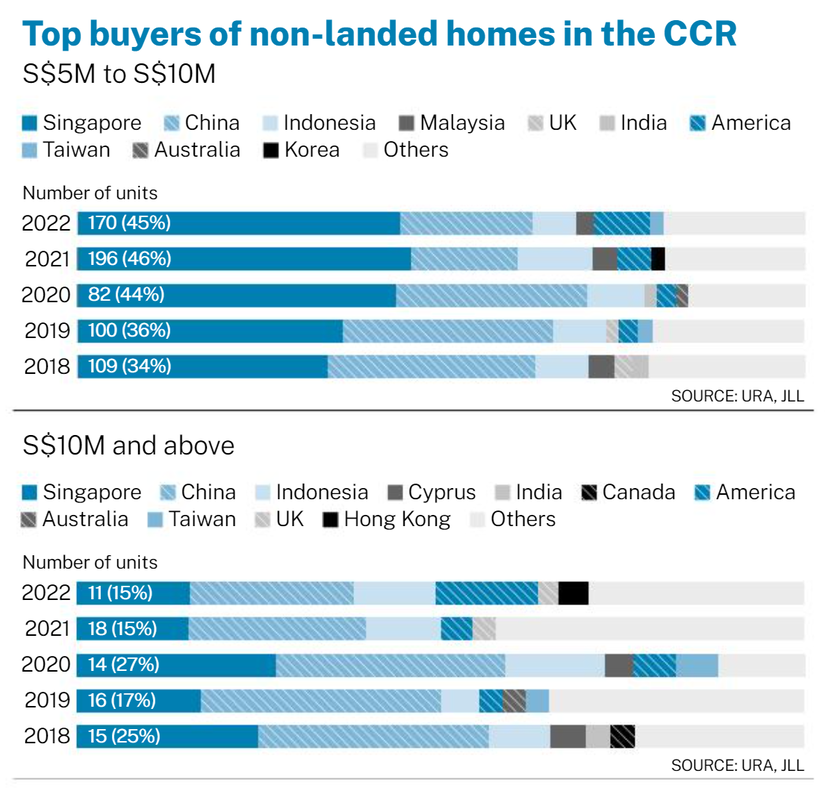

More Singaporeans are buying upmarket luxury condo properties costing at least $5 million from the Core Central Region (CCR) and the Rest of Central Region (RCR). Many affluent Singaporeans view high-end homes as a symbol of success and achievement. Owning a luxurious property can provide a sense of status and prestige, and can be a way for individuals to showcase their wealth and social standing. High-end homes may also be viewed as a sound investment opportunity, as Singapore's property market has historically been seen as a safe and stable investment.

"Rising affluence has played a significant role in boosting the demand for high-end homes in Singapore, as more affluent individuals seek out properties that reflect their lifestyle and aspirations." said real estate professional Kiwi Lim from Huttons Asia. "Other than rising affluence, other factors such as limited land supply, prime locations, and exclusive amenities have also contributed to the growing demand for high-end homes in Singapore. The recent increase in buyer's stamp duty for both residential and non-residential properties of higher value may not dampen demand for luxury properties."

Reasons why Singaporeans may choose high-end homes:

