La Ville sold for $152 million to Hong Kong-listed property firm ZACD Group

La Ville’s third collective enbloc sale attempt saw the 40 unit residential development located at Tanjong Rhu sold for $152 million to Hong Kong-listed property firm ZACD Group translating to a land rate of $1,540 psf per plot ratio (ppr). After factoring in an additional 7% bonus gross floor area (GFA), the unit land rate will be about $1,477 psf ppr.

Built in the 1980s, the 40-unit La Ville sits on a freehold land area of 47,012 sq ft. The site is zoned residential with a plot ratio of 2.1 under the 2019 Master Plan. The site has the potential to be redeveloped into a new 107-unit condominium project based on an average size of 85 sqm (915 sq ft). The lucky owners of La Ville is expected to receive between $3 million and $5.9 million per unit.

Built around 1977, Peace Centre and Peace Mansion are two properties that sit on a single commercial site at 1 Sophia Road comprising 319 strata units, with 232 commercial units, 86 apartments and a carpark with 162 lots.

Peace Centre and Peace Mansion, two properties that sit on a single commercial site at 1 Sophia Road have been sold for $650 million in a collective sale to a joint venture (JV) comprising CEL Development, SingHaiyi Crystal, and Ultra Infinity subject, among others, to the joint offerors obtaining a sale order approving the collective sale, meeting planning criteria and getting the lease topped up.

The joint venture group will apply to top-up the lease and also seek approval from the URA to redevelop the property into a mixed-use commercial and residential development. The site, which spans 7,118 sq m, is currently zoned "commercial", near shopping amenities such as Bugis Junction with six MRT stations within 1km distance and near educational institutions such as Singapore Management University, the School of the Arts, Lasalle College of the Arts, Nanyang Academy of Fine Arts.

At the sale price of S$650 million, based on a new development comprising 60 per cent commercial and 40 per cent residential quantum, the unit land rate after including an estimated lease top-up premium is approximately S$1,426 per sq ft per plot ratio, or S$1,388 per sq ft per plot ratio after factoring in an additional 7 per cent bonus gross floor area for the residential component.

Chuan Park condominium has closed its tender and is currently "in a private treaty negotiation process" after the 400,588.72 sq ft residential development received some interest from developers in its enbloc collective sale attempt.

Located beside Lorong Chuan MRT, Chuan Park condominium comprises 444 residential apartments, a food and beverage space not currently occupied, as well as a supermarket. Developed by Golden Developer, a unit of Far East Organization, the property has a 99-year lease which began in 1980. The lease will expire on June 5, 2079, or in about 58 years.

In 2018, Chuan Park condominium tried for a collective sale with an asking price of $900 million, but could not secure the necessary 80 per cent consent of owners. This came even after the asking price was raised from its initial $790 million. More than 80 per cent of the owners consented to the tender in October this year with an indicative price of $938 million.

