Whistleblowers who call out private property buyers who use the so-called “99-to-1” or similar arrangements to evade or reduce additional buyer’s stamp duty (ABSD) on their purchase willbe rewarded up to $100,000 in cold hard cash by the Government agency responsible for the administration of taxes and enterprise disbursement schemes.

IRAS revealed it is unable to disclose “the number of 99-to-1 transactions that it has identified, including similar arrangements, as well as the number of buyers who have been penalised, or the number of promoters/facilitators who have been referred to the relevant regulatory agencies but its audit will be done in phases and that it will also probe transactions after 2021.

As part of tax surveillance efforts, the Inland Revenue Authority of Singapore detected “a small but rising number” of such deals in recent years which led IRAS to start audits of such transactions. If IRAS finds cases of tax avoidance, it will recover the rightful amount of stamp duty from the buyers and may impose a 50 per cent surcharge on the additional stamp duty payable.

Such arrangements generally make up a very small proportion of overall transactions, the impact on the residential and mortgage markets is not significant. As for individuals who promote or facilitate such arrangements, they will also be dealt with. Property agents, for example, will be referred to the Council for Estate Agencies for investigation and disciplinary action. They may face financial penalties and suspension of registration.

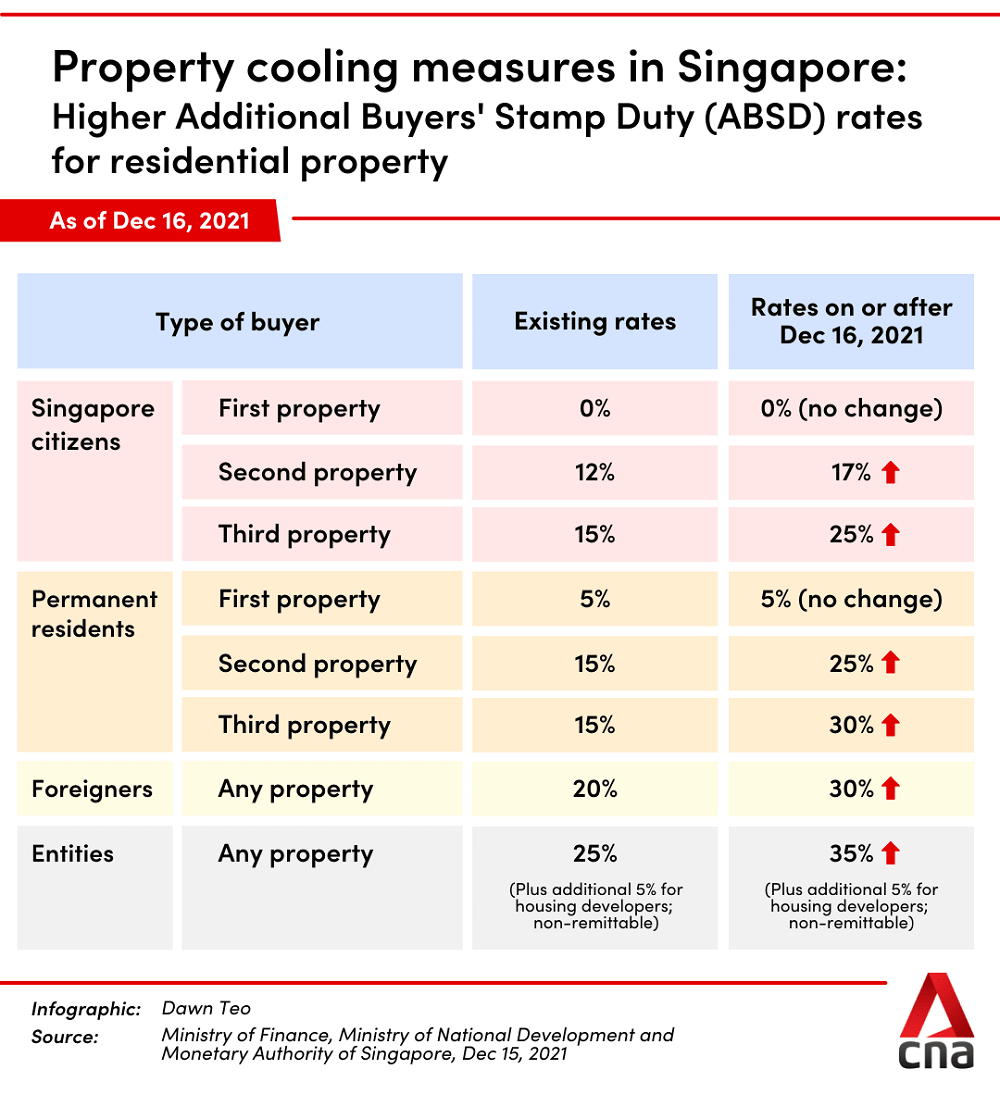

Property curbs such as ABSD were introduced in December 2011, with a 3 per cent duty tacked on Singaporeans’ third and subsequent property purchases. Permanent residents buying a second or subsequent residential unit had to pay ABSD of 3 per cent, while foreigners paid 10 per cent ABSD for every property.

Singaporeans now pay 17 per cent ABSD on their second residential property, and 25 per cent on third and subsequent homes. Foreigners now pay 30 per cent ABSD on property purchased.

This is not the first time Iras has offered a reward for information on tax avoidance or evasion. Those who are aware of those who entered into such tax avoidance or tax evasion arrangements can write to Iras at [email protected]

Taxpayers who wish to come forward voluntarily to disclose and make good any underpayment of taxes may do so, and Iras will, in general, look at such cases more favorably.

In cases of tax avoidance, the Commissioner of Stamp Duties will disregard or vary any tax avoidance arrangement, recover the rightful amount of stamp duty and impose a 50 per cent surcharge on the additional duty payable. Further penalties of up to four times the outstanding amount may be imposed if the stamp duty and surcharge are not paid by the deadline.

Reward payments are at the discretion of Iras, which said it will keep confidential the identities of informants and documents/information - reference from Straits Times news article.

RSS Feed

RSS Feed