The four-room unit at Pinnacle@Duxton set a new record, surpassing the previous record set in March, where another four-room flat in the same block but on a higher floor was sold for $1.21 million.

The number of million-dollar Housing Board flats tripled last year and resale prices climbed for 22 consecutive months even after new property cooling measures were introduced in Dec 2021.

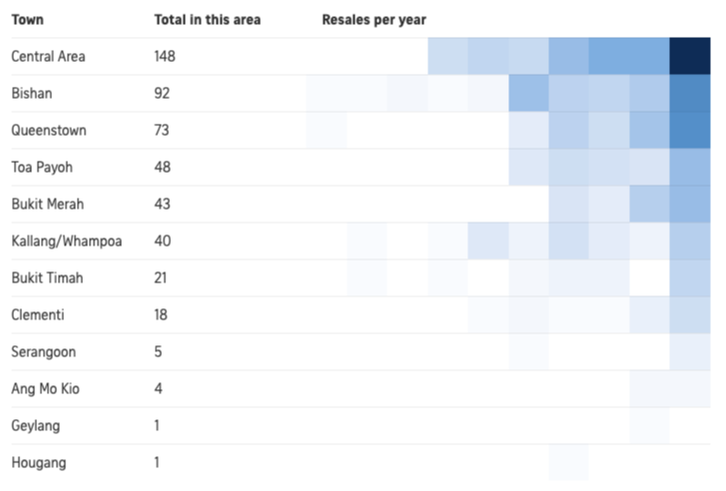

Just what made these flats so attractive to their buyers? Typically, they are large units on high floors with unblocked views, in a convenient central location and not more than 20 years old. But not all fit this mould. Data shows that a number of older units or those on lower floors were transacted at high prices because they possessed desirable traits, such as prime location and larger-than-usual size.

Price hikes were seen in both mature and non-mature estates, with prices increasing by 1 per cent in mature estates and 1.2 per cent in non-mature ones, compared with March where prices rose by 0.7 per cent and 0.9 per cent respectively.

Meanwhile, resale volume climbed by 0.2 per cent, with an estimated 2,273 units changing hands last month, up from the 2,269 units the month before.

The month of April saw 22 HDB resale flats changed hands for at least $1 million, down from 27 in March. Of these, five each were in the central area and Clementi, four units in Bukit Merah, three in Serangoon, two each in Toa Payoh and Ang Mo Kio and one in Bishan.

The 22 million-dollar flats made up 1 per cent of last month's total resale transactions.

"With a limited supply of prime location flats for sale, resale flat prices in these areas may continue to climb" Kiwi Lim from Huttons Asia explained: "Many young couples who are intending to have kids are choosing to buy resale flats in matured estates as they are not willing to wait 6 years to endure the long construction periods for new BTO flats. Moreover, the restrictions of PLH BTO flats may also hamper their asset progression plans as they find the 10 year MOP for new BTO PLH flats unappealing."

RSS Feed

RSS Feed