Prime Minister Lee Hsien Loong and Malaysian Prime Minister Mahathir Mohamad reaffirmed the strong ties between Singapore and Malaysia. At the start of an official lunch at the Istana, Mr Lee said that while this was Dr Mahathir's first official visit to Singapore as the seventh prime minister of Malaysia, he is very familiar with the Republic, having visited many times and collaborated on bilateral projects such as the Linggiu Dam in Johor and the Second Link in Tuas. "Malaysia is Singapore's closest neighbour and vice versa. We are bound by geography and history. Our economies are extensively intertwined." Mr Lee noted that Singapore and Malaysia are each other's second-largest trading partners, and Singapore is Malaysia's second-largest foreign investor. "Our relationship is further strengthened by bonds of kinship, friendship and memories. We all have friends and relatives who live, study or work across the Causeway, and we feel at home when we visit each other," he added.

Putin breaks ground for new Russian Cultural Centre

A Russian Cultural Centre that houses a Russian Orthodox Church will rise at an empty plot of land in Rangoon Road near Little India, a symbol of Russia's growing ties with Singapore. The ground-breaking ceremony for the project was officiated by Russia's President Vladimir Putin and President Halimah Yacob, with the unveiling of a large cornerstone by the two leaders.

The ceremony was held just hours after Mr Putin arrived in Singapore for his two-day state visit, his first ever to Singapore, with this year marking the 50th anniversary of the establishment of diplomatic ties between the two countries. The last top Russian leader to visit Singapore was then-prime minister Dmitry Medvedev in 2009. There were 690 Russian companies in Singapore as of 2017. Russia is Singapore's 24th largest trading partner. Similarly, Singapore companies have ventured into many parts of Russia including in the Moscow, Tatarstan and Penza regions.

MAS launches US$5b kitty to woo fund managers to drop anchor here

The Monetary Authority of Singapore (MAS) is making a US$5 billion move to anchor fund managers in Singapore, in preparation for a scale-up in private market activity. This is the first time it is launching a fund for private market investments, to be managed by top global private equity and infrastructure fund managers. The managers must either be committed to deepening their existing presence in Singapore or establishing a significant one. Under the programme, MAS will allocate US$5 billion of its own capital as part of its investment in the private markets asset class. The fund was announced by Enterprise Singapore chairman and MAS board member Peter Ong at the Global Investor Summit, which is being held during this year's Singapore Fintech Festival.

Leaders of Asean's 10 members and six key trading partners vowed to seal a pact to create the world's largest free trade area next year - the Regional Comprehensive Economic Partnership (RCEP). Five more chapters of the pact were concluded this year, bringing the total to seven. And "significant breakthroughs" were made in negotiating parts on trading rules.

China, Singapore agree to deepen ties in various areas

Singapore-China relations have been "progressive, forward-looking and strategic", and leaders from both countries have committed to working closer together in a wide range of areas, from science and technology to trade and culture. The two governments said they would build on the foundations laid by past generations of leaders from both sides and maintain frequent high-level exchanges. They also vowed to keep to the principles of mutual respect, sovereign equality and noninterference in each other's internal affairs. Singapore will also maintain its consistent "one China" policy.

Singapore can achieve steady, sustained growth

Singapore's economy must continue to grow, and that is why the government is pressing on with its economic transformation plans, said Prime Minister Lee Hsien Loong. Speaking at the biennial People's Action Party conference at the Singapore Expo, he pointed out that there are already some early successes, and "companies big and small are restructuring themselves, embracing technology and training workers". He noted that high-tech industries such as robotics, aerospace engineering and digital farming have taken root in Singapore. The country's startup scene, meanwhile, is "beginning to thrive" in areas such as fintech, where a number of home-grown firms are doing well, he said. The prime minister made these remarks on the broader point about the importance of imbuing Singaporeans with hope for the future.

Asean on track to realise 2025 vision of free and open trade

Three agreements sewn up were billed as part of Asean's growing economic integration and the bloc's commitment to free, open trade, en route to its plan for 2025. The South-east Asian body must forge ahead with its 2025 vision for the Asean Economic Community (AEC), said Minister for Trade and Industry Chan Chun Sing, as he opened the AEC Council's afternoon meeting. "Against the backdrop of rising anti-globalisation sentiments and trade tensions, Asean will need to continue to stay open and connected, and leverage on our collective strength to navigate the disruptive trends and anchor our relevance to the global economy," he added. He noted that the region has already hit "critical milestones in Asean's transition towards AEC 2025".

