Housing Board resale flat prices rose for the 17th consecutive month, climbing at a faster pace of 1.3 per cent in November compared with October, according to flash data from real estate portals 99.co and SRX on 9 Dec 2021 (Thursday).

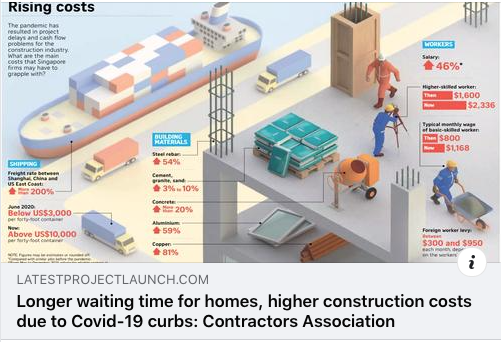

Home prices are pushing new boundaries as demand outweighs supply in many locations. The market exuberance has been propped by a recovering economy, low mortgage rates and new buyer demand as a result of construction delays of Build-To-Order (BTO) flats.

Property analysts are widely expecting the robust performance seen in the HDB resale market to continue into 2022, largely on the back of fears of further construction delays in BTO projects after the detection of the Omicron variant. The emergence of Omicron has shown that the Covid-19 pandemic will take much longer than expected to resolve, which may further boost prices of HDB resale flats.

In November this year, a total of 2,586 HDB resale flats changed hands, an increase of 3.2 per cent from the month before. Some buyers may have turned to the HDB resale market as the completion periods can be "quite long" for some of the new BTO launches, especially projects in the mature estates as buyers feel uncertain about the completion periods of BTO project.

Between 29,000 and 30,000 flats is expected to change hands this year, with prices up by another 2 per cent to 2.5 per cent in the last quarter of 2021 bringing the overall average price increase for the whole of 2021 to more than 11 per cent, the biggest jump since 2010. Kiwi Lim from Huttons Asia noted that the increase in resale HDB prices are also seen across non-mature estates, for example the highest transaction price in non-mature estates was $970,000 for a five-room loft unit at Treelodge @ Punggol according to SRX.

The increase in HDB resale flat prices is caused by the mismatch in supply and demand, which, in turn, is caused by the supply chain disruption and delays in the construction industry that are induced by the pandemic, unless the construction delays of BTO flats are resolved, the mismatch can cause HDB resale flat prices to rise by at least another 7 per cent in 2022.

RSS Feed

RSS Feed