From 9 May 2023, HDB flat buyers must have a valid HFE letter when they:

a) apply for a flat from HDB during a sales launch or open booking of flats; or

b) obtain an Option to Purchase (OTP) from a flat seller, as well as when they submit a resale application to HDB.

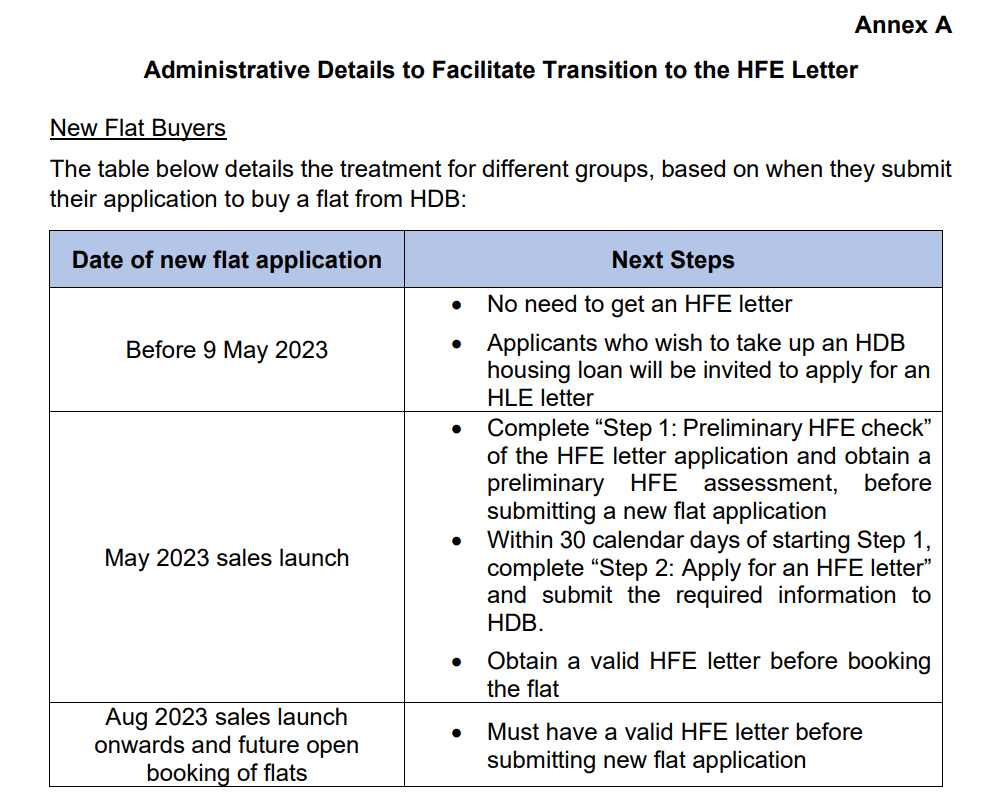

There will be transitionary arrangements made for various groups of home buyers / applicants. Please refer to Annex A for the administrative details for new and resale flat buyers at various stages of their home-buying journey.

In addition to the HFE letter, HDB will also be rolling out several improvements to the HDB Flat Portal on May 9, 2023, such as an integrated loan application service with participating financial institutions.

The portal will also have features to guide flat buyers, who can receive "personalised information" on their flat application.

HDB explained that the information will help them plan and prepare at different stages of their flat purchase journey, such as working out their financial/ payment plans early.

The HDB Resale Portal will also be integrated into the HDB Flat Portal to provide convenient transactions between flat sellers and buyers.

