In the monthly update by URA, the property market confounded all expectations by turning in an exceptional performance in April 2020. Developers sold an estimated 277 units in April and almost 100 units via virtual viewing from 7 to 30 April.

There were still naysayers who believed the worst in the economy is yet to come with a deeper recession and more unemployment. They further predict that sales volume will fall in May 2020 as the circuit breaker and physical viewing was extended to 1 June.

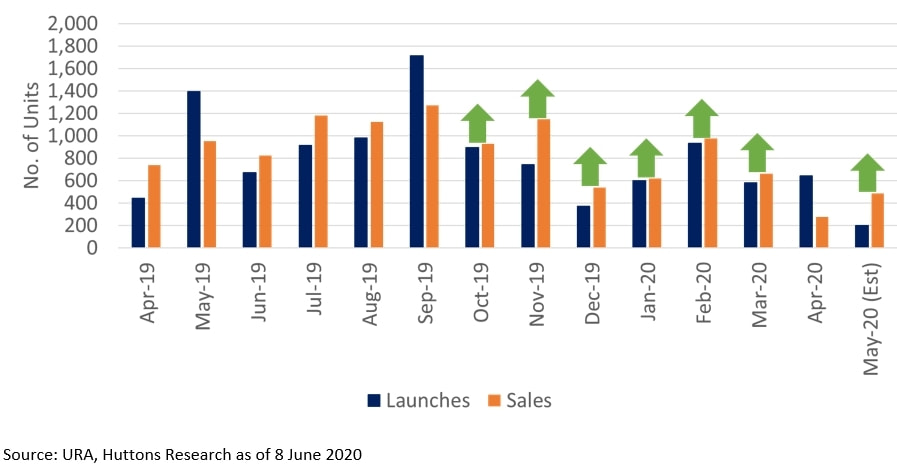

Huttons did an analysis of developer sales based on caveats downloaded on 8 June 2020. Again, the property market never failed to surprise us with its strength and resilience. Developers sold an estimated 484 units in May 2020, an eye-popping 75% higher than April’s sales. Before the circuit breaker, developer sales have exceeded launches for six consecutive months. We believe it will be the case of sales exceeding launches in May, reflecting the depth of demand in the market.

Why did people continue to buy properties amidst the uncertainties?

Firstly, we think there is a shift in buying behaviour. While property is a big-ticket purchase, the one-month circuit breaker in April has made people accustomed to buying things online. Without this shift in buying behaviour, online sales of property will be very challenging. There were many examples of buyers who commit to a purchase in May 2020 without even viewing the show gallery.

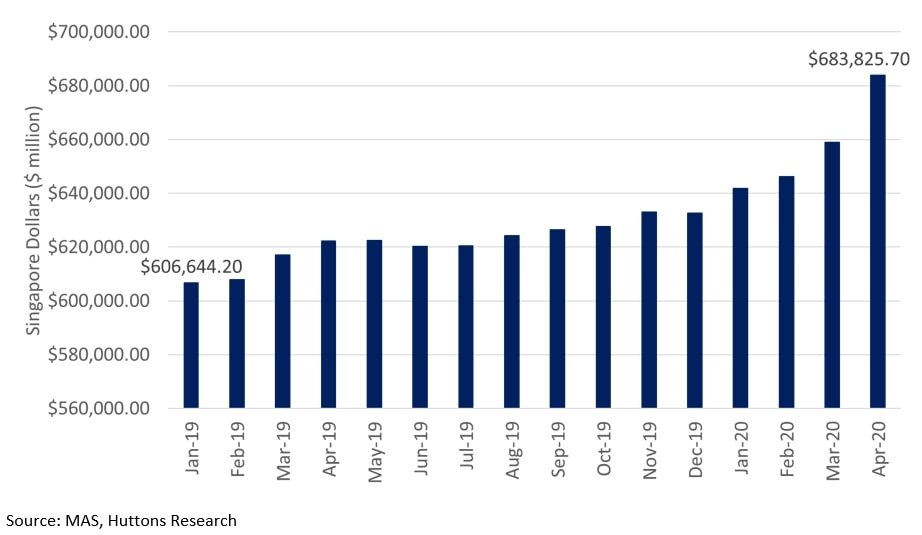

Secondly, the high savings rate of residents is a boon in this uncertain time and it has given asset purchases like properties a boost. M2 deposits in Singapore has risen by almost S$80 billion or 13% over a period of 15 months.

Lastly, it is a bit counter-intuitive but Covid-19 actually jolted some buyers to actively plan for their future. The uncertainties over income and employment were a wake-up call that the road to financial freedom lies elsewhere. Safer and stable assets like properties were preferred over the volatile stock market.

Huttons Asia's real estate professional - Kiwi Lim said that the government has also raised the awareness that construction costs are going to increase by around 5% to 7% in the near future due to Covid measures in place at construction sites and higher cost of construction materials. This will mean that developers will not be able to give more discounts now and some may need to even transfer the higher costs to buyers in future.

Taken in totality, this shows that buyers are ignoring the short-term uncertainties caused by Covid-19 and buying into the long-term fundamentals of Singapore, reflecting a resilient property market! The buying momentum had continued into June 2020. Developers sold around 130 units in the first week of June. Which are the top selling projects in the first week of June? Follow us on our next issue.

RSS Feed

RSS Feed