This year, Chevron announced in Jan that it would triple its spending on share buybacks to $75 billion after reporting a record full-year profit of $36.5 billion, buoyed by high oil prices. Exxon said it would issue another $35 billion in buybacks and Facebook-parent Meta Platforms saw its stock surge by 20% after the company announced plans to boost its share repurchase plan by $40 billion after seeing the company losing more than $600 billion in market value over the past year. 2023 will likely be the first fiscal year with at least $1 trillion in completed S&P 500 company buybacks, said Howard Silverblatt at S&P Dow Jones Indices.

"It is important to note that the amount of share buybacks in a given year is dependent on a number of factors, including the financial performance of companies, market conditions, and regulatory policies. While it is very highly possible that companies may engage in share buybacks totaling USD$1 trillion in 2023, it is impossible to say for certain at this time since we are only in the first quarter of 2023." said Kiwi Lim, real estate professional.

It is important to note that share buybacks are not always viewed positively by investors or analysts, as they can be seen as a way for companies to boost their stock prices artificially rather than investing in their businesses for long-term growth. Ultimately, the decision to engage in share buybacks is up to each individual company and their board of directors.

Share buybacks can be seen as a positive sign by investors because they indicate that the company has confidence in its own financial position and future prospects. By reducing the number of outstanding shares, the buyback can also increase earnings per share and potentially boost the stock price, which can be beneficial for shareholders.

However, share buybacks can also be viewed as a negative sign if the company is using them to artificially boost its stock price rather than investing in its business. If the company is repurchasing shares instead of using the money to fund growth opportunities or pay dividends, it may suggest that the company is not confident in its ability to generate strong returns through these other means.

Furthermore, if a company is using debt to finance the share buyback, it could be taking on unnecessary financial risk. If the company's financial position deteriorates or if interest rates rise, the debt burden could become unsustainable.

Overall, whether share buybacks are a good sign or not depends on the context and the company's overall financial situation. Investors should evaluate the reasons behind the buyback and the potential long-term impact on the company's financial health before making any investment decisions.

During a recession, central banks may lower interest rates in order to boost the economy. The decision of a company to buy back its own shares is not necessarily directly linked to changes in interest rates. However, changes in interest rates can indirectly affect a company's decision to repurchase shares, as well as the timing and amount of any buybacks.

When interest rates go up, borrowing costs for companies typically increase, which can make share buybacks more expensive if the company is financing them with debt. As a result, companies may be less inclined to repurchase shares when interest rates are high. Conversely, when interest rates are low, companies may find it more attractive to use debt to finance share buybacks, as the cost of borrowing is lower.

However, there are many other factors that can influence a company's decision to buy back shares, including its financial position, growth prospects, and available cash flow. For example, a company with excess cash on hand may choose to repurchase shares even if interest rates are high, if it believes that this is the best use of its funds.

Overall, while changes in interest rates can indirectly affect a company's decision to repurchase shares, it is just one of many factors that can influence this decision. Companies will consider a variety of factors when making the decision to repurchase shares, including their current financial position and growth prospects, as well as broader economic trends.

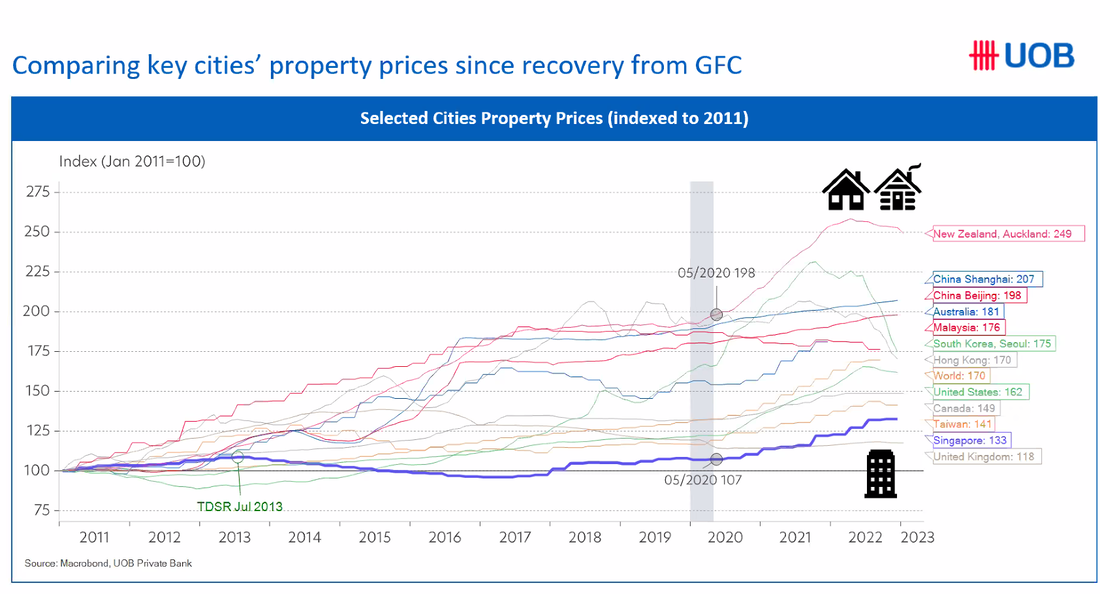

All across the world, countries have seen property prices rising exponentially during the past 3 years - known as the Covid Pandemic Period. However from the graph above, we can see that Singapore's property price increase during Covid pandemic period is only considered moderate when we compare to other developed cities globally. Therefore, it is safe to say that the possibility of a property bubble in Singapore is extremely low especially after the government intervened with recent property cooling measures.

Demand for property in Singapore is expected to remain strong from overseas buyers due to a combination of reasons, including strategic location, quality of life, political stability, investment potential, and diverse culture. Moreover, central banks are expected to lower interest rates, including home mortgage rates during a recession in order to boost spending" say real estate professional Kiwi Lim.

"China's reopening is set to drive more of Asia's wealthy to our shores and pent-up demand from these high net worth individuals (HNWI) is expected to boost Singapore's luxury property market. With more CCR condo projects expected to be launched this year, sales of luxury homes in Singapore may break last year's record of $3.5 billion this year."

RSS Feed

RSS Feed