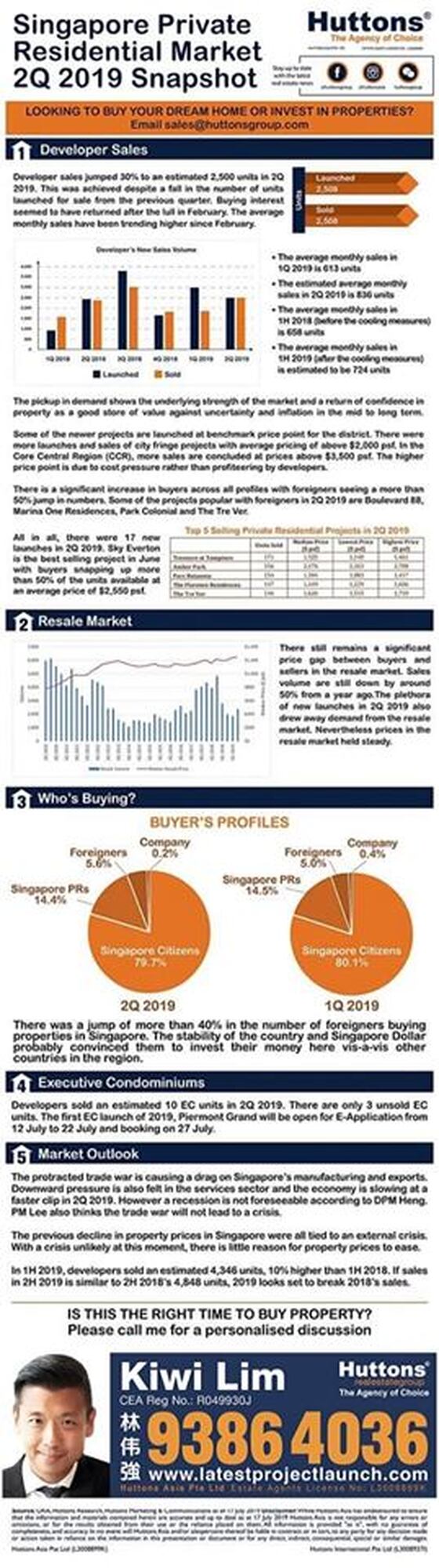

Despite a dampened economic outlook, the private property market was in rude health in the second quarter, with the transaction volume of new homes and prices both rising. Nevertheless, with Singapore’s economic growth set to slow in the second half of the year, analysts were divided on how the chips will fall for the property market — given that the global uncertainty has already seen an influx of foreign investors snapping up homes here in recent months. Data compiled by real estate agency Huttons showed that between April and July 2019, about 2,500 new private properties were sold — a year-on-year increase of almost 6 per cent. The increase could help reverse three straight quarters of decline in the overall transaction volumes — including resale deals — from June last year to March this year, said property experts. The period coincided with the introduction of property cooling measures in July last year.

Earlier, flash estimates by the Urban Redevelopment Authority (URA) indicated that private property in the second quarter rose by 1.3 per cent from the previous quarter, hitting a five-year high. According to Huttons’ data, a total of about 4,300 new private properties were transacted in the first six months of this year — a 10-per-cent increase compared with the same period last year. Mr Lee Sze Teck, Huttons Asia head of research, said he expects the buoyant demand to continue into the second half of the year, noting recent successes in condominium launches in the past month. “If the momentum continues at the same rate, then it could mean a turnaround for the industry for 2019,” said Mr Lee, noting the likelihood of sales in the second half of the year exceeding the 4,848 clocked in the same period last year.

Private property resale transactions down 50% while sales of new units jump

While sales of new private homes rose in the second quarter from the same time last year, the private property resale market remained in the doldrums, real estate firm Huttons said in a report on Wednesday (July 24). Between April and June, there were about 2,400 resale transactions, down 50 per cent from the same period a year ago, it said. This was partly because there is a significant gap between what buyers are willing to pay in the resale market and what sellers are holding out for, it added. “The plethora of new launches in (the second quarter) also drew away demand from the resale market,” the report said. “Nevertheless prices in the resale market held steady.” There were 17 new launches in the second quarter. Developer sales rose 6 per cent in the second quarter from a year ago to an estimated 2,500 units. “The pickup in demand shows the underlying strength of the market and a return of confidence in property as a good store of value against uncertainty and inflation in the mid to long term,” Huttons said.

Private home prices in Singapore are currently at the highest in five years, with the official flash estimate private residential index reaching 150.5, the highest since the first quarter of 2014 when the index was 151.3. It comes in the wake of two unexpected changes. First, developers sold 821 units last month, the highest sales figure for the month since June 2013, when 1,806 units were sold. This stellar performance is encouraging because the June school holidays tend to make the month a slow one for new home sales as many parents would go on vacation with their children. Second, the unexpected increase in private home prices in the second quarter of this year, with preliminary figures showing prices going up by 1.3 per cent. This reverses the decline of the preceding two quarters from last October to March this year after cooling measures were imposed last July. Prices have risen by 0.6 per cent since the start of this year.