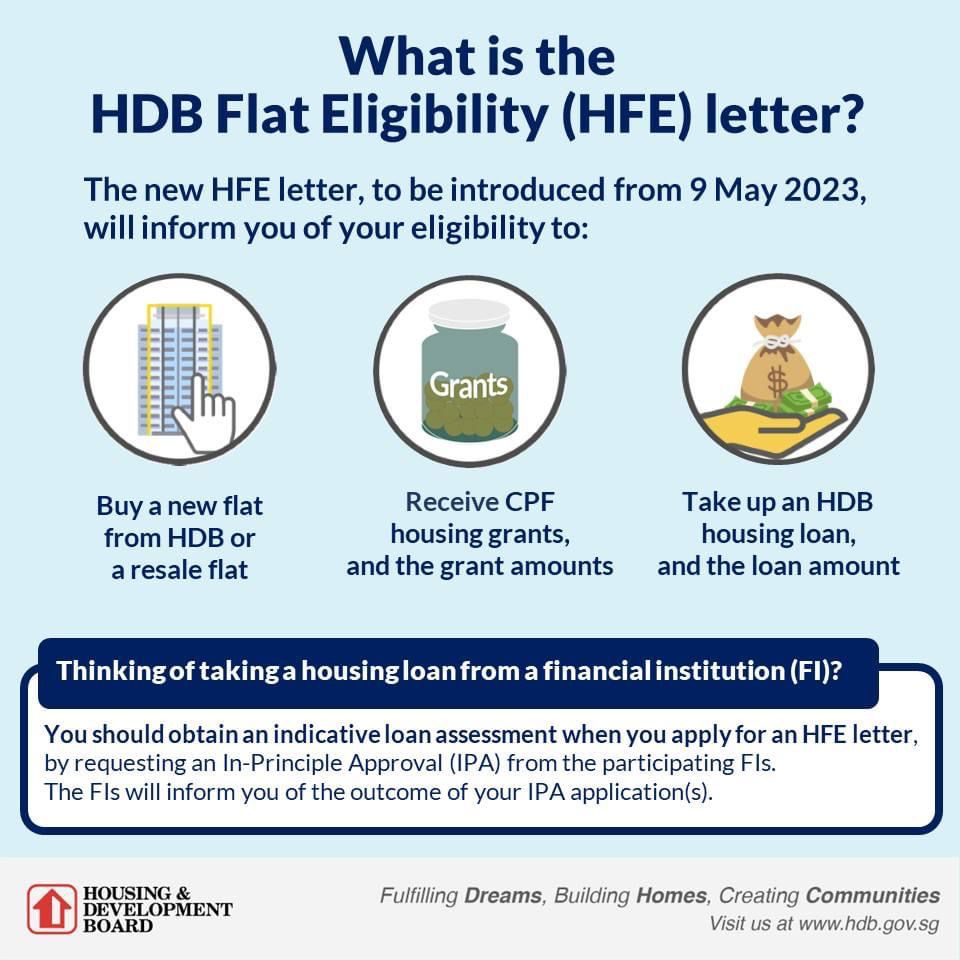

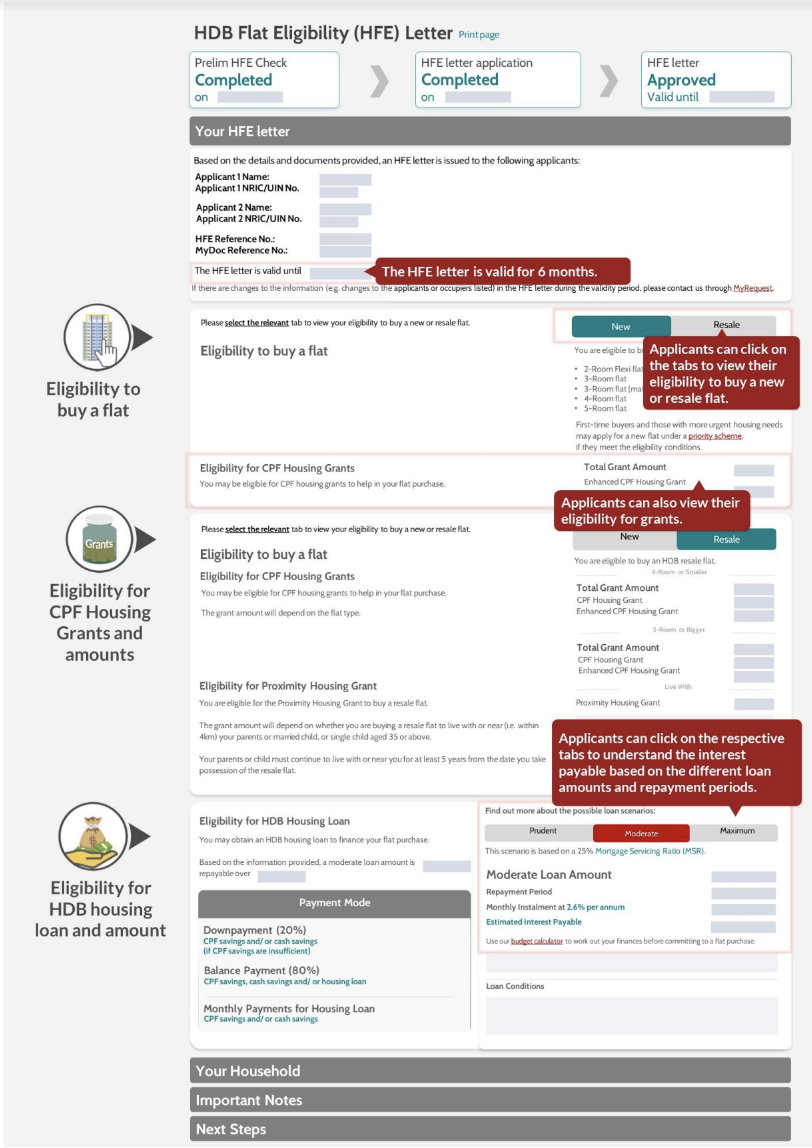

Currently, HDB assesses flat buyers’ eligibility for flat purchase, CPF housing grants and HDB housing loans at different stages of their home buying journey. At each assessment, flat buyers must provide the relevant supporting documents (e.g., pay slips and CPF statements) to HDB for verification. Also, when they apply for a new flat or secure the purchase of a resale flat, their eligibility for the flat purchase and housing grants have yet to be confirmed. This may lead to some uncertainty among flat buyers on their housing budget.

