CEL Real Estate Development’s offer to buy over the estate is close to 30 per cent higher than the asking price, and analysts said that it was unexpected given that the mixed development, with residential and retail units, is not in a central location. Chip Eng Seng said that it intends to develop a low-rise residential condominium on the site, comprising around 320 units, with full facilities and possibly some retail shops.

The estate, located at the junction of Upper Changi Road North and Jalan Mariam, comprises 60 apartments, 12 penthouses and 12 shops. Chip Eng Seng beat eight other bidders to win the tender. The purchase price works out to S$888 per square foot (psf) per plot ratio for the 200,093 sqft site.

Analysts noted that the asking price is already considered high, but the developer is willing to bid even higher therefore translating to higher prices when the new development is launched towards the end of next year. Market analysts said the price reflects the confidence the developer has in the property market in the short term, that prices will increase. The estimated break-even price is calculated to be around from S$1,350 psf to S$1,400 psf.

Due to severe land constraint in Singapore, current supply of GLS land parcels are very limited and therefore faced with land supply shortage, developers have to aggressively bid for enbloc sites to stock up on their landbanks.

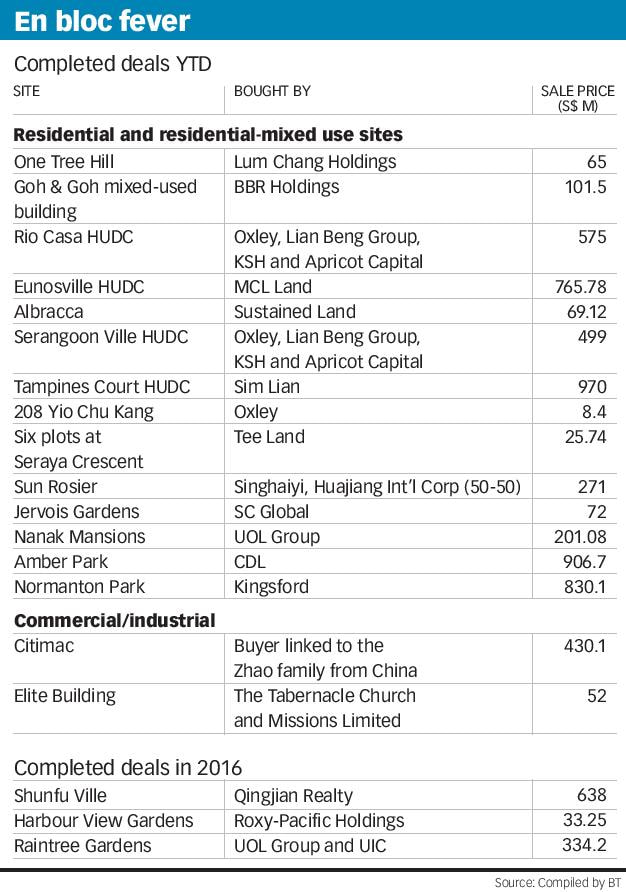

Chinese developers are also keen to hold commercial properties here for recurring income. In July, a buyer said to be linked to the Zhao family from China acquired freehold industrial complex Citimac.

Talk in the market is that the SingHaiyi joint venture was in such hurry to seal the deal for Sun Rosier that it came without representation from lawyers and without amendments to any terms in the collective sales agreement.

RSS Feed

RSS Feed