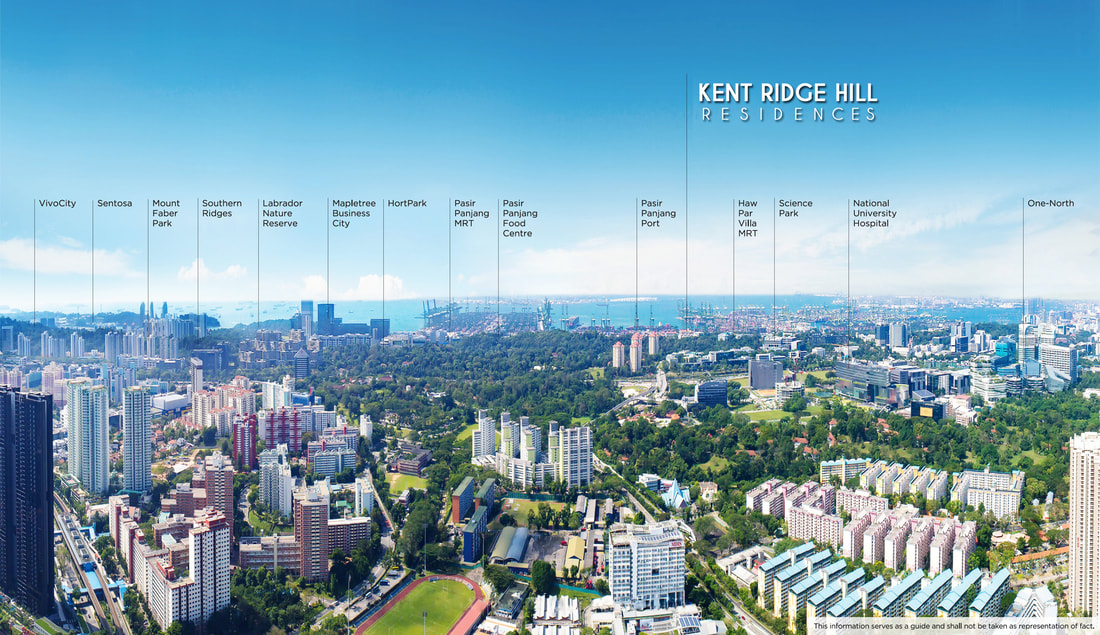

Almost half of the 250 units at Kent Ridge Hill Residences were sold at its official launch last weekend, said home-grown property developer Oxley Holdings. A total of 116 units at the five-storey property along South Buona Vista Road were snapped up on Saturday and Sunday, Oxley said in a news release on Tuesday.

The average price of the units sold was S$1,700 psf. Eighty per cent of the units sold comprised one-bedders, one-bedroom and a study, and two-bedroom units. The remaining 20 per cent were three-bedroom units, five-bedroom penthouses and strata landed homes. Four out of every five buyers were Singaporeans, and the rest were permanent residents and foreigners.

100 units of The Woodleigh Residences released for sale

The Woodleigh Residences sold 60 per cent of the 50 units released for sale during the soft launch, which prompted joint developers Kajima Development and Singapore Press Holdings to release another 50 units. Units sold over the weekend achieved an average of above S$2,000 psf. Located at the junction of Upper Serangoon and Upper Aljunied roads, The Woodleigh Residences is part of a mixed-use commercial and residential development that will feature 667 premium residential units overlooking Alkaff Lake and Bidadari Park, while The Woodleigh Mall will offer close to 28,000 sq m of retail, dining and commercial space. The 99-year-leasehold property comprises two-, three-, and four-bedroom units, which start at S$1,873 psf. A two-bedroom apartment has a starting price of S$1.088 million, while the fourbedroom units are S$2.55 million onwards.

October new private home sales fall, rebound seen this month on new launches

New private home sales slumped month-on-month in October owing to a dearth of new launches, but analysts expect sales to rebound in November, thanks to a slew of major launches. Developers in Singapore sold 487 private homes - excluding ECs - last month, falling nearly 48 per cent from the 932 units moved in September, and 36 per cent lower than the 761 units they booked in October last year. There was only one new launch - the 56-unit freehold condo 10 Evelyn located off Newton Road - which sold two units at a median price of $2,478 psf. The 202 units from existing projects launched for sale last month were the lowest number since February this year.

The trend is similar to that following earlier rounds of cooling measures "where the number of project launches, units launched and units sold eased in the third month of the measures", Huttons Asia head of research Lee Sze Teck noted. "This is likely to be a blip. Buyers are finding value in earlier launched projects and committing to a buy... Sales volumes are still heavily concentrated in the city fringe or rest of central region (RCR) largely due to a number of major launches in the RCR in 2018," he added. An analyst expects new sales to rebound this month, fuelled by new major launches such as Whistler Grand, Kent Ridge Residences, Parc Esta and Woodleigh Residences. "Total developer sales could potentially near or even exceed 1,000 units in November," she said.

