The Ministry of National Development (MND) and the Housing Development Board (HDB) in a press release today on 5 March, Tuesday announced that eligible young couples will get more help when buying a new Housing Board (HDB) flat from June this year, including a reduced initial downpayment of 2.5% of the purchase price if the BTO flat.

The reduced initial downpayment may be a “significant financial barrier” for some couples and will ease the initial cost for these couples when buying a Build-to-Order (BTO) from the Junes sales exercise this year onwards.

Currently, young couples – full-time national servicemen (NSFs), students, or those who have completed their studies or National Service within the last 12 months of applying for the HDB flat eligibility letter – can apply for a new BTO flat first and defer their income assessment for housing grants or loans to just before key collection.

This is because if income was assessed at the time of application, these couples may not be eligible for grants such as the Enhanced CPF Housing Grant (EHG), which requires at least one party to be continuously employed for a minimum of 12 months. By deferring income assessment to the collection of keys, they are more likely to be eligible for the grant and may even qualify for a higher loan amount.

To be eligible, these couples must be current full-time students, recent graduates or national servicemen. At least one party must be aged 30 or below, and the couple must be married or applying for a flat under the Fiance-Fiancee Scheme.

Other eligibility conditions for deferred income assessment include the requirement for at least one applicant to be 30 years old or below. The couple must be married or are applying for a flat under the Fiance-Fiancee Scheme, which has a minimum age requirement of 21 years old.

For Build-to-Order (BTO) applications from 30 September 2022, the down-payment will be 20%. This can be paid using a combination of CPF Ordinary Account (CPF OA) savings and cash. The minimum cash down-payment is 5%. For example, if the purchase price of your BTO is S$400,000, your down-payment would be S$80,000.

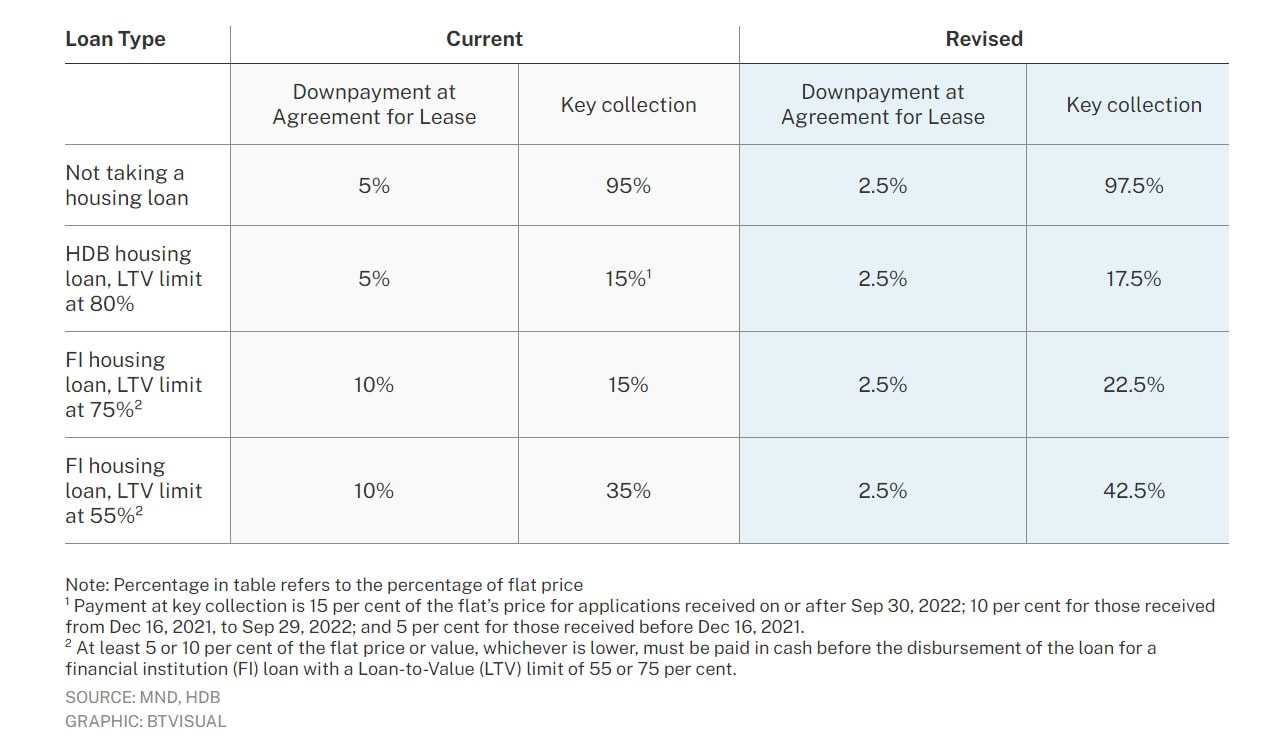

Under the current staggered down-payment scheme, these young couples are able to pay the minimum down-payment of 20 per cent for their flat in two instalments. The first down-payment is either 5 or 10 per cent, depending on the type of loan taken. The second instalment is due at key collection. Since they have deferred their income assessment, they will only receive their EHG closer to key collection and must rely on their own savings or support from family for initial costs of booking a flat thus the new enhanced staggered down-payment scheme will reduce the initial down-payment to 2.5 per cent.

Since 2018, more than 3,700 couples have tapped on the deferred income assessment, with support from the staggered downpayment scheme, to ease their upfront costs and start their home ownership journey early.

"This newly announced lower downpayment scheme may improve the application rate for Plus and Prime BTO flats as young couples may intend to stay longer in their flats and is more accepting of the 10 year MOP period" commented Kiwi Lim.

The Housing Development Board (HDB) is responsible for providing affordable public housing to the residents of Singapore with the majority of Singaporeans living in HDB flats, which are available for purchase or rent. HDB public housing estates are designed to promote community bonding and social cohesion through the provision of communal facilities, community programs, and events which helps to foster a sense of belonging and neighborliness among residents.

HDB plans, designs, and develops public housing estates across Singapore, including the construction of new HDB flats, upgrading of existing estates, and provision of amenities and facilities.

Real estate professional Kiwi Lim praised HDB for its efforts in consistently exploring and developing sustainable and innovative solutions for public housing, such as green building technologies, smart home features, and eco-friendly initiatives to reduce energy consumption and carbon footprint for its newer BTO estates, like in Tengah where forest and nature themes are featured strongly in the planning and design of the districts to weave nature into homes. The BTO estate of Tengah are designed with considerations in the 5 key elements of neighborhood landscapes - soil, flora and fauna, outdoor comfort, water, and people. All the districts in Tengah will incorporate biophilic designs to connect residents more closely to nature, to promote better health and well-being.

Reference: MND, Channelnewsasia & Business Times

RSS Feed

RSS Feed