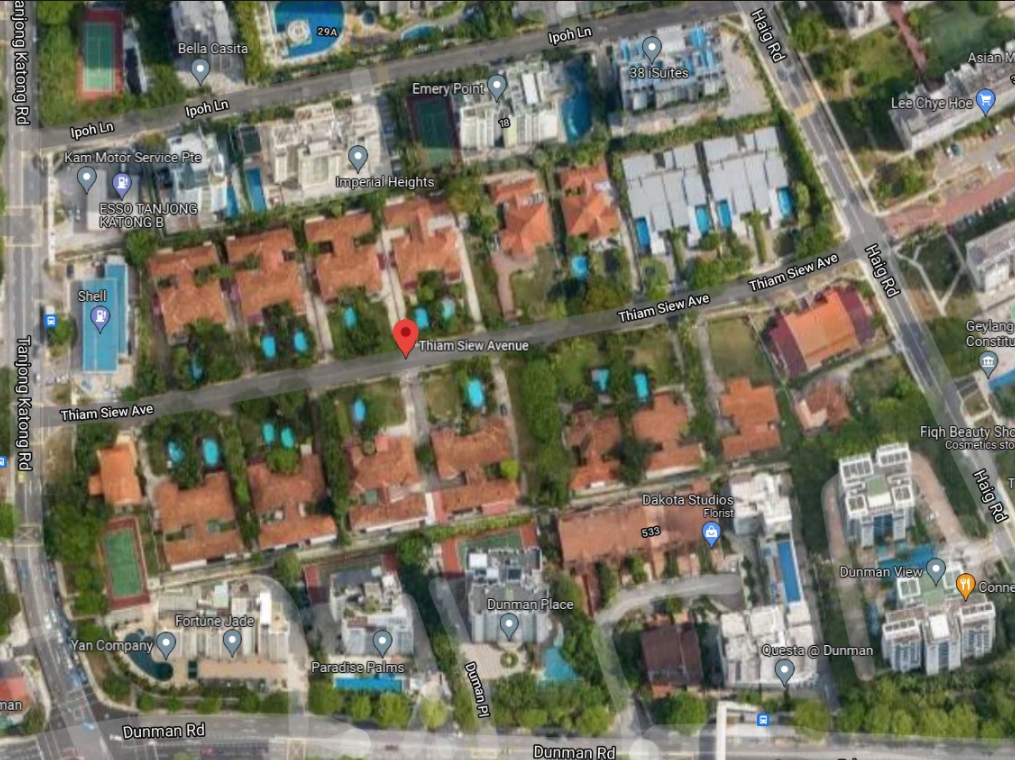

Situated between Tanjong Katong Road and Haig Road, two freehold development sites at Thiam Siew Avenue in District 15 have been sold for S$815m via public tender, which closed on 18 November 2021.

Thiam Siew Avenue is flanked on both sides by single-storey, pre-war semi-detached houses and bungalows making the 263,794 sq ft area the largest land sale recorded in 2021 so far. A joint venture between Hoi Hup Realty and Sunway Developments secured the plum sites consisting of 22 plots of smaller freehold residential development sites zoned as “residential”, with a plot ratio of 2.8 based on the URA Masterplan 2019.

For the Thiam Siew Avenue sites, they are within walking distance to 2 MRT stations (EW8/CC9 Paya Lebar Interchange MRT station and CC8 Dakota MRT station), so their proximity to the Paya Lebar Central precinct could mean greater buyer demand when the sites are fully developed. They are also within 1km of Kong Hwa, Haig Girls’ and Tanjong Katong Primary Schools.

Based on the sale price of $815 million, and a further estimated development charge of approximately $284 million, the land price works out to about $1,488 psf per plot ratio (psf ppr). If the price includes an estimated $39.3 million for 7% balcony space, the land price works out to $1,440 psf ppr.

Spanning 220,241 sq ft, the Shelford Road property is located in the prime residential enclave at Watten Rise, which is within 1km of two popular primary schools: Nanyang Primary School and Raffles Girls' Primary School. Watten Estate Condominium is also about 650m away from Tan Kah Kee MRT station. In its vicinity are Coronation Shopping Plaza, King's Arcade Shopping Centre, Crown Centre, Serene Centre, Cluny Court and Adam Road Food Centre.

UOL Group has plans to develop a luxury condominium project on the site "with about 200 larger format units on elevated ground.

Built around 1983, Watten Estate Condominium is zoned residential with a gross plot ratio of 1.4 and an allowable height of up to five storeys now houses 104 units of townhouses and apartments.

The winning bid was submitted by an 80:20 joint venture between United Venture Investments (UVI), a wholly owned subsidiary of UOL Group, and Singland Residential Development (SRD). UVI will pay 80 per cent of the purchase price or $440.6 million and SRD will fund the remainder.

Real estate professional Kiwi Lim from Huttons Asia believe more developers may turn to the collective sale market to replenish their land banks given the conservative supply from the Government Land Sales programme and with unsold inventory easing to around 15,000 units by the fourth quarter of this year, we are seeing the lowest supply of available new condo units in the market since 2006. Next year's upcoming launches may include another 5,000 new condo units in the market but the Singapore real estate market is now currently seeing around 10,000 new condo units sold a year on average driven by strong domestic demand. As the borders slowly re-open, we may see more foreign buyers entering the market and buying the avail new condo units in the RCR and CCR regions.

RSS Feed

RSS Feed