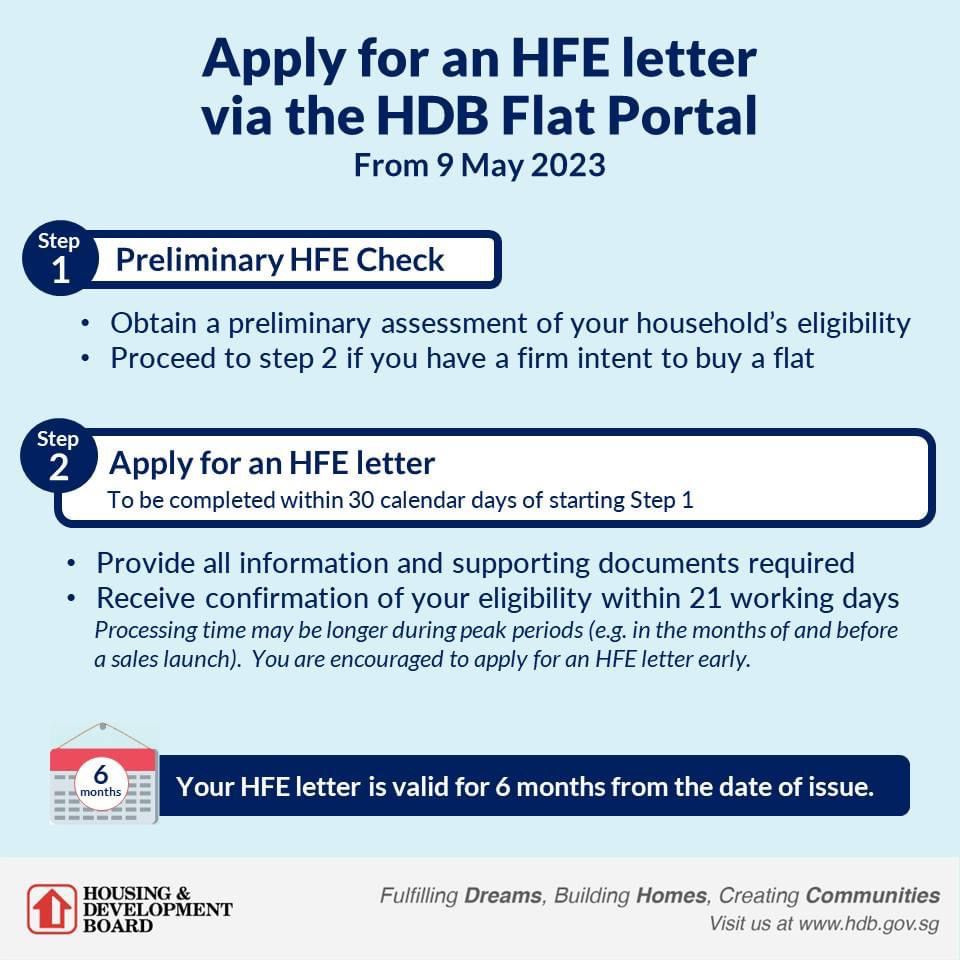

With the new HFE letter, HDB will streamline the flat buying process by integrating the different eligibility assessments for HDB flat purchases, housing grants, and HDB housing loans into a single application through the HDB Flat Portal. This will bring about more certainty and convenience to flat buyers. With greater clarity