. It remains to be seen if the government is more inclined to fill its national reserves or lower their collections from the sale of each plot of GLS if they decide to supply more GLS land. Increased supply will usually lower the bid price submitted by developers.

Upcoming projects include Belgravia Ace, Kovan Jewel, Royal Hallmark, The Arden, Piccadilly Grand, Gems Ville, Sophia Regency, Evelyn Newton, former 10A/B & 11 Institution Hill, former 2, 4 and 6 Mount Emily Road , former Ji Liang Gardens , projects along Ang Mo Kio Ave 1 and Tanah Merah Kechil Link .

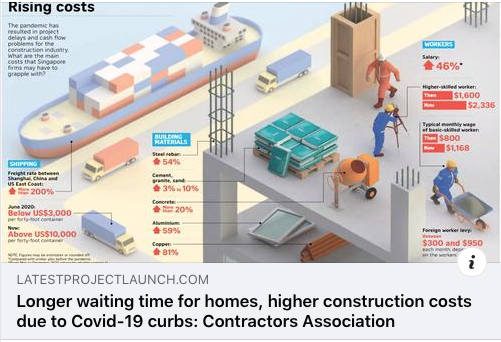

Overall , the new home market may see sales between 8,000 and 9,000 units while prices may move up to 3% in 2022 on the back of higher construction costs.

Kiwi Lim from Huttons Asia believed that due to the current very low levels of unsold inventory, developers will continue sourcing for GLS land and en-bloc smaller residential projects cautiously. Developers are also not expected to cut prices for existing launches as unsold inventory remains very limited and developers have to brace themselves with higher construction costs which may be made even higher with the prospect of an increase in GST this year.

RSS Feed

RSS Feed