The GLS Programme for 2H2021 comprises four Confirmed List sites and nine Reserve List sites.

The Confirmed List comprises four private residential sites [including one Executive Condominium (EC) site] which can yield about 2,000 private residential units (including 375 EC units).

In addition, the Reserve List comprises six private residential sites (including one EC site), two White sites and one hotel site. These sites can yield about 4,860 private residential units (including 700 EC units), 90,000 sqm GFA of commercial space and 530 hotel rooms.

A site on the Reserve List System will be put up for sale if a developer's indicated minimum price in his application is acceptable to the Government. The price to trigger the Reserve List site is secret and not known to the developer beforehand and only if the price submitted by the developer matches the government's desired price, the government will consider putting it up for tender.

The Government will also consider launching a Reserve List site for sale if it has received sufficient market interest for the site. This is when more than one unrelated party has submitted a minimum price that is close to the Government's Reserve Price, within a reasonable period.

The unsold inventory of private housing units has declined over the past year amidst strong demand. Nonetheless, even as the economy is recovering from the recession in 2020, there are continued uncertainties in the economic and labour market conditions due to the ongoing COVID-19 situation globally and locally. On balance, the Government has decided to moderately increase the supply of private housing on the Confirmed List to 2,000 units for the 2H2021 GLS Programme, up from 1,605 units for the 1H2021 GLS Programme. The supply on the Reserve List also gives developers a good selection of sites to initiate for development.

The Confirmed List comprises four private residential sites [including one Executive Condominium (EC) site] which can yield about 2,000 private residential units (including 375 EC units).

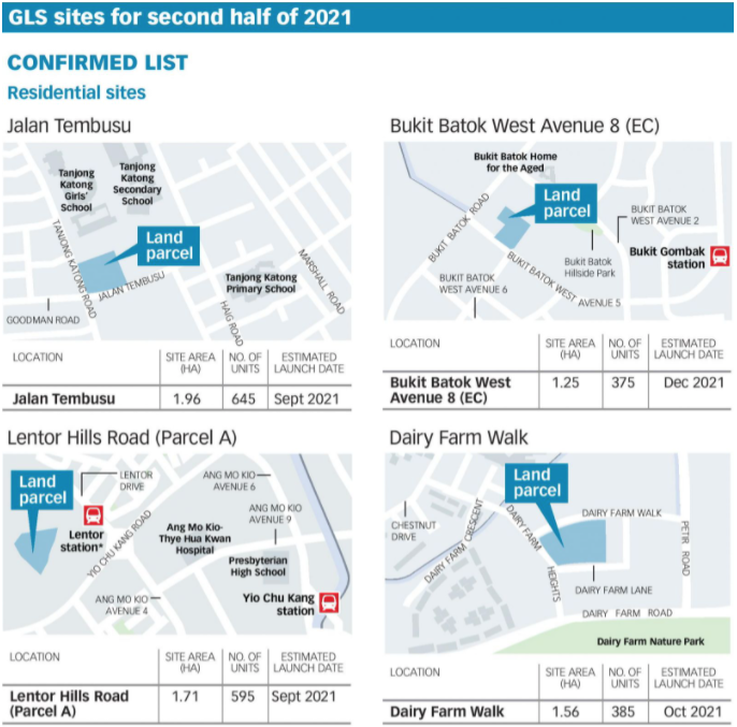

The Jalan Tembusu GLS site, which spans 1.95ha, is estimated to yield 640 units, has strong locational attributes, as it is near the upcoming Tanjong Katong MRT station, East Coast Park, and amenities along East Coast Road. Furthermore, several prominent schools are also located in the area such as Tanjong Katong Primary School, Tanjong Katong Secondary School, and Tanjong Katong Girls' School.

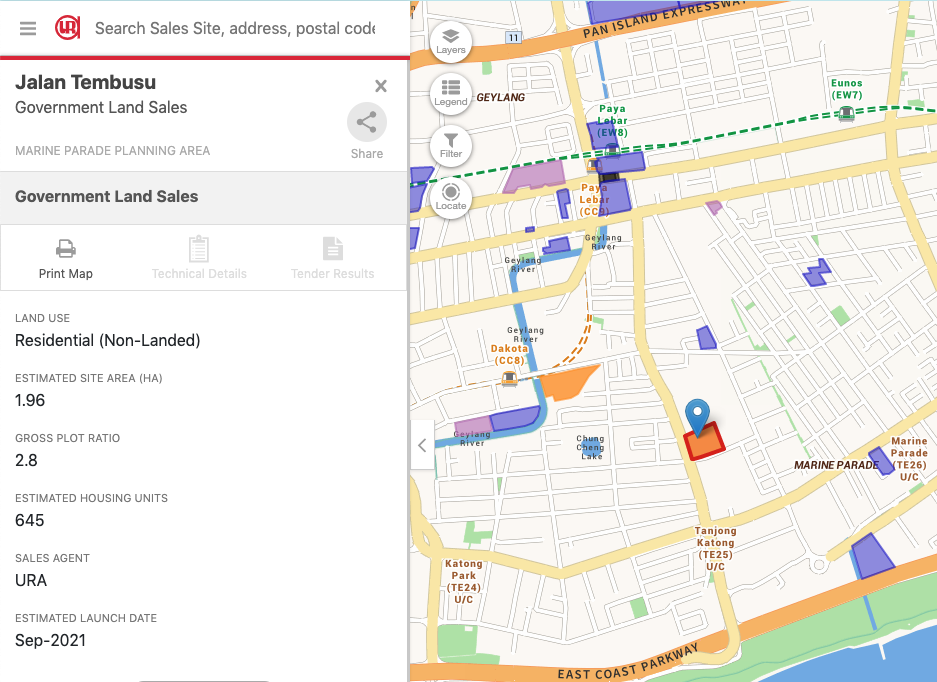

The GLS site at Lentor Hills Road (Parcel A) can yield about 595 units and has a site area of 1.71ha. It is located right next to the Lentor Central GLS site released earlier in April this year as well as the Lentor MRT station on the TEL. Residents will be two stops away from the Cross Island Line (CRL), four stops from the Circle Line (CCL), and six from the Downtown Line (DTL).

