A consortium comprising Far East Organization, Sekisui House and Sino Group has sold 92 units at One Holland Village Residences. These units were sold between Nov 21, when preview sales at the 296-unit project began, and 6 pm on Dec 1. The District 10 project's official launch was held on Saturday, Nov 30. The sales outcome is seen as positive, given the relatively high price points. In its release on Sunday evening, Far East said that the average achieved prices for the three components are S$2,600 psf for Sereen, S$2,900 psf for Leven and S$3,200 psf for Quincy Private Residences.

The most popular units are the one- and two-bedroom apartments in Sereen. Ninety per cent of the total 92 units sold were bought by Singaporeans. Permanent residents and foreigners made up the remaining buyers. These include South Koreans, Norwegians and US citizens. Buyers of just under half of the total 92 units sold live in Districts 10 and 11. One Holland Village Residences and a 255-unit serviced residence Quincy House make up the residential component of the mixed-use project, which will also have offices and retail space.

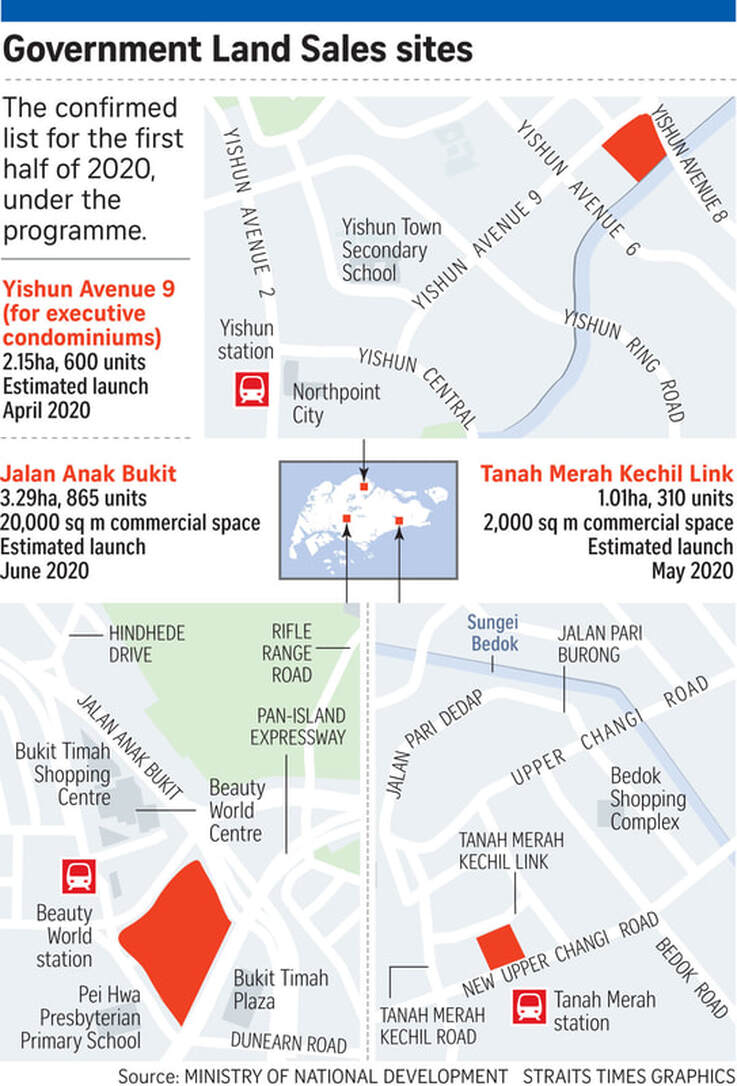

The government is holding land supply for private homes steady for the first half of 2020, which should keep the residential market stable amid a big supply of unsold units. It said that it will keep the supply of private housing units on the confirmed list for the H12020 government land sales (GLS) programme broadly similar to that for H22019. The confirmed list for H12020 has three new sites on it - two private residential sites (including an executive condominium or EC site), and a commercial and residential site. Jointly, they can yield about 1,775 private residential units (including 600 EC units) and 22,000 sq m of gross floor area (GFA) of commercial space. In the confirmed list in H22019, 1,715 private residential units were made available. Huttons Asia's real estate analyst Kiwi Lim believe that the government's move to keep the supply of dwelling units similar to that in H22019 is good news, as it reduced its initial planned supply quantity in order to keep the market stable. Therefore, Kiwi Lim predicts the property market prices in Singapore to see a continuous growth albeit a slower growth instead of taking a dip.

