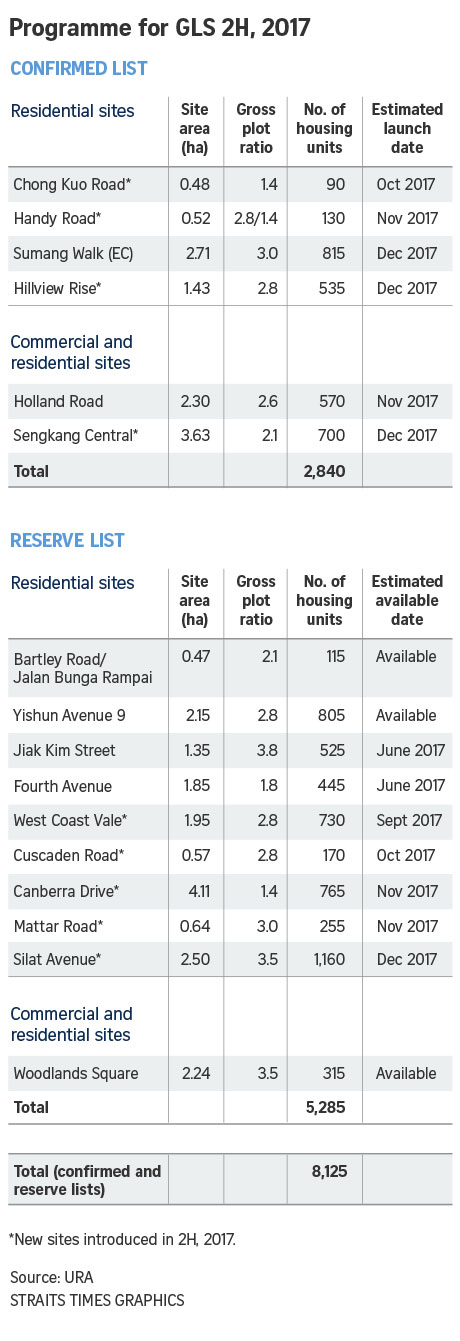

There are 16 sites on the Government Land Sales programme for the second half of the year. These can yield up to 8,125 private homes, up from the 7,465 units offered in the first half, the Ministry of National Development said yesterday. Although more development sites will be available to meet the demand for land from developers keen to capitalise on a recovering property market analysts warn that the increased land supply for the next six months may still not be enough to satisfy developers, who have been aggressively bidding for sites recently.

This arises from a need to ensure "an adequate pipeline supply of new private housing units to meet the needs of our population", the ministry said, adding: "As the demand for new private housing from home buyers continued to rise in the first half of 2017, the number of unsold private housing units in the pipeline has declined.

The reserve list has 10 sites - nine private residential and one commercial. They can accommodate 5,285 private homes and 56,790 sq m gross floor area of commercial space, mostly for office use.

Confirmed-list sites go on sale regardless of interest, while those on the reserve list are launched only when a developer commits to an acceptable bid.

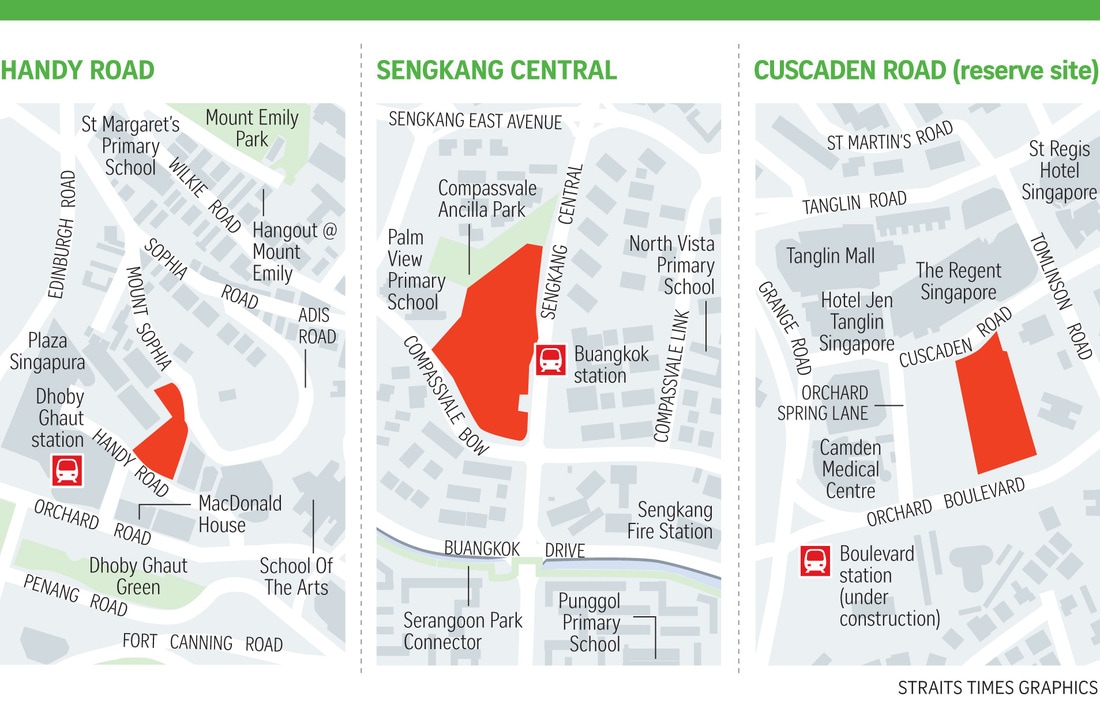

Analysts say the private residential sites in Jiak Kim Street, Fourth Avenue and Cuscaden Road on the reserve list are the ones most likely to interest developers, owing to their prime locations. "These offer very palatable quantums and are expected to set new benchmarks," said Mr Desmond Sim, head of CBRE Research for Singapore and South-east Asia.

Government land sales for future residential developments have garnered strong interest of late. Earlier this month (June), bids topped S$1.1 billion for a a 99-year-leasehold mixed commercial and residential site in Bidadari estate. Meanwhile, two China-based developers crossed the billion-dollar mark for a wholly residential site in May, with their bid for a plot in Queenstown.

This comes amid a decline in both supply and vacancies in the private residential market. Pipeline supply (including ECs) dropped to 46,016 units in the first three months of this year from 50,548 units in the final quarter of last year, Urban Redevelopment Authority's data showed. Excluding ECs, incoming supply declined to 36,942 units in the first quarter this year from 40,913 units in the previous quarter. Over the same period, the vacancy rate for the same stable of residential units dipped by 0.3 percentage points, to 8.1 per cent from 8.4 per cent.

RSS Feed

RSS Feed