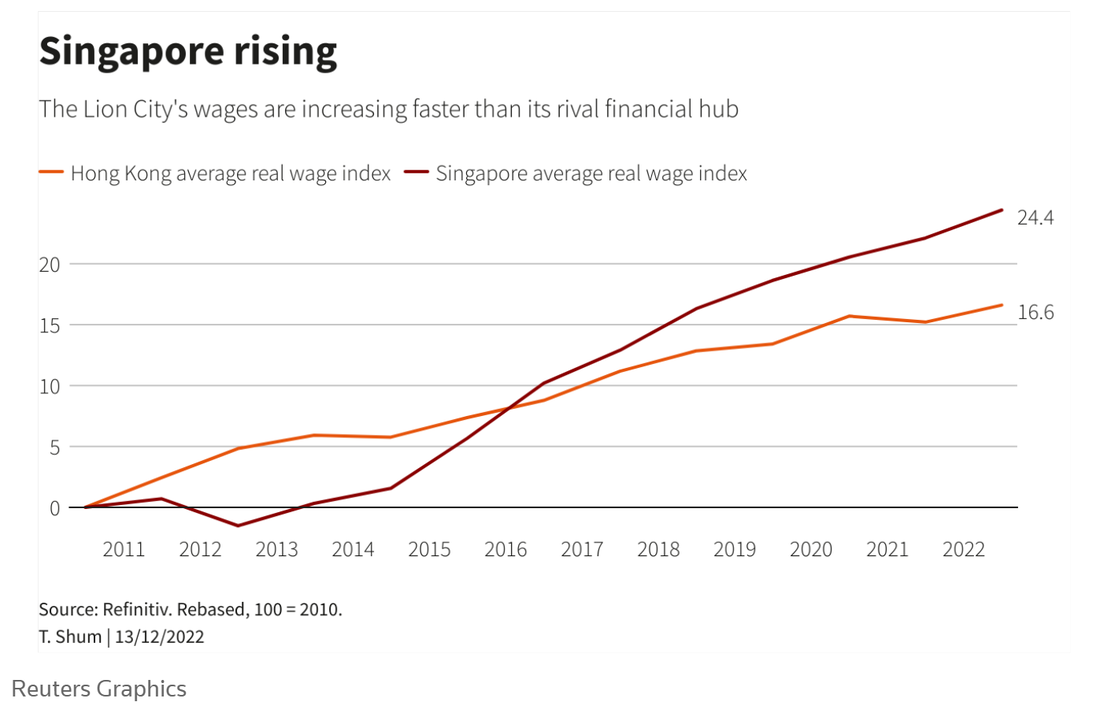

- Rising affluence: Singapore has experienced significant economic growth in recent years, leading to an increase in disposable income and affluence. This has led to a growing demand for luxury goods, including high-end homes.

- Limited land supply: Singapore is a small island nation with limited land supply, which has led to a scarcity of land for development. As a result, high-end homes are often built in prime locations and offer a sense of exclusivity and prestige.

- Quality of life: Singaporeans place a high value on their quality of life, and high-end homes can offer a luxurious lifestyle with exclusive amenities, such as private pools, gyms, and concierge services.

- Investment potential: Singapore's property market has historically been seen as a safe and stable investment, with high-end homes offering potential for capital appreciation over the long term.

- Family needs: High-end homes can also offer ample space for families, with larger living areas, multiple bedrooms and bathrooms, and outdoor spaces for relaxation and recreation.

There are several reasons why foreign buyers may be attracted to high-end homes in Singapore:

- Strategic location: Singapore is a hub for business and finance in Southeast Asia, making it an attractive location for foreign investors who are looking to establish a presence in the region. High-end homes in prime locations may offer easy access to business districts, as well as cultural and entertainment amenities.

- Quality of life: Singapore is known for its high standard of living, safety, and cleanliness, which can be attractive to foreign buyers who are looking for a comfortable and secure place to live.

- Political stability: Singapore is known for its political stability and economic growth, which can offer a sense of security to foreign buyers who are looking to invest in property.

- Investment potential: High-end homes in Singapore may offer potential for capital appreciation over the long term, as well as rental income from tenants. Foreign buyers may be attracted to the stability and growth potential of Singapore's property market.

- Diverse culture: Singapore is a multicultural society with a diverse population, which can be appealing to foreign buyers who are looking for a cosmopolitan and inclusive community.

"Overall, foreign buyers may be attracted to high-end homes in Singapore for a combination of these reasons, including strategic location, quality of life, political stability, investment potential, and diverse culture." say real estate professional Kiwi Lim. "China's reopening is set to drive more of Asia's wealthy to our shores and pent-up demand from these high net worth individuals (HNWI) is expected to boost Singapore's luxury property market. With more CCR condo projects expected to be launched this year, sales of luxury homes in Singapore may break last year's record of $3.5 billion this year."

RSS Feed

RSS Feed