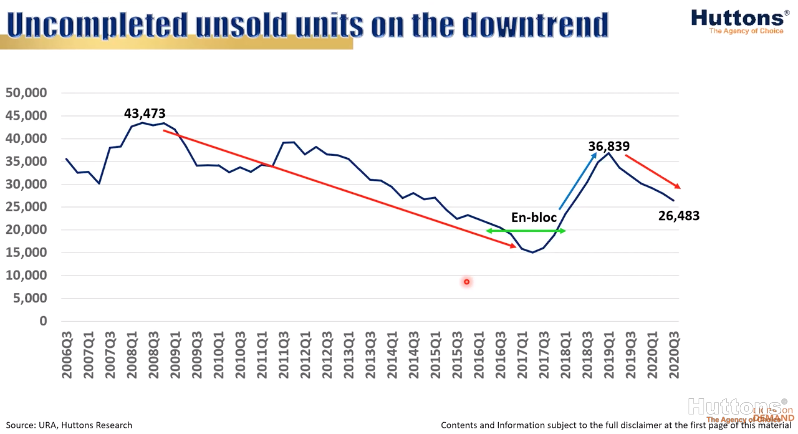

Huttons Asia real estate adviser Kiwi Lim believes that such a rare strong turnout of developers for these two plots of government land sales (GLS) sites in OCR locations is a good indication that most developers in Singapore are running out of land banks for future residential condo launches. According to Kiwi Lim, developers in Singapore have launched almost all their land banks secured during the en-bloc frenzy of 2017 and 2018, with transaction values at S$8.3 billion & S$10.3 billion respectively.

This comes as the property market has remained resilient in the face of the COVID-19 pandemic and consequent economic uncertainty, said analysts.

This year saw just two en bloc deals totalling S$77.2 million, Yuen Sing Mansion in Geylang, which was transacted in August, and adjoining sites Fairhaven and Sophia Ville, which were taken off the market in early December. Last year, Roxy-Pacific Holdings forked out S$93 million for 15 terraced houses in the Guillemard Road area and a consortium bought a plot with 11 homes near Haig Road for S$32.8 million.

The GLS supply is very competitive and there are many eyeing it. For smaller developers, it’s a bit harder to compete, so they may go for en bloc sites as an alternative source. Developers need to start shoring up their land banks to plan for future projects, and en bloc sales are a “quick way” to do that.

While this could be good news for owners looking to sell, the return of the en bloc market could also drive up overall land and property prices. However, the upcoming interest in the collective sales market may not match the extent of the fervour seen in 2017 and 2018, due to more economic uncertainty.

RSS Feed

RSS Feed