Home Fire Insurance

Fire insurance covers only the expenses incurred to restore a building's structural integrity after a fire.

Home Insurance

Home insurance is more comprehensive, typically covering personal property, removal of debris and alternative accommodation during renovations.

It is important for home owners to know the coverage of the home insurance plan they have purchased. There is a misconception among some home owners that home insurance insures the amount they had paid for the property. Home insurance claims cover only the cost of reconstructing the property, and it is almost always lower than the market value of the property. Rebuilding a home damaged by fire and other unexpected perils, and counting the losses of your destroyed home contents, can be costly if you do not have a comprehensive home insurance plan.

On 16 Aug (Tues) morning a fire broke out in a ninth-storey flat in Jurong East where one resident was killed and three others rescued from a next door unit. In May, a Bedok North flat fire killed three people including a three-year-old, and in March, another fire in a New Upper Changi Road flat claimed one life.

HDB Fire Insurance Enough?

A common misconception among many HDB homeowners is that the Housing Development Board (HDB)'s fire insurance - which is mandatory with every purchase of a HDB flat - is enough.

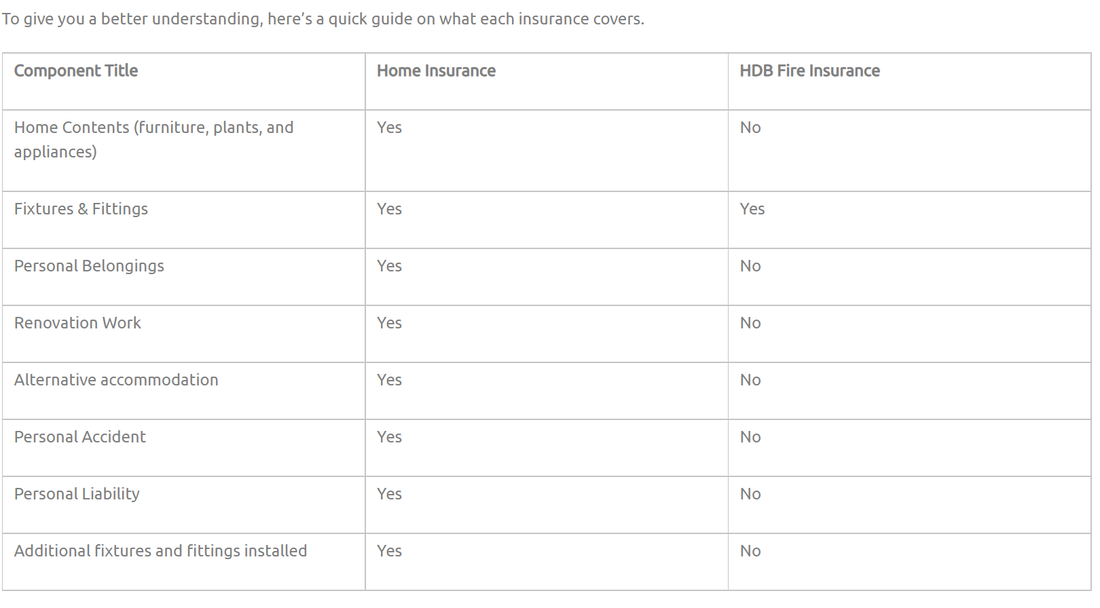

Housing Development Board's fire insurance cover is very basic as the insured value is limited to either the outstanding loan amount or the cost of reinstating the building structure. HDB's fire insurance scheme does not include household contents such as furniture and personal belongings, or the cost of work done during renovations.

Therefore it is important for a separate policy covering incidental costs such as the loss of rent, damages to third-party property, renovations, alternative accommodations during renovations and content of the house, etc. However, many home owners do not see home insurance as an essential purchase. These are important elements to consider, especially if there is widespread damage to the property.

Real estate professional Kiwi Lim felt home insurance premium is low when compared to cost of property and its contents. Depending on the coverage, annual premiums usually range from $50 to $350 per $100,000 coverage. Insurers often bundle a variety of benefits factored into the premiums. A good home insurance will cover both the building structure and the home contents. In other words, it is a combination of fire insurance and home contents insurance. Therefore examine your policy and look through your risk exposure carefully when choosing your insurer.

RSS Feed

RSS Feed