Goldman Sachs Group Inc believes the money is transferred to Singapore amid escalating political protests in the former British colony. Singapore looks like a choice destination as it is also an alternative financial center for Asia.

Hong Kong's increasingly violent demonstrations that have roiled the city for four months began in opposition to a Bill introduced in April that would have allowed extradition to mainland China, but they have since spiraled into wider issues.

The law, which went into effect on 5 Oct 2019 (Saturday) at midnight local time, bans protesters from wearing any sort of mask or face covering, including paint, at any public gathering, including both lawful protests and unlawful assemblies. Those who violate the ban could face up to one year in jail and a fine of HK$25,000 (about $3,200 US dollars), according to the Hong Kong Free Press. The rule will exempt people who wear face coverings for their job or for religious reasons.

Lam relied on a 1922 law that gives Hong Kong’s leader additional powers in times of emergency which hasn’t been used since 1967. Lam denied that the face mask ban meant that Hong Kong was in a state of emergency, but the ban has only galvanized those opposed to Hong Kong’s government and is expected to worsen the situation in Hong Kong. In the following days, protesters defying the law against face masks, continued to wear face masks in their demonstration. Protests broke out across Hong Kong till Sunday (6 Oct 2019), with more businesses and transit stations vandalized, and clashes with police turning more violent.

Hong Kong’s powerful Public Order Ordinance, passed during a wave of riots in 1967, lets the government establish curfews and close areas from public access. The Emergency Regulations Ordinance of 1922 goes further, allowing the chief executive to make “any regulations whatsoever” to ensure public security, including censorship, snap arrests and property searches and seizures. That ordinance hasn’t been used in more than a half century.

- Foreign-currency deposits at both domestic and international banks operating in Singapore rose to a record S$12.8 billion ($9.3 billion) as of August 2019, according to Monetary Authority of Singapore preliminary data. The bulk of the increase took place in July and August, when the figure rose S$5 billion in total, a 64% increase in two months, the data show.

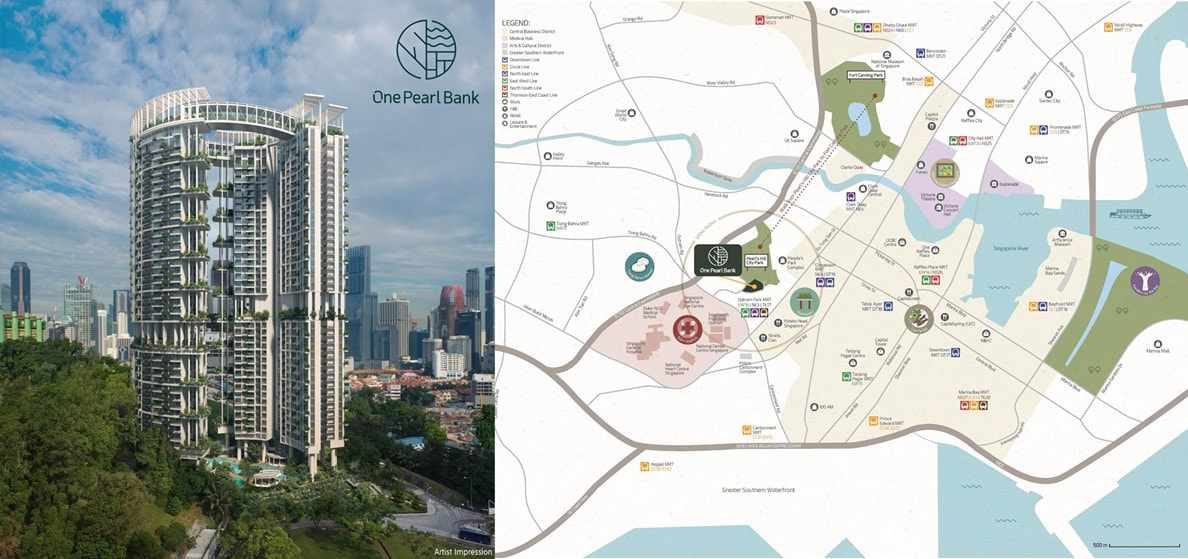

- Property analysts believe that a portion of these recently recently transferred foreign funds may be used for property investments in Singapore. Real Estate Agency, Huttons Asia's Kiwi Lim said "foreigners, not only Hong Kongers - see Singapore as a good alternative safe haven to house their families and park their money because of our stable government, good banking laws, convenient transport and easily available eateries and amenities for comfortable living. Property prices in Singapore is also attractively priced when compared to other major First world financial centres across the globe."

- Two straight quarters of increases in the overall private home price index of the Urban Redevelopment Authority (URA) have sparked a debate on whether this might prompt the authorities to respond with more measures to cool down the property market. Barclays' regional economist Brian Tan thinks the risk of more cooling measures has risen to "a relatively high level", and that the government could act quickly. He said the continued rise in the private home price index suggests that its surprising jump in the second quarter did not come from a distortion or measurement error. Huttons Asia's Kiwi Lim felt that property buyers or investors should not expect the government to remove or lower the ABSD and that now may be a good time to buy.

RSS Feed

RSS Feed