This restriction, together with a slew of announcements by the government effectively ended the en-bloc fever that saw around 100 private residential developments being acquired by various property developers in Singapore creating more than 9,000 millionaire households. Some bought properties immediately for their new accommodation but almost half of them kept the funds.

Real estate professional Kiwi Lim believe that during the Circuit Breaker period in 2020 when Covid-19 threaten to bring down the healthcare system in Singapore, families realized they need more space and probably used these funds to acquire more properties either for investment or for family members to have their own private space thus driving the property market in Singapore to new heights.

To date, more than 20 other developments, including the latest freehold private residential development Trendale Tower also started the collective sale process just months after the government’s market cooling measures announced in December 2021 that triggered a slight knee jerk reaction which lasted for about two months before the buying resumed due to strong local demand for property.

On 11 Aug, it was announced that Trendale Tower has been put up for sale again, this time with a higher guide price of S$178 million via a public tender exercise. Situated at 79 Cairnhill Road, the 20-storey development houses 18 apartments of 298 square metres each, which works out to S$2,386 per plot ratio after factoring in the 7 per cent bonus gross floor area for balconies. Excluding the bonus gross floor area, the guide price rounds to S$2,449 per plot ratio. The nearest MRT station is Newton station, only less than 500 metres away and future residents will have access to schools like Anglo-Chinese School (Primary), Anglo-Chinese School (Primary) and EtonHouse International Pre-School, which are situated within 1 kilometre of the development.

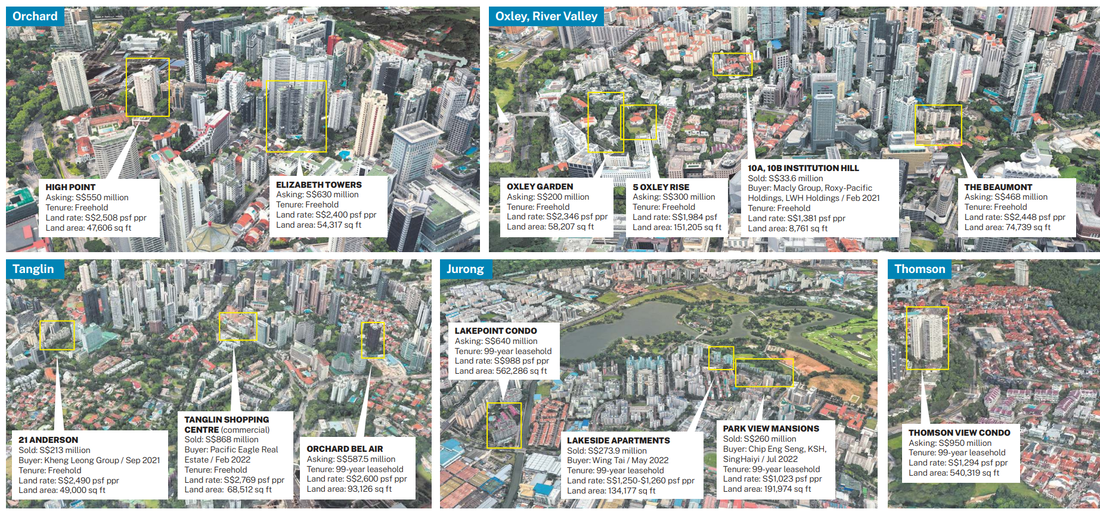

ORCHARD, OXLEY, RIVER VALLEY, TANGLIN:

High Point

Asking: S$550 million Tenure: Freehold

Land rate: S$2,508 psf ppr Land area: 47,606 sq ft

Elizabeth Towers

Asking: S$630 million Tenure: Freehold

Land rate: S$2,400 psf ppr Land area: 54,317 sq ft

Oxley Garden

Asking: S$200 million Tenure: Freehold

Land rate: S$2,346 psf ppr Land area: 58,207 sq ft

5 Oxley Rise

Asking: S$300 million Tenure: Freehold

Land rate: S$1,984 psf Land area: 151,205 sq ft

The Beaumont

Asking: S$468 million Tenure: Freehold

Land rate: S$2,448 psf Land area: 74,739 sq ft

Orchard Bel Air

Asking: S$587.5 million Tenure: 99-year leasehold

Land rate: S$2,600 psf ppr Land area: 93,126 sq ft

Lakepoint Condo

Asking: S$640 million Tenure: 99-year leasehold

Land rate: S$988 psf ppr Land area: 562,286 sq ft

THOMSON:

Thomson View Condo

Asking: S$950 million Tenure: 99-year leasehold

Land rate: S$1,294 psf ppr Land area: 540,319 sq ft

SERANGOON:

Kensington Park

Asking: S$1.28 billion Tenure: 999-year leasehold

Land rate: S$1,414 psf ppr Land area: 491,000 sq ft

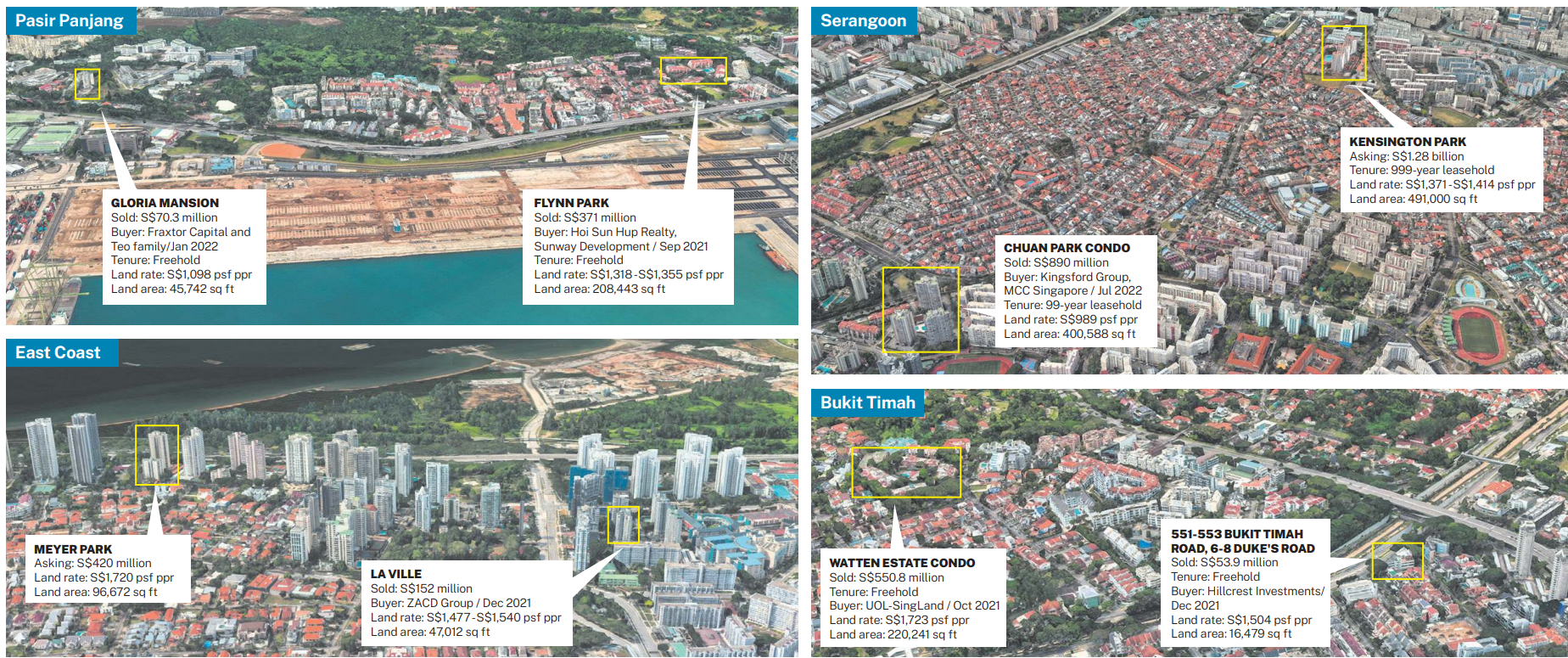

EAST COAST:

Meyer Park

Asking: S$420 million Tenure: Freehold

Land rate: S$1,720 psf ppr Land area: 96,672 sq ft

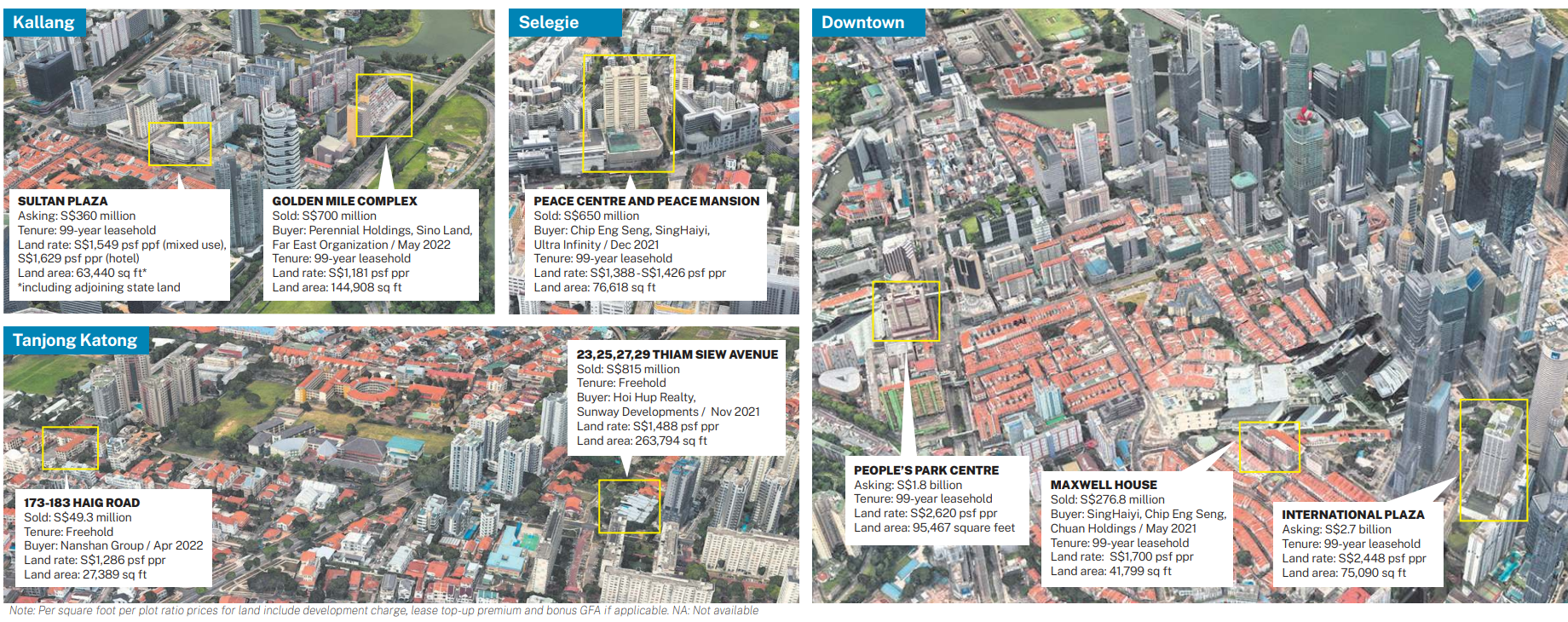

KALLANG:

Sultan Plaza

Asking: S$360 million Tenure: 99-year leasehold

Land rate: S$1,549 psf ppf (mixed use), S$1,629 psf ppr (hotel)

Land area: 63,440 sq ft* *including adjoining state land

DOWNTOWN:

People’s Park Centre

Asking: S$1.8 billion Tenure: 99-year leasehold

Land rate: S$2,620 psf ppr Land area: 95,467 sq ft

International Plaza

Asking: S$2.7 billion Tenure: 99-year leasehold

Land rate: S$2,448 psf ppr Land area: 75,090 sq ft

Faced with the possibility of a recession in Europe and United States next year, Kiwi Lim felt developers are currently more keen to target smaller plots for en-bloc in order to reduce their exposure to economic risks even though Singapore is not likely to see a recession next year. Therefore, “bite-sized” smaller older developments could still attract developer’s attention. Kiwi expects around 20 private residential / commercial developments to enbloc this year - approximately double of last year.

RSS Feed

RSS Feed