Fragrance Group launching the sale of its Jervois Treasures condominium

Mainboard-listed property developer Fragrance Group will be launching the sale of its Jervois Treasures condominium in prime District 10, with prices starting from $1.37 million for a onebedroom apartment. Located in Jervois Road in the Tanglin area, the five-storey luxury development has 36 units, comprising one-to three-bedroom units of between 506 and 1,432 sq ft. Prices for two-bedroom units start from $1.64 million, while those for three-bedroom apartments begin at $2.85 million. The condo is being developed on the site of the former Lotus @ Jervois, which Fragrance Group bought en bloc for $46.3 million in March last year. The price worked out to $1,683 per sq ft per plot ratio, inclusive of an estimated development charge of $200,000. The condo, which is expected to be completed in March 2021, is a five-minute drive from Orchard Road, the Central Business District and Marina Bay Financial Centre. The nearest MRT stations are Redhill, Tiong Bahru and Orchard Boulevard on the Thomson-East Coast Line (due to open in 2021).

Having gone into building integrated developments in addition to condos in the last decade, GuocoLand is starting to think about the next steps for its Singapore business. GuocoLand Singapore's group managing director Cheng Hsing Yao said that it is contemplating new asset classes, business lines or even possibly a Reit. But for now, one of its main focus is Guoco Midtown on Beach Road, its second integrated development project in Singapore, to be completed in 2022. The S$2.4 billion Guoco Midtown will feature a 30-storey office block, a residential tower Midtown Bay and an array of public spaces. Mr Cheng hopes that this - along with its first integrated project Guoco Tower - will build the group's reputation as a leader in urban rejuvenation here and abroad. With Guoco Midtown, Mr Cheng's goal is to rejuvenate the Beach Road area, similar to how, he said, Guoco Tower enlivened the Tanjong Pagar area with an influx of corporates and their staff to work and dine. He sees Midtown as the "missing link" connecting the various developments in the City Hall; Bugis and Marina Centre sub-markets.

New $778m complex for Buangkok in 2022

Buangkok residents were given a first look at plans for a new complex in the area that will house a community club, retail spaces and private homes under one roof. The project, which will be built on a 3.7ha site next to Buangkok MRT station, is due for completion in 2022. A three-storey mall below 680 apartments will have a hawker centre and childcare facility. "Food options around here are quite limited, so the new development is welcome," said administration executive Alicia Woo, 49, who lives in the area. "It's good to have it within walking distance of my home as well." Fellow resident and engineer Ryan Aw, 38, said: "For me, the childcare centre will be important because it's very hard to get a place around here."

Political and social tensions in the region are sparking renewed interest from ultra-high-net-worth foreign investors for luxury apartments in prime districts here. Wealthy residents of Hong Kong, which has been roiled in recent weeks by the worst social unrest since the former British colony returned to Chinese rule, seem to be among those looking to Singapore as a property safe haven in more turbulent times. In one sign that more investors from Hong Kong are looking to park some of their wealth here, agents here handling commercial property and hotels have seen a pickup in inquiries in the past few weeks from family offices and funds in the territory, starting from $200 million to more than $500 million. The luxury property market is certainly showing signs of life, with interest among high-net-worth investors in trophy assets. Luxury apartments are defined as branded developments in this region with a price quantum of $5 million and above. The buzz over high-end freehold Boulevard 88 in Orchard Boulevard helped boost the number of caveats lodged for luxury apartments in the prime district or Core Central Region (CCR) by 18 per cent to 164 units in the first half of the year, compared with 139 in the second half of 2018. But cooling measures implemented last July meant sales were down 29 per cent from 232 in the first half of last year. Foreigners and permanent residents made up 70 per cent of the 164 transactions in the first half of this year in the prime district or CCR. That was up from 61 per cent a year ago with mainland Chinese comprising the biggest group, followed by Indonesians, Americans, Cambodians and Britons.

Property investment sales up 49% in second quarter

Real estate investment sales surged 49 per cent quarter on quarter on the back of big-ticket officesector deals. The second quarter of the year recorded S$6.7 billion in real estate investment sales, with 52 per cent of that figure coming from commercial deals. The quarter's two largest office-space deals alone generated just under S$2 billion in sales. One is the purchase of Oxley Holdings' Chevron House by AEW for S$1 billion. In the other deal, the South Korean National Pension Service bought a S$982.5 million half-stake in Frasers Tower after Frasers Commercial Trust declined to exercise its right of first refusal, as the deal would not be yield-accretive for its unitholders. Residential and industrial sales amounted to S$1.7 billion and S$0.5 billion respectively, bringing the total volume in H1 2019 to S$11.2 billion.

Japanese lender expanding in Asia, plans branch in Singapore

One of Japan's biggest regional banks is resuming an expansion overseas, 20 years after the country's financial crisis forced it to retreat. Concordia Financial Group plans to expand in Asia to offer cash management services to its Japanese corporate clients and infrastructure loans to local entities, said its president Kenichi Kawamura. It aims to hire specialists and double overseas loans to more than 400 billion yen (S$5 billion) in three years. The country's second-biggest regional bank by assets aims to set up a branch in Singapore as a transaction banking hub for Japanese corporate clients operating in South-east Asia, he added. Many of the bank's customers, such as auto-parts makers, operate in the region and need help with trade finance and managing their cash flows more efficiently, he said. About 1,500 of Concordia's corporate clients do business in South-east Asia and India. The push into overseas transaction banking should give the lender better access to foreign currency deposits, in turn, providing funding for its lending plans, he said.

RSS Feed

RSS Feed