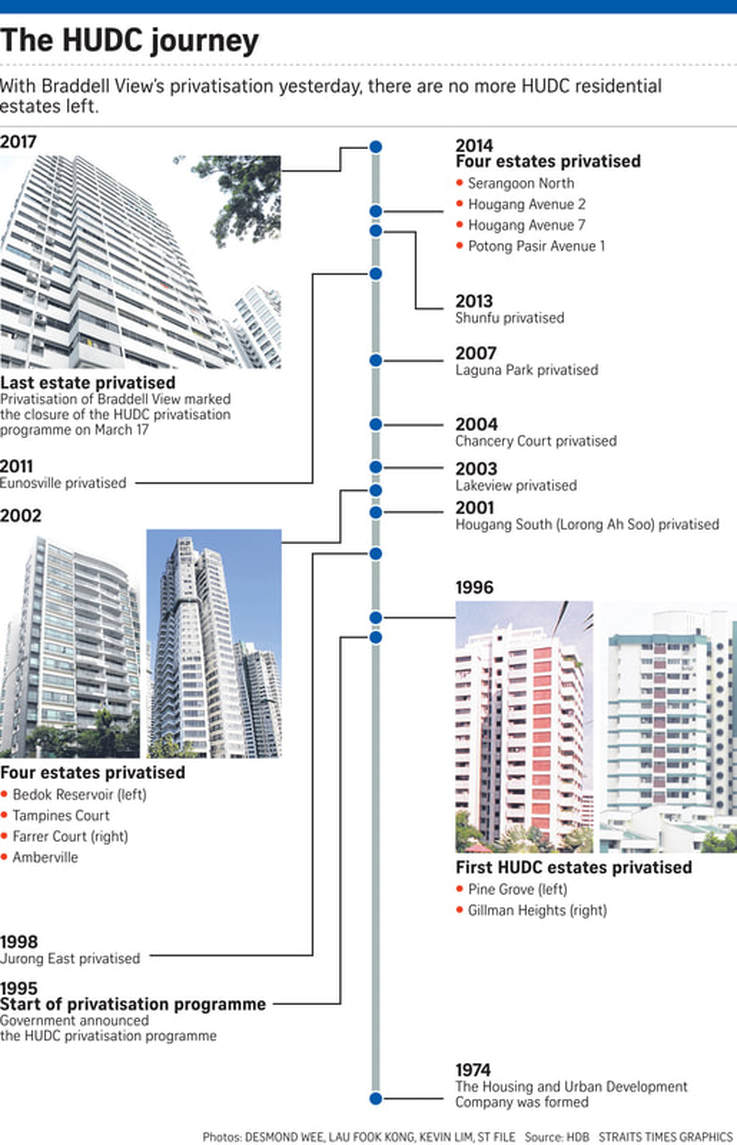

However, HDB decided to phase out the building of HUDC flats in 1987 as their demand declined and as land scarcity issues surfaced on our tiny Singapore island. There are therefore a total of 18 HUDC estates comprising 7,731 residential and 23 shop units by the time the government decided to stop building new HUDC estates in Singapore.

Since the gradual privatisation of the HUDC estates from 1995 into private housing estates, thirteen out of eighteen of these private housing estates had been collectively sold to private developers through various enbloc exercises creating thousands of new millionaire households.

below are HUDc estates that successfully enbloc

FARRER COURT HUDC estate was sold above the owners’ reserve price of $1.2 billion but below their asking price of $1.5 billion to CapitaLand at an awesome $1.34 billion for the sprawling Farrer Court estate in 2007. Owners at the 618-unit complex will get about $2.15 million each, depending on the size of their flats, which range from 1,453 to 1,615 square feet. FARRER COURT HUDC estate has now been transformed into a grand condo project called d'Leedon

MINTON RISE HUDC estate was sold to Kheng Leong, a privately owned property group controlled by the family of banker Wee Cho Yaw for $209 million in 2007. Minton Rise has 342 apartments in total and owners of the privatised HUDC estate will receive about $611,000 on average. MINTON RISE HUDC estate is now a condo with amazingly beautiful facilities called The Minton.

WATERFRONT VIEW HUDC estate in 2006 was acquired by Far East Organization and Frasers Centrepoint's maiden joint venture, which bought the privatised former HUDC estate facing Bedok Reservoir, for $385 million. This price works out to a land price of $241 psf per plot ratio inclusive of an estimated $102.2 million payment to the state for lifting title restriction to enhance the site’s plot ratio, and upgrading the site’s lease to 99 years for this sprawling 809,037 sq ft site. Due to its huge land size, WATERFRONT VIEW HUDC estate is now divided into 4 condo developments: Waterfront Waves, Waterfront Gold, Waterfront Key and Waterfront Isle.

A beautiful new condo development will be launched soon on this site called: Jade Scape. Register for the soft launch invite, updates and floorplans for Jade Scape here.

The location is near the very popular Bidadari estate and UVD is looking to develop the 201,405 sq ft site to house about 750 units. This HUDC site will be developed into an exciting project called: The Tre Ver, register for the soft launch invite, updates and floorplans here.

A new upcoming condo development will be launched soon called: Riverfront Residences. Register for the soft launch invite, updates and floorplans here.

The new condo development that will be built on this plot of land is called: Affinity at Serangoon. Register for the soft launch invite, updates and floorplans here.

The 389,236 sq ft site is zoned residential with a gross plot ratio of 2.8 and could yield around 1,000 units. The land price works out to $842 per sq ft (psf) per plot ratio (ppr) after factoring in the estimated differential premiums of $288.6 million to top up the lease to a fresh 99 years and develop the site to the gross plot ratio of 2.8.

Florence Regency is one of the last few privatised HUDC estates in the north-east region. The future development will enjoy unblocked views, located next to landed housing estates and across the Hougang Stadium and the sports and swimming complex. Find out how this estate will be developed in future by registering your interest here.

With the sale of Chancery Court, only five of 12 former HUDC estates remain for now - Ivory Heights, Pine Grove, Laguna Park, Braddell View and Lakeview. All five are in various stages of the collective sale process.

RSS Feed

RSS Feed