The SRPI Central index saw the strongest growth since April 2017, rising 3.9% over the five-month period. This is due to the limited supply of newly launched private residential homes in the Central Region, which causes buyers to turn to the resale market. In September, the Central index rose 0.4% month-on-month.

The SRPI Non-Central index also saw a 2.1% increase over the same five-month period. The SRPI Small Units index rose just 0.3% over the five month period, but registered the strongest growth for September alone, rising 0.9% month-on-month. These indicate that the Singapore property market is poised for a recovery as investors from Asia turn their focus to Singapore due to our stable government and Singapore's attractive property prices compared with property in their own Asian cities.

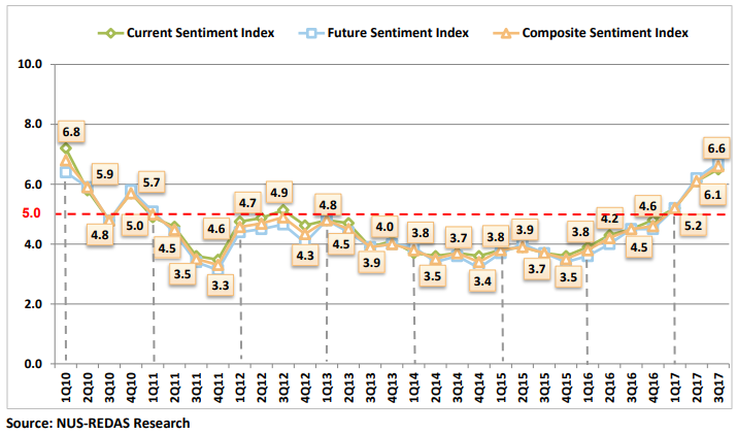

Both the property indices reflecting current and future sentiment rose from 2nd Quarter 2017, continuing the uptrend from 4th Quarter 2015. Every quarter of the year, National University of Singapore and REDAS holds a survey among senior executives of REDAS member firms to measure real estate market sentiment in Singapore. A score above 5 indicates improving conditions.

In August, prices for private non-landed homes excluding small units in the central region were up 1%, compared to 0.1% month-on-month increase in July. Prices for private non-landed homes excluding small units in the non-central region also saw a gain of 0.9%, after a 1.1% hike in July. Meanwhile, prices of small units (up to 506 sq ft) climbed 0.3%, following a 0.6% decline in July.

RSS Feed

RSS Feed