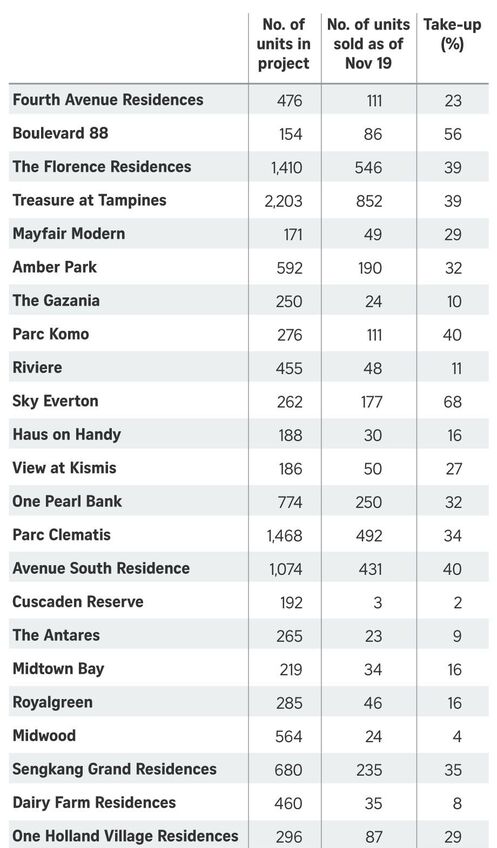

November’s take-up was led by projects coming up in the suburban areas or outside central region (OCR) which saw 608 units sold. This was followed by 351 units from projects in the city fringes or rest of central region (RCR) and 188 units from those in the prime districts or core central region.

The best-selling project was the 680-unit Sengkang Grand Residences which launched for sale last month. The 99-year leasehold condominium coming up next to Buangkok MRT Station sold 235 units of the 280 units offered at a median price of $1,741 per square foot (psf).

Three previously launched projects did well in November include Parc Esta (102 units), Jadescape (60 units) and Parc Botannia (59 units).

Year to date, a total of 9,547 units, excluding ECs, have been sold, out of 10,751 units launched, already exceeding the 8,795 units for the whole of last year. Some market watchers said developer sales could exceed 10,000 units for the whole of 2019.

Real estate professional Kiwi Lim from Huttons Asia believes Singapore's property market will only get better next year in 2020, with the economically damaging US - China trade war dispute showing signs of resolving. The recent phase-one trade deal between the world's 2 largest economies of US and China could de-escalate trade tensions and boost market confidence surely benefit Singapore's economy with capital continuing to enter Singapore’s property market next year as more Chinese capital flows inward towards Singapore from Hong Kong and China.

Market analysts also believe that mortgage rates may remain low or even go lower next year, which would help property buyers and further boost property sales.

RSS Feed

RSS Feed