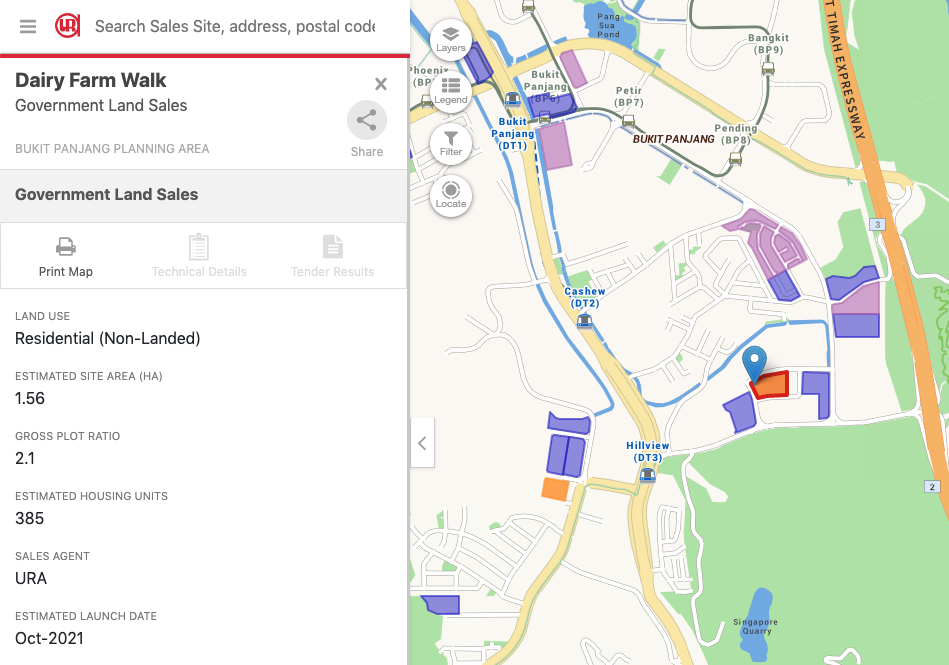

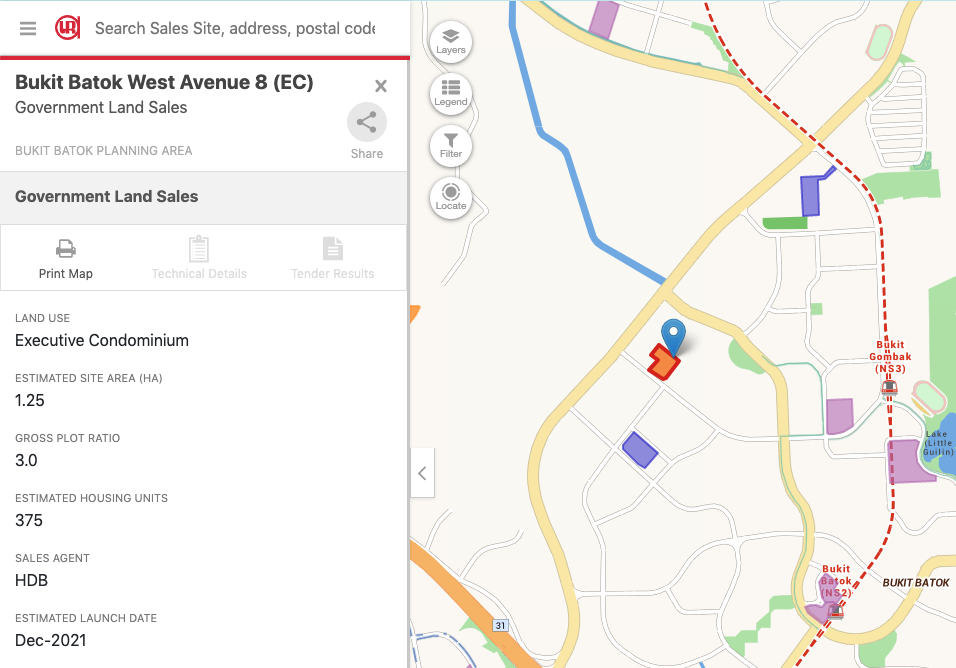

The EC site at Bukit Batok West Ave 8 will be near the Tengah Garden Walk EC site which was recently awarded to Taurus Property SG for $603 psf. The 99-year leasehold site can yield 375 units with a site area of 1.21ha. However, the site is expected to fetch lower bids as it's not near to an MRT station.

In order to continue providing good homes for Singaporeans, we will have to recycle previously developed land, some in matured estates and some in prime locations, like the city centre and the Greater Southern Waterfront.

Kiwi Lim from Huttons Asia believe these few confirmed GLS land parcel sites are not enough to satisfy the current strong domestic demand for residential properties and may trigger the enbloc market possibly before the end of 2022 next year. Future condo launches from enbloc sales will naturally cost more as developers need to pay more to acquire the land from enbloc owners and foot additional costs to demolish and possibly top up lease for leasehold enblocs. This will inadvertently see prices of new condo projects climbing upwards in the near future.

RSS Feed

RSS Feed