Two plum sites in latest land sales; Bt Timah plot to revive Jln Anak Bukit vicinity

Two plum sites - Jalan Anak Bukit for mixed development and Tanah Merah Kechil Link residential site - have been offered in the latest Government Land Sales (GLS) programme for 1H 2020. The sites are well located near MRT stations, with the Jalan Anak Buikit site having an integrated bus interchange which will provide amenities for commuters and residents in the area. In line with the 2019 Master Plan to transform the Beauty World area, the government has decided to push out an integrated transport hub site on the 1H 2020 GLS programme, said Lee Sze Teck, director (research), at Huttons Asia. "This is definitely the choicest site of all and will be on the radar of a lot of developers," said Mr Lee.

The Urban Redevelopment Authority (URA) has made available for application a white site in Kampong Bugis and a hotel site in River Valley Road on the government's reserve list. The Kampong Bugis site, at the mouth of Kallang River, will be released for sale to a master developer to allow for a comprehensive master plan, development in phases, and the implementation of district-wide "car-lite" initiatives and sustainable urban solutions. The 8.2 hectare (ha) site can potentially yield up to 4,000 housing units and 50,000 sq m of gross floor area (GFA) for complementary uses such as retail, serviced apartments and offices and for community use.

The site has a maximum GFA of 390,000 sq m. The URA has also drawn up an option scheme, which is a flexible-payment scheme and phaseddevelopment approach to enable the chosen developer to phase the site's development according to market demand, and so bear lower upfront costs and risks. The entire precinct is estimated to be completed over 11 to 13 years. The 1.02 ha River Valley site, located above Fort Canning MRT station and situated between Fort Canning Park and the Singapore River, has a maximum GFA of 28,666 sq m and could yield 530 hotel rooms. It has been envisioned as a distinctive waterfront landmark.

HDB resale prices up 0.6% in November

Housing and Development Board (HDB) resale prices have notched their biggest month-on-month (m-o-m) increase this year despite a smaller number changing hands. Resale prices, which through most of 2019 have moved within a -0.2 to +0.2 per cent range, rose 0.6 per cent in November from October. It is the biggest monthly increase since January's 0.5 per cent rise from December 2018. Prices in non-mature estates rose by 2 per cent year-on-year. Those in mature estates fell 2 per cent.

Bank deposits here from residents outside Singapore rose to levels not seen since early-2016, preliminary data from the Monetary Authority of Singapore showed. The latest data showed S$49.76 billion from residents outside Singapore were held through the domestic banking unit as at October this year. It includes deposits from persons with registered addresses outside Singapore - including overseas residents - Singaporeans working abroad, and companies with a registered address outside Singapore. Figures compiled by The Business Times showed that such deposits have been rising month to month since April. That makes seven straight sessions of expansion. Foreign-currency deposits have also continued their climb. As at October, they totalled S$15.47 billion - the highest since 1991, which is as far as records went - having risen in each consecutive month since May this year, with the biggest surge recorded in July. Foreign-currency deposits come from both residents and non-residents, and have mostly stayed within the S$7-8 billion range in the past three years.

Singapore business sentiment up slightly in Q1 2020; hiring to drop

Business sentiment among local firms has risen slightly for the first quarter of 2020, according to the latest Business Optimism Index study by the Singapore Commercial Credit Bureau (SCCB). Business sentiment rose to +5.31 percentage points in Q1 2020 from +4.82 percentage points in Q4 2019, with five of six indicators in the positive zone. The services sector was the most optimistic for Q1 2020, with all six indicators in the green. Its selling price indicator jumped to +29.03 percentage points from -12.90 percentage points in Q4 2019. Employment levels was the only indicator that fell, from +12.90 percentage points to +6.56 percentage points. The study polled 200 business owners and senior executives representing major industry sectors across Singapore.

RSS Feed

RSS Feed