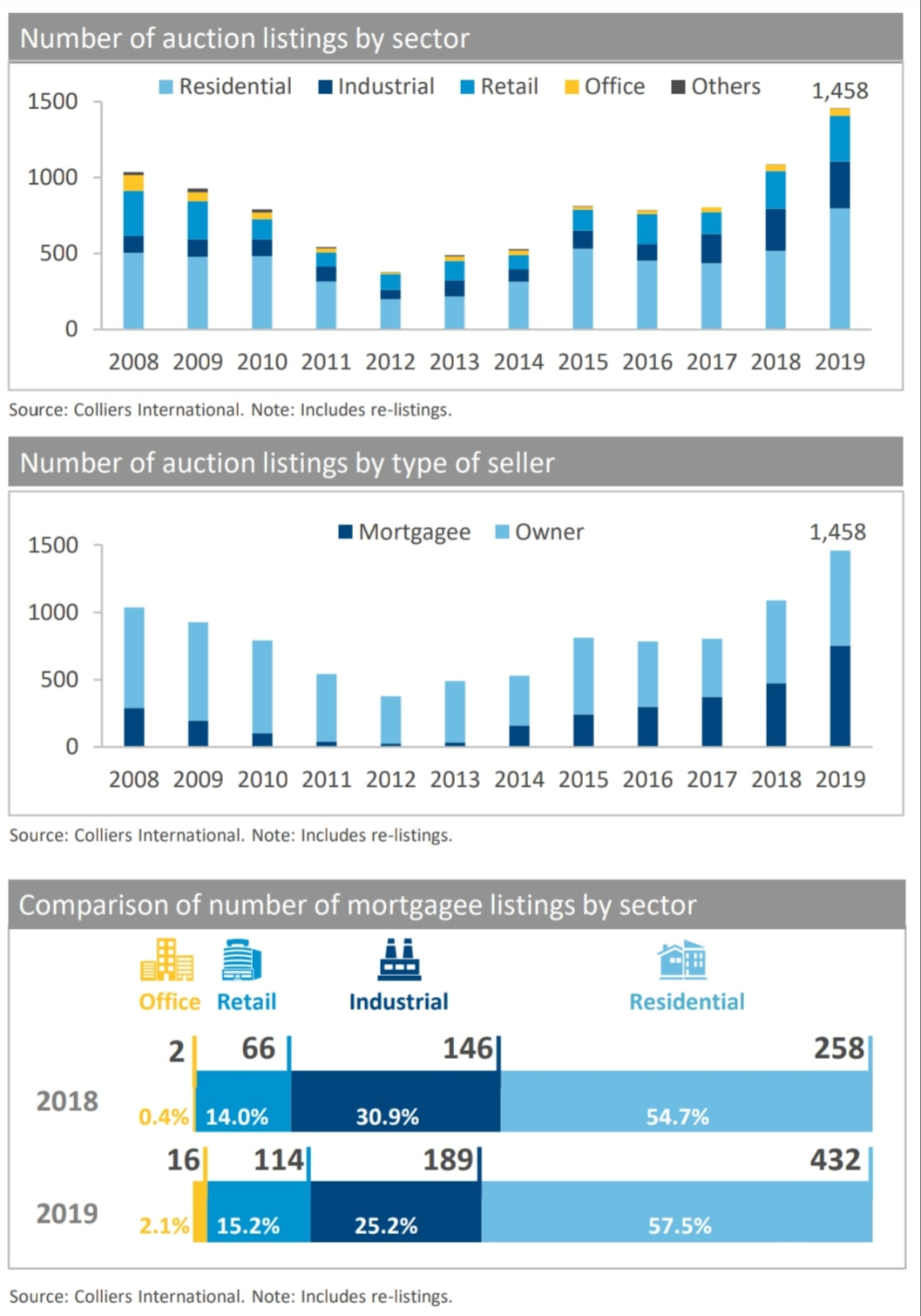

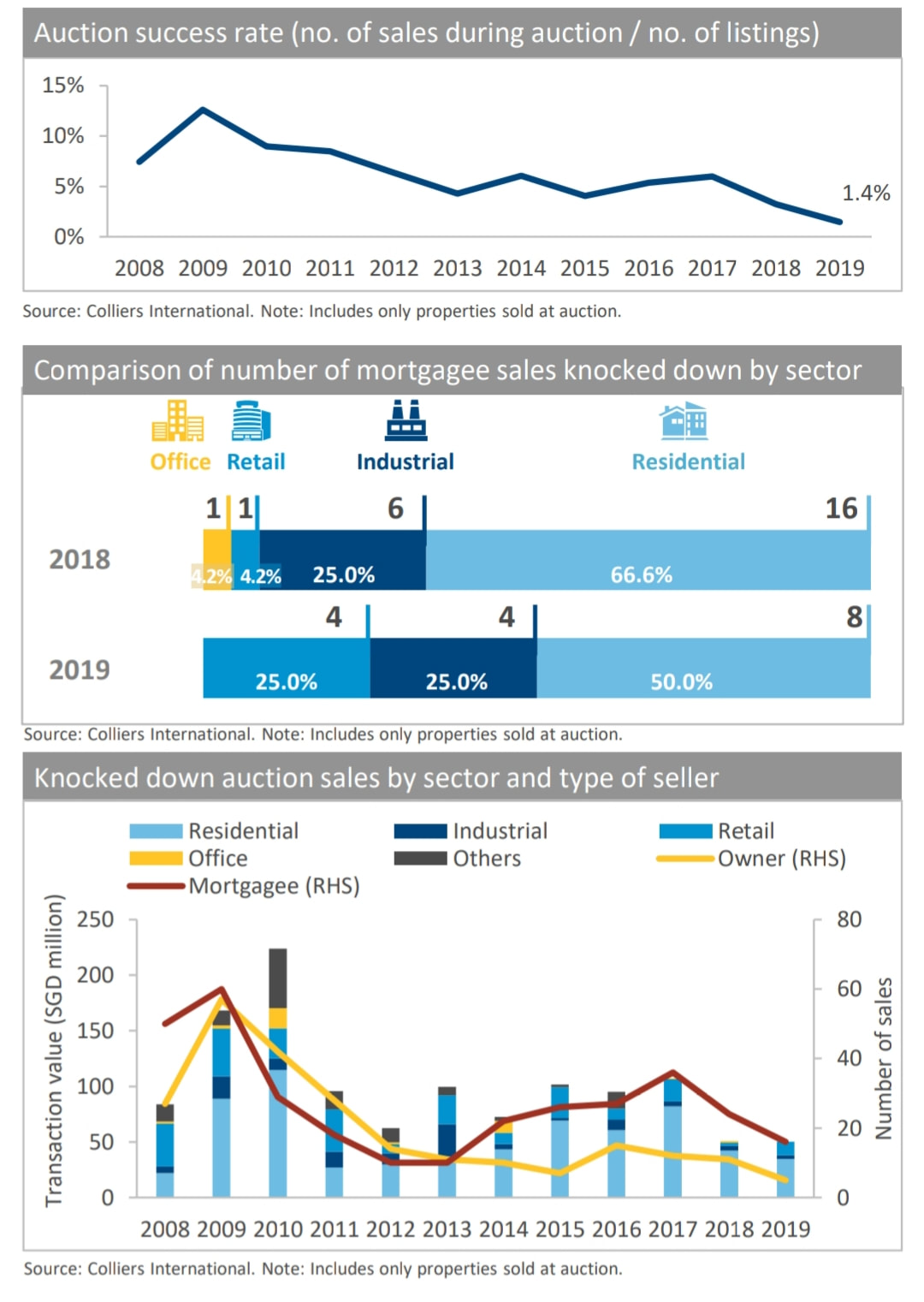

With rising listings, the success rate fell further to 1.4% in 2019, lower than the 3.2% achieved in 2018 and the lowest annual level in our database. However, this rate does not take into account properties sold before or after the auctions. The results from Colliers International’s auctions indicated that the success rate including sales during and outside of Colliers’ auctions and excludes re-listings, was much higher at 13.3% in 2019. Of the 21 properties knocked down during auctions in 2019, 16 (or 76.2%) were mortgagee sales, a decline of 33.3% YOY from 24 in 2018. Of these 16 mortgagee sales in 2019, eight were residential (down 50.0% YOY), four were industrial (down 33.3% YOY) and four were retail (up four times YOY).

Personal circumstances such as loss of job or bankruptcy could also have led to higher defaults. After cooling measures in July 2018, possibly more distressed owners were unable to dispose of properties quickly enough, leading to default. Retail mortgagee listings saw a 72.7% increase YOY to 114 as many were small units in strata-titled malls or locations with low foot traffic which had difficulty finding tenants or sustainable rents, leaving owners unable to support mortgage payments. Industrial mortgagee listings rose by 29.5% YOY to 189 while office mortgagee listings surged by eight times YOY to 16.

Colliers expected an increase in distressed or mortgagee sales in the retail, industrial and residential sectors from the ongoing COVID-19 outbreak especially if it precipitates a downturn into H2 2020 with prices to be more realistic, leading to an improved success rate.

RSS Feed

RSS Feed