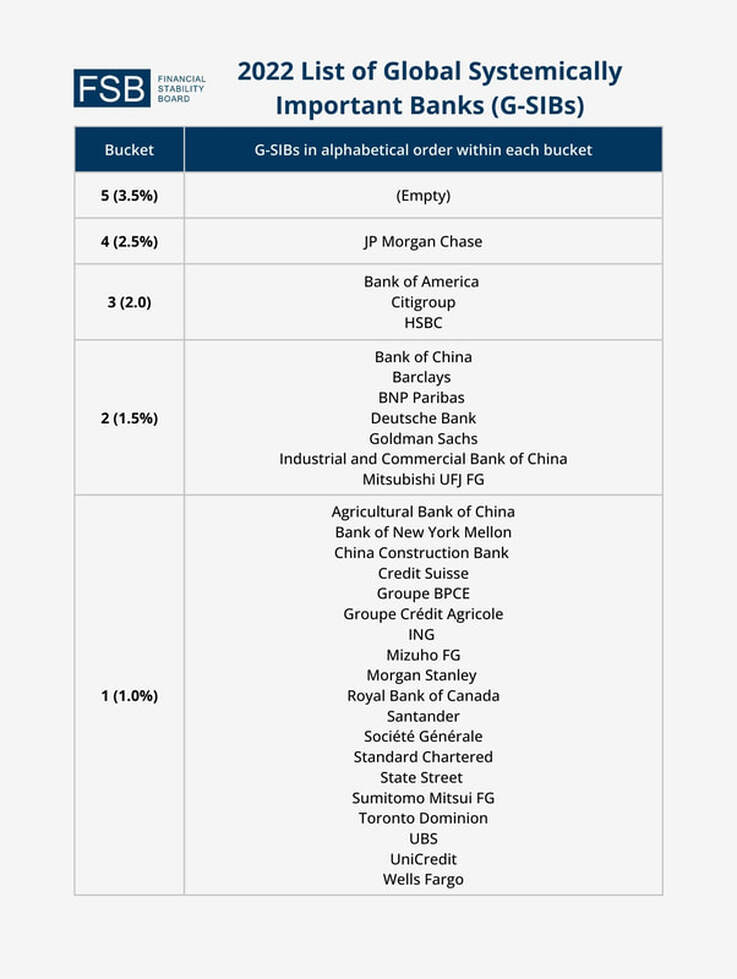

It started with Silicon Valley Bank, Silvergate and Signature Bank in New York and most recently the 2nd largest bank in Switzerland - Credit Suisse, a powerful bank that were deemed to be too big to fail by The Financial Stability Board (FSB) that has shortlisted 30 super important banks globally popularly known as Global Systemically Important Banks (G-SIBs). These 30 G-SIB banks are vital to the world's financial banking system and whose potential failure of any of these banks could have a systemic impact on the global financial system.

What is a Banking Contagion?

With 4 well established banks collapsing in a matter of days across America and Europe, global markets fear that other banks will continue to fail one after another impacting the banking and financial industry in a term we call "Banking Contagion" or the potential for depositors' fears about bank safety to migrate to other institutions, causing more bank runs and additional failures. No central bank will want to see such a situation.

"Even though the American and Swiss governments step in to bailout these failed banks in their efforts to contain this Banking Contagion, people wonder whether more banks are hiding unpleasant surprises. and are afraid of what they don't know." said real estate professional Kiwi Lim.

"Credit Suisse is the main shocker being among the 30 G-SIBs that is evaluated to have a high systemic importance to world banking and financial operations. Since bank runs are a crisis of confidence and confidence is at a low now, I expect to hear more news of bank failures among the thousands of small and regional banks in the United States and Europe in the upcoming months."

UBS bank appeared as the knight in white armour by agreeing to buy over rival Credit Suisse in an eleventh-hour merger engineered by the Swiss government, as the world’s central banks tries to reassure investors about the health of the banking system. Credit Suisse was 'super cheaply sold' to UBS at a bargain price of 3 billion Swiss francs (S$4.34 billion) and UBS will assume up to US$5.4 billion in losses in a deal expected to close by the end of 2023.

The Financial Stability Board (FSB), an international body that monitors and makes recommendations about the global financial system, maintains a list of "global systemically important banks" (G-SIBs) that are considered to be the most systemically important institutions.

Global Systemically Important Banks (G-SIBs) are banks that are deemed to be too big to fail and whose potential failure could have a systemic impact on the global financial system. The Financial Stability Board (FSB) is responsible for identifying G-SIBs on an annual basis.

FSB member authorities apply the following requirements to G-SIBs:

- Higher capital buffer: The G-SIBs are allocated to buckets corresponding to higher capital buffers that they are required to hold by national authorities in accordance with international standards. Total Loss-Absorbing Capacity (TLAC): G-SIBs are required to meet the TLAC standard, alongside the regulatory capital requirements set out in the Basel III framework.

- Resolvability: These include group-wide resolution planning and regular resolvability assessments.

- Higher supervisory expectations: These include supervisory expectations for risk management functions, risk data aggregation capabilities, risk governance and internal controls.

- Bailouts: Governments can provide financial assistance to troubled banks by injecting capital or buying their assets to keep them afloat. This can help stabilize the financial system and prevent a wider economic crisis.

- Regulation: Governments can introduce regulations to ensure that banks operate in a safe and sound manner. This can include requirements for banks to maintain sufficient capital and liquidity, conduct regular stress tests, and adhere to strict lending standards.

- Deposit insurance: Governments can also provide deposit insurance to protect customers' deposits in case of bank failures. This can help maintain confidence in the banking system and prevent bank runs.

- Coordination: Governments can work together with other countries or with large banks to coordinate their responses to bank crises. This can involve sharing information, providing assistance to each other's financial systems, and collaborating on international regulatory standards.

As of now, America is debating if they need to temporarily expand Federal Deposit Insurance Corporation (FDIC) coverage to all deposits, a move sought by a coalition of banks arguing that it is needed to head off a potential financial crisis. This is a big authorities do not yet view such a move as necessary, especially after regulators took steps this month to help banks keep up with any demands for withdrawals but they too worry in case the situation worsens.

Deposit insurance is a tightrope act. On the one hand, a full deposit insurance that covers all deposits regardless of amount can significantly reduce the incidence of bank runs or even stop runs altogether in countries with strong institutions and proper safeguards. On the other hand, when not done carefully, such explicit deposit insurance can fuel bank crises by giving banks perverse incentives to take unnecessary risks.

"I believe The Federal Reserve may reverse their plans and decide to lower interest rates towards the end of 2024 as inflation, employment rates, GDP growth are expected to fall next year amidst weak global economic conditions widely linked to the sharp rise in borrowing costs. We all know The Federal Reserve's primary goal is to maintain stable prices and maximum employment, and they adjust interest rates to achieve these goals. If inflation is low and the unemployment rate is high, the Fed may lower interest rates to stimulate economic growth and increase employment." said market observer - Kiwi Lim.

"The Fed's decision-making process is complex and takes into account many different factors, so it's difficult to predict with certainty whether they will lower rates in 2024. But in my own opinion, there is a very high possibility where we may see home loan mortgage rates in Singapore drop to below 3% interest rates from 3rd quarter of next year 2024 onwards as The Fed tries to stabilise the banking and financial markets as well as providing a boost to the largest economy in the world"

RSS Feed

RSS Feed