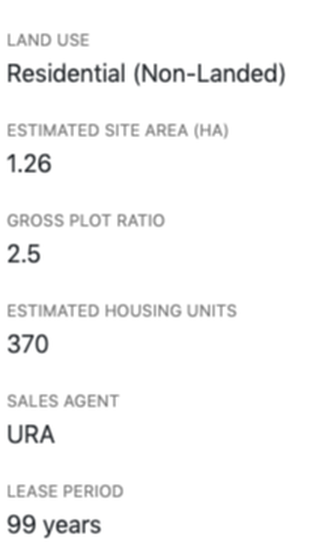

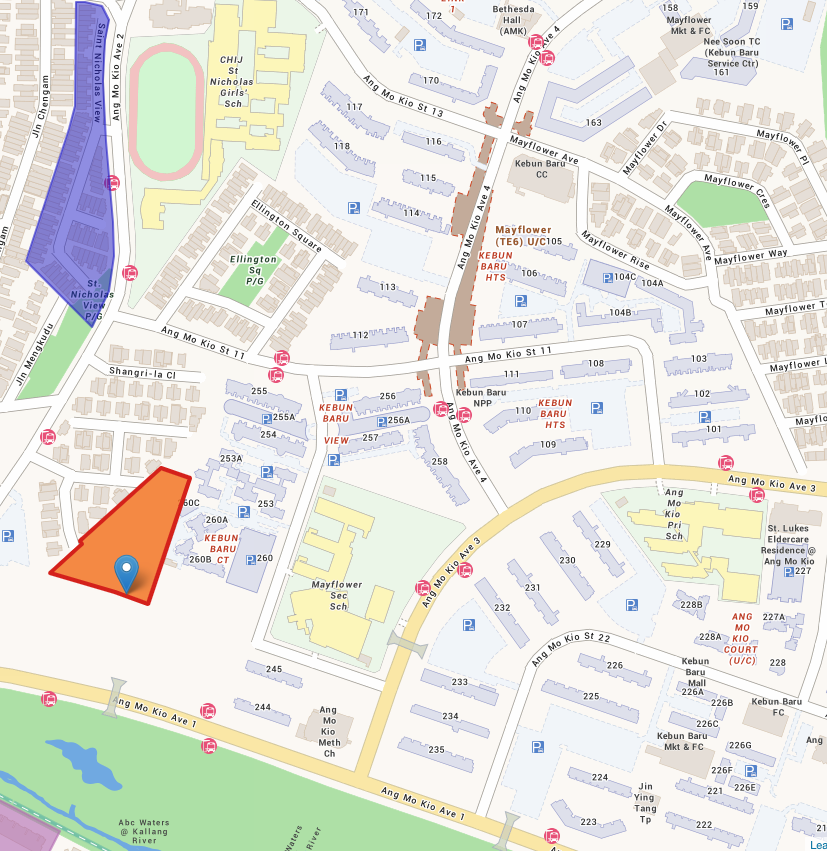

Both residential sites are on the GLS programme's confirmed list, which was released in June. The two sites combined can yield about 985 residential units, although the actual number may vary depending on the developers, said the Urban Redevelopment Authority (URA) and the Housing Board (HDB) on Thursday. The land parcel in Ang Mo Kio is located at Ang Mo Kio Avenue 1 with a site area of 12,679 sq m and a GFA of 31,699 sq m. The 99-year leasehold site is estimated to yield around 370 units.

Ms Wong Siew Ying, PropNex's head of research and content, noted that it is the latest GLS site to be offered in the area in six years, since the sites of two condo projects -Thomson Impressions and The Panorama - were successfully awarded for $173.6 million ($731 psf ppr) and $550 million ($790 psf ppr) respectively.

She said that apart from being in a mature town and an established residential area, the plot is also near the upcoming Mayflower MRT Station on the Thomson-East Coast Line. She predicted that demand for the site would be "buoyant" and that it would attract more than 10 bidders, with the top bid at $273 million to $290 million or $800 to $850 psf ppr.

Kiwi Lim from Huttons Asia believe this Ang Mo Kio land parcel will attract quite a few interested parties as most developers have already depleted their existing land parcels and 2021 will see much lesser new condo launches in the pipeline as compared to 2019 and 2020 with the biggest blockbuster being Normanton Park and an extremely rare seafront condo at Keppel Bay - The Reef at King's Dock.

URA and HDB will offer a longer tender period of six months to allow developers more time to make their assessment in view of the ongoing Covid-19 situation. Tender for the two land parcels will close at noon on May 25, 2021.

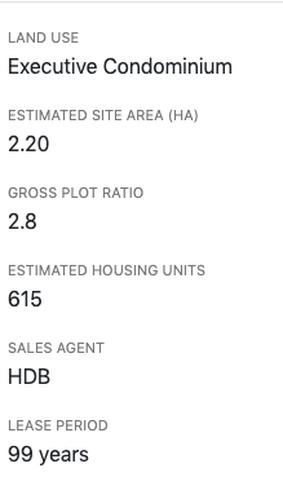

Located next to the upcoming Garden Vines @ Tengah Build-To-Order (BTO) project, it will be the first EC housing project in the "forest town" of Tengah.

Developers are likely to view the EC market "favourably", as there are only four EC projects in the launch pipeline and demand could pick up under better market conditions next year. While the Tengah plot is in a relatively less developed area, it could be in fair demand due to the lack of new EC projects in the west and could offer first-mover advantage to the successful bidder.

The last time an EC site was sold in the area was the Sol Acres parcel in Choa Chu Kang in 2014. ERA Realty's head of research and consultancy Nicholas Mak estimated that the site could attract six to nine bids, with the top bid varying from $331.8 million to $352 million, which translates to $500 to $530 per sq ft per plot ratio (psf ppr).

RSS Feed

RSS Feed