upfront on their housing budget and financing options, flat buyers will also be able to make more informed and prudent decisions in their home purchase (see above chart).

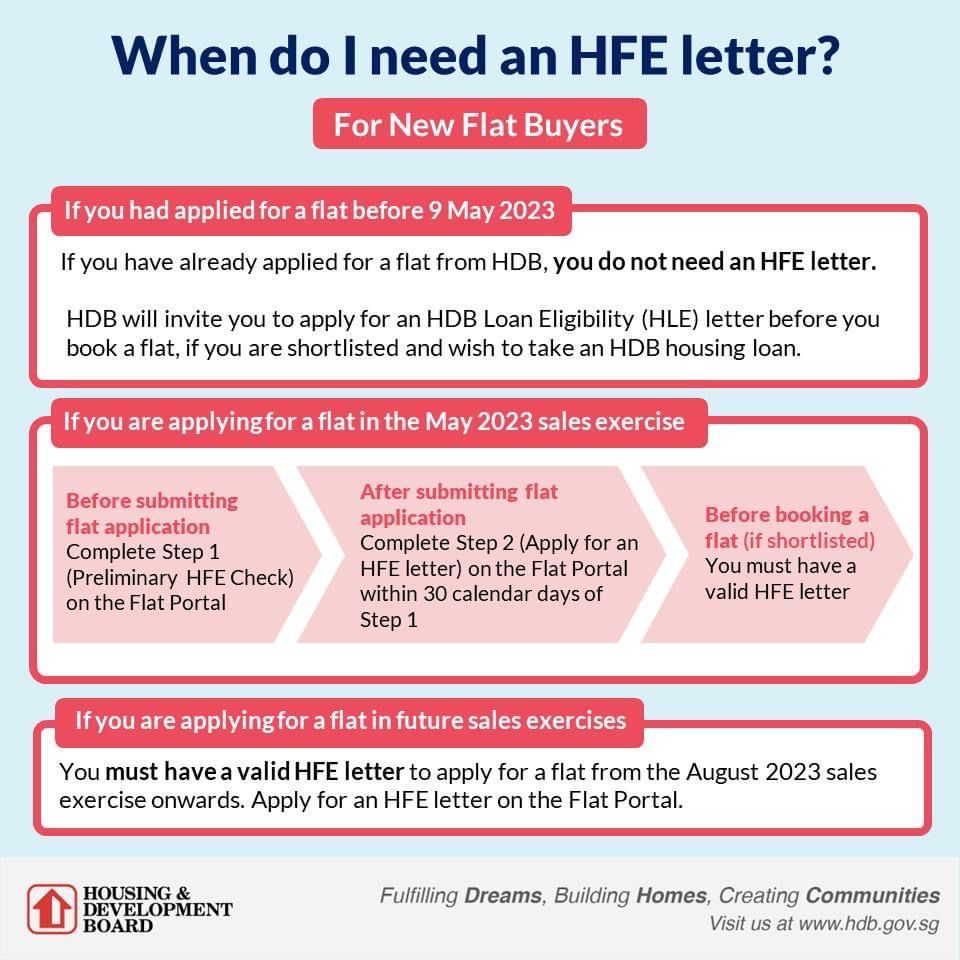

New flat buyers who apply before May 9 will not need an HFE letter, but will be invited to apply for an HLE letter should they wish to take up an HDB housing loan.