Despite highlighting that the July cooling measures have affected sentiment in the Singapore residential property market, UOL Group is planning to launch two projects in the second quarter of next year. They are a freehold residential project with about 56 units on the former Nanak Mansions site in Meyer Road, and a 99-year leasehold project in Silat Avenue with about 1,074 residential units and 1,300 sq m of commercial space. Revenue shrank 3 per cent to S$523.8 million from the preceding year. The drop was due to a 43 per cent contraction in revenue from property development to S$165 million, due to lower recognition from Principal Garden and Botanique at Bartley as the projects approach completion in Q4 2018 and Q1 2019, respectively, as well as the completion of Alex Residences in September 2017. The revenue decline was partly offset by Amber45, which was launched in May this year, and higher revenue from The Clement Canopy project arising from the UIC consolidation.

Keppel Land ready to roll out AI-backed smart homes

Keppel Land and Habitap have unveiled Singapore's first smart home powered by artificial intelligence. This smart home that comes equipped with the machine learning capabilities is touted as being capable of anticipating users' preferences and usage patterns. Property developer Keppel Land said that it intends to apply such smart home systems at its upcoming residential development in Nassim Hill. This would not be the first deployment of smart home system in a Keppel Land's development. Back in 2016, Keppel Land had also collaborated with Habitap to deploy a smart home system at the former's Corals at Keppel Bay residential development. Similar smart mobile applications were rolled out for residents at three other Keppel Land's projects here - Highline Residences, The Glades and the Garden Residences.

Shoebox units remain popular with developers and buyers alike

The latest move by the government to revise a guideline that caps residential units in projects outside the Central Area (CA) is laudable in its intent to curb excessive building of shoebox units and prevent new projects from posing a strain on local infrastructure. Last month, URA announced a revision to the guideline by raising the average GFA parameter in the formula from 70 sqm to 85 sqm. While this move is widely seen as a response to the stark increase in new units from the many collective sale sites sold over the past two years, the reality is that this revised guideline would not apply to any of these sites.

This is because the revised guideline only applies to development applications submitted to URA from Jan 17 next year. Most collective sale sites sold to developers would already have their development applications for new projects submitted to URA before then, and would thus not be subject to the new guideline. For these sold collective sale sites, however, the maximum number of dwelling units is already capped by a pre-application feasibility study that developers need to undertake when seeking the approval of the Land Transport Authority (LTA). This is on top of an existing LTA requirement on Transport Impact Assessment for sites with at least 700 residential units. All things considered, while developers have been blamed for the ramp-up of shoebox apartments in their quest for profit maximisation, it is clear that there is demand for these small units. The total debt servicing ratio (TDSR) regime since June 2013 has clipped the capital outlay of aspiring homebuyers and investors.

Shoebox units appeal to a substantial group of quantum sensitive home buyers, singles looking to live separately, and investors. This is reflected in strong buying demand for shoebox units. In new non-landed projects outside the CA, shoebox units sold as a percentage of total sales continued to climb from 16 per cent in 2012 to as high as 22 per cent in 2016 and remains elevated at 19 per cent this year, based on caveats as of end-October. It is assumed that developers are keen to build more shoebox units because they can sell these units more quickly and peg a higher psf price. But there is a limit to how high these shoebox units can be priced without hurting their appeal to quantum-sensitive home buyers. An exceedingly high psf pricing will also turn yield-seeking investors away.

Tengah flats among 7,214 HDB units launched for sale

The Housing Board launched 7,214 flats for sale under the Build-To-Order (BTO) and Sale of Balance Flats exercise this month. There are 3,802 BTO units for sale, with prices ranging from $101,000 (excluding grants) for a two-room Flexi unit in non-mature estate Tengah, to over $472,000 (excluding grants) for a fiveroom flat in mature estate Tampines. The number includes 1,620 flats at BTO project Plantation Grove in Tengah, Singapore's first new town in more than 20 years after Punggol, as well as the first batch of BTO flats with shorter waiting times. Tengah is touted as the first "forest town" in Singapore, and will have a car-free town centre and lush greenery around the site. The town will be about 700ha, roughly the size of Bishan. Buyers of the BTO project in Tengah can also opt to subscribe to a centralised cooling system, the first to be piloted in an HDB estate, instead of installing their own air-conditioning units. The November launch also comprises the first batch of BTO flats with shorter waiting times, of two to three years from application, in the Sembawang, Sengkang and Yishun projects. The usual waiting time is about three to four years. There are also 3,412 Sale of Balance Flats for sale in locations such as Bukit Batok, Bishan and Clementi.

RSS Feed

RSS Feed