Those looking to book a flat from a May 2023 sales launch must obtain a valid HFE letter before booking the flat.

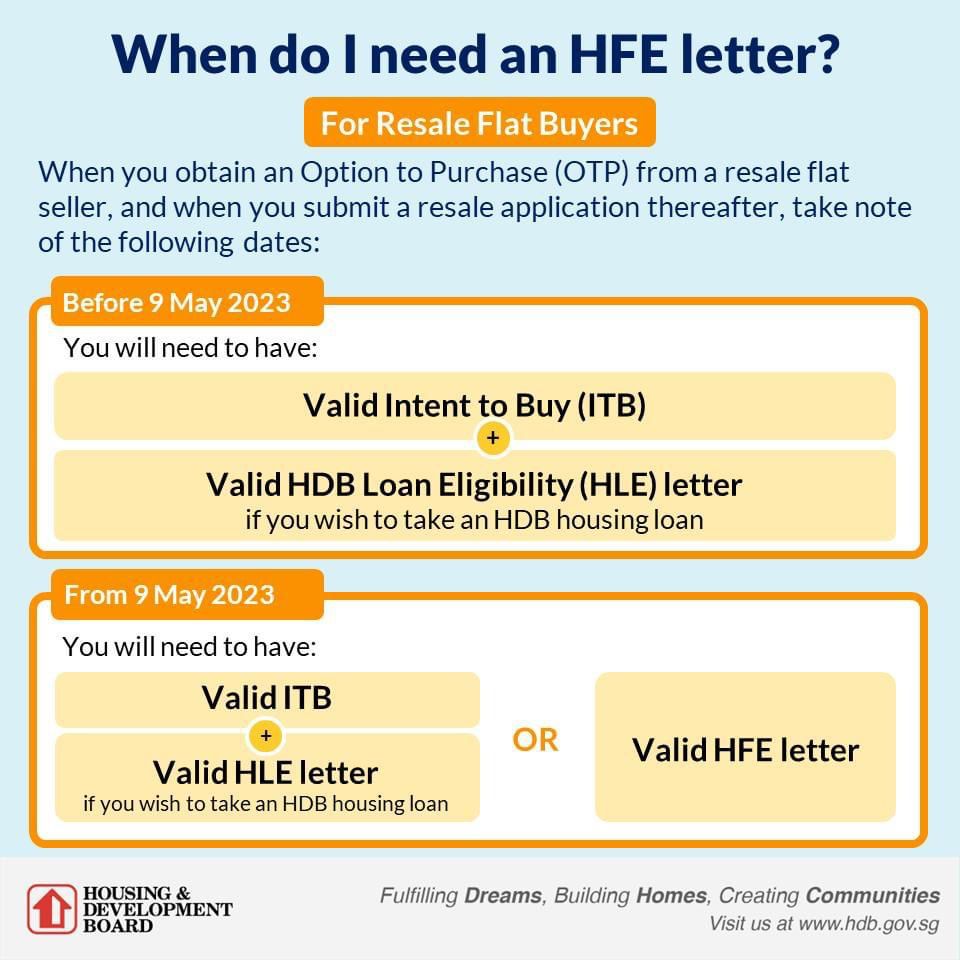

From May 9, 2023, resale HDB flat buyers who do not have an Intent To Buy (ITB) will need to obtain an HFE letter before they obtain an OTP from a flat seller and submit the resale application to HDB.

Those resale HDB flat buyers who already have an Intent To Buy (ITB) and want to take up an HDB housing loan but do not have a valid HLE letter will also need to obtain an HFE letter.

Resale HDB flat buyers with Intent To Buy (ITB) who either have a valid HFE letter or are not intending to procure a housing loan from HDB can proceed with their resale application.

RSS Feed

RSS Feed